Larry Kudlow, director of National Economic Council, said…

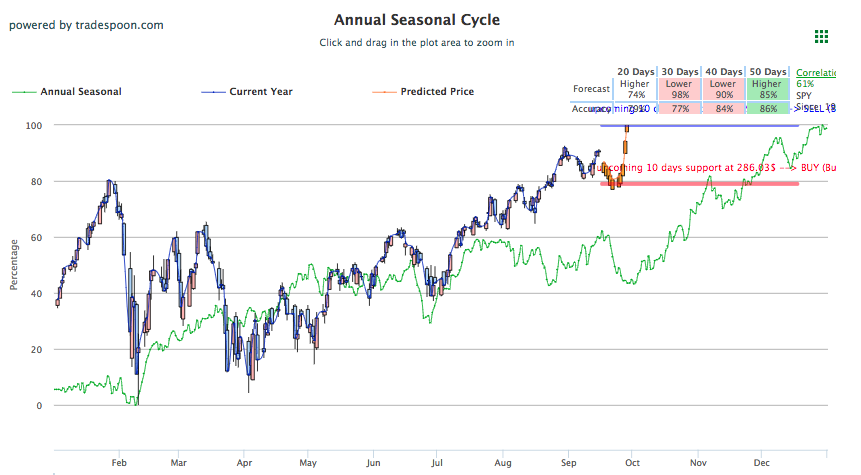

U.S. Stocks are slightly down today after posting five straight sessions of gains behind renewed global optimism on the recently escalating trade tensions between the U.S. and its trade partners. Last week’s good sentiment does not look to spill into today as the normally low-volume month of September is susceptible to volatility and slower action. With little to guide markets, currently being between earnings seasons and decreased rate of economic report releases, investors will look to next week’s FOMC meeting and subsequent minutes to inform further trading and state of the economy as 2018 goes into its fourth quarter. For now, look for more developments on the back and forth between the U.S. and China regarding escalating tariffs, as well as the U.S.’s other trading partners. SPY Seasonal Chart forecast is shown below:

On Friday, President Trump indicated he still intends to impose tariffs on $200 billion of Chinese goods, which would come on top of the already $250 billion in tariffs in place. Initially, these tariffs were considered on pause as word spread that China and U.S. are working at setting up another meeting to talk trade before the end of the month. This snowballed into Chinese delegates indicating they will likely decline the offer for renewed trade talks if the additional tariffs go through. As progress halted and trade-war fears grew over the weekend, U.S. assets, as well as Chinese, began to drop. European markets were mostly unchanged and, thus far, the global impact of the various trade-related development has mirrored U.S.’s movement.

Larry Kudlow, director of the National Economic Council, said today that he believes President Trump is not satisfied with trade talks and negotiations thus far with China and also that he doesn’t believe tariffs have impacted the economy negatively. For the year, U.S. assets and indices are certainly up, but slightly down from July, when the U.S. imposed its first 25%tariff on $34 billion worth of Chinese goods. Within the U.S., investors, for the most part, have been able to move past trade fears and work off economic data and corporate reports, which continue to produce mostly positive results. Look towards next week’s FOMC meeting for another boost of economic data while China and other trade developments get worked out.

With the generally down-trending market environment today, some easy takeaways investors can spot are the troubles in consumer-discretionary and tech stocks. All FAANG members are down today while the only tech standout looks to be Oracle Corp., up almost 0.5% ahead of its scheduled, after-market earnings report. Still, U.S. consumer sentiment, as recently reported, hit a multi-month high which is usually a good sign of growth and a positive for the economy.

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.11% moves to -0.56% in five trading sessions. The predicted close for tomorrow is 2,890.59. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

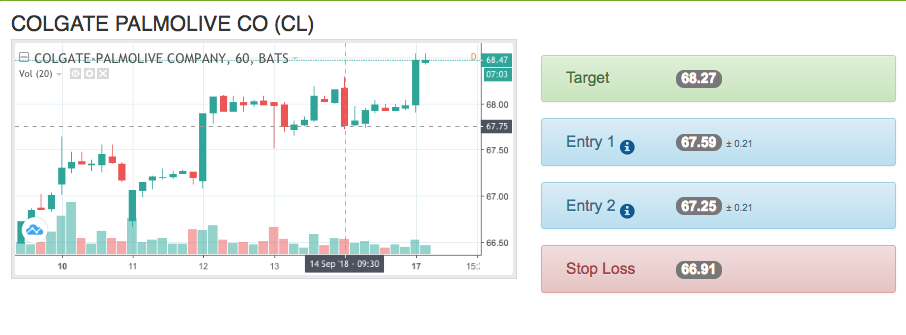

On September 14th, our ActiveTrader service produced a bullish recommendation for Colgate Palmolive Co (CL). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

CL entered the forecasted Entry 1 price range of $67.59 (± 0.21) in its first hour of trading and moved through its Target price of $68.27 the following trading session in its first hour of trading. The Stop Loss was set at $66.91.

You Don’t Want to Miss This!

Today only, we are going to do something we RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

Click Here To Sign Up…

Tuesday Morning Featured Stock

Our featured stock for Tuesday is General Dynamics Corp (GD). GD is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $202.14 at the time of publication, up 0.81% from the open with a 0.51% vector figure.

Tuesday’s prediction shows an open price of $199.50, a low of $199.29 and a high of $200.61

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLV8) is priced at $68.82 per barrel, down 0.25% from the open, at the time of publication. Oil futures faced some volatility today, currently down but earlier in the day the commodity was up. U.S. sanctions on Iranian oil is a continues threat on supply disruption, while U.S.-China trade conflict and its rising tensions also continue to loom over oil futures.

Looking at USO, a crude oil tracker, our 10-day prediction model mixed signals. The fund is trading at $14.48 at the time of publication, down 0.10% from the open. Vector figures show -0.25% today, which turns +0.00% in two trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is up 0.41% at $1,206.00 at the time of publication. After a troublesome week for gold, the commodity finds some solid footing today with minor gains amid a slightly weaker dollar. With various global trade developments still out there, there is no guarantee the safe haven commodity continues to perform as such, having already run along and counter to the dollar this summer. Usually, when the dollar is up, the safe-haven commodity that is gold is down.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $113.68, up 0.59% at the time of publication. Vector signals show +0.06% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 0.15% at 3.00% at the time of publication. After some early-morning action that had yields on the rise, long and short-dated contracts have pulled back from their initial large spike. The 10-year yield had reached a high of 3.02% before settling into a 3.00% range; two and thirty-year notes are also up and remain near their daily highs.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.01% moves to -0.29% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is up 7.46% at $12.97 at the time of publication, and our 10-day prediction window shows all positive signals. The predicted close for tomorrow is $12.82 with a vector of +7.29%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

You Don’t Want to Miss This!

Today only, we are going to do something we RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!