Markets Rebound, Key Employment Data Impresses

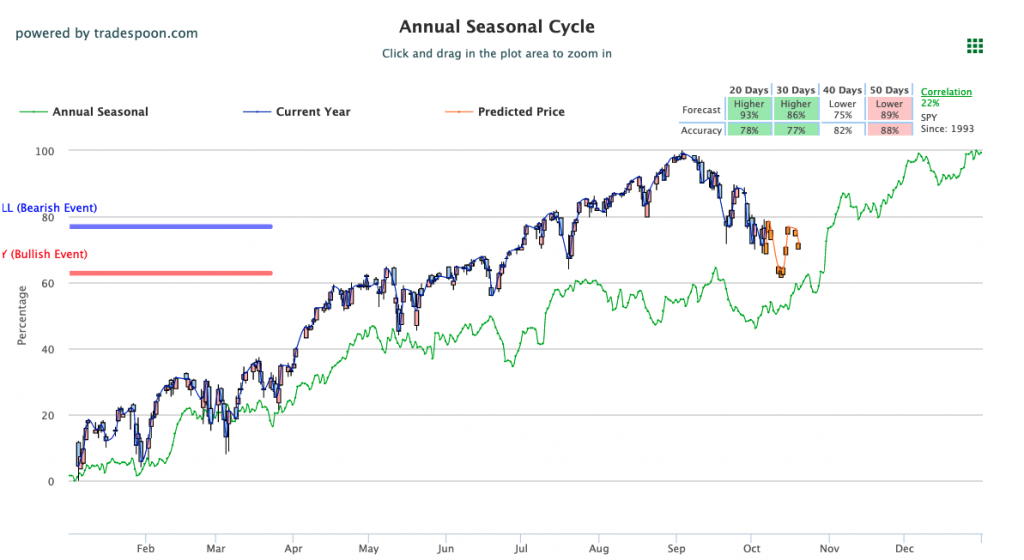

Following the early week struggles, U.S. markets impressively rebounded on Wednesday as the VIX lowered to the $20 level. To start the week, markets sold off behind struggles in the tech sector and inflation concerns, pushing the VIX to the $25 level. Today, all three major U.S. indices finished in the green with the Dow boasting its best comeback rally of the year. The rally also saw treasury yields rise and oil, which spiked to start the week, dip. We recommend watching the critical support levels on the SPY at $428 and $420 as the bottoming process continues. PEP, CAG are key earnings announcements this week while employment data will be the main event that can determine the next move in the market. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

ADP Employment data for September returned higher than expected with 568,000 private-sector jobs added, significantly higher than estimates. However, August data was adjusted showing a slight dip from previous reports. Look out for additional data to release on Thursday and Friday, including payrolls, unemployment rate, and average hourly earnings. The U.S. dollar saw positive action today while the tech sector was able to stabilize and return to the green. Globally, both Asian and European markets traded lower with several points of contention influencing global markets.

Key U.S. Economic Reports/Events This Week:

- ADP Employment (September) – Wednesday

- Weekly Jobless Claims (10/2) – Thursday

- Consumer Credit (August) – Thursday

- Nonfarm Payrolls (September) – Friday

- Unemployment Rate (September) – Friday

- Average Hourly Earnings (September) – Friday

‘If you’re looking for free trading resources… click here’

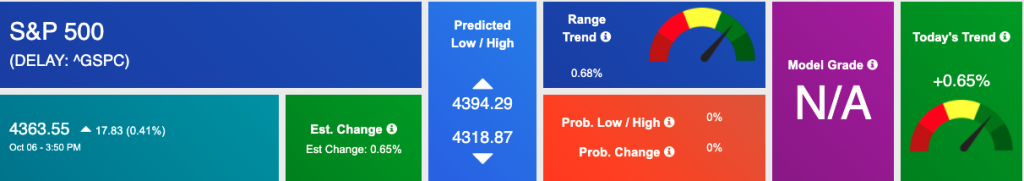

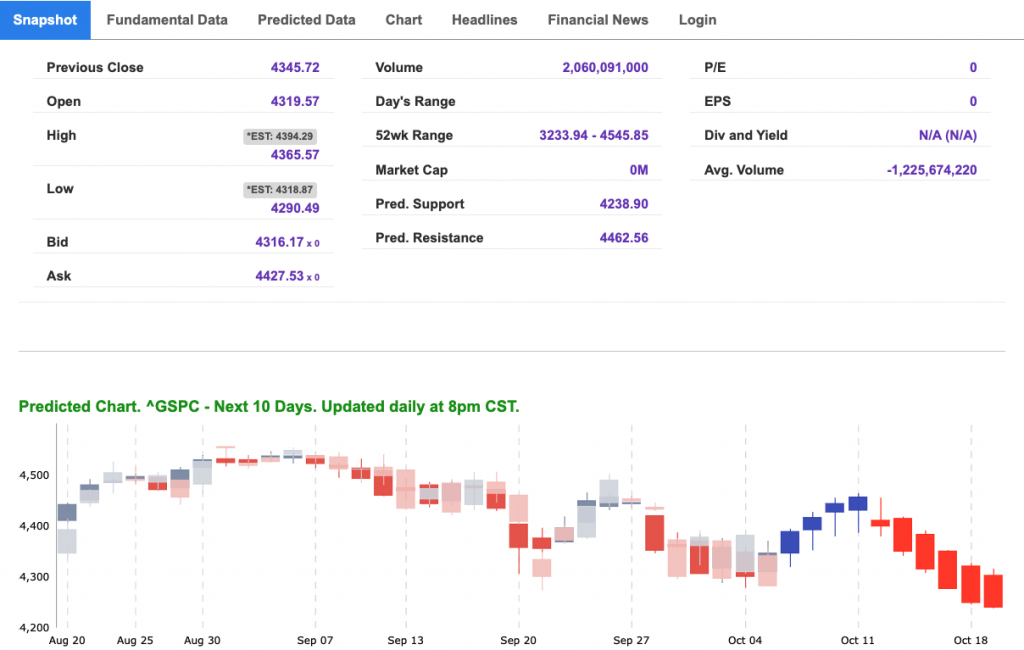

For reference, the S&P 10-Day Forecast is shown below:

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Thursday Morning Featured Symbol

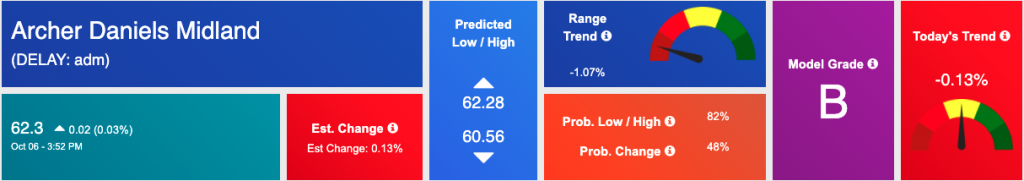

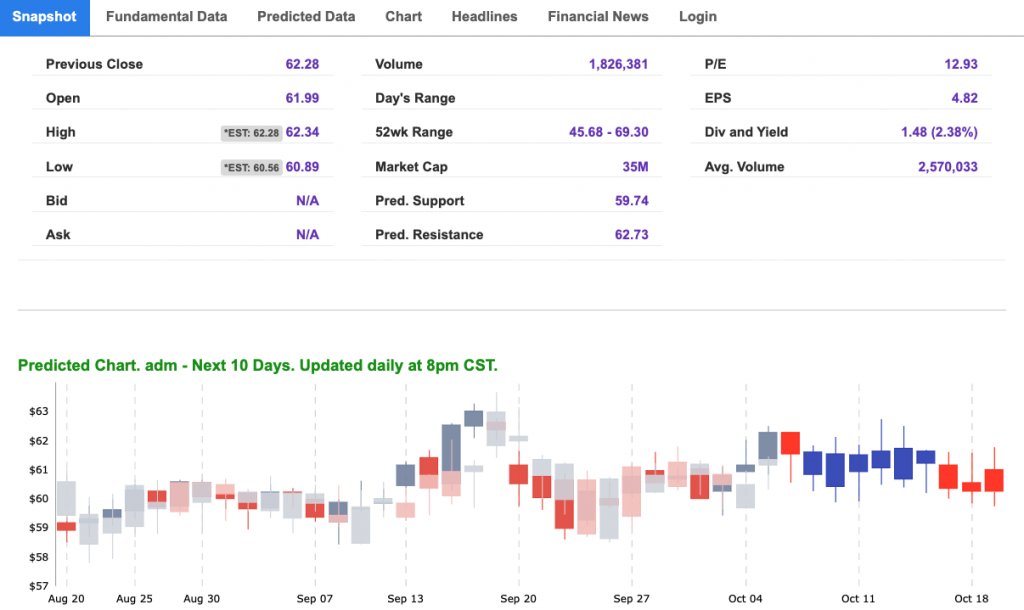

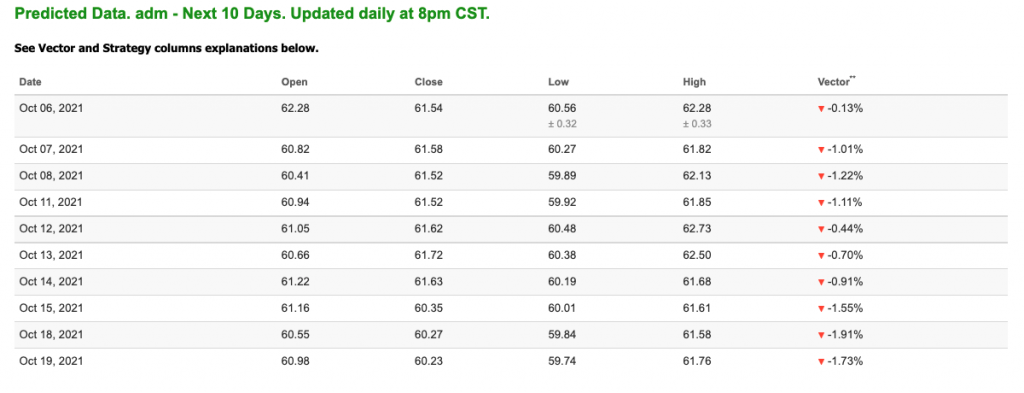

Our featured symbol for Thursday is Archer Daniels Midland (ADM). ADM is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $62.3 with a vector of -0.13% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, adm. Our featured symbol is part of your free subscription service. Not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

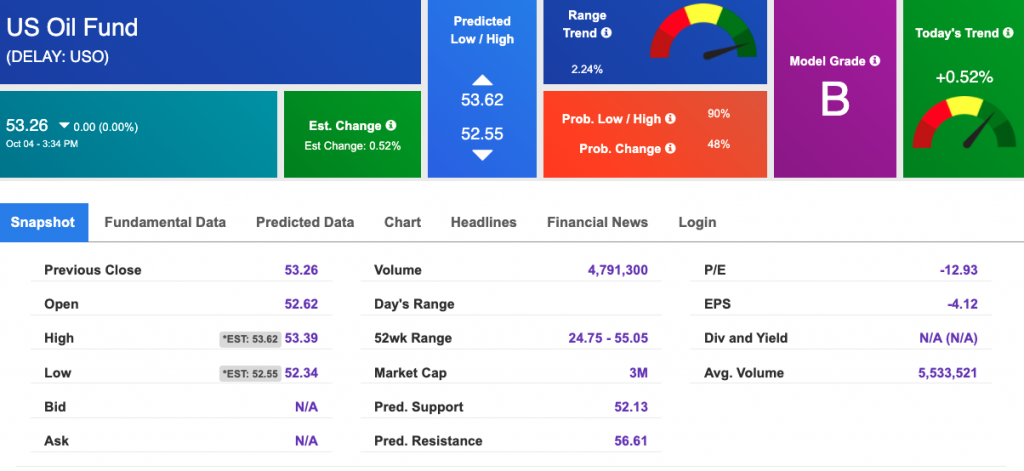

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $76.94 per barrel, down 2.52% at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $53.26 at the time of publication. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

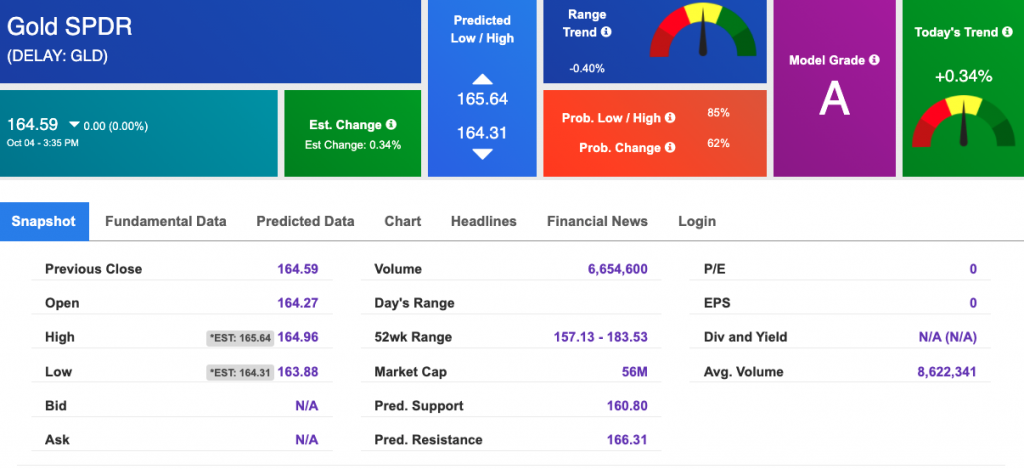

Gold

The price for the Gold Continuous Contract (GC00) is up 0.16% at $1763.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $164.59 at the time of publication. Vector signals show +0.34% for today. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

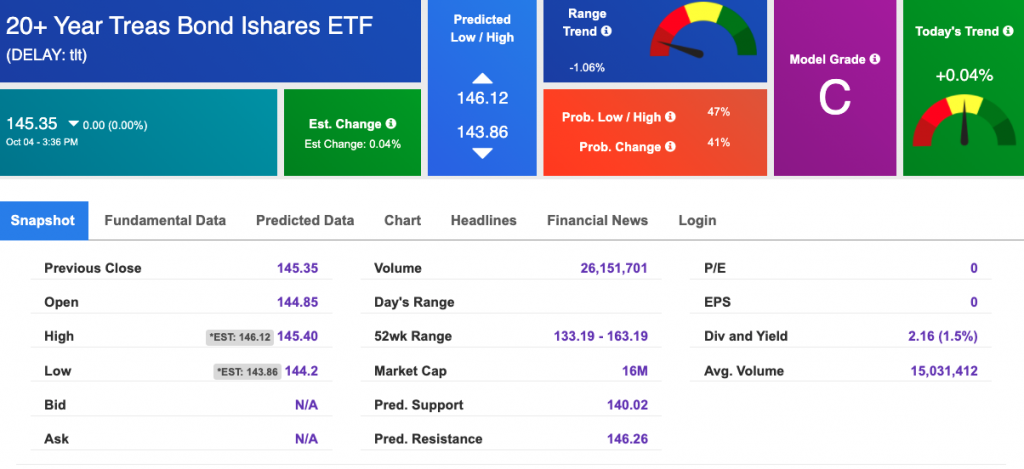

Treasuries

The yield on the 10-year Treasury note is down, at 1.524% at the time of publication.

The yield on the 30-year Treasury note is down, at 2.082% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

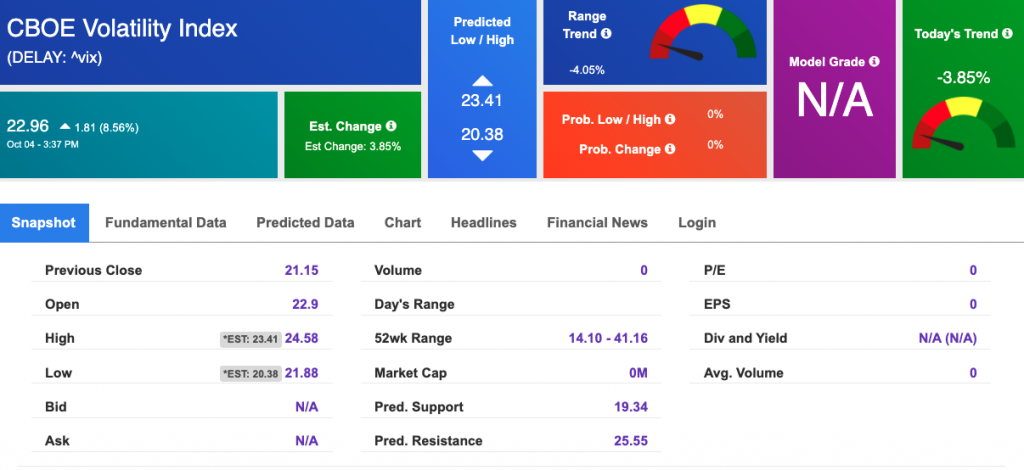

Volatility

The CBOE Volatility Index (^VIX) is $22.96 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.