Markets Remain Low Before and After Beige Book

Markets lowered in early morning trading ahead of today’s Federal Beige Book release, which serves as a good indicator of the current state of the U.S. economy. All three major U.S. indices are traded modestly lower while global markets did not fare better today with Asian and European markets closing to mixed results after trading lower for the majority of the day. Other data influencing U.S. markets today include the estimated 183,000 jobs added in the private sector for the month of February and the $621 billion recorded trade deficit for 2018, a 10-year high. Also in the spotlight today, GE shares took a big hit after the company forecasted “significant headwinds” for 2019 while President Trump is reportedly pushing for a China deal to be completed sooner than later in hopes of igniting a market rally. Continue monitoring the 200-day moving average for the SPY, currently at $274, and if we dip below this level expect some more downward movement. Avoid chasing the rallies and look for the selloffs as good buying opportunities. For reference, the SPY Seasonal Chart is shown below:

Today’s Beige Book reported ten out of twelve districts with “slight to moderate growth” while the lone standouts were Philadelphia and St. Louis, which reported “flat” economic conditions. Slower activity to start off the year and a more somber sentiment for the 2019 outlook, today’s Beige Book does not seem to be the market catalyst it was in previous months. Labor and employment were reported positively while spending was mixed throughout the twelve districts. Prices saw an increase while “several districts noting faster growth for input prices than selling prices.” Other data includes the reported weak agriculture conditions throughout the twelve districts and the mixed state of the energy sector.

The Trump administration is looking to get a China trade deal done in the near future to provide a stimulus for the market. On Tuesday, China debut several stimuli in hopes of supporting its slowing economy. Both nations aim to continue trade talks through March with a meeting by its two heads of state before the end of the month. Elsewhere, British banks are preparing for some volatility ahead of the Brexit deadline as further efforts to exit the EU continue to stall behind disagreements in Parliament.

GE took a decent hit today, currently down 7%, after the company reported a weak outlook for 2019. Shares of Dollar Tree and Abercrombie soared after fourth-quarter earnings returned positively. Look out for jobless and consumer credit data tomorrow while on Friday we will see further employment data as well as a speech by Fed Chairman Jerome Powell.

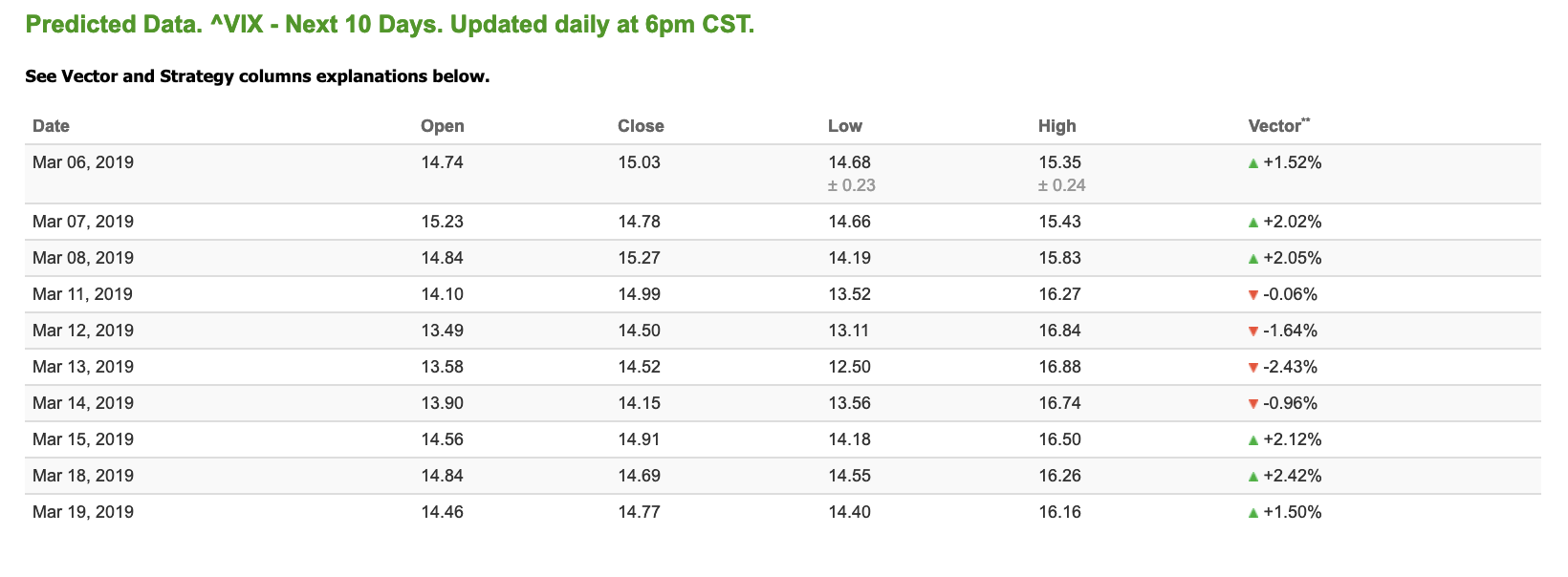

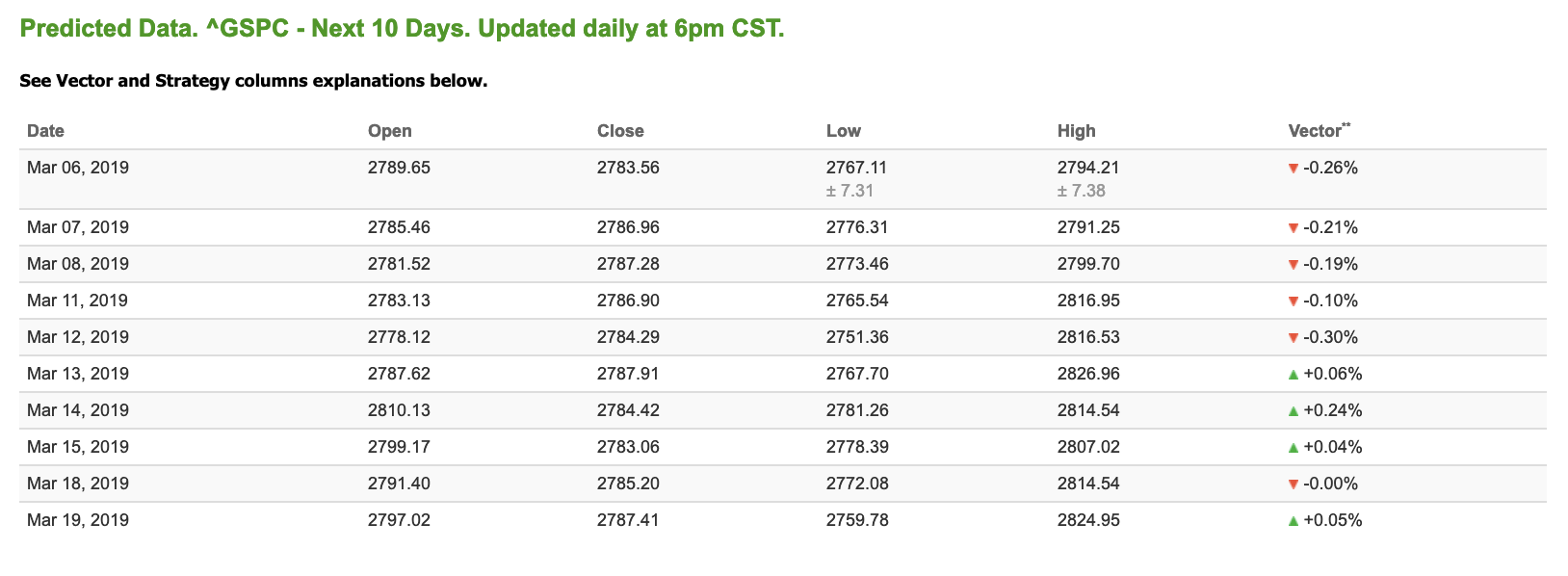

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.26% moves to +0.06% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

March Madness Offer!

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for a 1-year membership.

Bonus: ActiveTrader Lifetime Access

(Daily Stock & Option Trade Recommendations)

You Don’t Want to Miss This!

Offer Ends Midnight Tonight.

Click Here to Sign Up

Highlight of a Recent Winning Trade

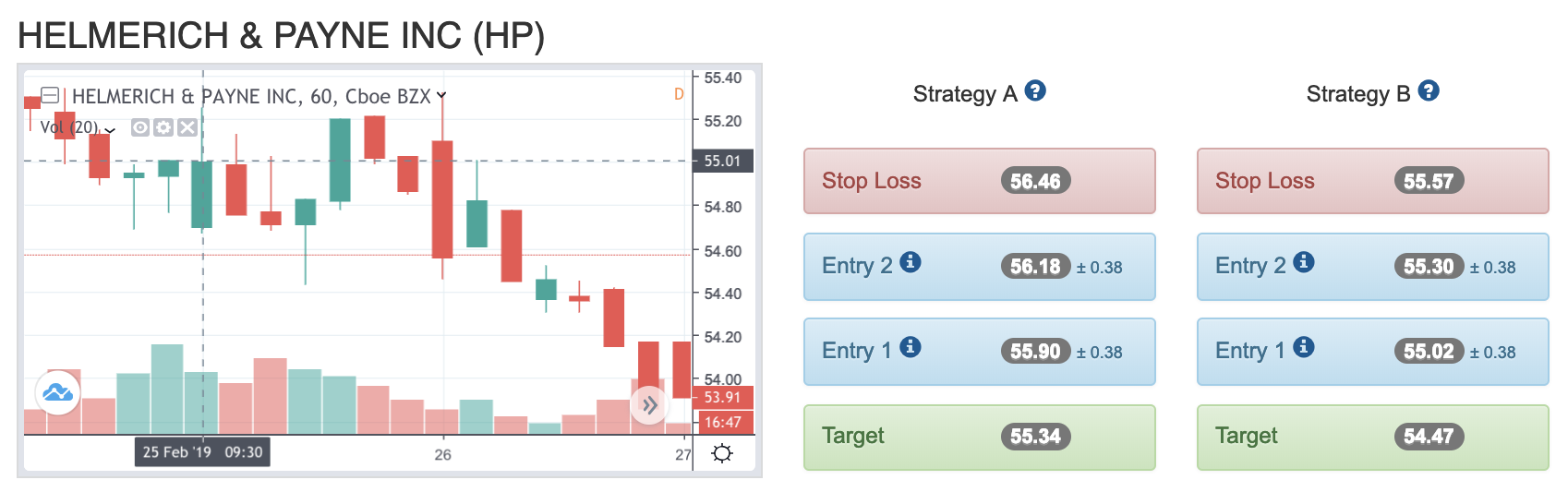

On February 25th, our ActiveTrader service produced a bearish recommendation for Helmerich & Payne Inc (HP). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

HP entered its forecasted Strategy B Entry 1 price range $55.02 (± 0.38) in its first hour of trading and passed through its Target price $54.47 in the first hour of trading the following day. The Stop Loss price was set at $55.57

Thursday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

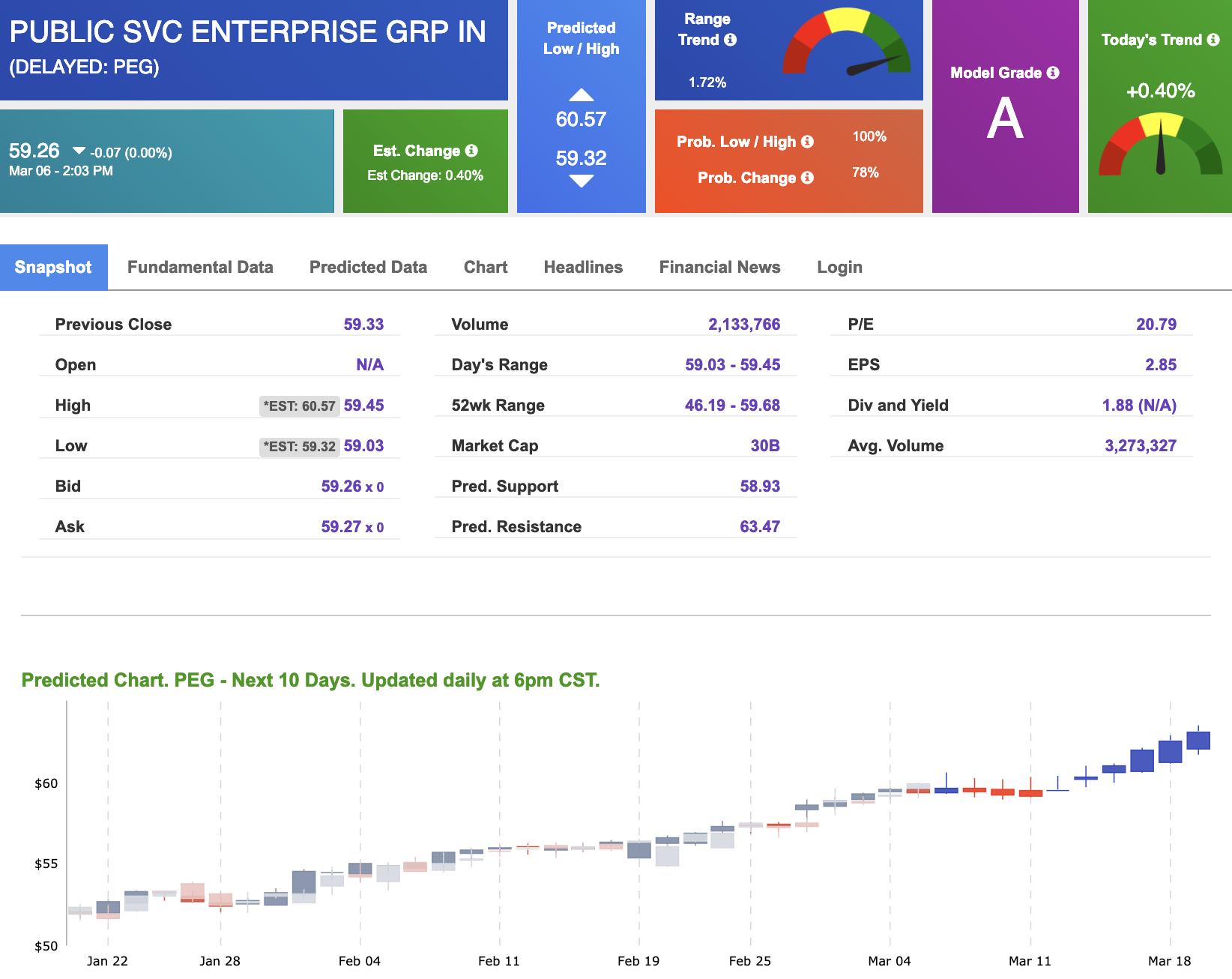

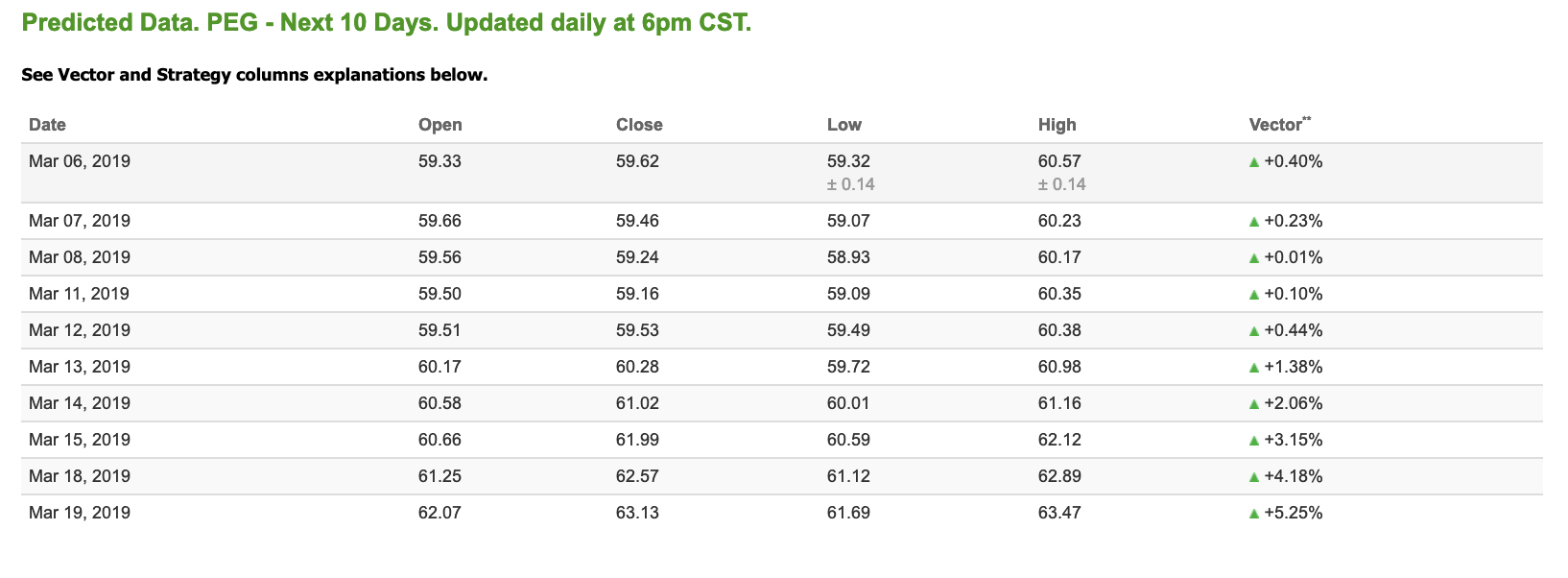

Our featured stock for Thursday is Public Service Enterprise Group (PEG). PEG is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $59.26 at the time of publication, with a +0.40% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

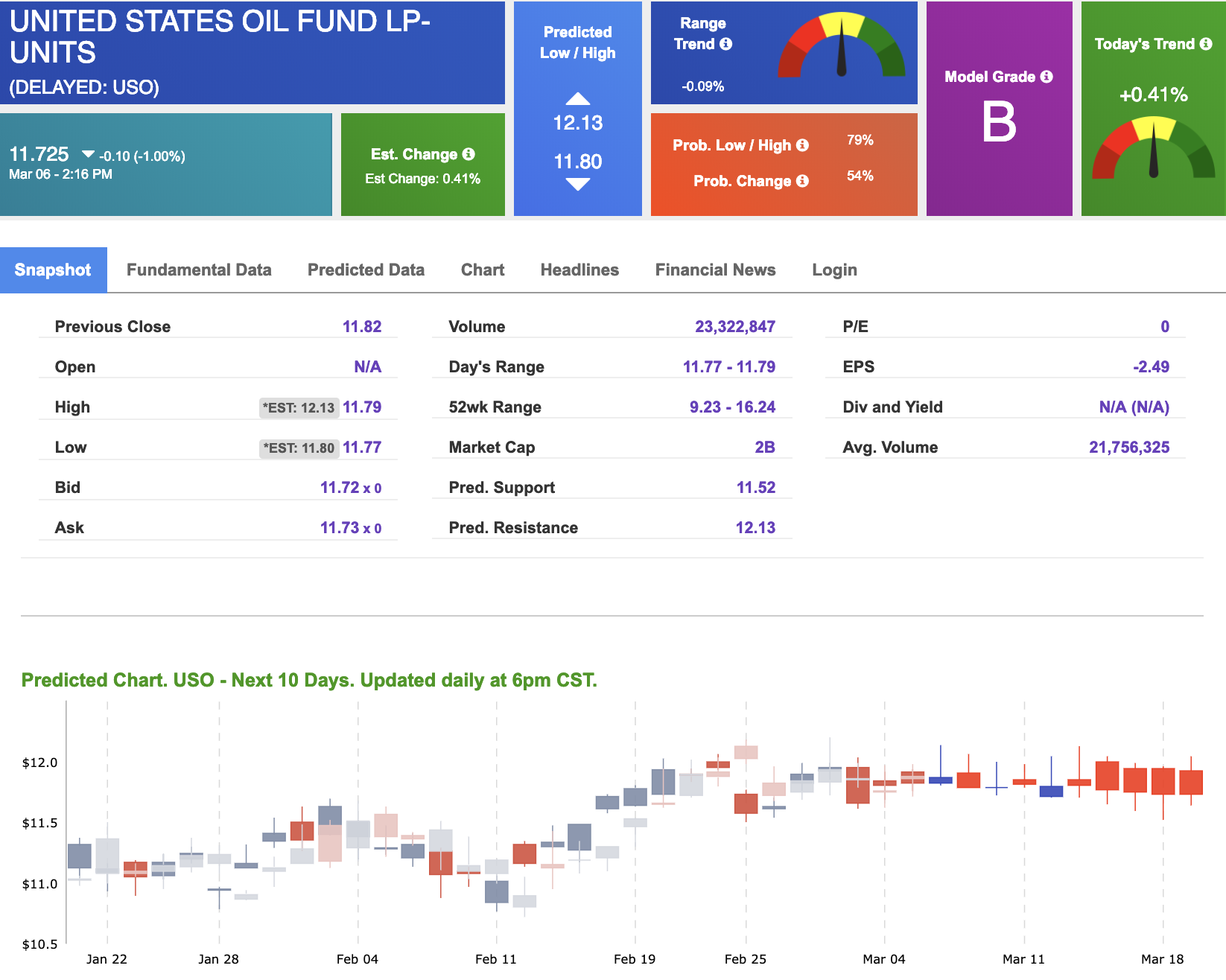

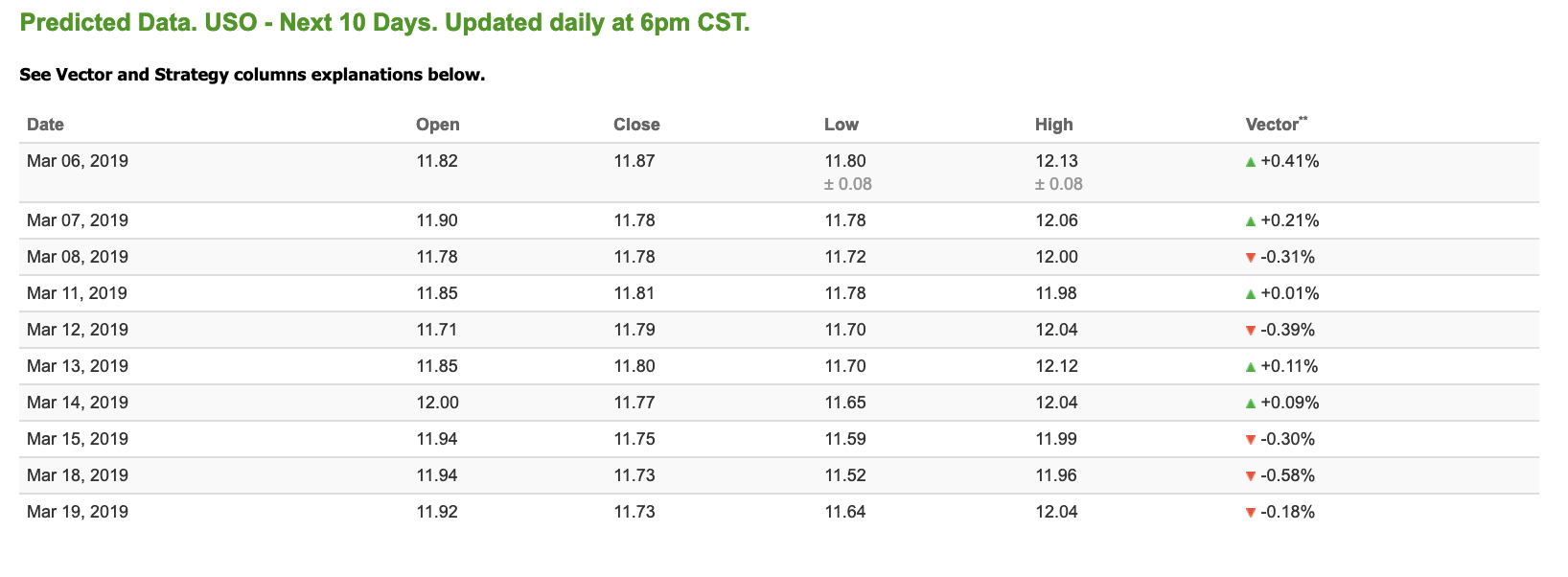

Oil

West Texas Intermediate for April delivery (CLJ9) is priced at $56.17 per barrel, down 0.69% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $11.72 at the time of publication, down 1.00% from the open. Vector figures show +0.41% today, which turns +0.11% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

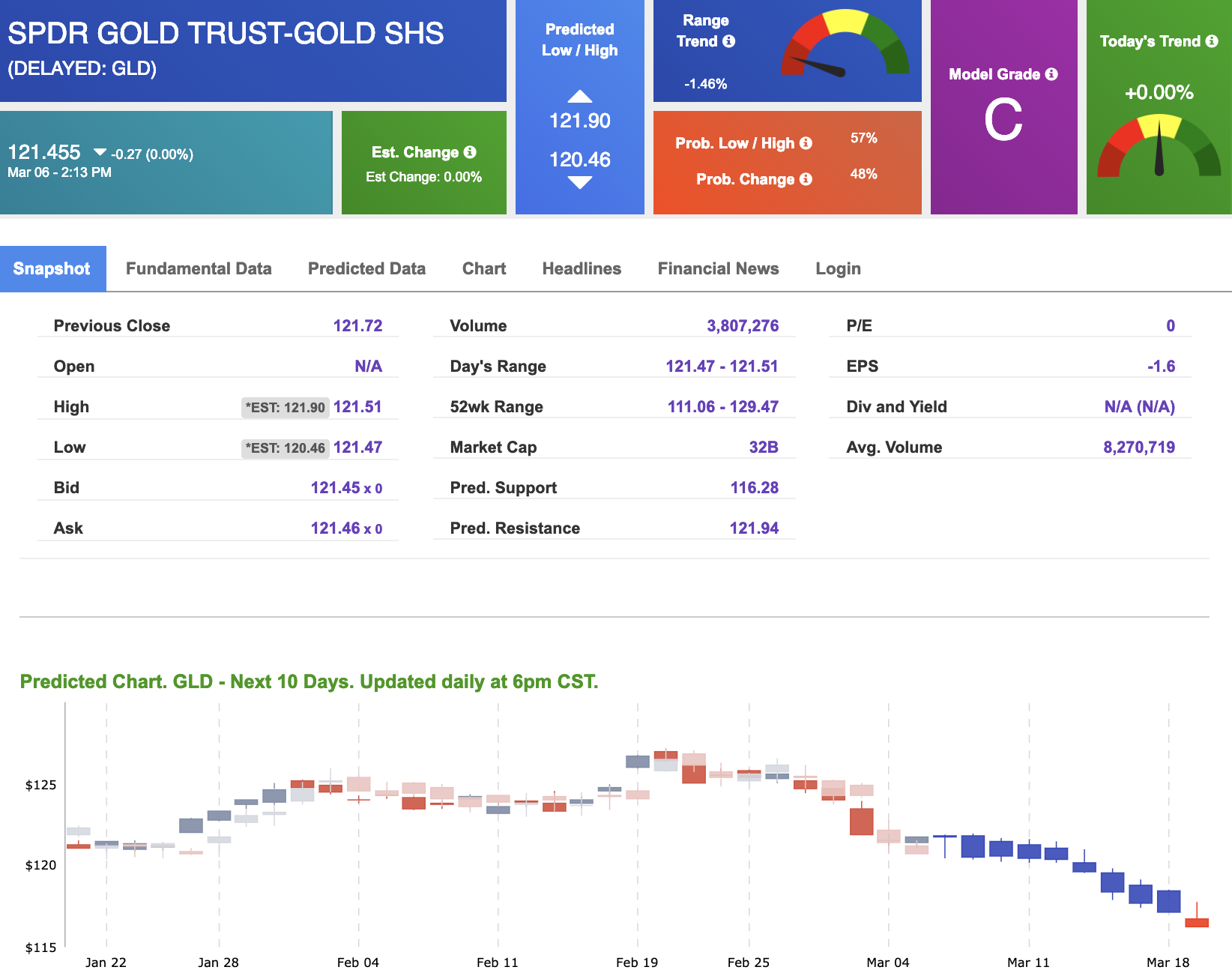

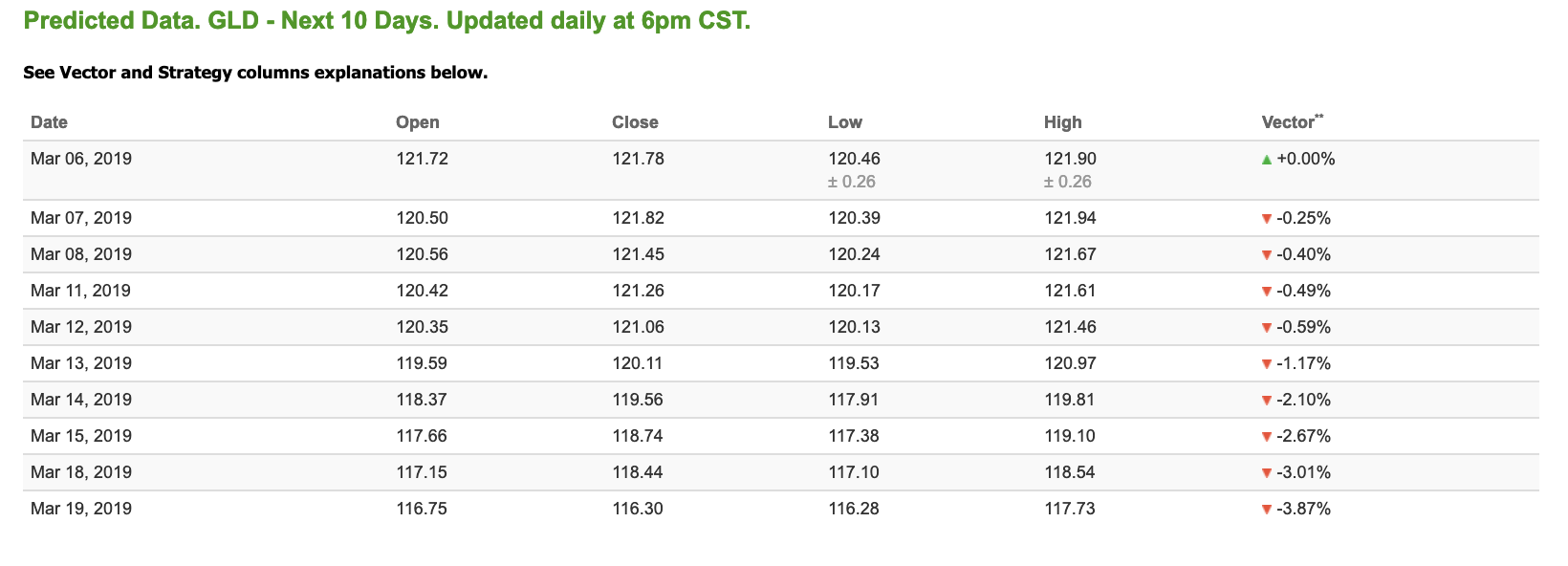

The price for April gold (GCJ9) is up 0.20% at $1,287.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $121.45. Vector signals show +0.00% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

Treasuries

The yield on the 10-year Treasury note is down 1.23% at 2.68% at the time of publication. The yield on the 30-year Treasury note is down 0.65% at 2.06% at the time of publication.

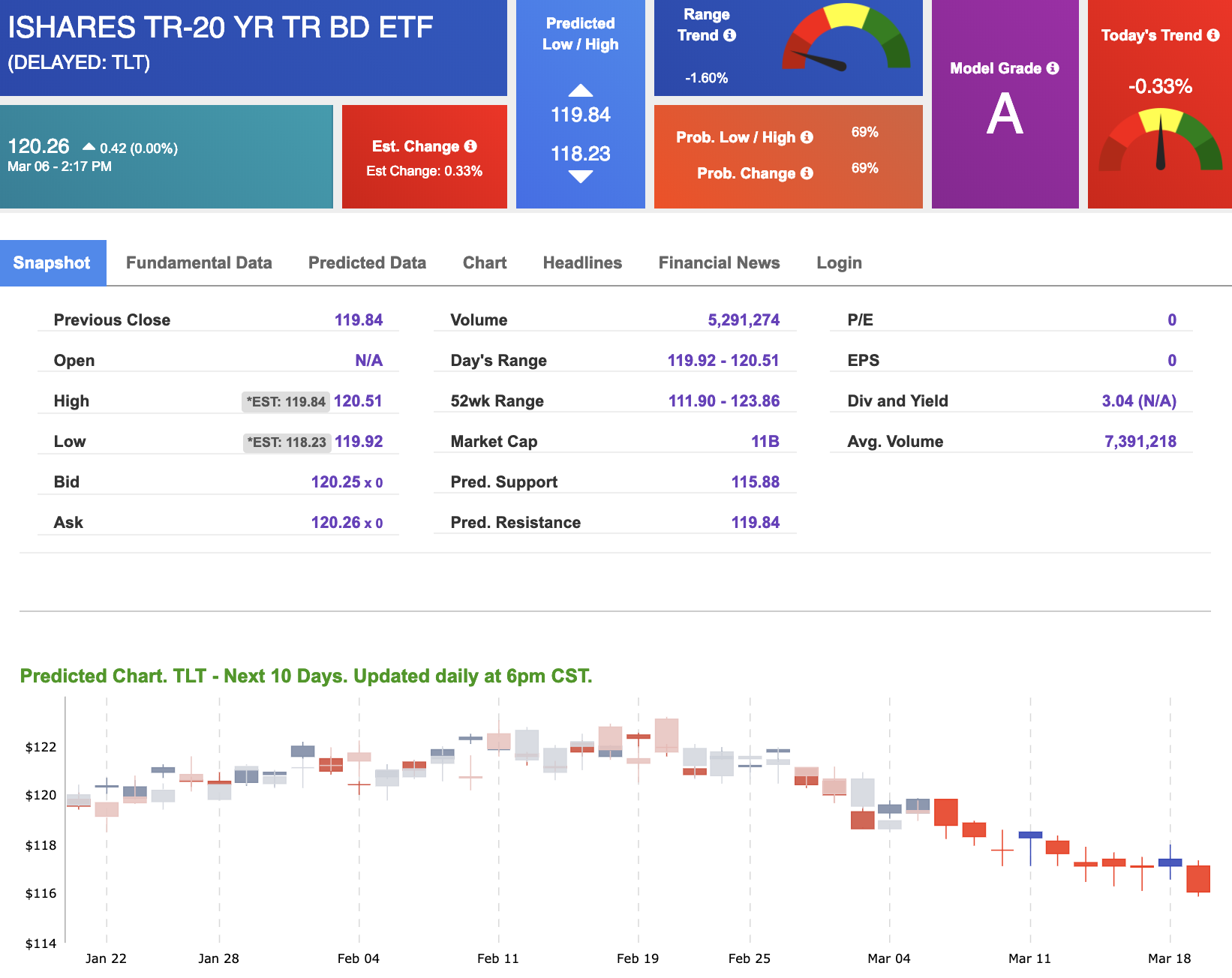

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.33% moves to -1.22% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

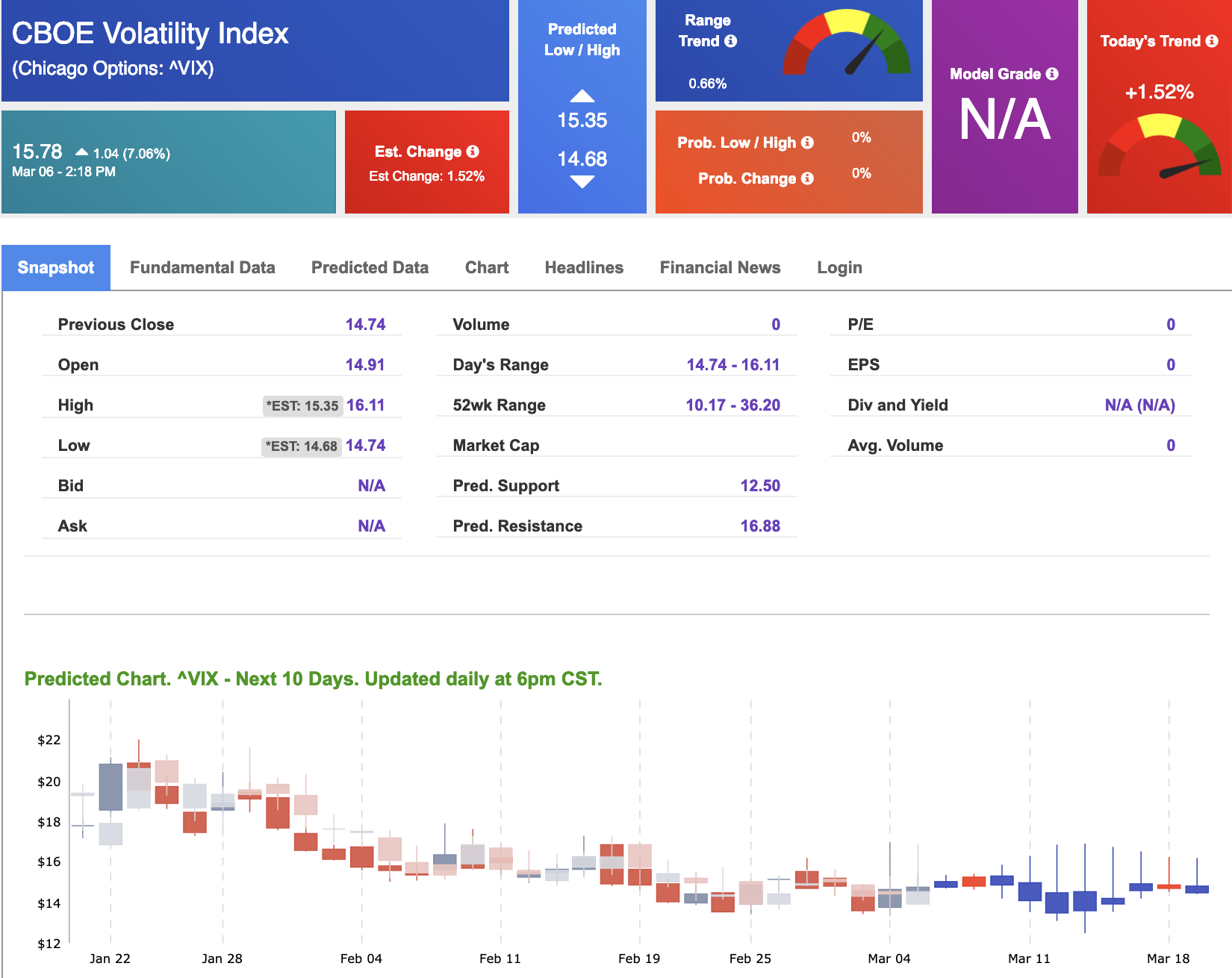

The CBOE Volatility Index (^VIX) is up 7.06% at $15.78 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $14.78 with a vector of +2.02%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

March Madness Offer!

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for a 1-year membership.

Bonus: ActiveTrader Lifetime Access

(Daily Stock & Option Trade Recommendations)

You Don’t Want to Miss This!

Offer Ends Midnight Tonight.

Click Here to Sign Up