Market Up For Third Straight Day, Powell Gives Speech

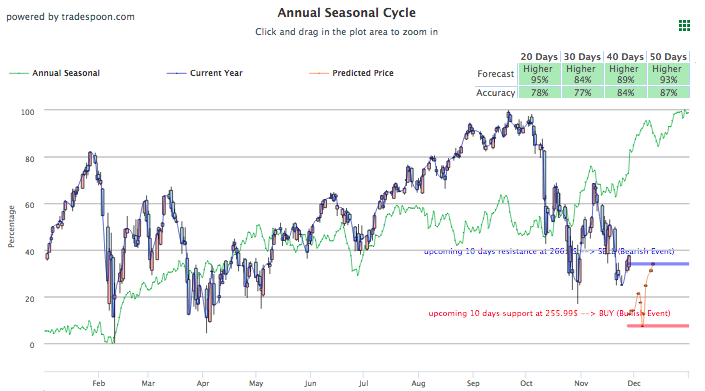

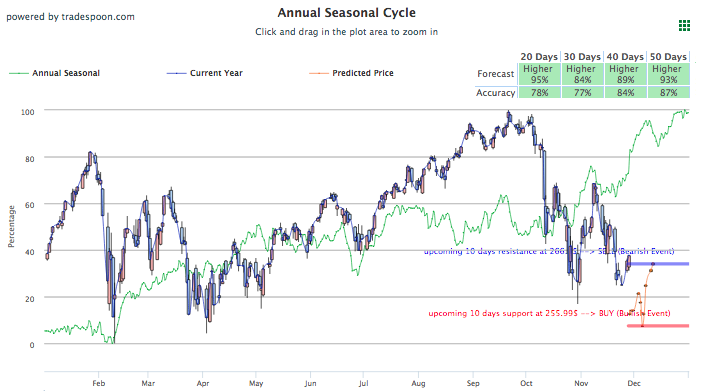

U.S. stocks are on the rise for the third straight day behind strong retail and financial sectors to start the week and renewed optimism for Chinese tariff negotiations. Chinese and U.S. officials, along with other world leaders, will meet later this week at the G20 summit in Argentina and will discuss trade, as well as climate change. The market is up today 1.5% and looks to be responding well to comments given by Fed Chairman Powell during a midday speech stating interest rates are fairly low by historical standards and “remain just below the broad range of estimates of the level that would be neutral for the economy,” clarifying it will not speed nor slow down growth. Powell’s comments and Chinese trade negotiations look to be at the center of the news cycle while other things to note include Microsoft surpassing Apple in terms of market cap to become world’s most valuable company and Trump’s recent feud with GM. The market looks to be oversold and at current market conditions the SPY support sits at $263 and overhead resistance is at $275 in the short term. Investors should consider buying now. For reference, the SPY Seasonal Chart is shown below:

Although trade concerns look to be at the forefront of investors’ minds, the market is riding a nice three-day streak after a troublesome Thanksgiving week which was worst in recent years. Look for more trade developments later in the week when world leaders converge in Buenos Aires for the annual G20 Summit. The other important financial factor at play today is Chairman Powell’s speech which featured a softer-dovish tone compared to his last speech and seems to be addressing both the recent trend of volatility and President Trump’s harsh criticism of the Fed Reserve. The recent comments indicating rates will remain below the economy run contrary and softer to his October comments but how that will play out in future policy is still to be seen. Some recent economic reports worth noting including GDP growth which came in at a 3.5% annualized rate during the third quarter and new home sales which fell in the month of October. Globally, Asian markets are up while European markets closed flat for the day.

Microsoft became the most valuable company in the world this week and has added to its lead today, currently up 0.6%, after Apple fell further behind over concerns regarding poor iPhone sales. Microsoft value is hovering around $828 billion and has been trailing Apple for a good portion of the last decade. With recent changes in the company such as improving cloud computing services, currently second behind Amazon in that market, and a focus on tablet, PCs, and laptops instead of smartphones, Microsoft was able to pull ahead of Apple. Since October, Apple is down 23%. In other news, after GM announced it would close several plants in the U.S. to which President Trump responded by threatening to cut subsidies. This has pushed GM slightly lower but could certainly go lower if any White House action is taken.

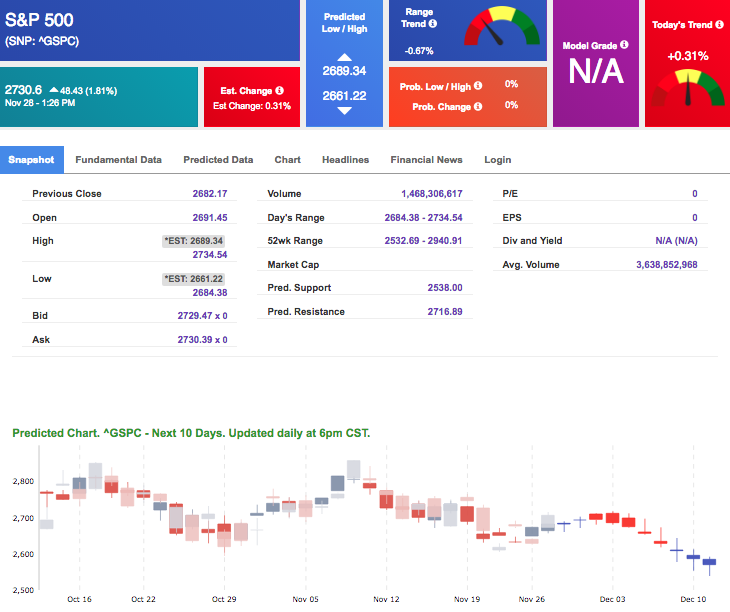

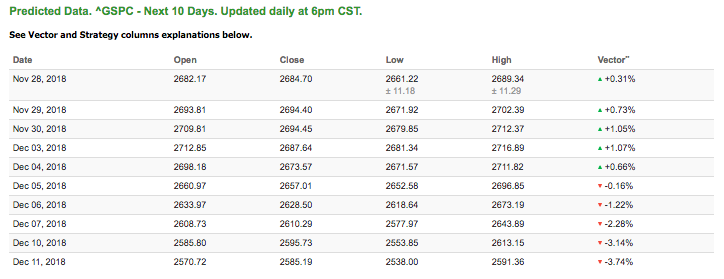

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.31% moves to -0.16% in five trading sessions. The predicted close for tomorrow is 2,994.40. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On November 23rd, our ActiveTrader service produced a bullish recommendation for Genworth Financial Inc. (GNW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GNW entered the forecasted Entry 1 price range of $4.47 (± 0.04) in its first hour of trading and hit its Target price of $4.54 in the second hour of trading, reaching a high of $4.54 for the trading day. The Stop Loss was set at $4.43.

LAST CHANCE: $uper Cyber Week $pecial!!!

What better way to celebrate Cyber week than by offering Market Commentary subscribers a Ridiculously Awesome Deal!

We are offering LIFETIME ACCESS to our Premium Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

NEW! Best Mobile Trading iPhone App –Buy, Sell and Learn!

Truly unique among stock trading apps. It acts as your gateway to the ultimate trading experience with our Tradespoons’ Stock Forecast Toolbox — all of which gives you a big edge in trading stocks profitably.

CLICK HERE To Download the Stock Forecast Toolbox FREE iPhone App Now!

Thursday Morning Featured Stock

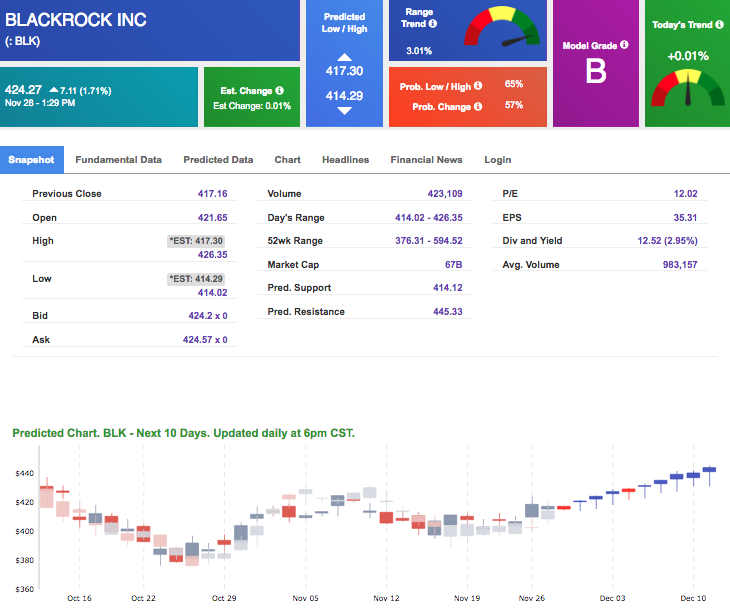

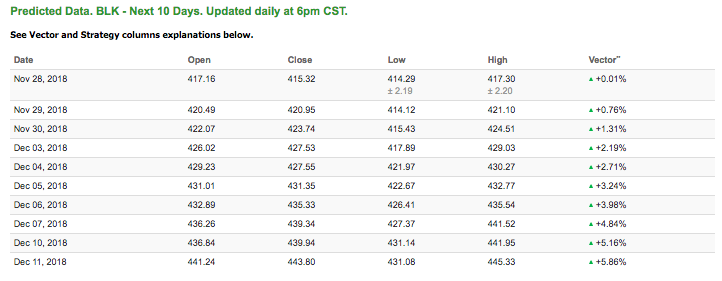

Our featured stock for Thursday is BlackRock, Inc. (BLK). BLK is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks,please click here.

The stock is trading at $424.27 at the time of publication, up 1.71% from the open with a +0.01% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

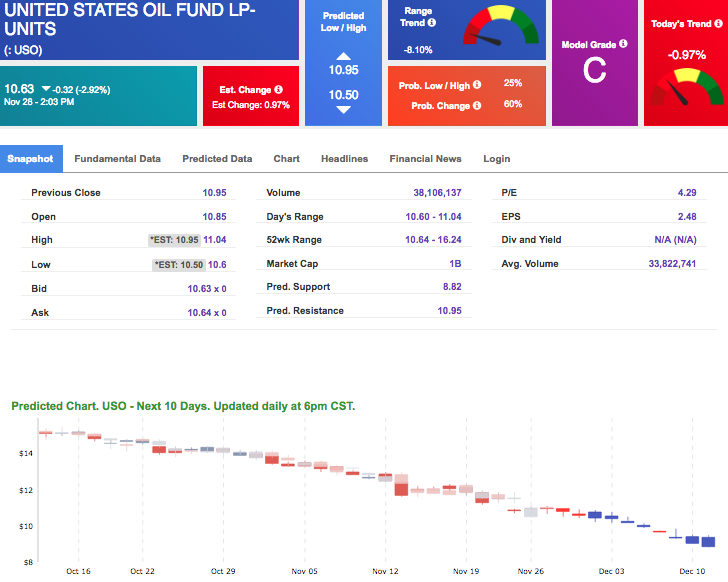

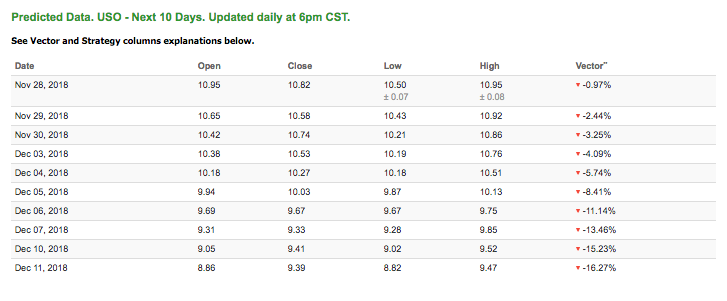

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $50.49 per barrel, down 2.11% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $10.63 at the time of publication, down 2.92% from the open. Vector figures show -0.97% today, which turns -8.41% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

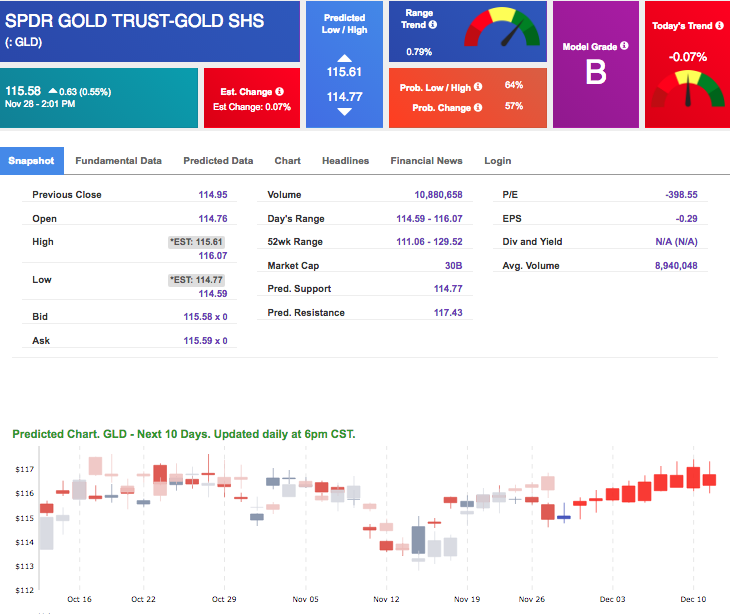

Gold

The price for December gold (GCZ8) is up 0.77% at $1,222.50 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $115.58, up 0.55% at the time of publication. Vector signals show -0.07% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

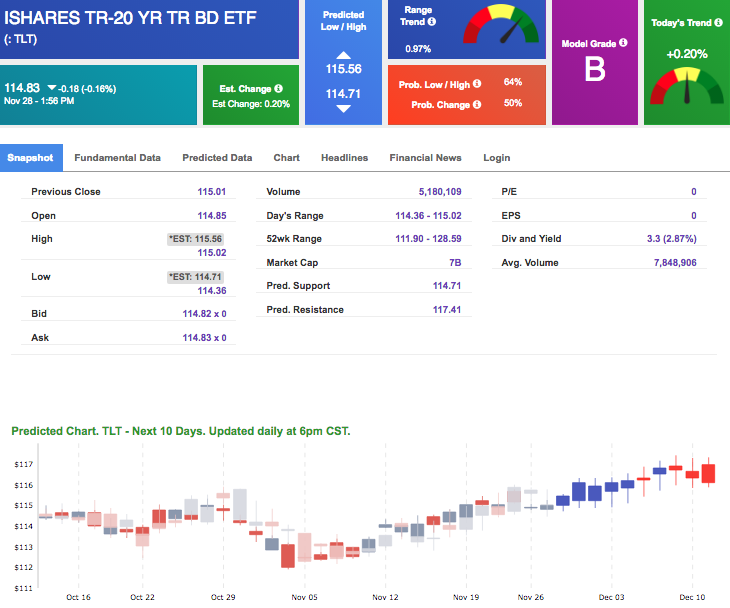

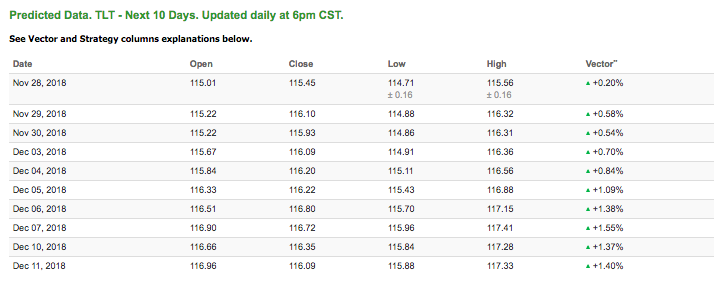

Treasuries

The yield on the 10-year Treasury note is down 0.63% at 3.04% at the time of publication. The yield on the 30-year Treasury note is up 0.33% at 3.33% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.20% moves to +0.70% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

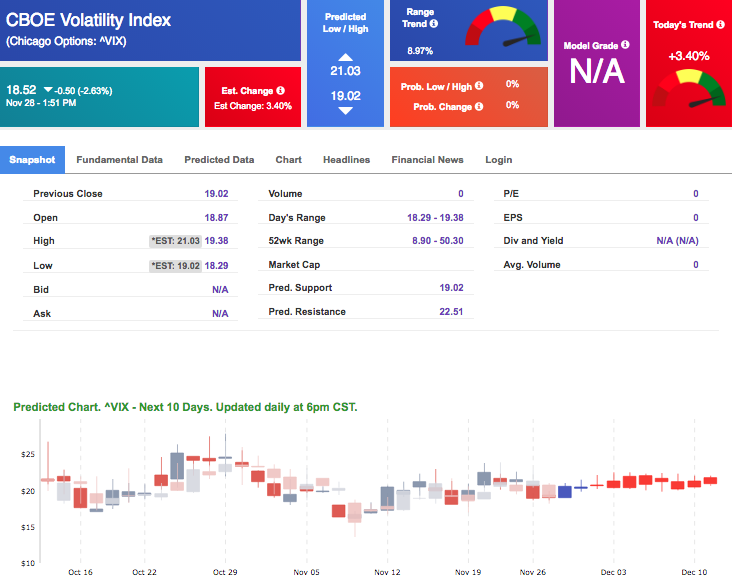

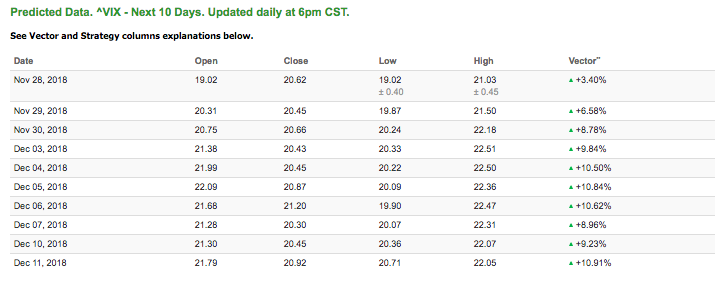

Volatility

The CBOE Volatility Index (^VIX) is down 2.63% at $18.52 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $20.45 with a vector of -6.58%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LAST CHANCE: $uper Cyber Week $pecial!!!

What better way to celebrate Cyber week than by offering Market Commentary subscribers a Ridiculously Awesome Deal!

We are offering LIFETIME ACCESS to our Premium Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

NEW! Best Mobile Trading iPhone App –Buy, Sell and Learn!

Truly unique among stock trading apps. It acts as your gateway to the ultimate trading experience with our Tradespoons’ Stock Forecast Toolbox — all of which gives you a big edge in trading stocks profitably.

CLICK HERE To Download the Stock Forecast Toolbox FREE iPhone App Now!