Markets Down Amid Weakening Global Trade, Brexit Brakes for Backstop

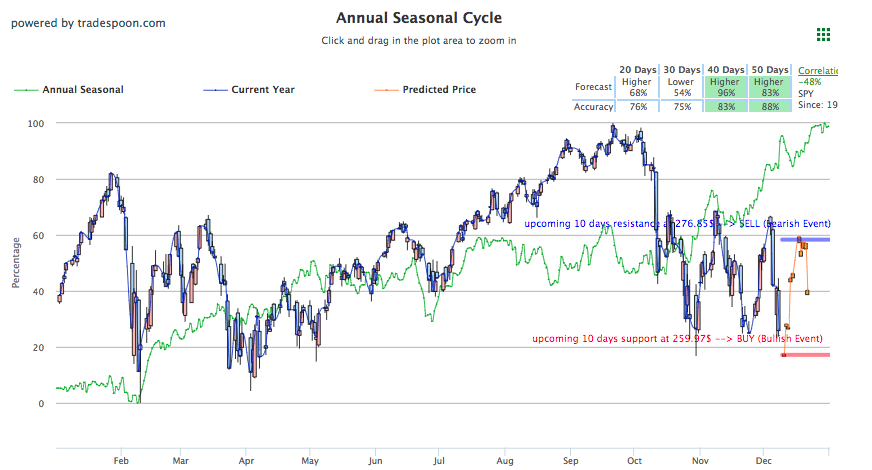

Markets are struggling for direction to start the week while Brexit, Nissan, Huawei, and Gilead Sciences lead financial-headlines today. All three major U.S. indices are currently down as growing global-trade pessimism, centered around the 90-day trade agreement reached by the U.S. and China during the G20 Summit, and mixed labor reports, released on Friday, have split market sentiment and outlook. Key support level is at $260 but if we break $255-$260, on above-average volume, the market will likely have another 5-10% correction. For reference, the SPY Seasonal Chart is shown below:

Last week, the Dow, Nasdaq, and S&P suffered one of their worst weeks of the year as an early-week rally was quickly erased during the shortened trading week that was closed on Wednesday for President George H.W. Bush’s funeral. Trade war fears continue to pressure markets that will not have much to relieve them on the docket for this week, in term of economic reports and events, and earnings are still over a month away. This week, we will see both Consumer and Producer Price Indices, Federal Budget report, and Retail Sales for the month of November. Next week, we will see the final FOMC meeting of the year that will likely include the fourth interest rate hike of 2018. Friday’s labor reports were below expectations but still supported a growing economy. Employment rate remained unchanged, hourly wages rose, and 155,000 jobs were added for the month of November. Sentiment following these reports was positive as investors and traders hope the steady employment data will help fend off an over-aggressive Fed in future FOMC meetings.

Tomorrow, Members of Parliament were scheduled to vote on Prime Minister Theresa May’s drafted Brexit deal which could present several issues in the days and month to come. First, over 100 conservative members of parliament are planning on denying the draft which will put the Brexit move in jeopardy. Then there is the issue of the Irish border where originally a “backstop” was drafted as a last resort if a deal between the UK and EU is not all-encompassing and lacks to properly address regulation at the Irish border; this, in turn, is a guarantee to avoid hardening borders and successfully maintaining a transitional period for the UK from the EU. Taking this into consideration, projections for the British pound have it forecasted below the Euro for the first time since its inception. Fear of weakening the pound has caused Prime Minister May to push back the vote.

Elsewhere, Gilead Sciences named Daniel O’Day, from Roche Holdings, as its CEO, bringing veteran leadership to the company. Gilead shares have trended down since the position was left open in July of this year and suffered large losses; O’Day’s take over in March 2019 and news of this has helped Gilead shares, though still down, ease of their losses. Nissan also finds itself in the headlines today as chairman Carlos Ghosn was

officially charged by Tokoyo prosecutors for misleading income reports and had his detention extended under suspicion of additional financial wrongdoings. Look for details on this and Huawei’s recent legal troubles, where CFO Meng Wanzhou is due in Candian court. Both instances can add to the current state of growing global-trade pressures and will surely continue developing as these proceedings progress. Globally, Asian and European markets closed lower today.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows positive signals. Today’s vector figure of -0.06% moves to +3.07% in five trading sessions. The predicted close for tomorrow is 2,697.78. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Holiday Sale: LIFETIME ACCESS to Tools Membership!

Get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and ActiveInvestor services which includes exact entry/exit prices!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

Highlight of a Recent Winning Trade

On November 30th, our ActiveTrader service produced a bullish recommendation for General Motors (GM). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GM entered the forecasted Entry 1 price range of $36.76 (± 0.28) in its first hour of trading and hit its Target price of $37.13 in that same hour, reaching a high of $37.89 for the trading day. The Stop Loss was set at $36.39.

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on December 3rd, where our winning trades ranged 5% to over 120% ROI!

Symbol Net Gain%

| GOOGL (Option) | 40.00% |

| XBI (Option) | 78.08% |

| XLF(Option) | 56.60% |

| IWM (Option) | 6.98% |

| MMC | 11.24% |

| LUV (Option) | 32.08% |

| ALK | 47.89% |

| TXN(Option) | -15.38% |

| PYPL(Option) | 85.33% |

| XLE (Option) | 5.51% |

| XHB (Option) | 120.00% |

| AMAT (Option) | 50.00% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

Tuesday Morning Featured Stock

Our featured stock for Tuesday is Newmont Mining Corporation (NEM). NEM is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $33.43 at the time of publication, up 0.12% from the open with a +1.14% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $50.71 per barrel, down 3.61% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $10.72 at the time of publication, down 3.51% from the open. Vector figures show +0.47% today, which turns +0.79% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is down 0.28% at $1,249.10 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $117.66, down 0.36% at the time of publication. Vector signals show +0.30% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 0.04% at 2.85% at the time of publication. The yield on the 30-year Treasury note is down 0.04% at 3.19% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.03% moves to +1.17% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

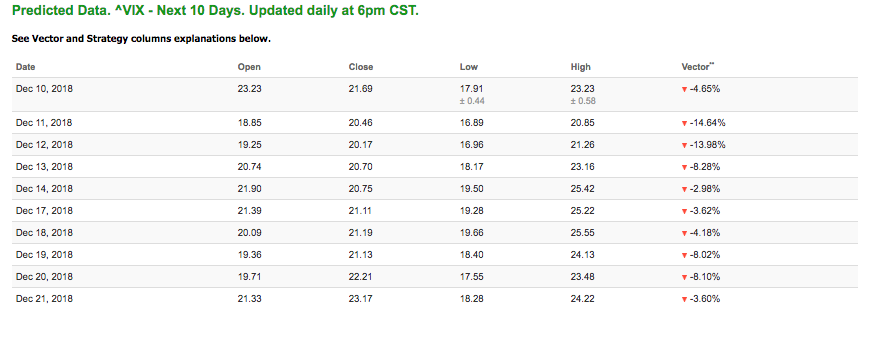

The CBOE Volatility Index (^VIX) is up 0.34% at $23.31 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $20.46. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Holiday Sale: LIFETIME ACCESS to Tools Membership!

Get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and ActiveInvestor services which includes exact entry/exit prices!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!