Major Banks Struggle, Netflix Earnings After Market

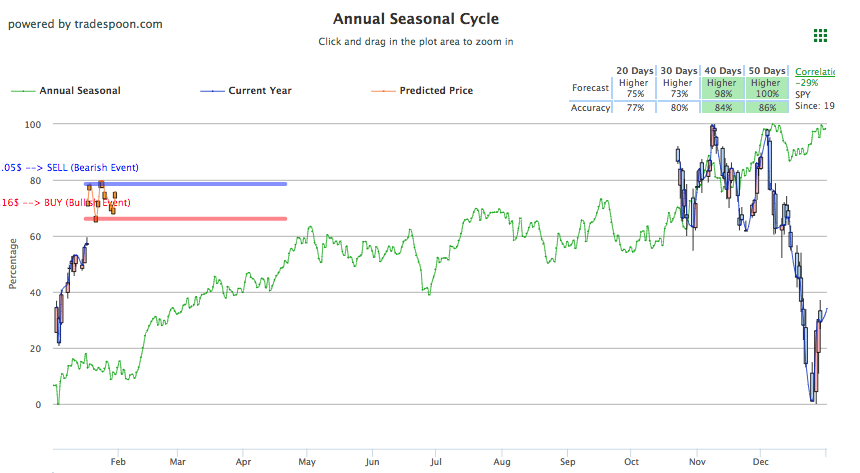

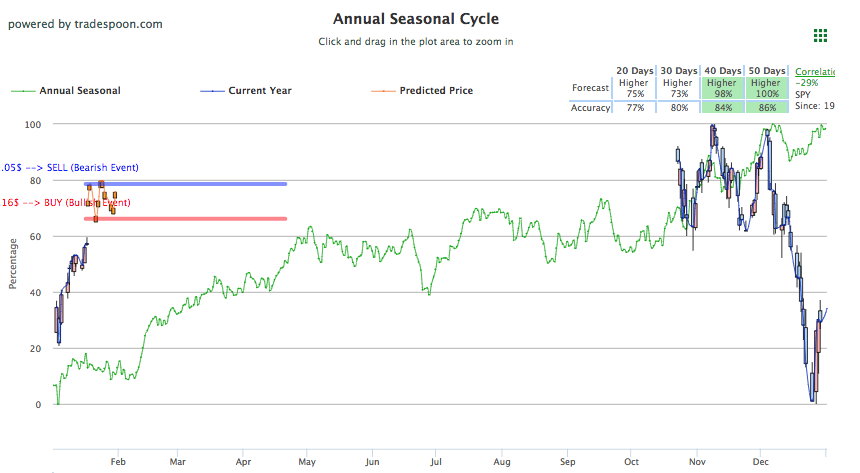

U.S. Stocks opened lower today, feeling pressure from underperforming bank earnings and continued global and domestic tension, before turning positive for modest gains in the afternoon. Morgan Stanley joins Citi and Chase as part of the major banks reporting this week below expectations while trade tension with China grows as Federal prosecutors open a criminal investigation into Huawei to determine if the Chinese tech company has been stealing trade secrets from its U.S. partners. The government shutdown is going on its 27th day with no significant signs of progress while overseas troubling news from England and France has weakened confidence in global trade. Support for SPY remains at $254, establishing the next level of resistance at $264. If poor earnings and geopolitical unrest worsen, expect a market retrace back to $254 level or possibly worse. Nevertheless, opportunities for a market rally will continue this month with more earnings and the first Fed policy update of 2019. Keeping this in mind and although we expect volatility to remain throughout the year, we remain bullish on the market for a potential rally into the end of the first quarter. For reference, the SPY Seasonal Chart is shown below:

Morgan Stanley, currently down 5%, reported earnings that did not meet profit or revenue expectations. The underwhelming earnings report snaps the impressive 12-quarter streak the bank was had for beating both revenue and profit estimates. Other economic data worth noting includes weekly labor reports and yesterday’s release of the Beige Book. Jobless claims lowered last week, as per labor report released today, while applications for unemployment benefits rose. Beige Book data showed the majority of Federal Reserve districts reported modest gains while general optimism may have lowered. Rising costs and lingering tariffs are weighing on market sentiment while the labor market is showing signs of growth with rising wages. Retail sales and manufacturing both rose while the agricultural sector struggled. Still, a good amount of data was not reported due to the partial government shutdown, which is going on its 27th day. The shutdown is the longest in U.S. history and little has come out of D.C. to provide optimism towards a resolution regarding the border wall dispute that initiated the funding dispute and partial shutdown.

A criminal investigation into Huawei Technologies Co. has been started by Federal Prosecutors for allegedly stealing trade secrets from its U.S. partners, most notably T-Mobile. The investigation adds to an already tense relationship between China and the U.S. that is now in the midst of 90-day truce to resolve trade disputes and the rapidly expanding tariffs. Huawei came under similar fire in 2017 from T-Mobile but no action was taken as both sides were found negligible. Huawei is the second-largest maker of smartphones in the world.

Global news to monitor today includes the next steps for Brexit and another major bank underperforming. After failing to get her drafted Brexit deal through Parliment, Prime Minister Theresa May faced a no-confidence vote which she survived 325-306. May urged both Members of Parliment to “put self-interest” aside and come together to leave the European Union as voted on and promised to the British people. The Brexit vote passed over two years ago and the deadline to leave the EU was set for March 29, 2019. In France, major bank Societe Generale lowered its fourth-quarter revenue estimates significantly, which lowered shares over 5%. In light of other major banks struggling, the global capital market continues to look shaky. European Markets closed lower today across the board, aside from Swiss, while Asian markets were mostly lower, aside from Australia and Taiwan.

Netflix earnings will release after market close today while next week we will see the number of earnings reported significantly increase. Over 200 companies will report next week including Capital One, Haliburton, Abbvie, and more.

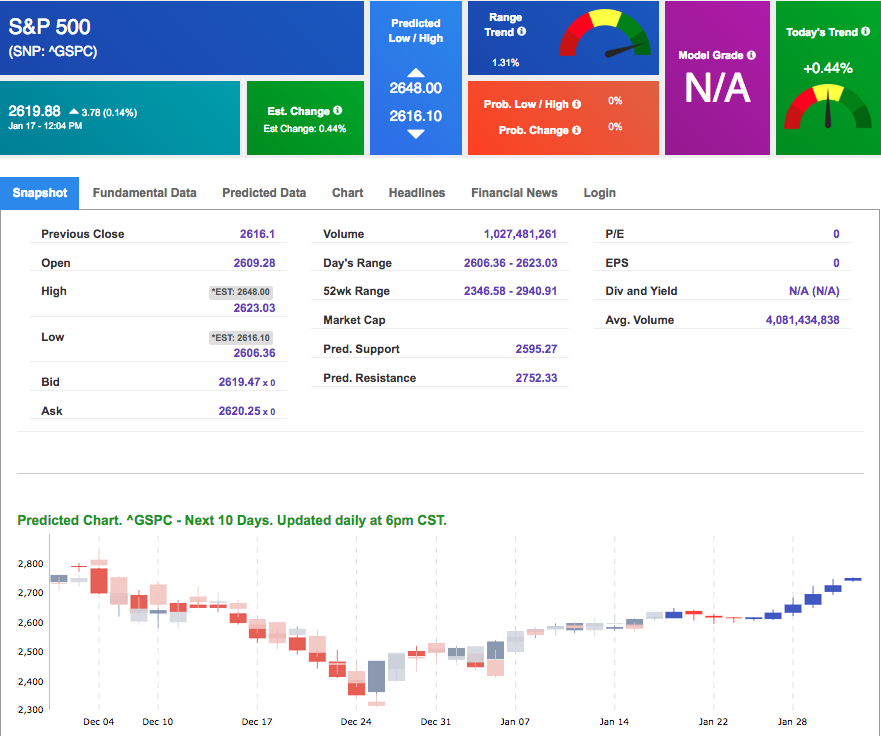

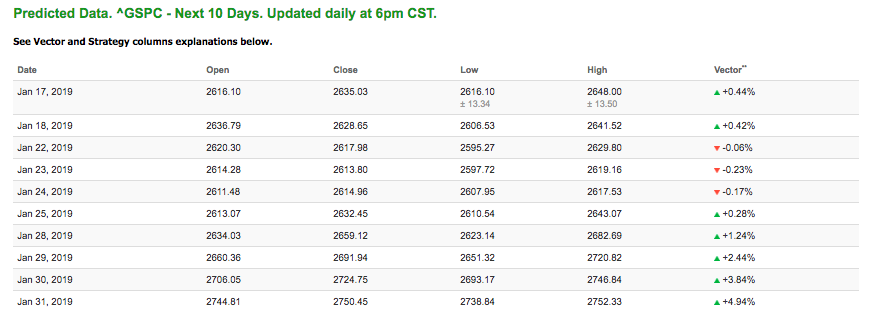

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.44% moves to -0.17% in four trading sessions. The predicted close for tomorrow is 2,628.65. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

“I cannot guarantee your acceptance”

Are you aware that you are one of a very select few (for real) to whom I recently extended a limited-time invitation to “test-drive” a game-changing very personal newElite Trading service from Tradespoon?

If you are quick enough, you can join me live, in my trading room (real time) and duplicate my trades seconds after I make them.

- This breakthrough service is limited to only 50 traders.

- Acceptance is on a first come first served basis and when the 50 Elite seats are taken, that’s it

- Your personal access PIN is 0014

- There is no risk for your trial

Click on the link below and hope that one of those 50 Elite seats is still available. If they’re gone, I’m sorry. There’s nothing I can do.

Click Here to Learn More and Check on Availability

Highlight of a Recent Winning Trade

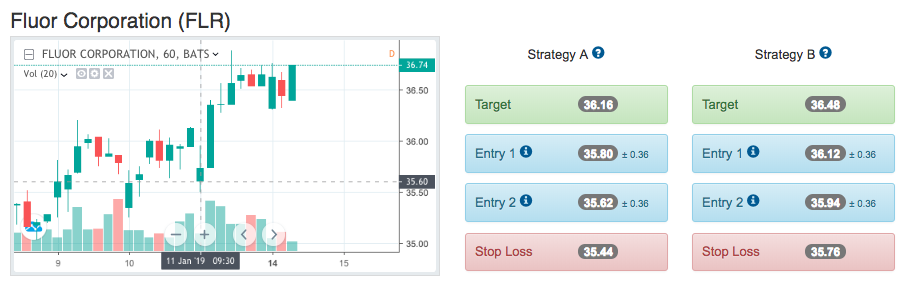

On January 11th, our ActiveTrader service produced a bullish recommendation for Fluor Corporation (FLR). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

FLR opened in its forecasted Strategy A Entry 1 price range $35.80 (± 0.36) and passed through its Target price $36.18 within the second of trading. The Stop Loss price was set at $35.44.

Friday Morning Featured Stock

Our featured stock for Friday is General Mills Inc. (GIS). GIS is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $42.73 at the time of publication, up 1.09% from the open with a +0.96% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

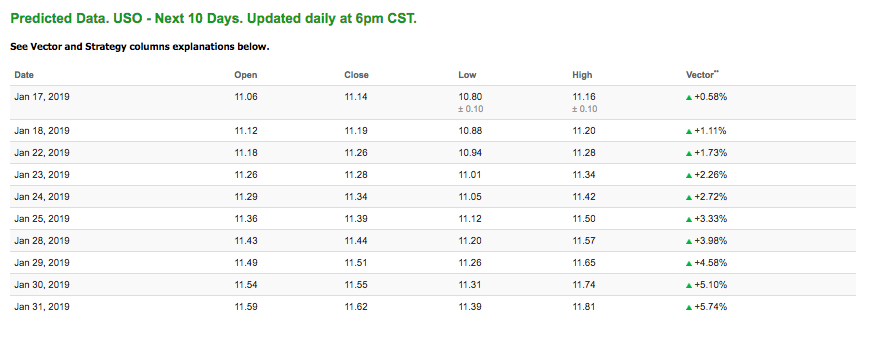

West Texas Intermediate for February delivery (CLG9) is priced at $51.77 per barrel, down 0.97% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $10.96 at the time of publication, down 0.94% from the open. Vector figures show +0.58% today, which turns +3.33% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

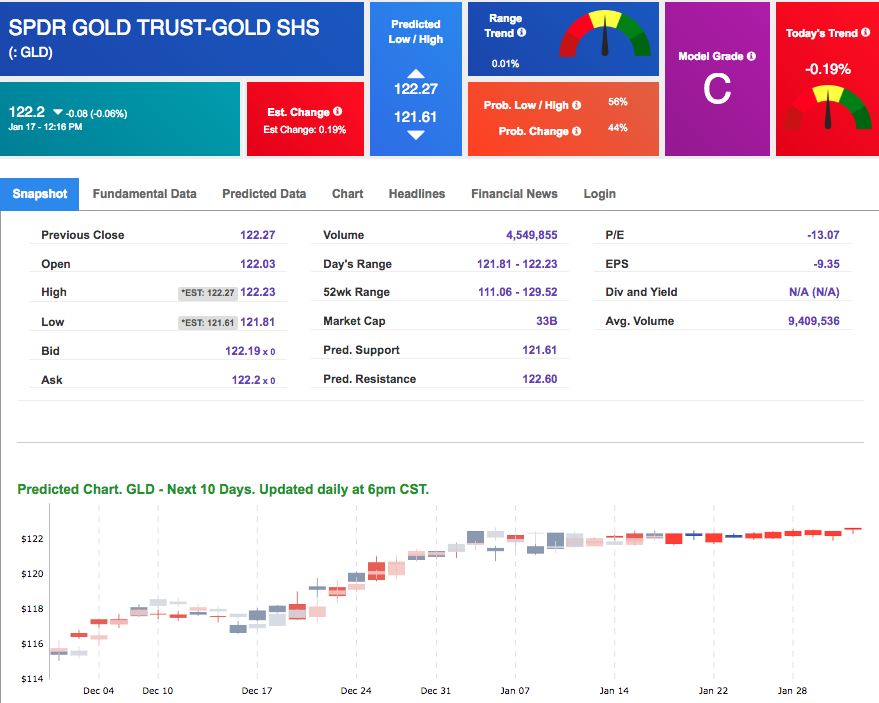

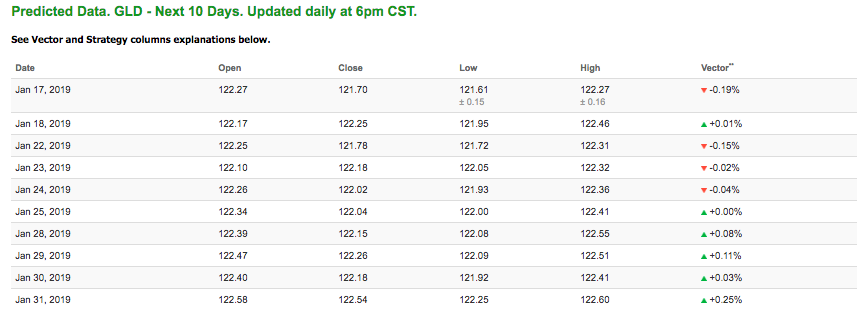

The price for February gold (GCG9) is down 0.15% at $1,291.90 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $122.2, down 0.06% at the time of publication. Vector signals show -0.19% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.32% at 2.73% at the time of publication. The yield on the 30-year Treasury note is down 0.13% at 3.07% at the time of publication.

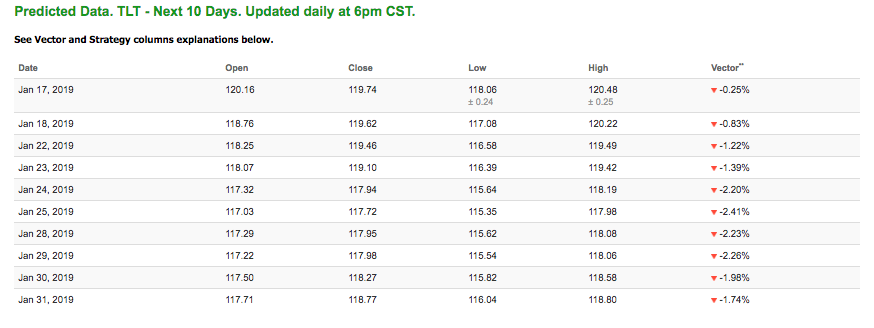

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.25% moves to -1.39% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

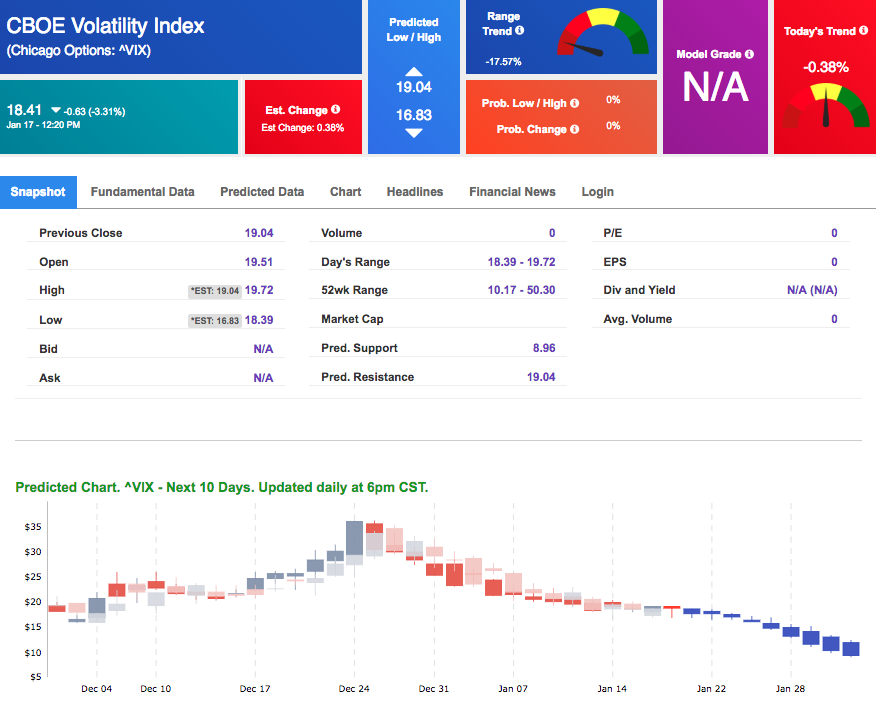

Volatility

The CBOE Volatility Index (^VIX) is down 2.61% at $22.36 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $18.48 with a vector of -3.45%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

“I cannot guarantee your acceptance”

Are you aware that you are one of a very select few (for real) to whom I recently extended a limited-time invitation to “test-drive” a game-changing very personal newElite Trading service from Tradespoon?

If you are quick enough, you can join me live, in my trading room (real time) and duplicate my trades seconds after I make them.

- This breakthrough service is limited to only 50 traders.

- Acceptance is on a first come first served basis and when the 50 Elite seats are taken, that’s it

- Your personal access PIN is 0014

- There is no risk for your trial

Click on the link below and hope that one of those 50 Elite seats is still available. If they’re gone, I’m sorry. There’s nothing I can do.