Markets Remain Down as Big Tech Meets in D.C., OPEC in Vienna

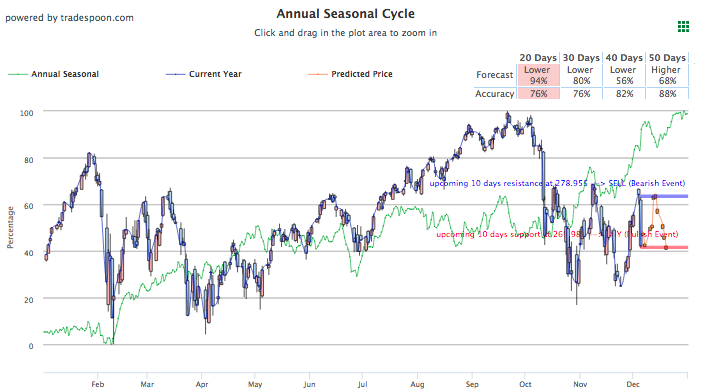

Stocks are trading sharply lower for the second day in a row after markets resumed trading following the national day of mourning for President George H.W. Bush’s funeral. At its current state, the market is optimal, at a risk vs reward profile, for going long. Oil is trading lower, currently down 3%, as OPEC members meet in Vienna today. Also worth noting, big tech CEOs from Google, Microsoft, IBM, an Oracle will converge in the White House today to discuss advance tech and tech-related issues. While the initial optimism that sent markets rallying has disappeared in the days following G20, I believe the market has a high likelihood of retesting 52 weeks high this month. The market is oversold, at its current rate, and is presenting good opportunities to buy on any corrections as long as SPY remains above $263 level. Should the SPY break below $260, expect a downright bearish market. For reference, the SPY Seasonal Chart is shown below:

Today’s set of big meetings will feature leaders from two struggling sectors in recent days, Oil and Tech, and should provide some clarity and direction as we head into the new year. The conclusion of the two-day OPEC meeting in Vienna today will likely address output cutbacks and 2019 goals, while one point that remains uncertain is Saudi’s willingness to cut back production. Elsewhere, big tech CEO will meet in D.C, not among them is Facebook, who did not choose to participate and is currently pending a U.S. court case. Facebook is part of a handful industry-giants down this week.

The biggest factor in this week’s decline seems to be the revoked optimism that followed the G20 summit, where China and the U.S. agreed to a temporary deal set to advance trade negotiations. Originally sparking optimism, the deal drew criticism and skepticism as the week went on and trade tensions and global relations should be monitored in the days and weeks to come. Recently, Canadian authorities arrested Huawei CFO Wanzhou Meng which prompted Chinese outrage and will likely draw U.S involvement. Globally, European and Asian markets closed sharply lower today.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -1.97% moves to +0.47% in five trading sessions. The predicted close for tomorrow is 2,617.21. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

Click Here to Sign Up

Highlight of a Recent Winning Trade

On November 30th, our ActiveTrader service produced a bullish recommendation for General Motors (GM). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GM entered the forecasted Entry 1 price range of $36.76 (± 0.28) in its first hour of trading and hit its Target price of $37.13 in that same hour, reaching a high of $37.89 for the trading day. The Stop Loss was set at $36.39.

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on December 3rd, where our winning trades ranged 5% to over 120% ROI!

Symbol Net Gain%

| GOOGL (Option) | 40.00% |

| XBI (Option) | 78.08% |

| XLF(Option) | 56.60% |

| IWM (Option) | 6.98% |

| MMC | 11.24% |

| LUV (Option) | 32.08% |

| ALK | 47.89% |

| TXN(Option) | -15.38% |

| PYPL(Option) | 85.33% |

| XLE (Option) | 5.51% |

| XHB (Option) | 120.00% |

| AMAT (Option) | 50.00% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

Friday Morning Featured Stock

There is no featured stock for Friday. Currently, there are no confident vector trends in our Stock Forecast Toolbox’s 10-day forecast we strongly recommend following.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $51.49 per barrel, down 2.65% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $10.9 at the time of publication, down 2.55% from the open. Vector figures show -1.42% today, which turns +1.93% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is down 0.02% at $1,242.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $117, down 0.10% at the time of publication. Vector signals show -0.07% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 1.26% at 2.88% at the time of publication. The yield on the 30-year Treasury note is down 0.97% at 3.14% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly positive signals in our 10-day prediction window. Today’s vector of -0.13% moves to +0.53% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is up 13.11% at $23.46 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $18.82. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!