How to Take Advantage of Earnings Season Trading Opportunities

I’m incredibly excited for the upcoming season of my Earnings360 Service. We’re now heading into my 15th consecutive quarter running the program.

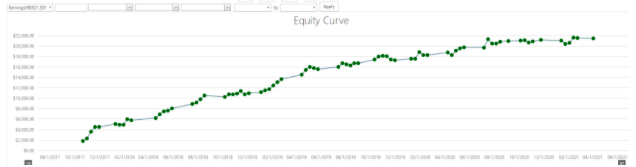

On Monday’s call, I think that you’ll find that my options-centric approach brings a new level of market analysis, options expertise, and accessibility — as its generated consistent gains for over 14 quarters. Earnings360 executes an average of 30 trades per quarter (3-4 per week) with just $350 per trade. This makes it active and ensures that no single trade results in an outsized loss. Over the past 3.5 years, Earnings360 has experienced just one losing quarter and had an average return of $1,730 per quarter for a total profit of $22,380.

You read that right, risking just $350 per trade has raked in a $22,380 profit.

What this service doesn’t do is take wild shots via purchasing out-of-the-money “lottery tickets,” hoping to hit a directional home run.

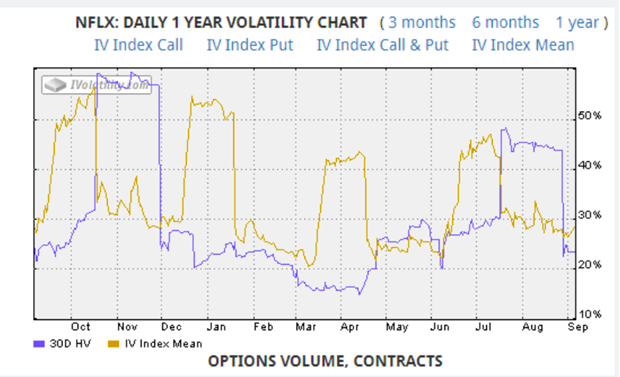

The Earnings360 approach harnesses predictable changes in implied volatility that come before and after earnings reports; namely the expected decline in implied volatility that occurs after earnings report releases; something I call the “Post Earnings Premium Crush (PEPC)”.

Now, let’s bring Post Earnings Premium Crush (also, “PEPC”), the quick-witted cousin, into our tool belt, where we rely on predicting implied volatility’s decline, or revert to the mean, once the earnings report’s released.

Take a look at Netflix’s (NFLX) implied volatility (gold line) vs. its realized volatility. Can you guess when the earnings reports were released?

This very simple but often-overlooked meaning of an option’s implied volatility is a powerful tool for producing consistent and predictable profits in seemingly irrational earnings report responses.

I can’t tell you how many times a company delivered the triple play of “beat on revenue, beat on EPS, and raised guidance,” only to be smashed with a sell-on-the-news response.

While the Earnings360 option-centric approach isn’t a guarantee, it does stack the odds considerably more in our favor by getting the PEPC tailwind at our back.

In my next article, I’ll describe the Pre-Earnings Premium or PEPE strategy. I will also be demonstrating and executing the PEPE trade live during the web presentation, Do not miss it.

The post How to Take Advantage of Earnings Season Trading Opportunities appeared first on Option Sensei.