Market Clears Key Resistance Levels

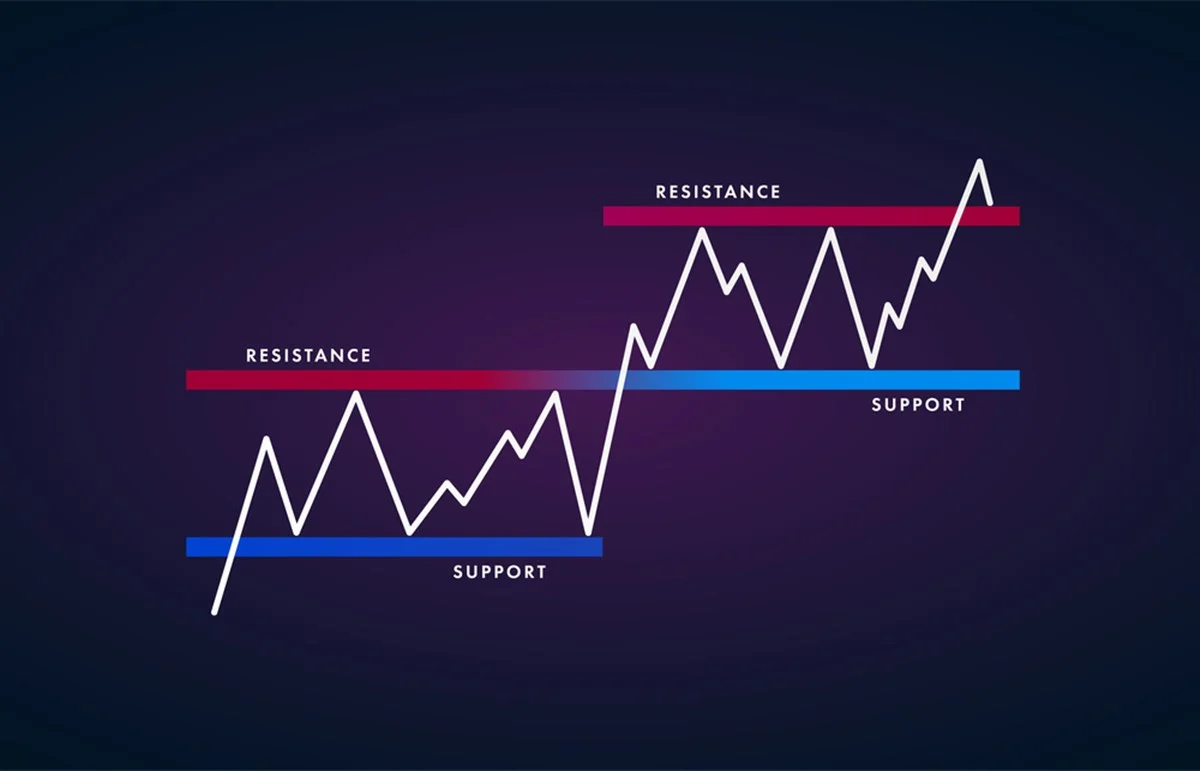

- Tuesday’s pop above key resistance levels was a bullish signal for the major indexes as there was some follow thru on Wednesday. The bullish action this week has kept the uptrend channels intact and previous resistance will now try to hold as support going forward.

- At current levels, the S&P is just 3% away from a fresh all-time high while the Nasdaq is 4% shy of record highs. The Dow and the Russell have lagged this year’s action and are 6% and 18% away, respectfully, from lifetime peaks.

- Of course, fresh support levels are going to need to hold into the weekend and over the near-term while higher highs continue to be established. Volatility has eased but is also facing a key test over the next few sessions that could provide ongoing clues about a possible summer rally.

The stock market tagged fresh multi-month highs on Wednesday but finished mixed as weaker-than-expected economic news weighed on sentiment. Specifically, private payrolls increased by just 37,000 and represented the lowest reading in over two years.

The Nasdaq closed at 19,460 (+0.3%) after trading to a high of 19,493. Key resistance at 19,500 was challenged and held. Support is at 19,250.

The S&P 500 tested a high of 5,990 before settling at 5,970 (+0.01%). Key resistance at 6,000 held. Support is at 5,950.

The Dow went out at 42,427 (-0.2%) dispute the intraday peak hitting 42,645. Resistance at 42,500 was cleared but held. Support is at 42,250.

Earnings and Economic News

Before the open: Ciena (CIEN), Cracker Barrel (CBRL), Duluth Holdings (DLTH), Hello Group (MOMO), Land’s End (LE), Toro (TTC)

After the close: Broadcom (AVGO), DocuSign (DOCU), Petco (WOOF), Vail Resorts (MTN), Zumiez (ZUMZ)

Economic news:

Initial Jobless Claims – 8:30am

Trade Deficit – 8:30am

Technical Outlook and Market Thoughts

Tuesday’s pop above key resistance levels was a bullish signal for the major indexes as there was some follow thru on Wednesday. The bullish action this week has kept the uptrend channels intact and previous resistance will now try to hold as support going forward.

At current levels, the S&P is just 3% away from a fresh all-time high while the Nasdaq is 4% shy of record highs. The Dow and the Russell have lagged this year’s action and are 6% and 18% away, respectfully, from lifetime peaks. We have talked about the small-caps possibly outperforming the other major indexes if there is a summer rally given the divergence.

Of course, fresh support levels are going to need to hold into the weekend and over the near-term while higher highs continue to be established. Volatility has eased but is also facing a key test over the next few sessions that could provide ongoing clues about a possible summer rally.

The Nasdaq broke out of a 15-session trading range on Tuesday after clearing and holding 19,250. Continued closes above 19,500 and the February 24th intraday top at 19,644 keeps upside potential towards 19,750-20,000 in focus.

A move back below 19,000 and out of the bottom of the current uptrend channel would suggest another false breakout with downside action to 18,750-18,500 and the 200-day moving average.

The S&P 500 continues to ride the edge of its uptrend channel and came within 10 points of clearing 6,000 on Wednesday. A trading range between 6,000-6,100 lasted for 19 days before the S&P tagged a fresh all-time high of 6,147 on February 19th.

Support is at 5,900-5,850. A close back below the latter gets 5,800 and the 200-day moving average back on the radar.

The Russell 2000 cleared key resistance at 2,100 on Tuesday and a level that was cleared and held four times in May. However, the peak only reached 2,114 and we would like to see 2,135 cleared and held this week, or next. If so, there could be a quick surge to 2,175-2,200 and the 200-day moving average.

Key support is at 2,050 with Monday’s low at 2,043. Multiple closes back below this level and out of the uptrend channel would imply a further slide down to 2,000 and the 50-day moving average.

The Dow closed back above its 200-day moving average on Tuesday but 13 points below it on Wednesday. We are still looking for multiple closes above 42,800, specifically, that could lead to ongoing strength to 43,750-44,000 over the near-term.

Key support at 42,000 has now been holding for seven-straight sessions. A drop below this level and out of the uptrend channel could indicate a further fade towards 41,500-41,000 and the 50-day moving average.

The Volatility Index (VIX) flirted with 17.50 for the second-straight day with continued closes below this level being very bullish for the market. There was one close below 17.50 on May 16th.

Key resistance remains at 20 with stretch up to at 24-25 and the 50-day moving average.

Thursday could also be another lackluster session as Wall Street awaits Friday’s unemployment report. The numbers could help or hinder the current action and why the close will be important for next week.