Major Bank Earnings Continue, Beige Book and Netflix-Report Tuesday

Market is modestly lower today

Major U.S. indices are trading modestly lower today on the first day of a shortened trading week with markets closed on Friday for Good Friday observance.

Big banks shares slide although topping earnings expectations

Last week, major earnings season kicked off with a few big name banks topping expectations only to see shares slide. Today, Citigroup and Goldman Sachs reported first-quarter earnings, while Netflix, Bank of America, and IBM are due to report tomorrow.

Pinterest IPO shares estimated in the $15-17 range

On Wednesday, Pinterest IPO is scheduled to debut with shares estimated in the $15-17 range while the Fed will release its latest Beige Book. Look for news on European Union and U.S. trade talks this week while next week Japanese delegation will head to Washington to also discuss tariffs.

(Want free training resources? Check our our training section for videos and tips!)

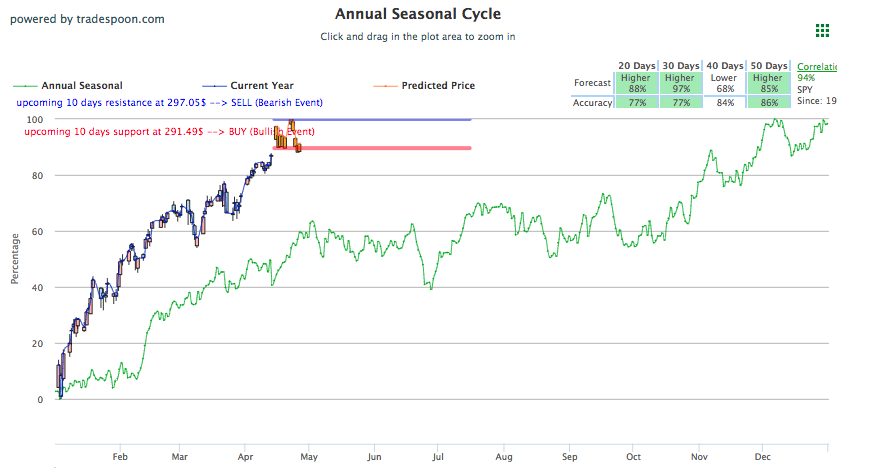

Retest 52 weeks high for the SPY at $294

The market remains on track to retest 52 weeks high for the SPY at $294. After breaking out of range, the SPY has traded above its 200-day moving average with short term support at $280-$284. For reference, the SPY Seasonal Chart is shown below:

Big banks in focus

On the first day of the short trading week, major indices lowered following a so-so start to the earnings season. Chase and Wells Fargo were able to top expectations however both banks saw shares lower, today and on Friday. Today, Citigroup and Goldman Sachs reported before market open, with both banks topping expectations, and similarly to Chase and Wells Fargo, saw shares lower.

Earnings season continue this week

Unlike the former financial institutes, Charles Schwab was able to recoup some gains in the current market conditions after their earnings beat expectations. Other earnings to monitor this week include Netflix, Bank of America, and IBM tomorrow, Morgan Stanley and PepsiCo on Wednesday. Also worth mentioning this week includes the Pinterest IPO release, expected in the range of $15-$17 per share and the release of the Federal Beige Book on Wednesday.

(Want free training resources? Check our our training section for videos and tips!)

Global markets review

Globally, markets closed to split modest results with both European and Asian markets showing slight movement. No new developments have yet to be reported regarding U.S.-China trade talks today while several other negotiation fronts are about to open up. The European Union gave the green light to begin the first round of tariff negotiations with the U.S. regarding industrial goods and manufacturing.

Tariff wars

The EU could tariff $12 billion of U.S. goods, including aircraft, retail favorites, and alcohol while the U.S. would look to retaliate with heavy auto tariffs. Next week, Japan will send a trade delegation in hopes of avoiding China’s fate of an extended tariff-off with the U.S., as they are likely one of the next trade-renegotiation targets the Trump administration is looking at.

(Want free training resources? Check our our training section for videos and tips!)

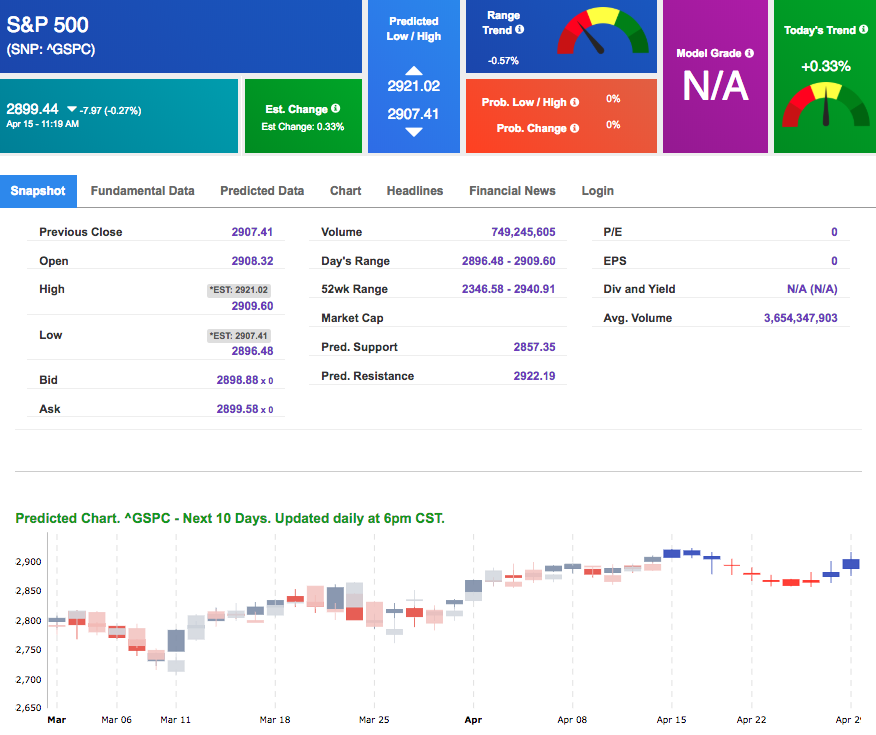

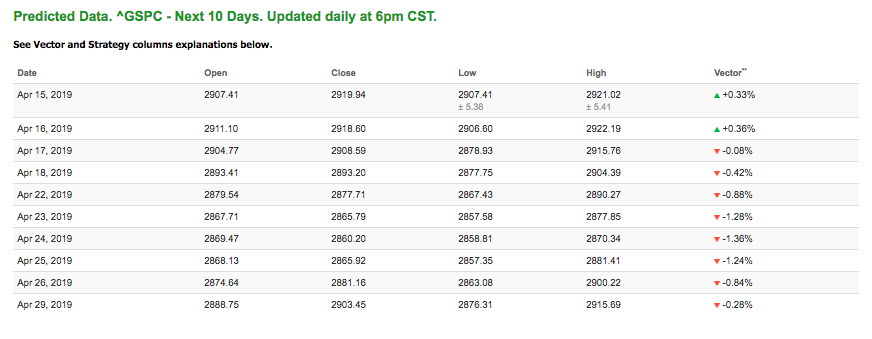

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.33% moves to -1.28% in five trading sessions. The predicted close for tomorrow is 2,918.60. Prediction data is uploaded after the market close at 6 PM, CST. Today’s data is based on market signals from the previous trading session.

Continue my run of 1,131% gains!

-

Execute the same exact trades I’m making in my own account, as I make them throughout the day.

-

Or, catch my early moves… go play a round of golf, (or whatever) … and then check back for the afternoon’s best-of-the-day action.

-

I expect seven winners from every ten trades I make.

-

Try duplicating my trades for 30 days RISK-FREE. Keep going only if you’re beating the pants off your old record.

-

See how simple, quick and easy this service makes it to harness the self-learning (AI) power of the most advanced set of algorithms out there.

Click Here For Lifetime Savings

Highlight of a Recent Winning Trade

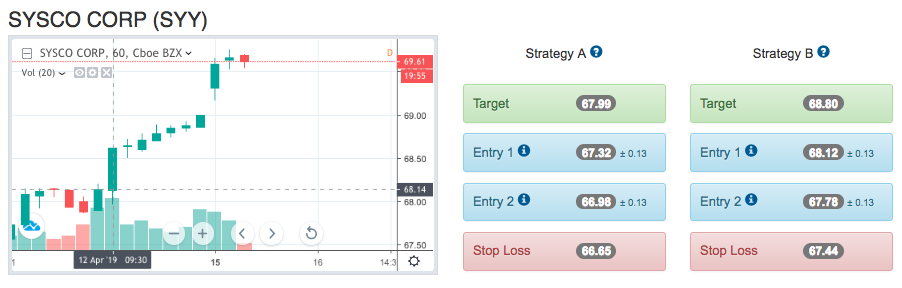

On April 12th, our ActiveTrader service produced a bullish recommendation for Sysco Corp (SYY). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

SYY entered its forecasted Strategy B Entry 1 price range $68.12 (± 0.12) in its first hour of trading and passed through its Target price $38.80 in the last hour of trading that day. The Stop Loss price was set at $67.44.

(Want free training resources? Check our our training section for videos and tips!)

Tuesday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

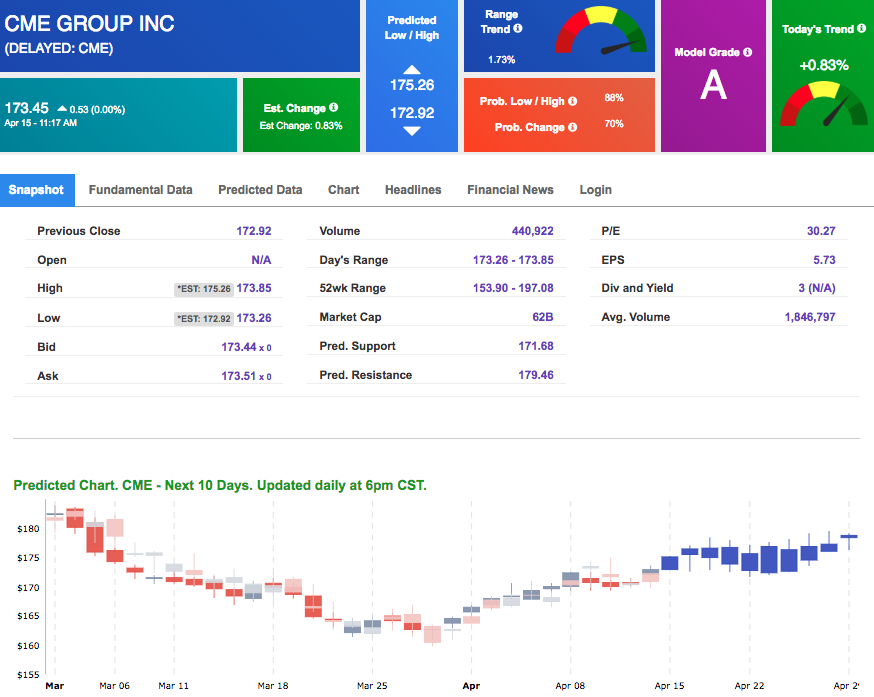

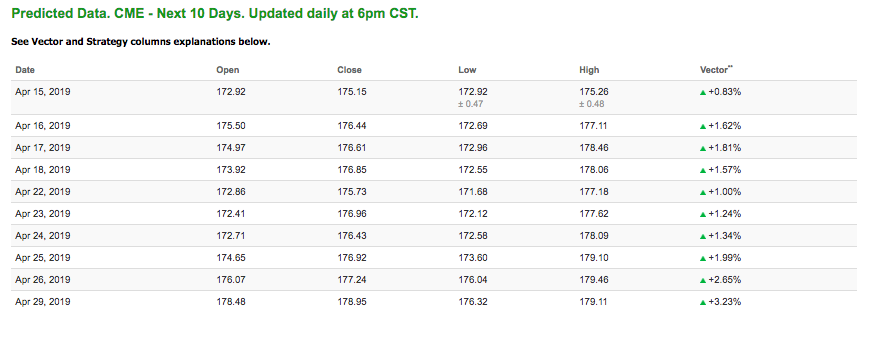

Our featured stock for Tuesday is CME Group Inc. (CME). CME is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $173.45 at the time of publication, with a +0.83% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

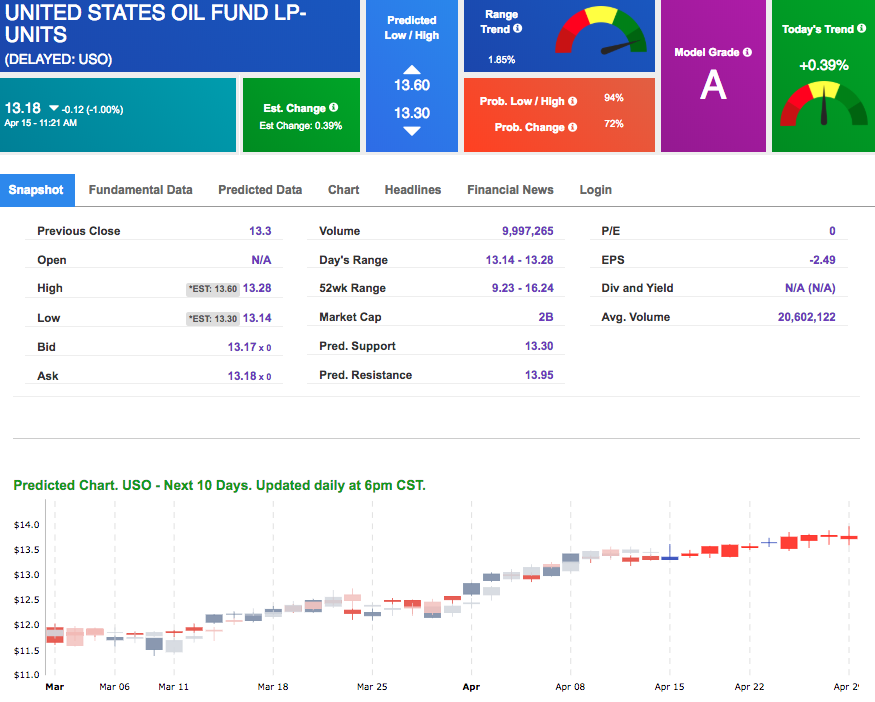

Oil

West Texas Intermediate for May delivery (CLK9) is priced at $63.22 per barrel, down 1.05% from the open, at the time of publication.

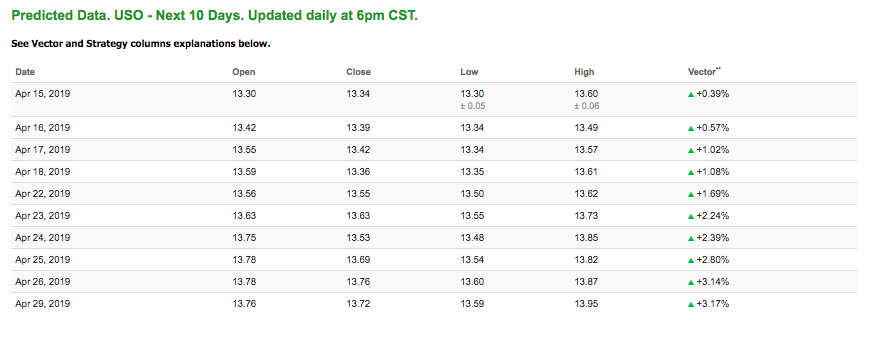

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $13.18 at the time of publication, down 1.00% from the open. Vector figures show +0.39% today, which turns +1.69% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

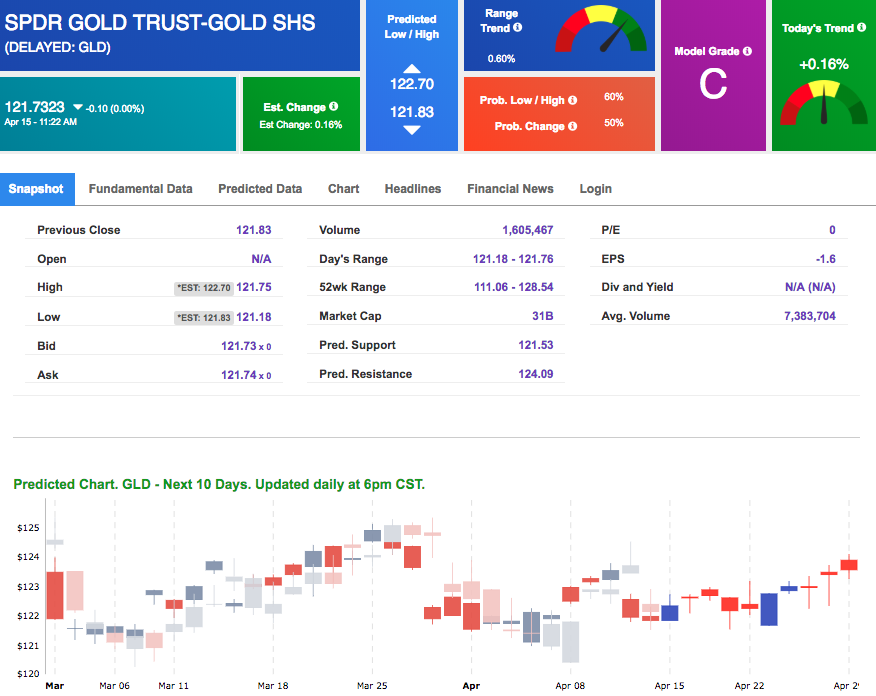

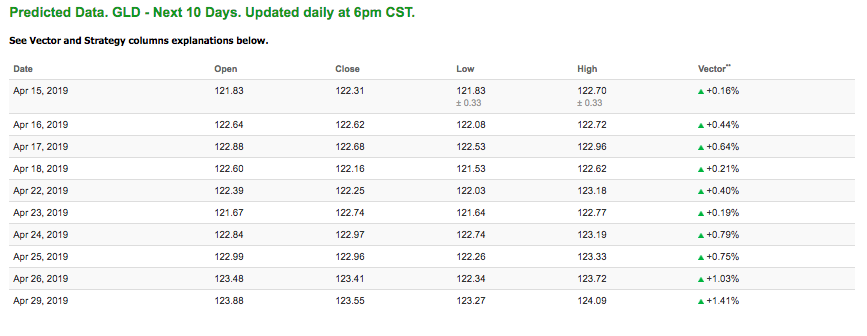

Gold

The price for June gold (GCM9) is down 0.23% at $1,292.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $121.73, at the time of publication. Vector signals show +0.16% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

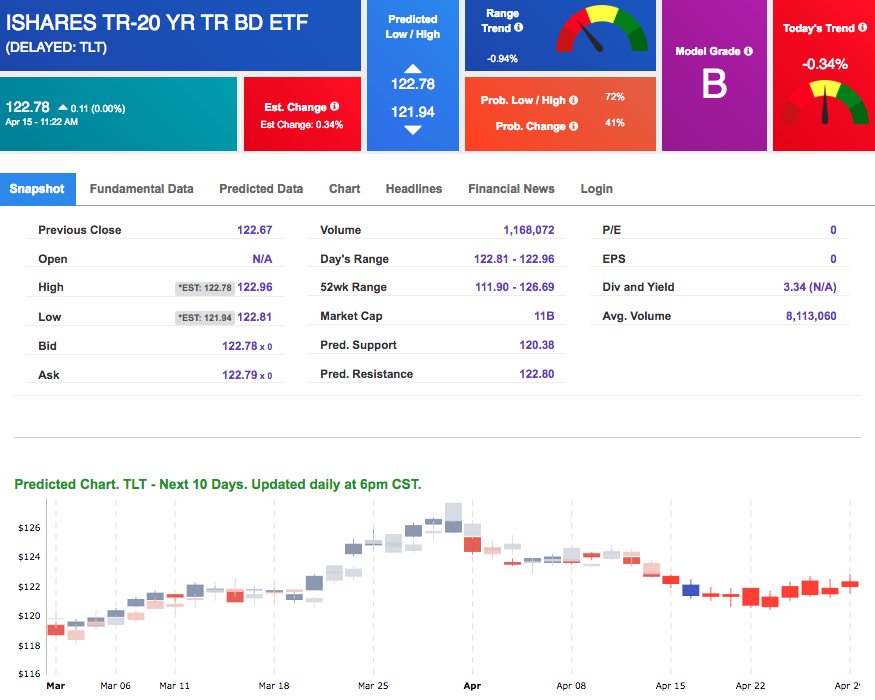

Treasuries

The yield on the 10-year Treasury note is down 0.72% at 2.55% at the time of publication. The yield on the 30-year Treasury note is down 0.36% at 2.97% at the time of publication.

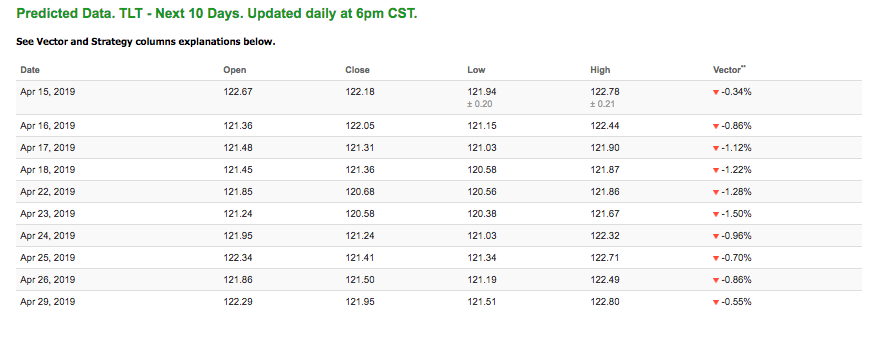

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.34% moves to -1.22% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

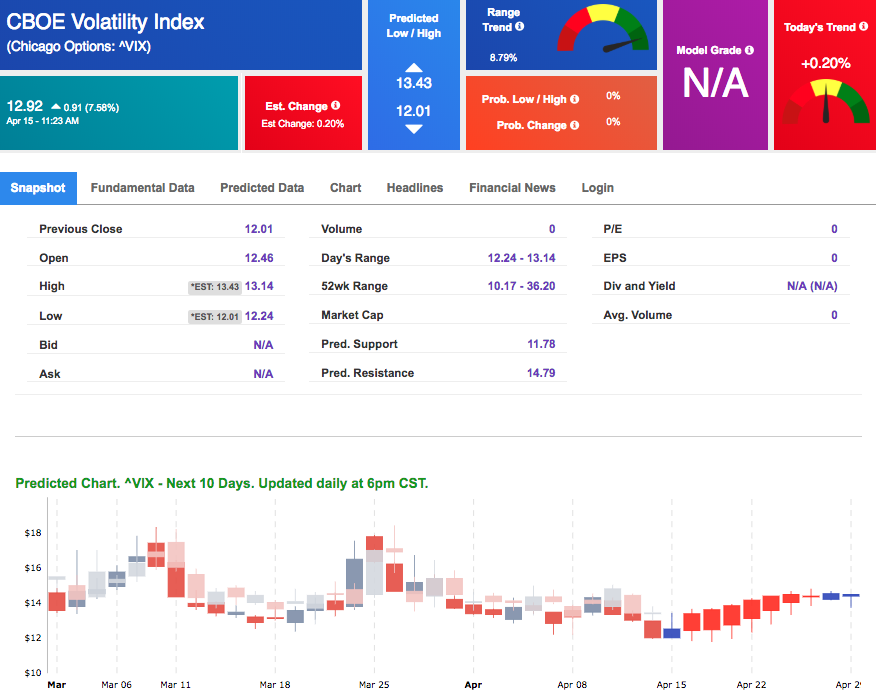

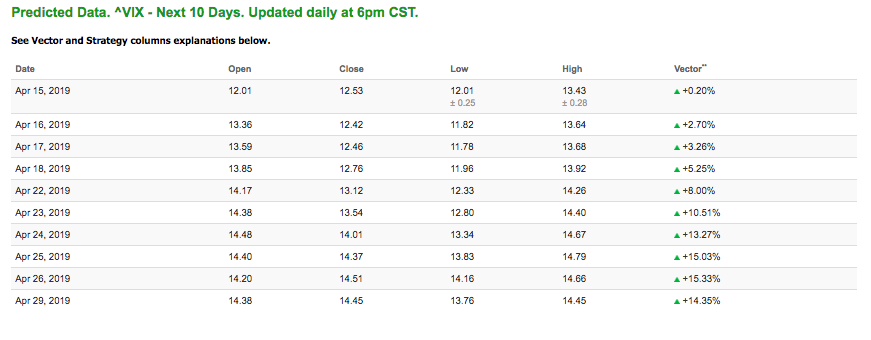

The CBOE Volatility Index (^VIX) is up 7.58% at $12.92 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $12.42with a vector of +2.70%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Continue my run of 1,131% gains!

-

Execute the same exact trades I’m making in my own account, as I make them throughout the day.

-

Or, catch my early moves… go play a round of golf, (or whatever) … and then check back for the afternoon’s best-of-the-day action.

-

I expect seven winners from every ten trades I make.

-

Try duplicating my trades for 30 days RISK-FREE. Keep going only if you’re beating the pants off your old record.

-

See how simple, quick and easy this service makes it to harness the self-learning (AI) power of the most advanced set of algorithms out there.