Losses Limited Despite Market Curveball

- For the week, the Nasdaq slipped 0.6% while the S&P was dipped 0.4%. The Dow fell 1.3% and the Russell stumbled 1.4%. The market pullback stalled momentum while volatility settled above a key level of resistance.

- The bright spot from Friday’s drubbing was Tech holding its uptrend channel and the S&P and Russell holding key support levels. The Dow, on the other hand, was the only index that disappointed as it fell out of its uptrend channel but did hold backup support.

- Defense stocks Northrop Grumman (NOC), RTX (RTX) and Lockheed Martin (LMT) rallied 3%-4%. These companies supply arms to Israel through contracts with the US government.

Wall Street got a curveball on Friday following Israel’s attack on Iran last Thursday night. The losses were less than 2% across the board and the weekly damage was limited following higher highs throughout the week.

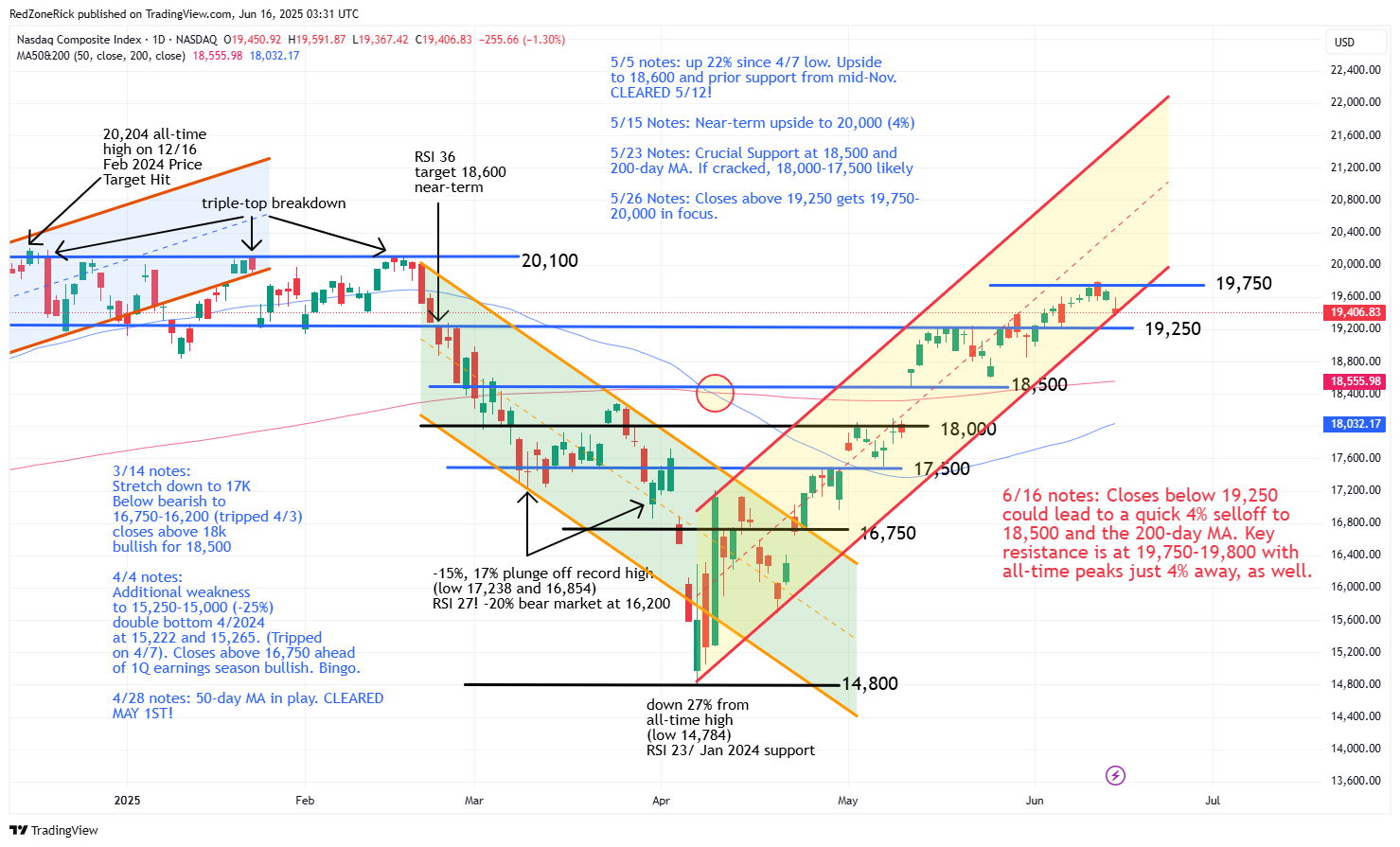

The Nasdaq ended at 19,406 (-1.3%) with the low kissing 19,367. Key support at 19,250 held. Resistance remains at 19,750.

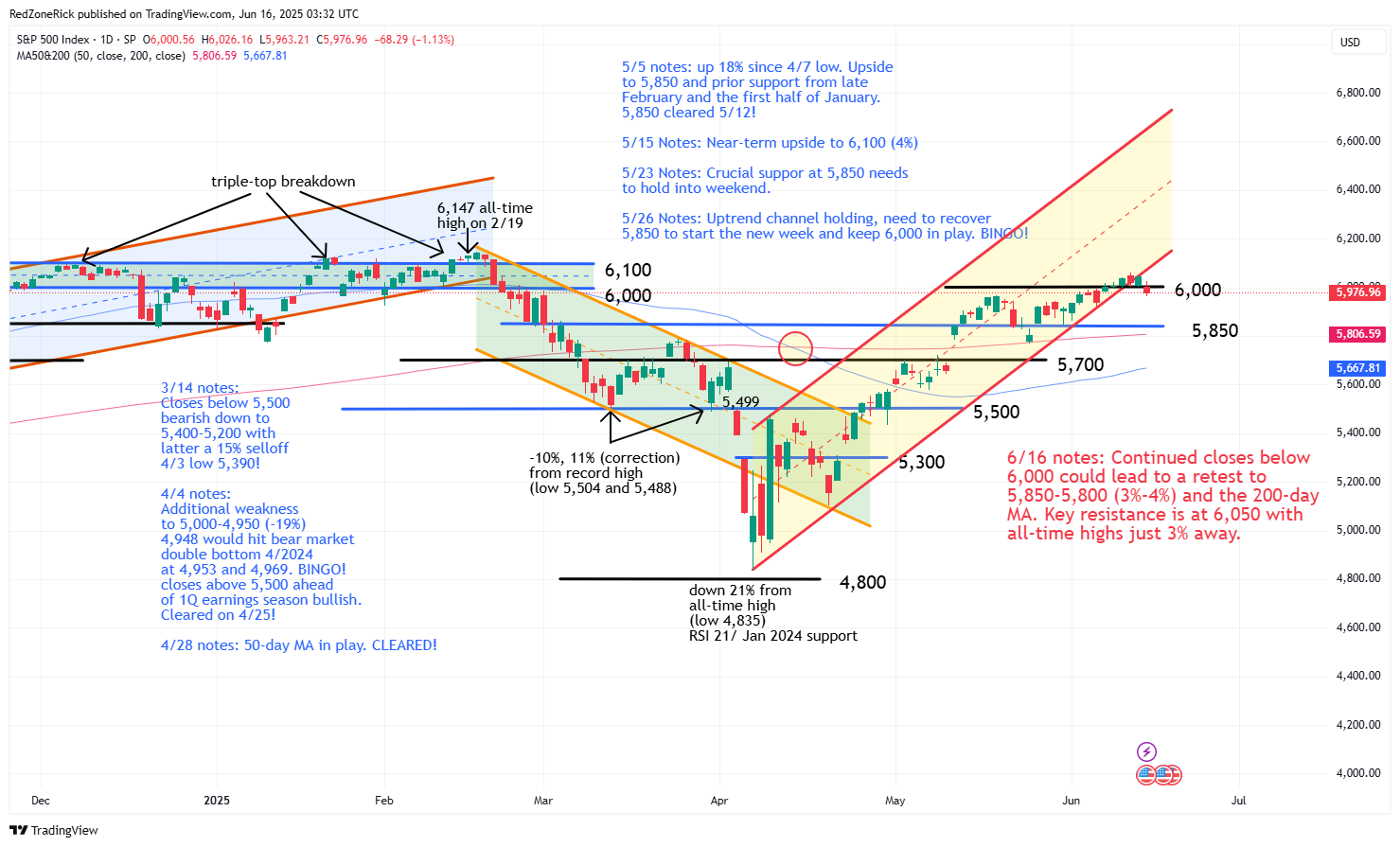

The S&P 500 tapped a low of 5,963 while settling at 5,976 (-1.1%). Key support at 6,000 failed to hold. Resistance is at 6,050.

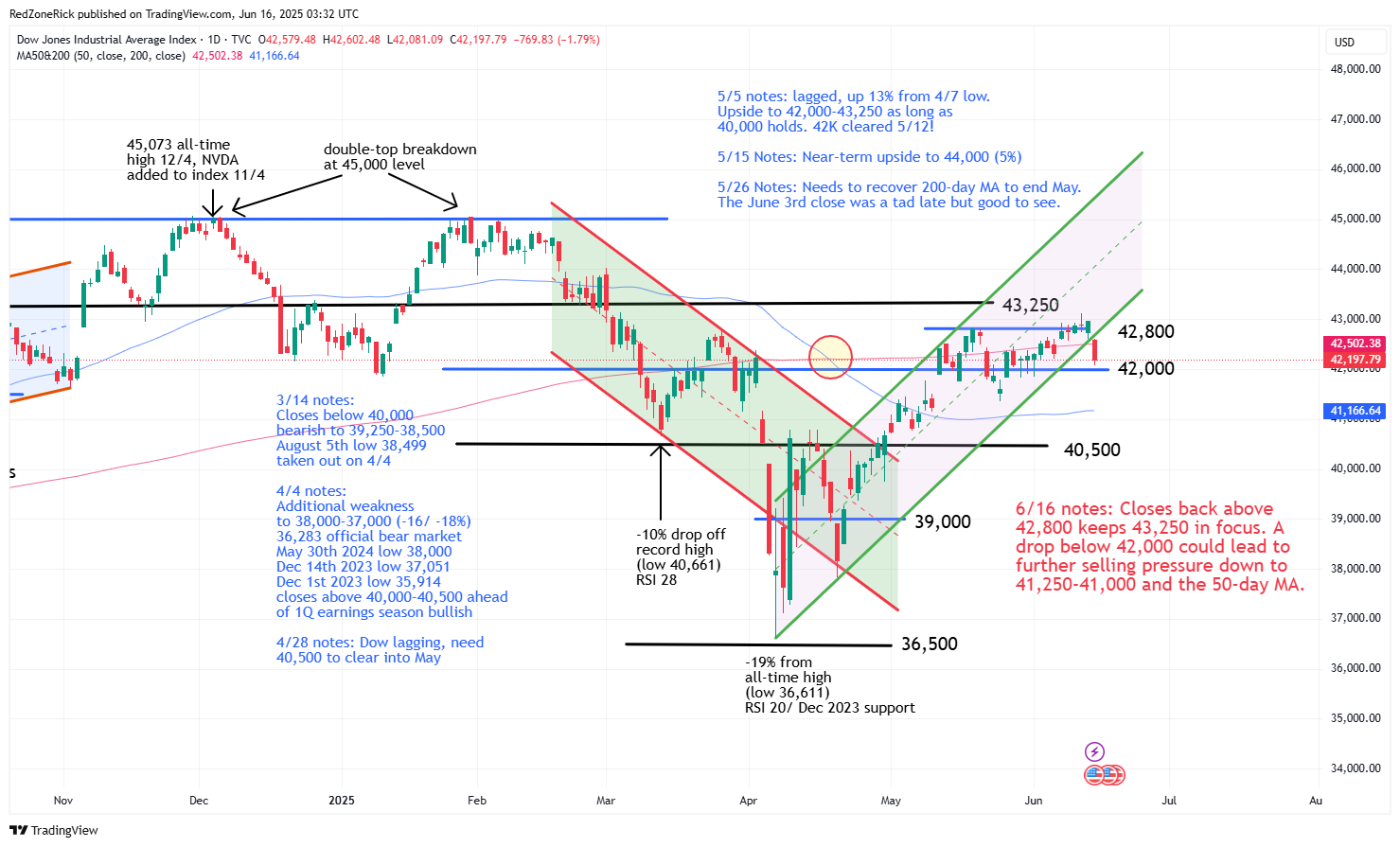

The Dow went out at 42,197 (-1.8%) after tagging a low of 42,081. Support at 42,000 held. Resistance is at 42,500.

Earnings and Economic News

Before the open: Coda Octopus Group (CODA), Powerfleet (AIOT)

After the close: Digital Turbine (APPS), Lennar (LEN), RF Industries (RFIL)

Economic News

Empire State Manufacturing Survey – 8:30am

Technical Outlook and Market Thoughts

For the week, the Nasdaq slipped 0.6% while the S&P was dipped 0.4%. The Dow fell 1.3% and the Russell stumbled 1.4%. The market pullback stalled momentum while volatility settled above a key level of resistance.

The key takeaway from last Thursday morning’s market update:

“Prior resistance levels are holding this week as key support and exactly what we wanted to see as far as the technical action. As a reminder, these price points are at Nasdaq 19,250; S&P 5,950; Russell 2,075; and Dow 42,800. A break below these levels ahead of the weekend would be a yellow flag for the bulls.”

The bright spot from Friday’s drubbing was Tech holding its uptrend channel and the S&P and Russell holding key aforementioned support levels. The Dow, on the other hand, was the only index that disappointed as it fell out of its uptrend channel but did hold backup support.

Let’s start with the Nasdaq as it has been holding 19,250 for nine-straight sessions. Continued closes above this level keeps 19,750-20,000 in play.

Closes below 19,250 and out of the uptrend channel could lead to a quick 4% selloff down to 18,500 and the 200-day moving average. On the flip side, the index is just 4% away from the all-time peaks north of 20,204.

The S&P 500 fell below fresh support at 6,000 and out of its uptrend channel on Thursday. Continued closes below this level would suggest a retest to 5,850-5,800 and the 200-day moving average, or another 2%-3% of weakness. We mentioned Thursday morning the index was riding its current uptrend channel but was dangerously close to falling out of it.

Key resistance is at 6,050 with last week’s peak at 6,059. A move above 6,075 would likely confirm a run to 6,100-6,150 with the all-time high at 6,147 and just 3% away from current levels.

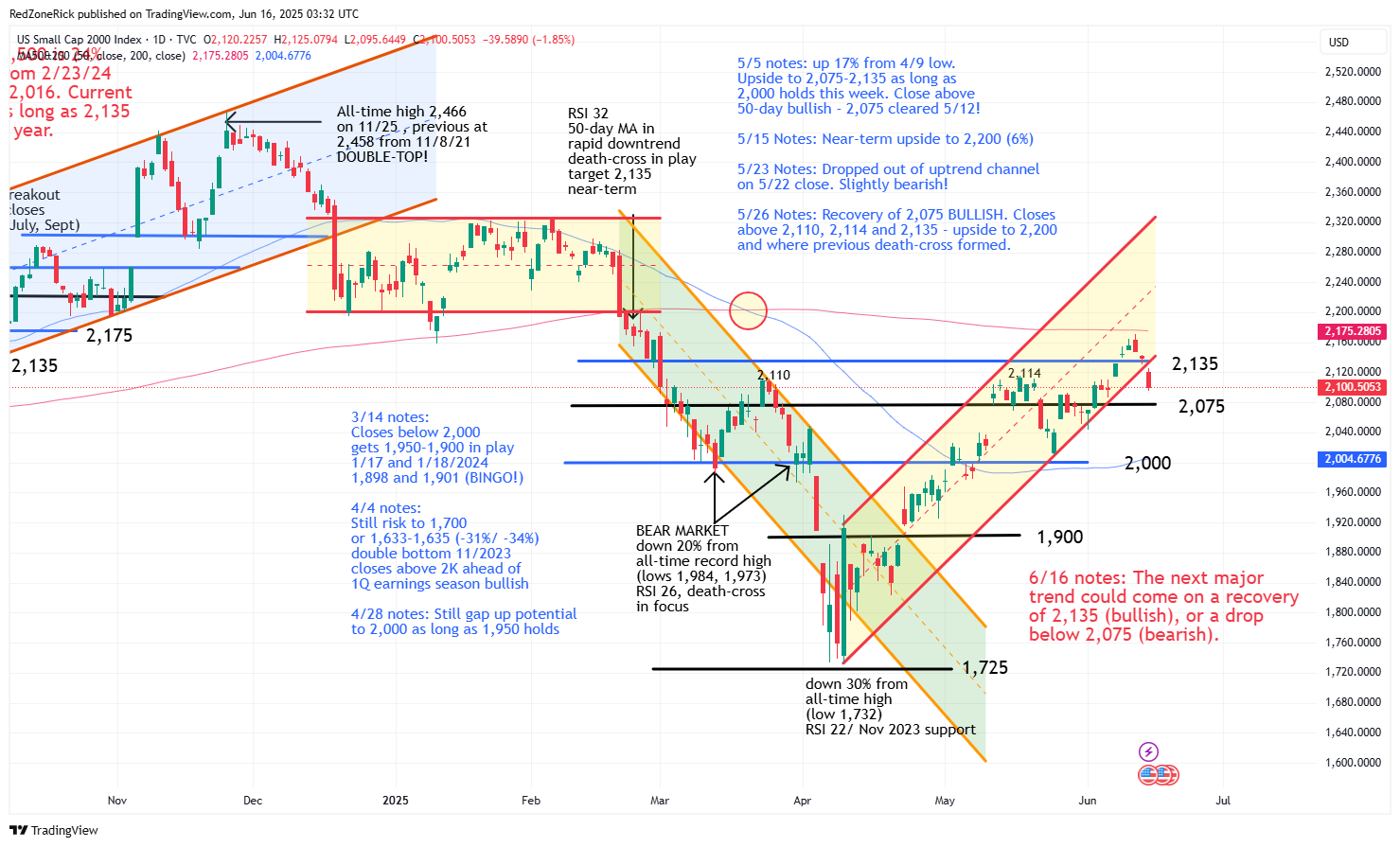

The Russell 2000 closed right on 2,100 and out of its uptrend channel after holding the 2,135 level for four-straight sessions. More important hurdles are at 2,175 and the 200-day moving average on closes back above 2,135.

Key support is at 2,075. The next major trend could come on a recovery of 2,135 (bullish), or a drop below 2,075 (bearish) with the index currently trapped in the middle.

The Dow also fell out of its uptrend channel and below its 200-day moving average after holding 42,800 for three-straight sessions. Closes back above this level gets 43,250 back in focus.

A drop below support at 42,000 could lead to further selling pressure down to 41,250-41,000 and the 50-day moving average.

The Volatility Index (VIX) spiked 15% while closing back above 20. Near-term resistance is at 22-22.50. Closes above 24-25 and the 50-day moving average would reopen upside risk to 30.

Near-term support is at 19-18.50. Thursday’s close back above 17.50 was a warning signal for the market and why we follow the VIX like a hawk.

Traders were understandably a tad nervous to hold positions over the weekend and we don’t blame them. The technical damage was slightly bearish and the fresh war between Israel and Iran is a new unknown for the stock market. Hopefully, a quick resolution will occur and the United States’ participation is very, very limited.

Defense stocks Northrop Grumman (NOC), RTX (RTX) and Lockheed Martin (LMT) rallied 3%-4%. These companies supply arms to Israel through contracts with the US government. The first two, NOC and RTX, remain in solid uptrends off the April 7th lows. LMT has remained in more of a trading range but is on the verge of a breakout on continued closes above $490-$500 and the 200-day moving average.