Liberation Day Arrives, Futures Sink

The stock market showed strength on Wednesday after trading on both sides of the ledger as Wall Street braced for a more specific update concerning tariffs. After the close, President Trump imposed a baseline tariff of 10% on countries that will start on April 5th with higher tariffs on some countries starting on April 9th.

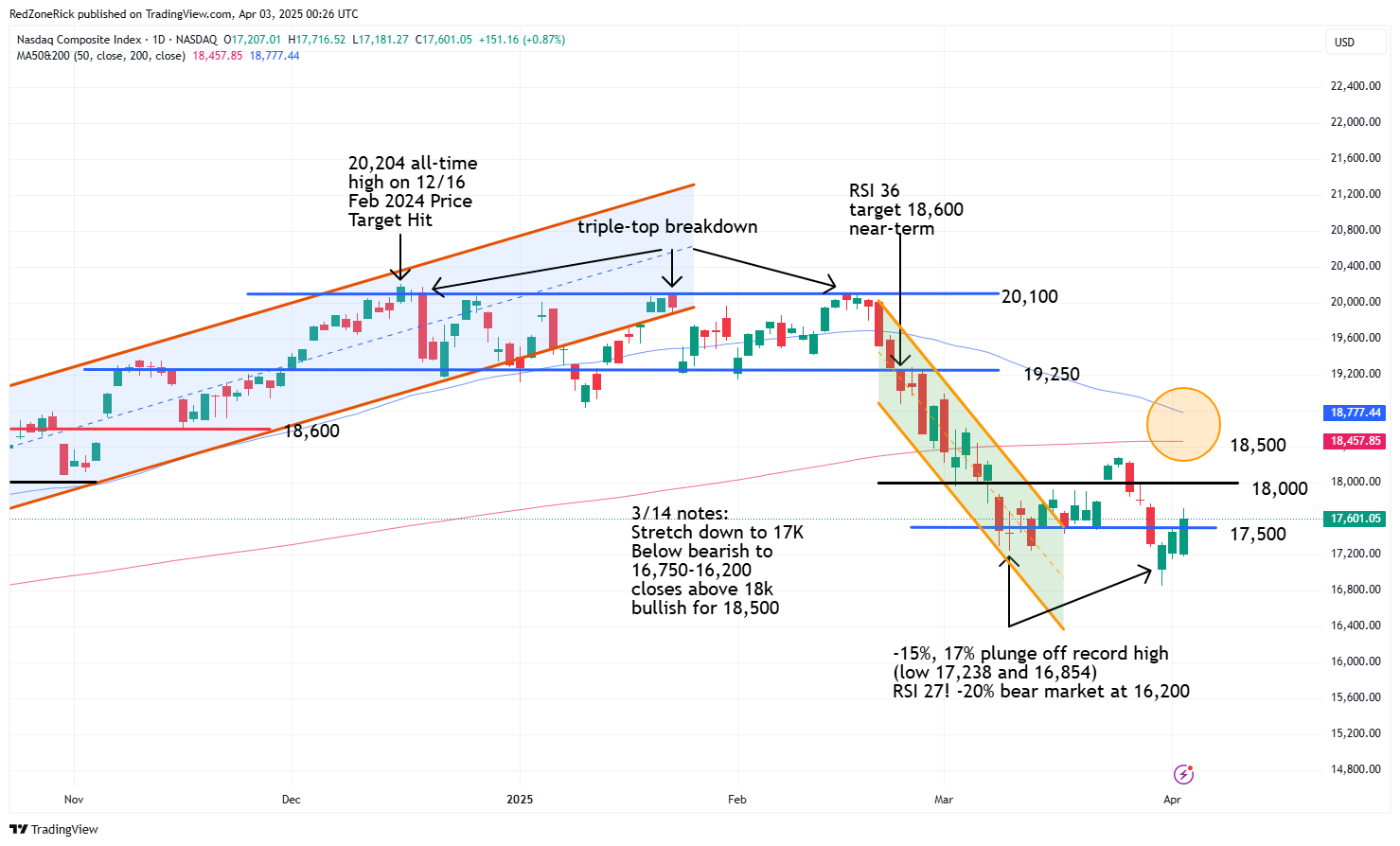

The Nasdaq traded to a high of 17,716 while settling at 17,601 (+0.9%). Resistance at 17,750 held. Support is at 17,500.

The S&P 500 closed at 5,670 (+0.7%) with the peak hitting 5,695. Key resistance at 5,700 held. Support is at 5,600.

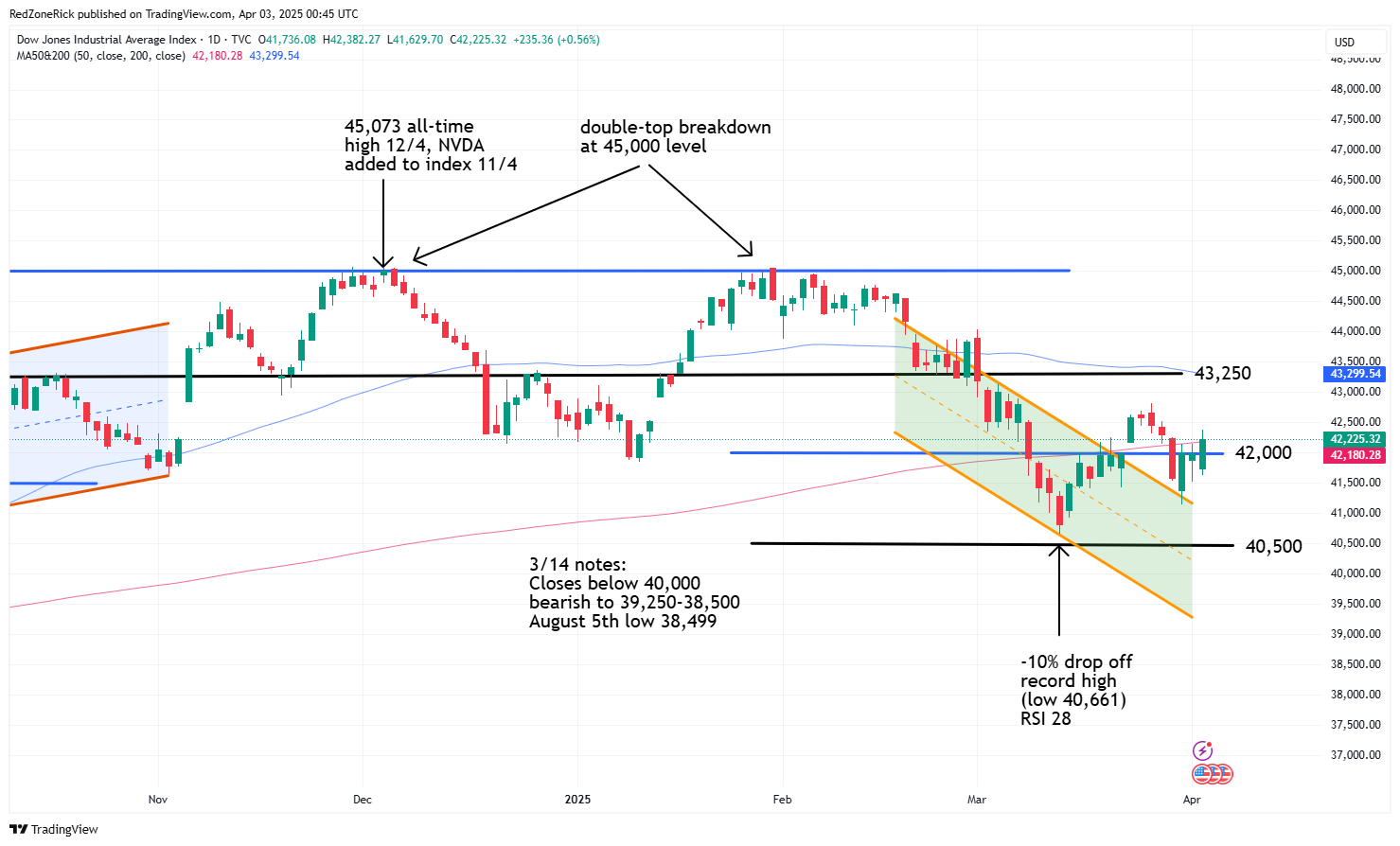

The Dow made a push to 42,382 before going out at 42,225 (+0.6%). Resistance at 42,000 was topped and held. Support is at 41,500.

Earnings and Economic News

Before the open: Acuity Brands (AYI), Conagra Brands (CAG), Lamb Weston (LW)

After the close: Guess (GES), Lifecore Biomedical (LFCR), Simulations Plus (SLP)

Economic news:

Initial Jobless Claims – 8:30am

PMI Services Index – 9:45am

ISM Manufacturing Index – 10:00am

Technical Outlook and Market Thoughts

We mentioned this week’s tariff news could have a major impact on how the month of April unfolds. The lower yearly lows on Monday were an omen as futures plummeted Wednesday night following the specifics of the tariffs. We will cover this in our closing summary, but first, let’s take a look at the charts.

The Russell 2000 tested a high of 2,048 with lower resistance at 2,050-2,075 getting challenged and holding. More important hurdles remain at 2,135 and 2,175 and the 50-day moving average.

Crucial support remains at 2,000 with Monday’s low at 1,973. This breached the previous intraday yearly low at 1,984 from March 13th with both lows representing bear market (-20%) territory for the small-caps. We talked about multiple closes below these levels getting 1,950-1,900 in play with the January 17th and 18th (2024) lows at 1,898 and 1,901, respectively. The latter would represent a 23% plunge off the all-time peak at 2,466 from last November.

The Nasdaq recovered key resistance at 17,500 yesterday with additional headwinds at 18,000 and 18,500 and the 200-day moving average. A death-cross remains in play with the 50-day moving average on track to fall below the 200-day moving average.

Monday’s fresh 2025 intraday low kissed 16,854 and represented a 17% drubbing from the all-time top at 20,204 reached last December. The index held 17,250. We have said stated multiple closes below this level would be a renewed bearish signal for additional risk down to 16,750-16,200. The latter represents bear market territory (-20%).

The S&P failed key resistance at 5,700 for the second time in four sessions. A move above this level would be slightly bullish for additional upside towards 5,750-5,800 and the 200-day moving average.

Key support at 5,500 was stretched but held on Monday’s drop to 5,488. This represented an 11% correction. Closes below this level would imply a further slide to 5,400-5,200 and levels from the first half of last August. The latter would also represent a 15% spanking from the February 19th all-time top at 6,147.

The Dow reclaimed 42,000 and the 200-day moving average on Wednesday. The next targets for the bulls are at 42,500-42,750 with the March 26th peak at 42,821 followed by 43,250 and the 50-day moving average.

Monday’s low kissed 41,148 with upper support at 41,000-40,500 holding. A move below the latter would indicate another near-term top with weakness down to 39,250-38,500. The August 5th low is at 38,499.

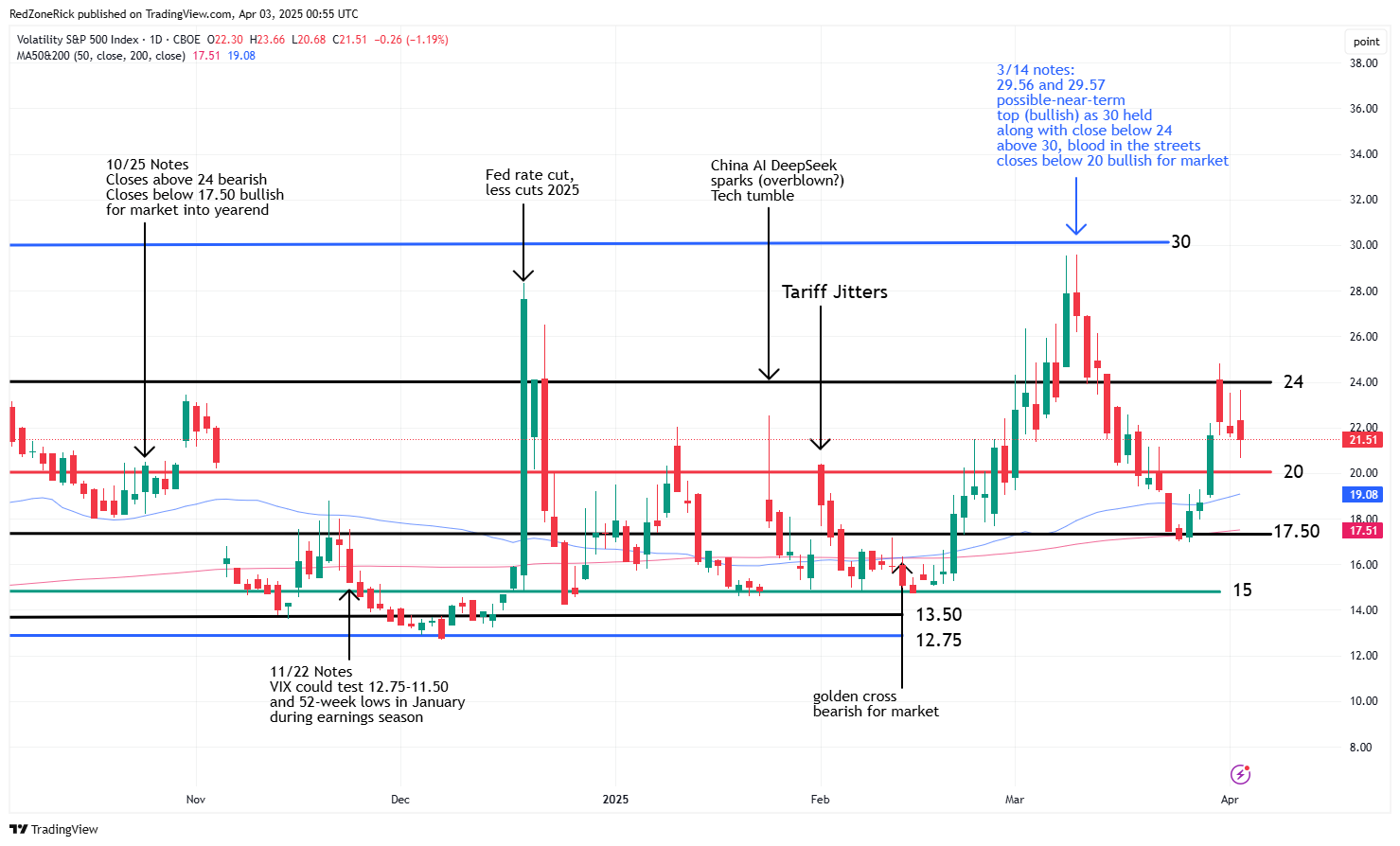

The Volatility Index (VIX) bubbled up to 23.66 after the open with key resistance at 24 holding. There is risk to 26-28 on Thursday with a close above 30 likely inducing panic selling in the overall market.

Support is 20 followed by 19-18.50 and the 50-day moving average.

Coming into the week, we said if the March 13th lows were breached, the major indexes could fall an additional 5%-10% while pushing the August 5th lows.

Late last night, the Ministry of Commerce urged the President to immediately cancel its unilateral tariff measures. Trump imposed steep tariff rates on some countries, including 34% on China, 20% on the European Union, 46% on Vietnam and 32% on Taiwan.

The Dow futures were down over 1,000 points (-2.4%) shortly after the conclusion of the tariff announcements; S&P futures were sinking 200 points (-3.5%); and the Nasdaq futures were plummeting 888 points (-4.3%). These numbers could get better, or worse, ahead of Thursday’s open but it looks like fresh 2025 lows will once again be in play.