How to Earn From Major Contract Awards

It’s about 100,000 tons, 1,106 feet long and 250 feet high. It can carry up to 90 combat aircraft and can be deployed anywhere in the world.

It’s about 100,000 tons, 1,106 feet long and 250 feet high. It can carry up to 90 combat aircraft and can be deployed anywhere in the world.

Powered by four massive shafts and a state-of-the-art reactor – the Gerald Ford aircraft carrier is a modern engineering marvel. It’s expected to be in service for the next 50 years and will be the home for a crew of over 2,600. The armament system? If you have to ask – you don’t want to mess with this ship.

The cost? $10 billion – part of a $36 billion program. She set sail this year.

Here’s a detail you should care about as a trader: Construction began on August 11th 2005 when Northrop Grumman (NYSE: NOC) started the ship. Which means that the contract was awarded years earlier.

NOC share price when it was awarded? Mid fifties. Today? Over $300.

In fact, the United States federal government spends over $400 billion per year on federal contracts for goods and services.

When a major contract is awarded – for anything – you want to know about it, because it has a direct impact on share price.

Why contract awards matter

A large portion of government spending – defense or otherwise – is determined through a competitive bidding process. Businesses of all sizes are free to bid on an available government contract. Think you can help with hurricane clean-up? Sign up! Want to sell paper towels? Sign up!

Bottom line: When the dollars get doled out, lots of businesses benefit.

In addition to federal government contracts, state and local governments also procure goods and services through a similar, competitive bidding process. Companies also contract with other companies to provide goods or services they need outside of their area of expertise.

When the award is large enough, and the company is publicly traded – investors have a habit of noticing.

Since the bidding process can be highly competitive, the award of the contract becomes a clear indication of the company’s standing and performance. It’s the exact type of news that can push the share price higher. Why? Dollars coming in.

An impact that can be felt in share price

Recently NOC received an award to build the air force’s next bomber. A $50 billion program. The result – a new facility and 1,500 new jobs in central Florida.

The current stock price represents the market valuation of the firm’s expected future cash flows. When a company gets a new contract award, this is a new source of revenue that the market had not priced into its current valuation.

The market must adjust its valuation of the company, and as a result, the stock price should rise.

While new contract awards result in additional revenue for companies, the amount that a particular contract can move a stock price can vary. Although all new contracts represent unexpected additional revenue for the firm, the stock price may not move much if the contract is a relatively small percent of annual revenue.

The bigger the award from a contract, the more the company’s stock price will increase because of the news. Smaller contracts may not move the stock price significantly for very large firms (high market capitalization), but they can be a huge source of additional revenue for smaller companies.

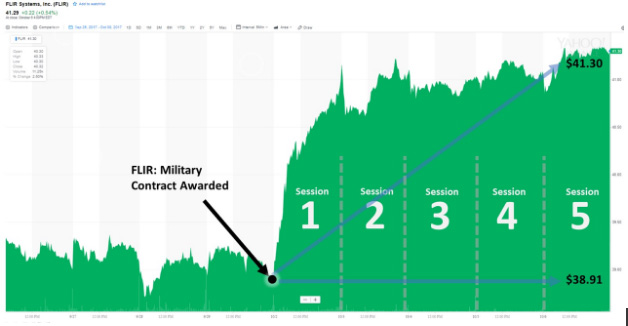

Here’s a perfect example: Sensor systems developer, FLIR Systems (FLIR), landed a $74.7 million contract with the U.S. military on October 2. They will provide TacFLIR surveillance cameras in support of the U.S. Army EO/IR-Force Protection (FP) program.

When the news came out – share price was trading at $38. Four days later – it rose steadily to $41 – passing a 6% gain in very short order to investors.

When contracts get awarded investors can win!

Trading contract award announcements

Before deciding to place a trade on a contract award announcement, it is important to do some additional research. Investors need to consider how large the contract award is in comparison to the market cap of the firm.

If the contract is a small percent of annual revenue, the stock price may not increase much at all. It may not be worthwhile to make a trade. If the dollar amount of the contract award is relatively high compared to annual revenues, there is a greater chance that the stock price will increase significantly and provide a reasonable return on the trade.

Also check to see if there is any other news in the overall market or within the company itself that could potentially push the stock down and overshadow the news of the contract award.

If you’ve ruled out the potential impact of bad market news and believe the market reaction to the contract award will be significant, there are three entry points to watch for:

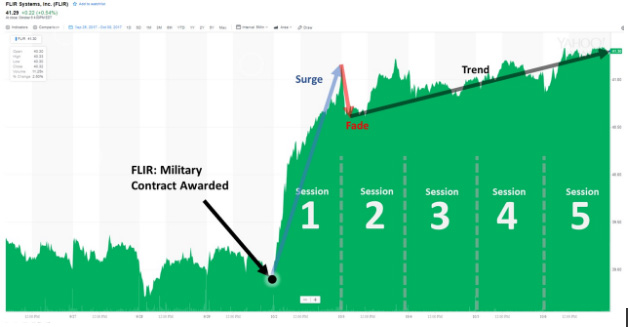

- Pop: The first move is the initial pop in the stock price that occurs very quickly as the market reacts to the unexpected news.

- Fade: These reactions, however, often cause the stock price to overshoot its initial target valuation. When this happens, a quick decline, or pull back, in the stock price follows the initial pop.

- Trend: Investors who miss the opportunity to trade on each of these quick market events, however, can still trade on the trend. Throughout the trading day, and often for several days following the event, the stock price continues to increase as the new information filters into the market and investors re-evaluate their expectations about the firm’s future earning.

One event, three entry points to watch for!

Keep an eye out for major contract awards, watch the stock and let your account grow with the rising tide!