Markets Remain Down While VIX Slows

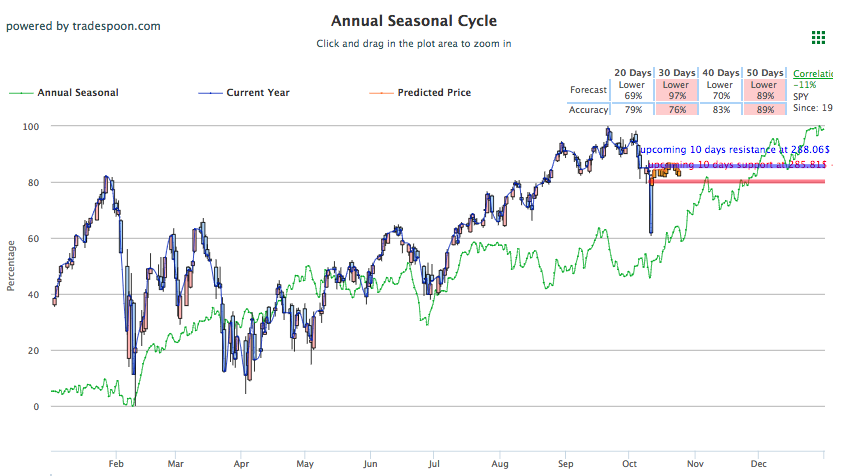

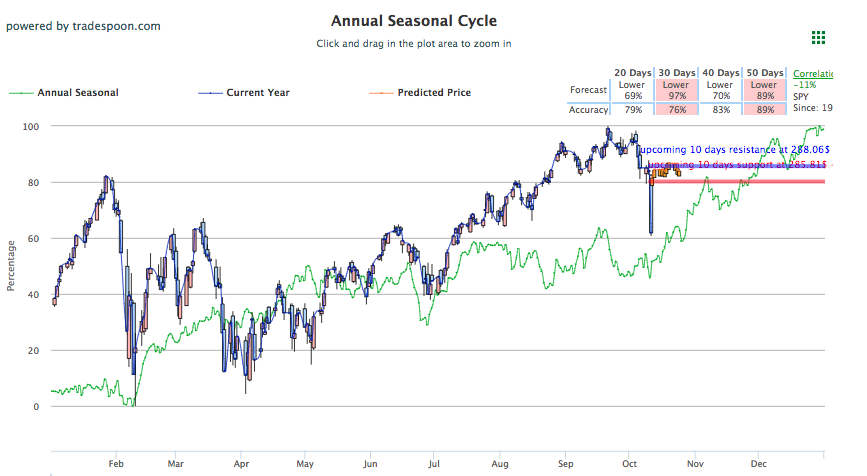

Today’s action had stocks continuing to selloff but not at their previous rate which saw substantial drops throughout most sectors. With the initial selloff likely ignited by the recent FOMC interest rate hike, it looks like the downward movement is nearing an end with earnings in front of us and the SPY reaching its, likely, bottoming process. The historic average for VIX has been around $20, today we reached VIX as high as $30. When VIX reaches these extreme level, it usually indicates the beginning of a marker reversal. Unless big bank earnings on Friday disappoint, U.S. markets could rebound as early as tomorrow but will need at least a few weeks to return to near previous levels. Do not anticipate one V-type recovery, volatility could be here to stay until middle of November. SPY Seasonal Chart forecast is shown below:

The multi-day losing streak continues for U.S. indexes as the Dow, S&P, and Nasdaq all lowered in early morning trading. Nasdaq bounced back during the middle of the day only to lose gains, while the other two remained in the red. Volatility looks to be subdued from yesterday as all three indexes fluctuated from gains to losses in early morning trading while $VIX remains near $22. Both the Dow and S&P had their single biggest day drop yesterday since February which comes as well as a bad multi-day streak of finishing below the 50-day moving averages. The rapidly increasing yields on Treasury notes looked to be a motivator to the recent selloff, however, notes have settled today for more stunted movement than earlier this week.

President Trump continues his criticism of the Fed, specifically calling out the recent hike and the rate of hikes. After some criticism of Fed Chairman Powell from the President made rounds late last week, Trump doubled down on the critique stating “I think the Fed is making a mistake. It’s so tight, I think the Fed has gone crazy,” yesterday as the selloff ensued. 10-year notes hit a seven-year high yesterday, reaching 3.25%. While Trump blamed the rising yields and interest rate hikes for the selloff, specifically under Powell’s direction, other analysts and strategist look to the 2008 recession as good reasoning for the hikes and inflation-related preventative measures.

Tomorrow, Citigroup, First Republic, JP Morgan Chase, PNC and Wells Fargo are all due to report tomorrow officially kicking off third-quarter earnings season. Bank of America reports on Monday followed by a crowded rest of the week for reporting, including Johnson & Johnson, Progressive, Netflix, Morgan Stanley, eBay, CSX, Abbott Laboratories, and many more.

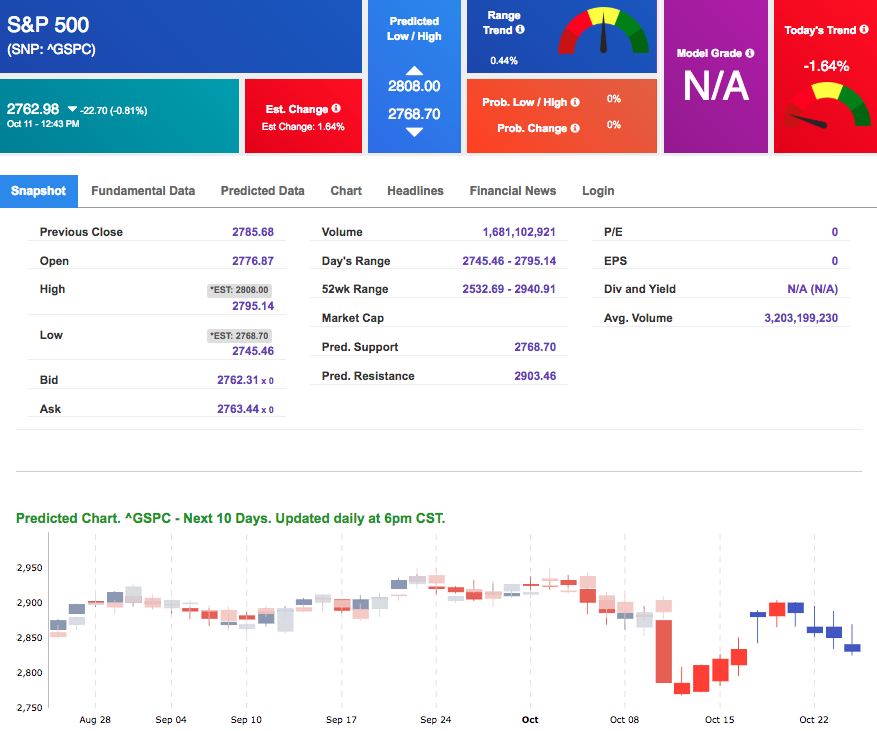

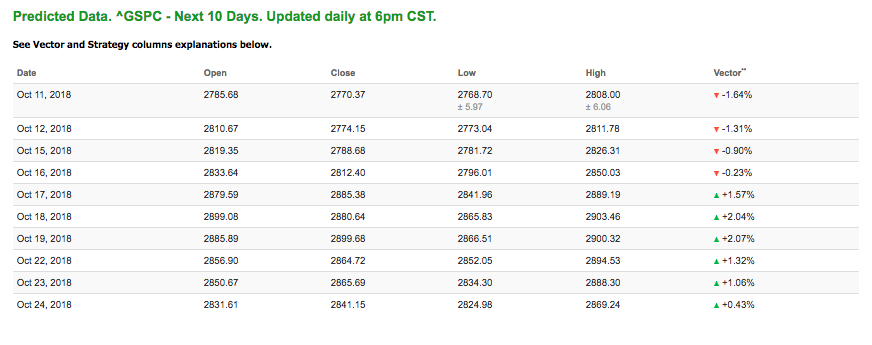

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -1.64% moves to +2.04% in five trading sessions. The predicted close for tomorrow is 2,774.15. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility Performance

Even with increased volatility, Tradespoon technology has been able to provide strong results and accuracy in our post-selloff trading. The mid-August selloff, similar one to the one we’re seeing this week, resulted in 77% winning trades!

Trade Breakdown

On August 13th, in the midst of the mid-August selloff, we recommended Devon Energy Corp at $42.45 and shorted the stock at $42.24 (32.31% Net Gain!), and that’s just one of many winning trades we had during volatility!

Highlight of a Recent Winning Trade

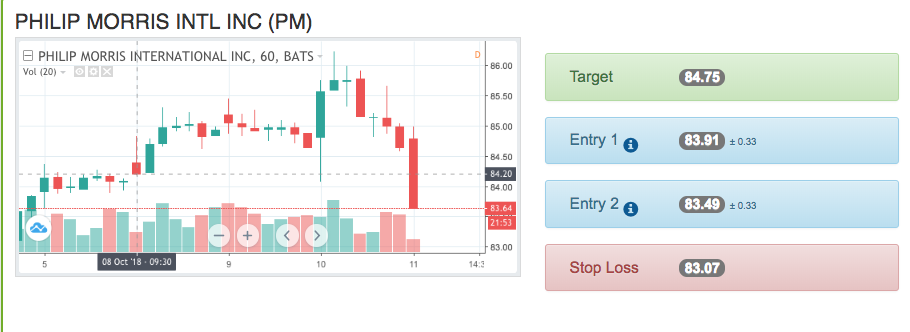

On October 8th, our ActiveTrader service produced a bullish recommendation for Philip Morris Intl Inc (PM). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

PM entered the forecasted Entry 1 price range of $83.91 (± 0.33) in its first hour of trading and moved through its Target price of $84.75 in its third hour of trading. The Stop Loss was set at $83.07.

Last Chance! Columbus Day Sale!

With gains to date of 836%*, and an 80% win-rate, a lifetime Premium Membership could easily help you turn your $100,000 into $836,000 and if the next few years are as good as the last you can make. . . $1,600,000. . . $2,400,000 or more*. Limited time offer!

CLICK HERE NOW

Friday Morning Featured Stock

There is no featured stock for Friday. Currently, there are no confident vector trends in our Stock Forecast Toolbox’s 10-day forecast we strongly recommend following. Today, we recommend investors hold their positions and wait for volatility to bottom out. Earnings seasons are near and markets should rebound next week.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Oil

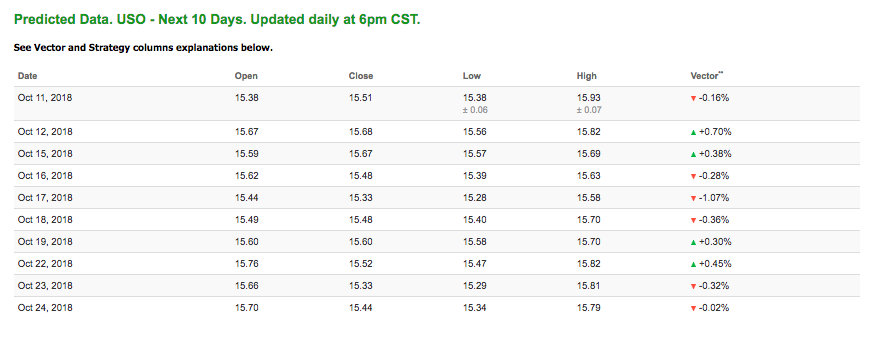

West Texas Intermediate for November delivery (CLX8) is priced at $71.27 per barrel, down 2.60% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $15.06 at the time of publication, down 2.08% from the open. Vector figures show -0.16% today, which turns -0.36% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

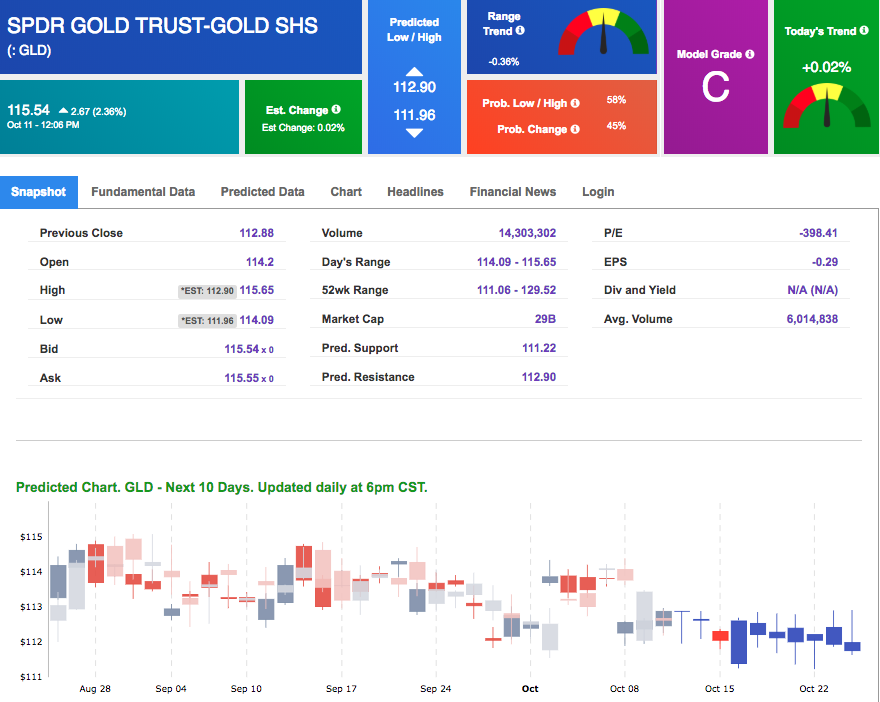

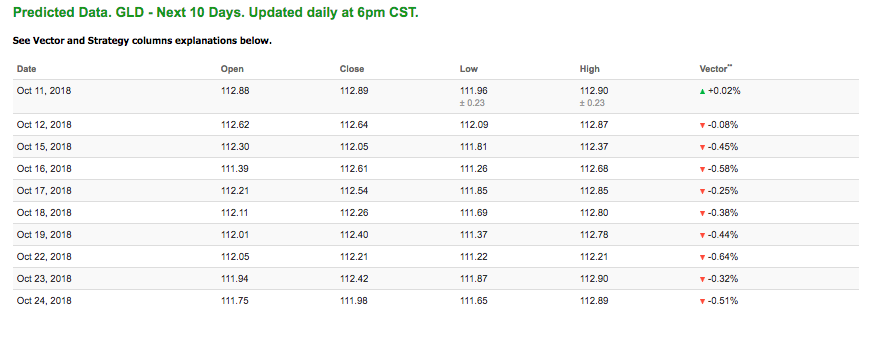

The price for December gold (GCZ8) is up 2.66% at $1,224.80 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $115.54, up 2.36% at the time of publication. Vector signals show +0.02% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

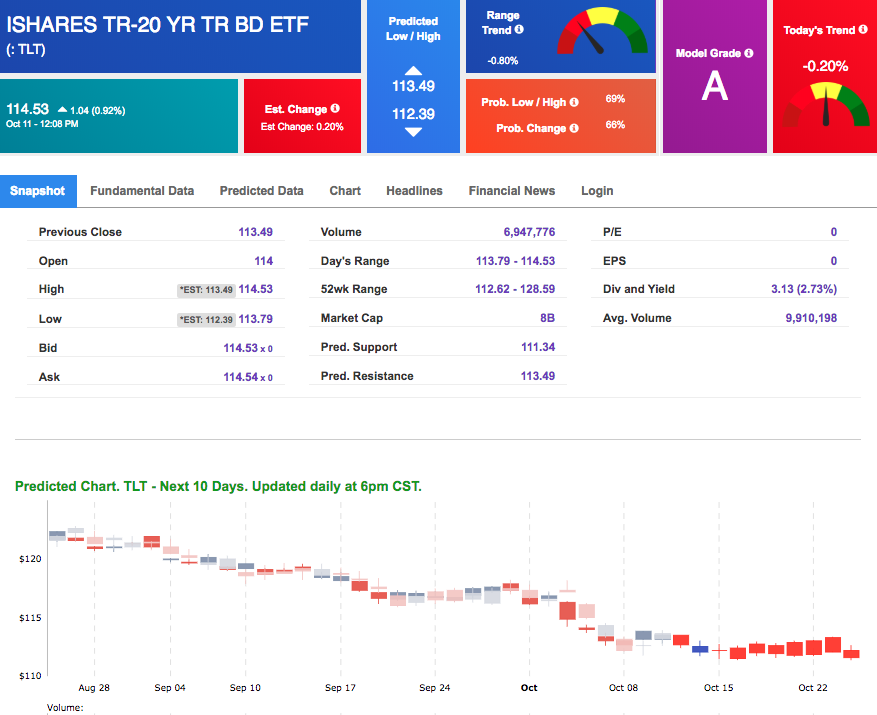

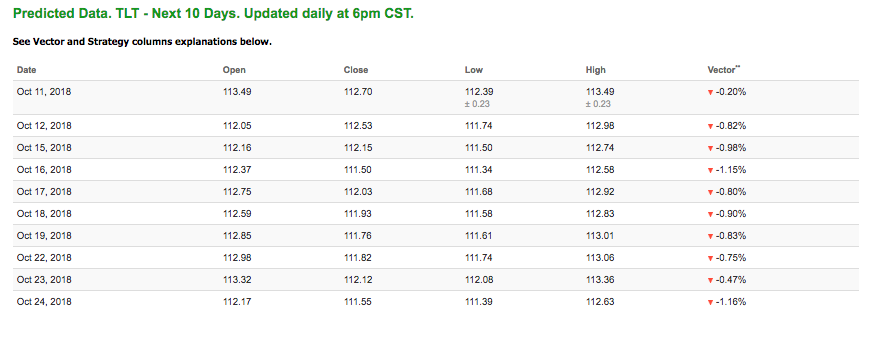

The yield on the 10-year Treasury note is down 0.27% at 3.16% at the time of publication. The yield on the 30-year Treasury note is down 0.49 % at 3.33% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.20% moves to -1.15% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

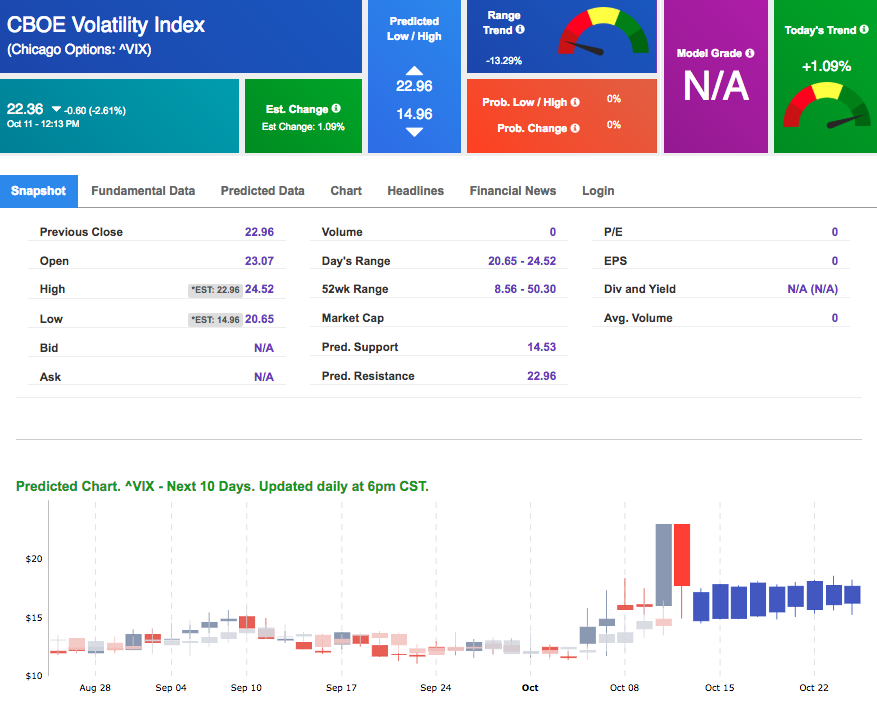

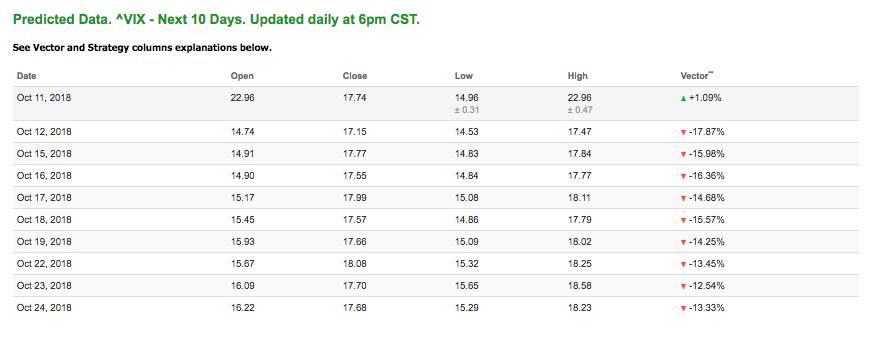

Volatility

The CBOE Volatility Index (^VIX) is down 2.61% at $22.36 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $17.15 with a vector of -17.87%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.