Market Rallies Post FOMC as Disney Buys Fox, Brexit Struggle Remains

U.S. Markets traded lower ahead of today’s FOMC but rebound following the meeting only to retreat before the close. Fed Chairman Powell met with the press following today’s conclusion of the two-day FOMC meeting. Rates were unchanged and patience was once more stressed for 2019. Other significant points of emphasis today include the emergency Brexit Parliament debate, Disney closing its $71 billion deal for Fox, and China-U.S. trade deal progress. Currently, the SPY trades above its 200-day moving average of $274. Our long-term outlook remains bullish but we project continued downward movement if SPY trades below its 200-day moving average, possibly retrace back to $268 level. For reference, the SPY Seasonal Chart is shown below:

Today’s late rally to push all three U.S. indices into the green was surprising as most analysts had already projected no rate changes for today’s FOMC yet markets opened lower today. After Powell took the stand for his scheduled post-FOMC presser, indices began reversing course, with Dow being the last to turn positive. The new policy update seems to indicate no rate hikes this year, something Powell also reiterated. With rates staying at 2.25%-2.5% for 2019 one of the most significant changes in this policy update is the 2020 outlook, where interest rates are now expected to be 0.5% lower compared to what was expected at the last FOMC. Powell also stressed the fed is expecting a slow down in the economy in the next few years and growth of 2% would be considered solid progress. Still, Powell sounded optimistic in the Fed’s goal of expanding and sustaining the economy, stating the U.S. economy is “in a good place.” Other things to note from the update and press conference include sliding yields following the update, an overall flat yield curve reported, and the slowing pace of the bond reduction program, which looks to end in September as the Fed looks to hold mostly short-term Treasuries.

Globally, European markets lowered noticeably while Asian markets remained modestly lower, apart from Japan’s Nikkei index which closed slightly higher. The pound continues to struggle and trend down, currently falling against both the dollar and euro. Prime Minister May has requested an extension from the European Council but it does not look like the UK will receive their full requested extension through June 30. Instead, it looks like the European Union will extend Brexit through May 23. An emergency debate in Parliament took place thereafter as Brexit deal drafts, May’s resignation, and more were up for discussion in hopes of making some progress. Look for more on this in the coming days as the extension has yet to be completed and the late March deadline is fast approaching.

U.S.-China negotiations will continue next week in Beijing with Trade Rep Lighthizer and Treasury Secretary Mnuchin scheduled to meet with Chinese officials in hopes of beginning final talks. President Trump stated negotiations were “going very well,” while new estimates of a completed deal now shift towards the end of April. Other news to monitor includes the conclusion of Disney’s purchase of Fox entertainment. Disney now owns all Fox properties, apart from Fox News and Fox Sports; some major properties in this purchase include Fox’s majority stake in Hulu, “The Simpsons,” National Geographic, FX Network, and other well-known IP’s such as X-Men, Avatar, and Titanic. With Disney set to debut its streaming service “Disney+” in late 2019, it will be interesting to see what happens with Hulu as it now owns 60% of the second biggest streaming platform and Netflix’s biggest rival and competitor in the streaming landscape.

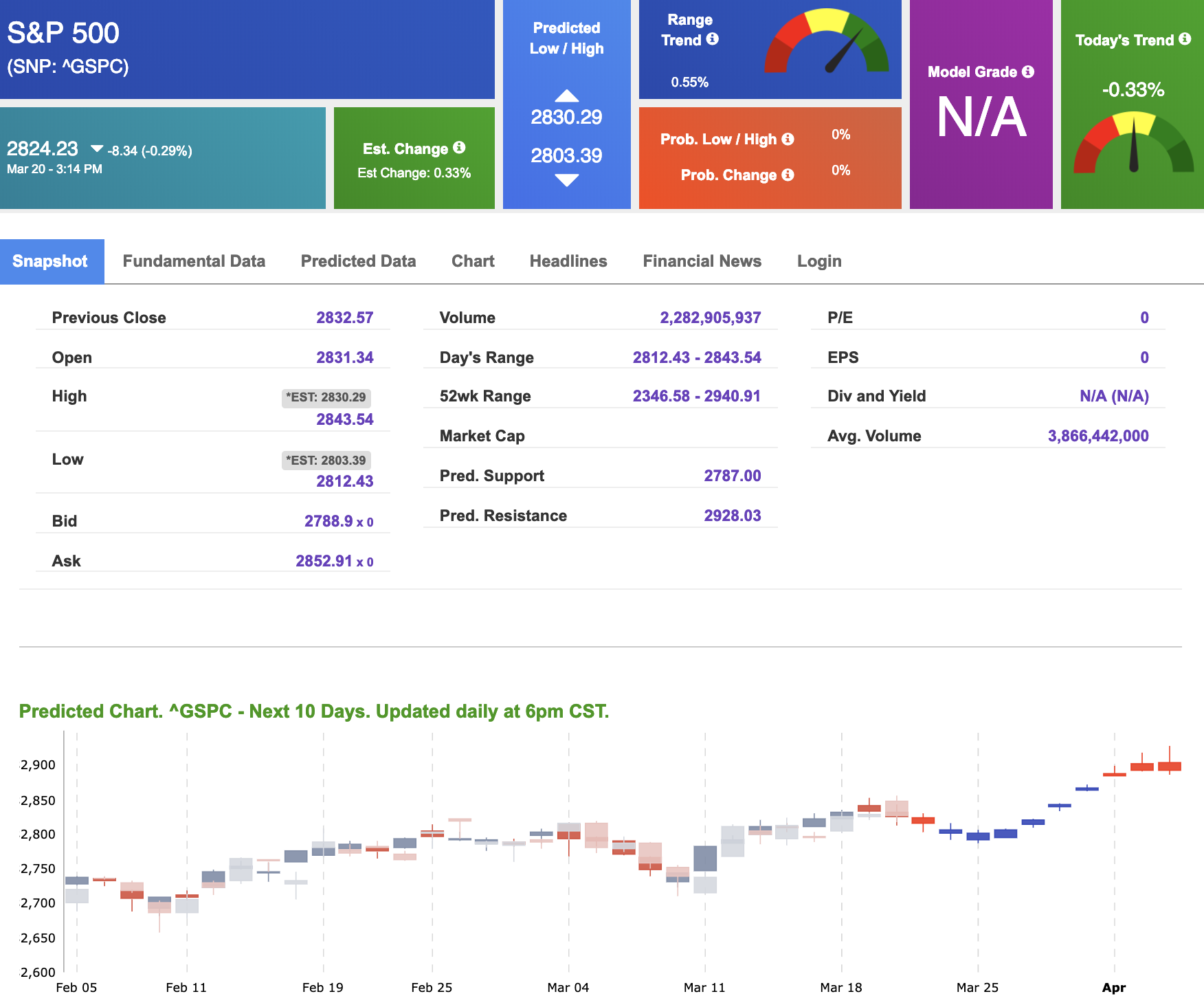

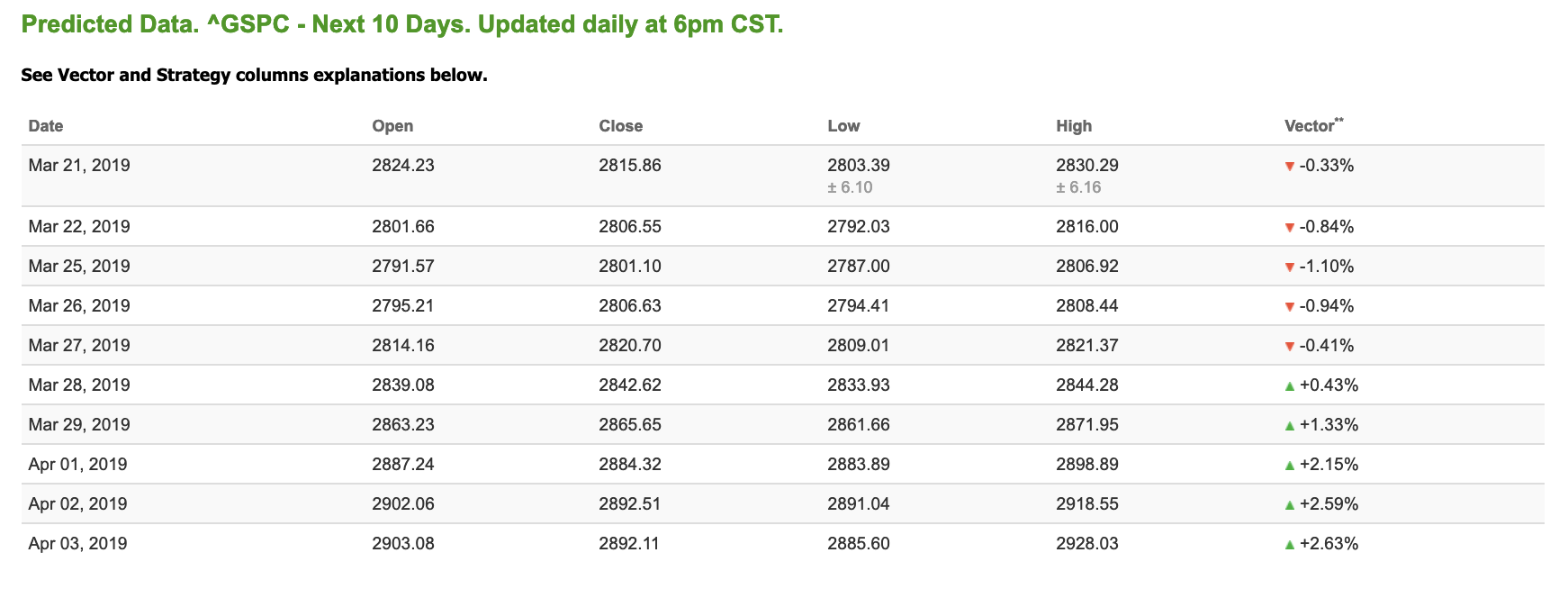

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.33% moves to +0.43% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Watch the Event we held yesterday and get the

names of the 2 hottest stocks about to

blow earnings estimates out of the water.

Click Here to Watch the Event Recording

and get the names of the two stocks we’re targeting for huge overnight gains.

Highlight of a Recent Winning Trade

On March 12th, our ActiveTrader service produced a bullish recommendation for Apple Inc (AAPL). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

AAPL entered its forecasted Strategy B Entry 1 price range $178.90 (± 1.01) in its first hour of trading and passed through its Target price $180.69 in the first hour of trading, reaching a high of 181.98. The Stop Loss price was set at $177.11.

Thursday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

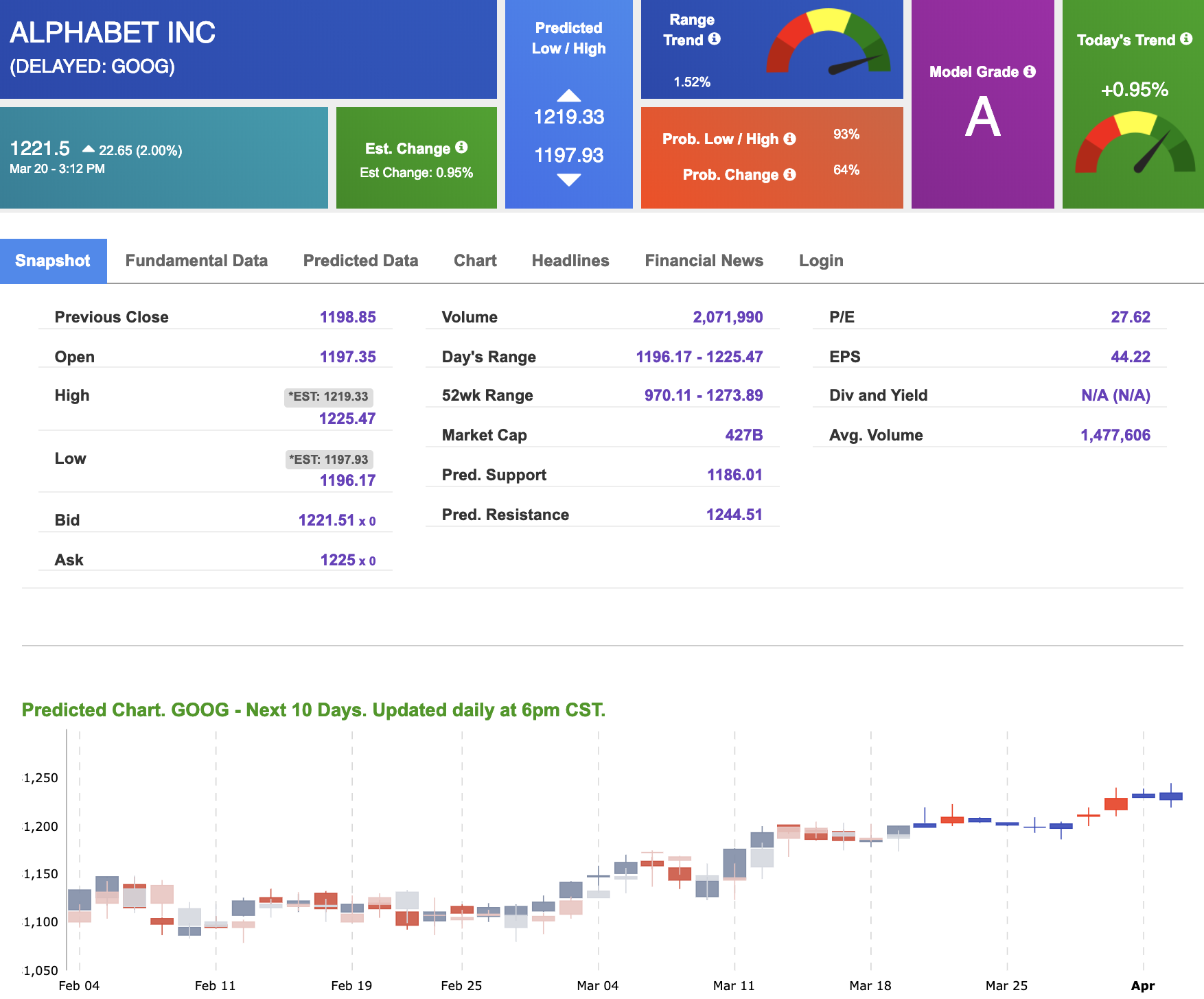

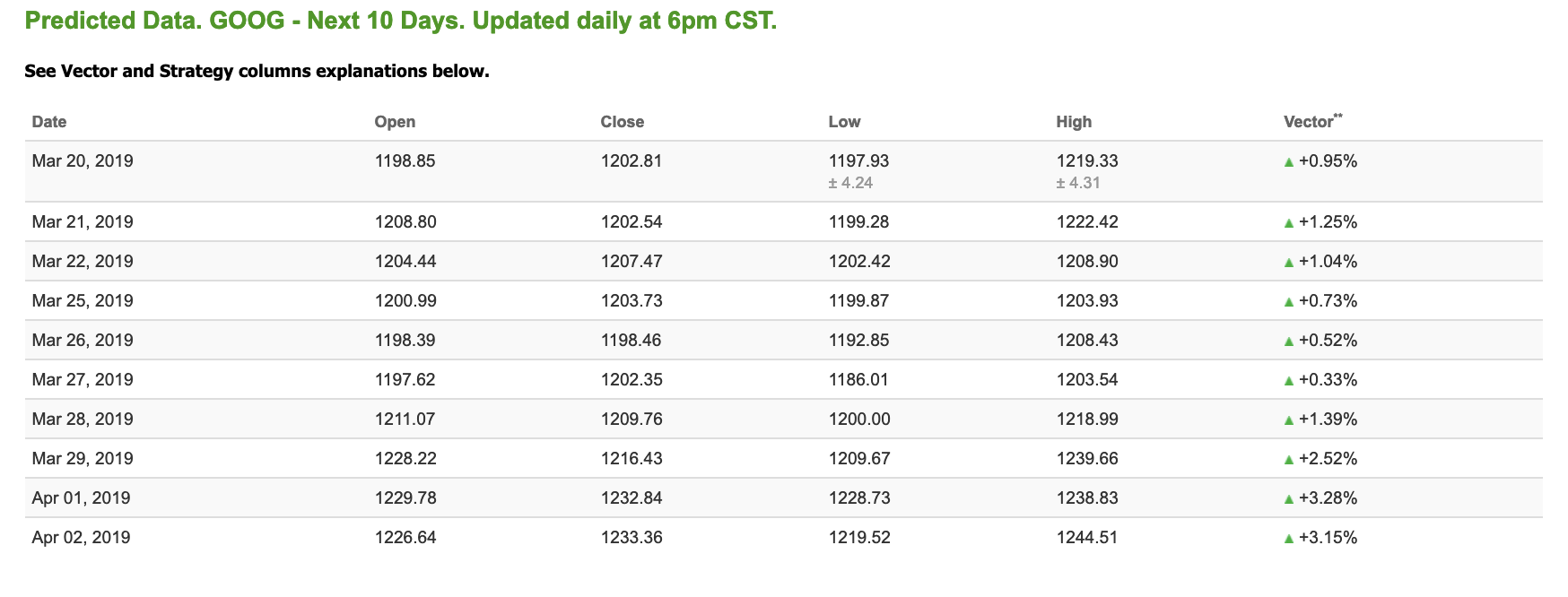

Our featured stock for Thursday is Alphabet Inc (GOOG). GOOG is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $1221.50 at the time of publication, up 2.00% from the open with a +0.95% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

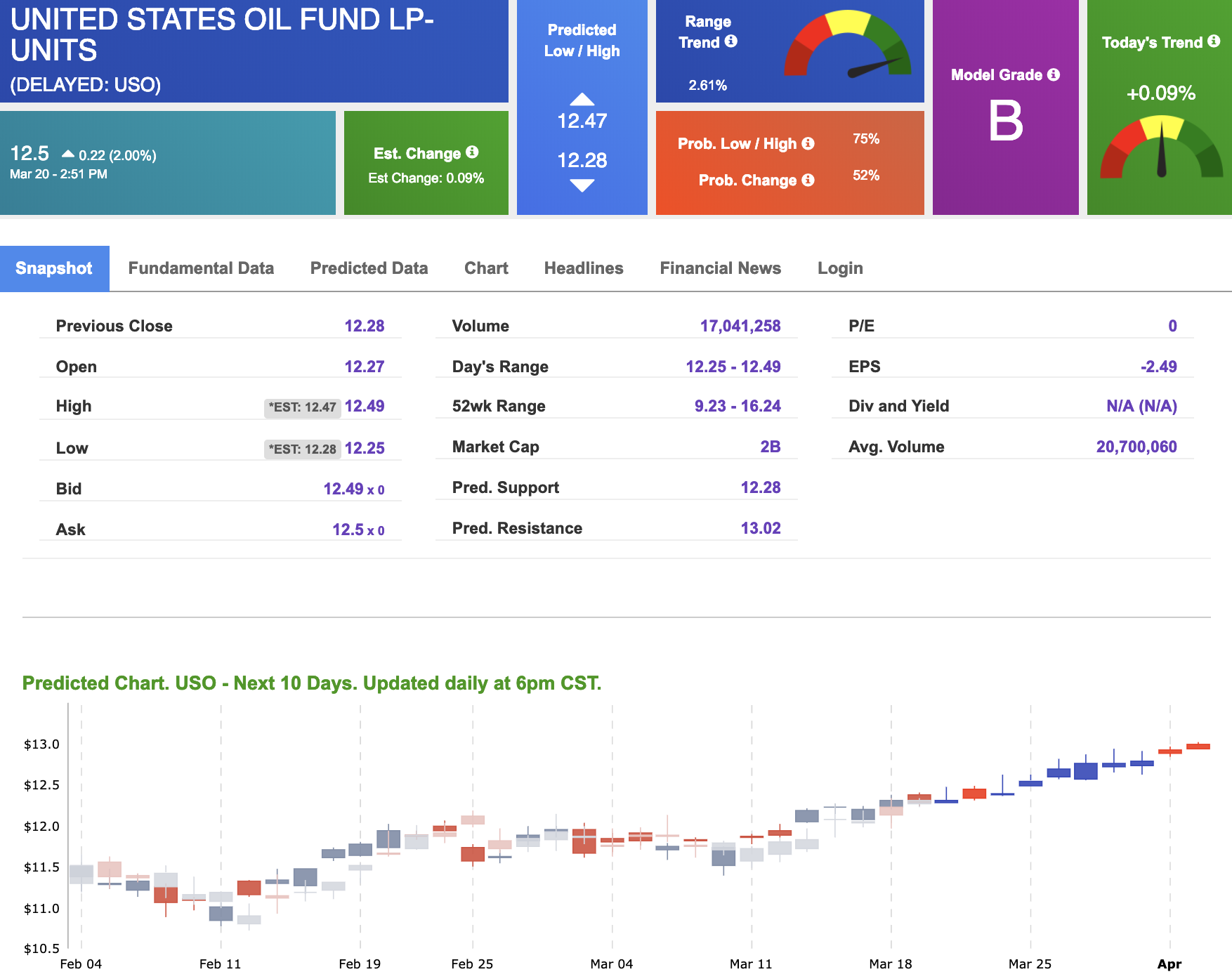

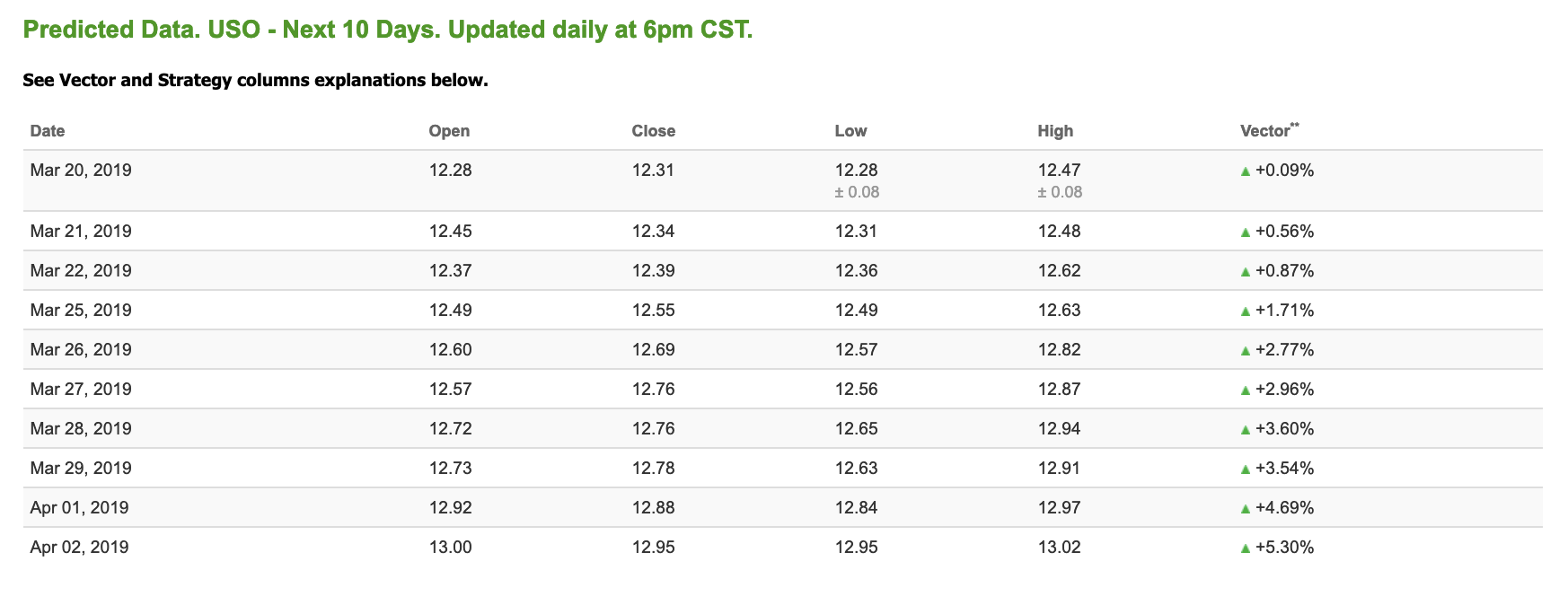

Oil

West Texas Intermediate for April delivery (CLJ9) is priced at $60.12 per barrel, up 1.85% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $12.5 at the time of publication, up 2.00% from the open. Vector figures show +0.09% today, which turns +2.96% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

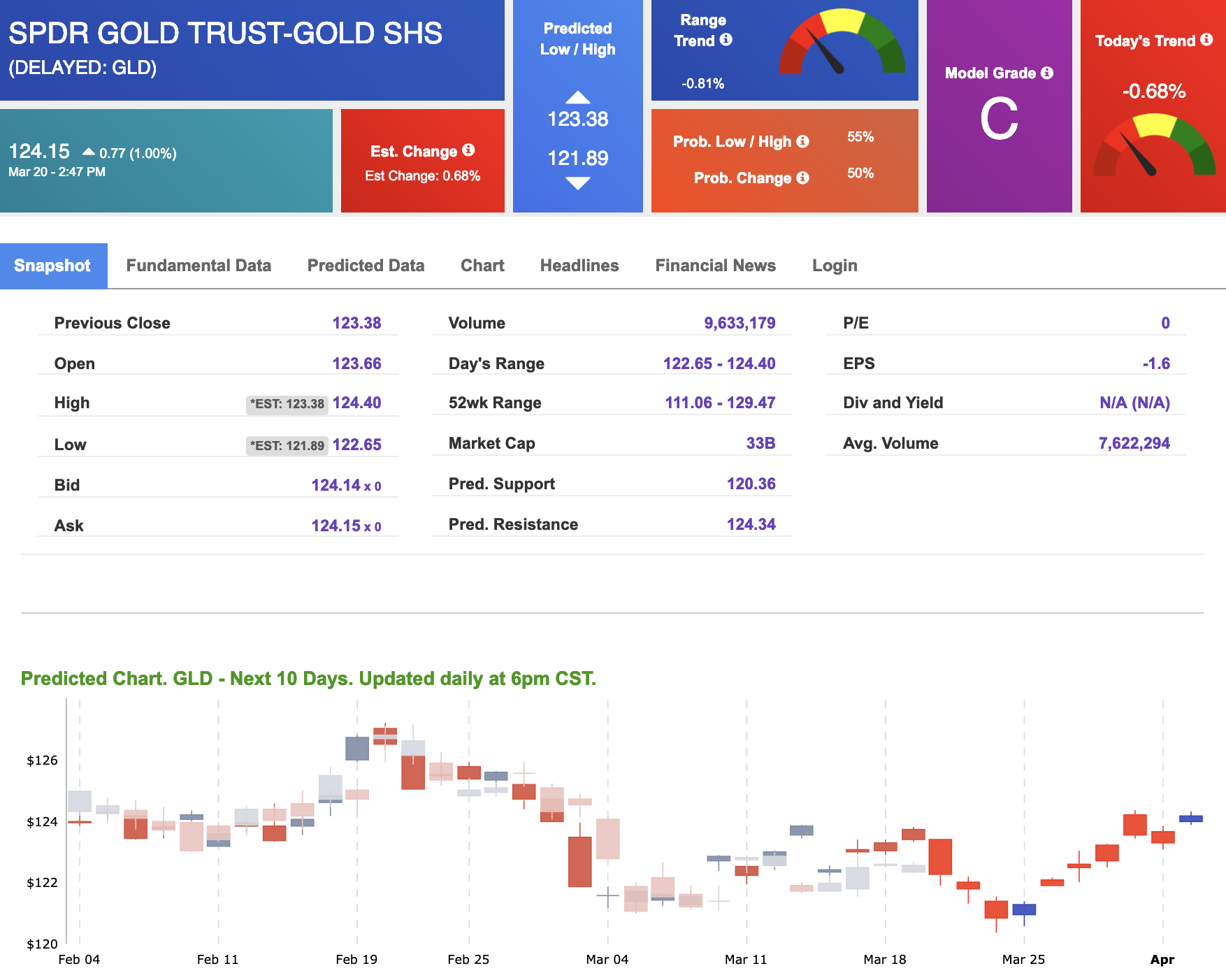

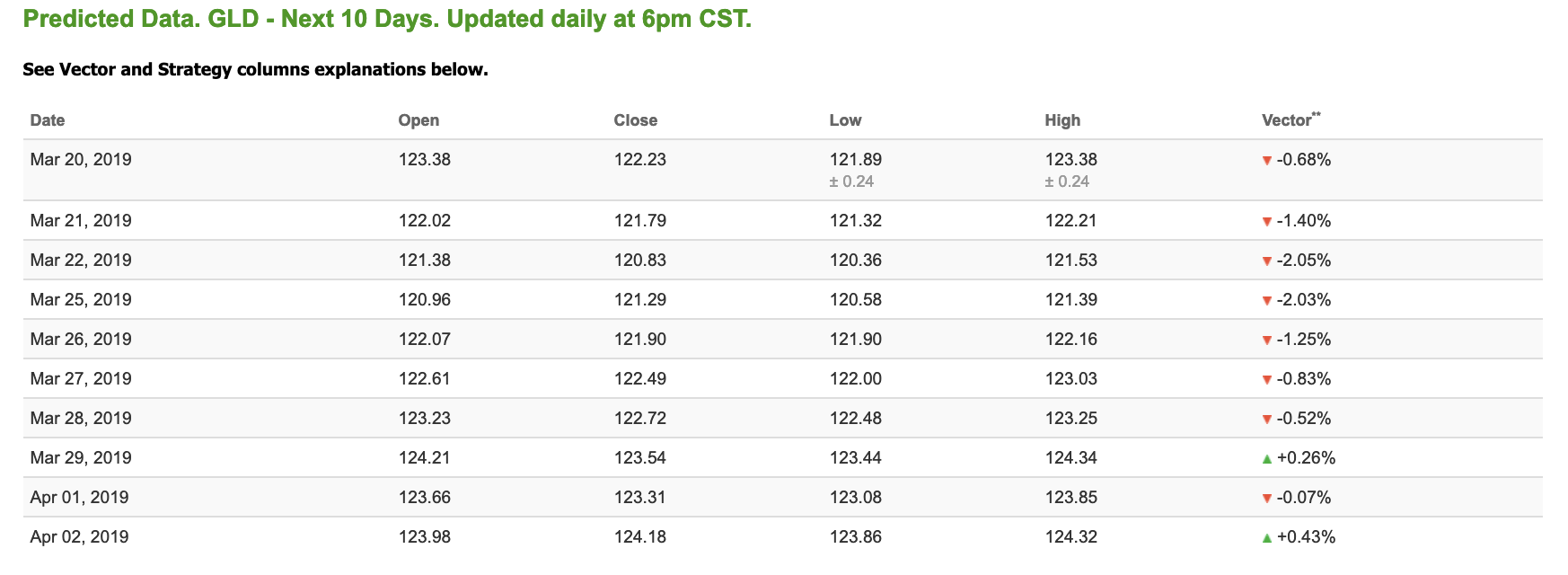

Gold

The price for April gold (GCJ9) is up 0.52% at $1,313.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $124.15, up 1.00% at the time of publication. Vector signals show -0.68% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

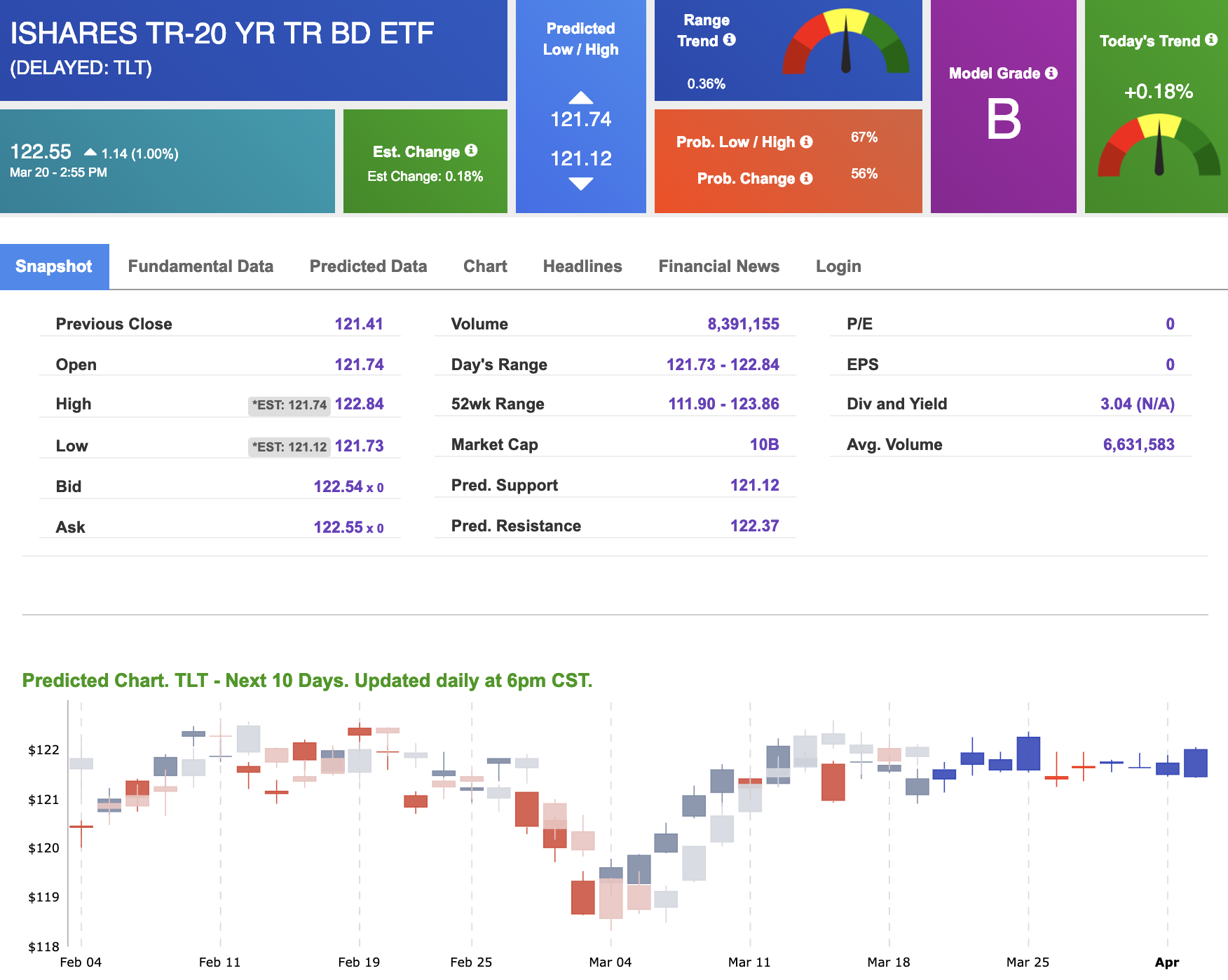

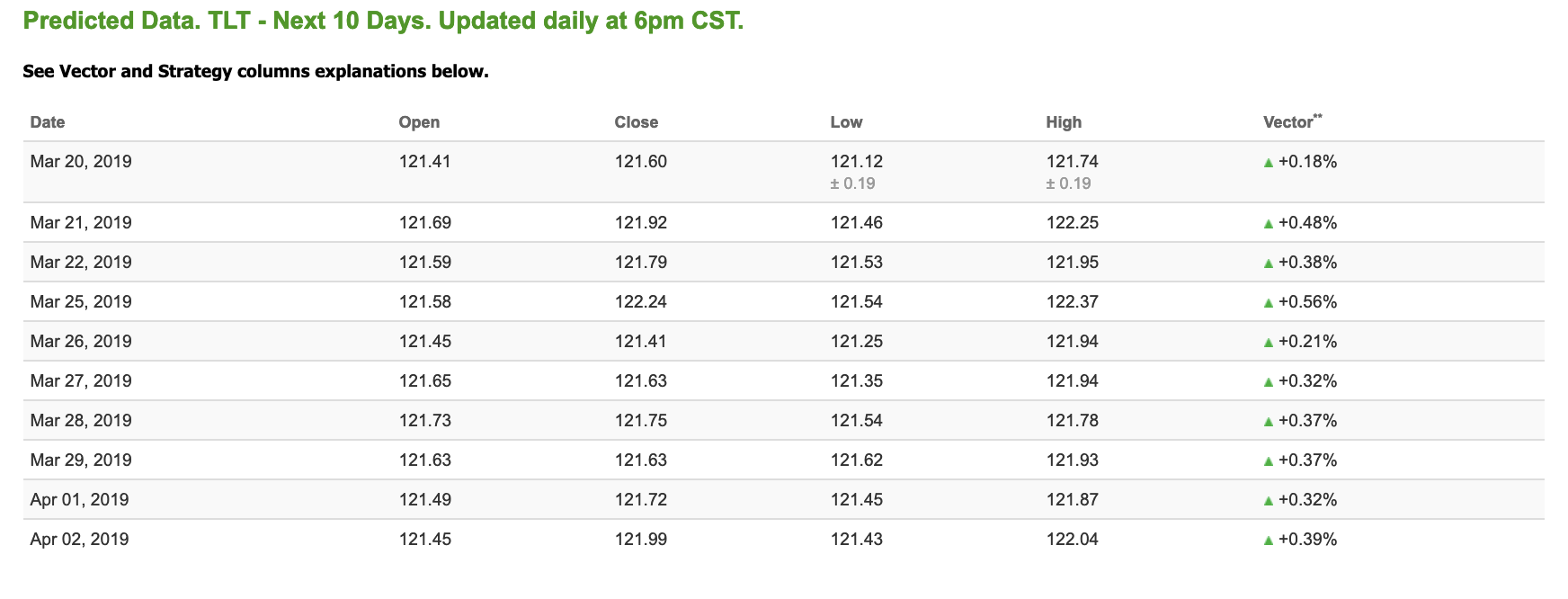

The yield on the 10-year Treasury note is down 3.29% at 2.53% at the time of publication. The yield on the 30-year Treasury note is down 1.98% at 2.97% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.18% moves to +0.56% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

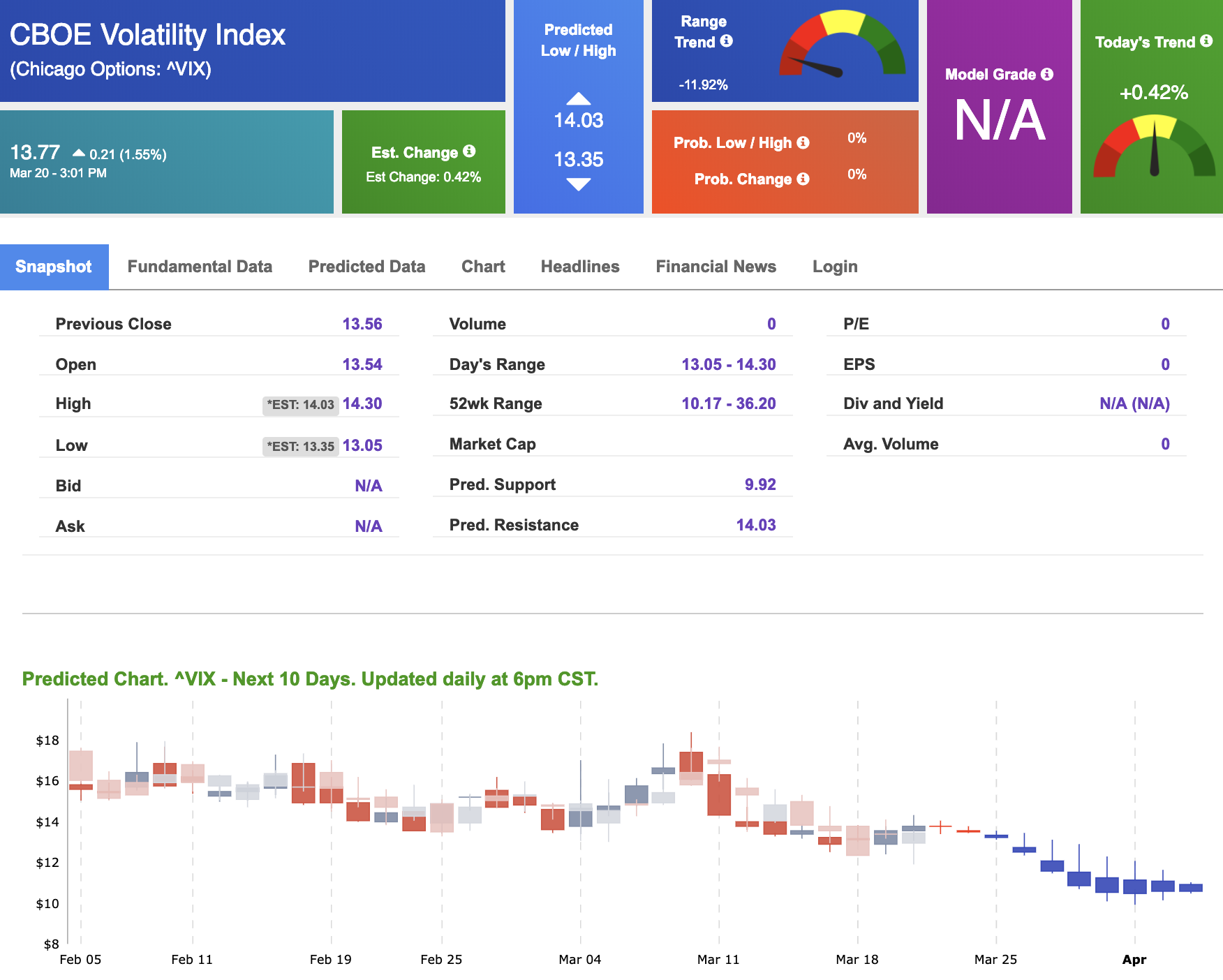

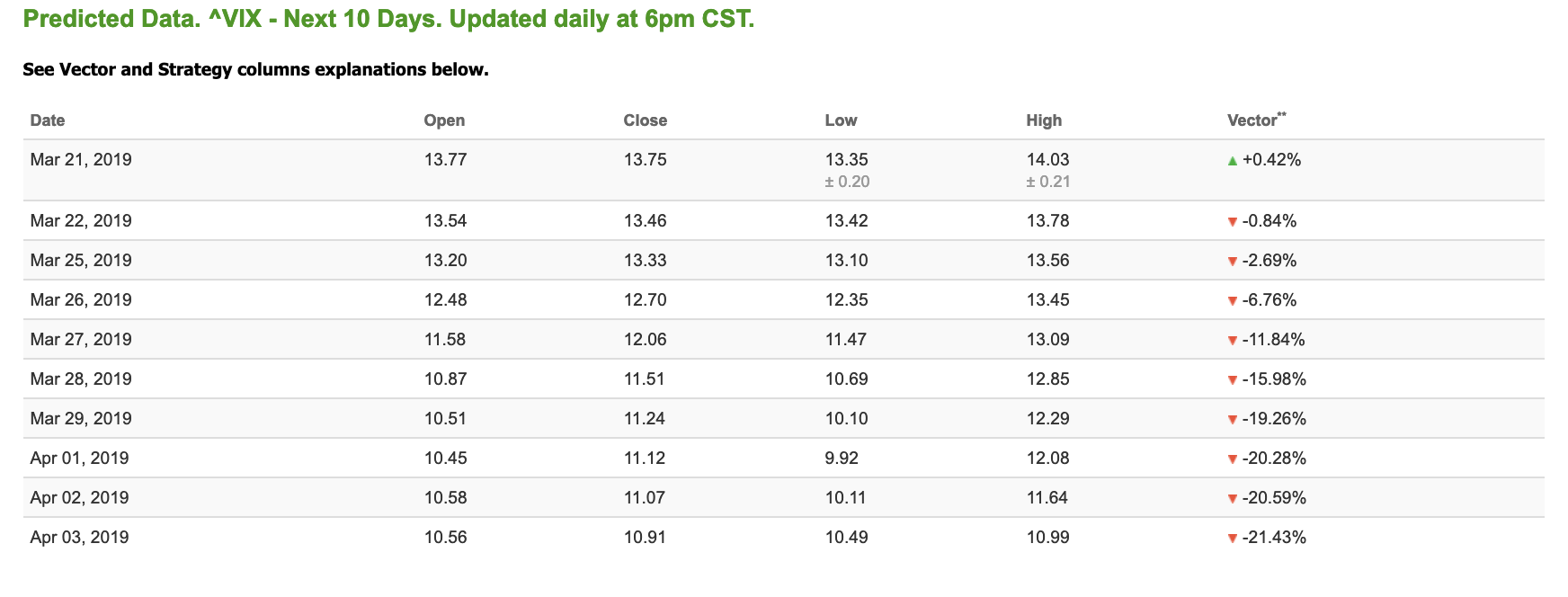

Volatility

The CBOE Volatility Index (^VIX) is up 1.55% at $13.77 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $13.46 with a vector of -0.84%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.