Markets Reverse Course After Historic Wednesday

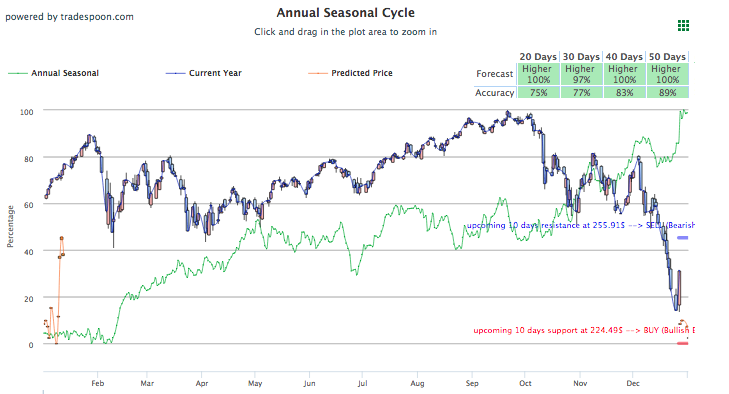

After yesterday’s historic rally, markets lowered today but set new lows at $230-233 for the SPY. Key support in the short term is $240 as the market continues to trade in the range of $233 and $253. All three major U.S. indices recorded gains of 5% yesterday but are lowering in unison today. Wednesday’s rally was the best day-after Christmas trading day in over 10 years, while the Christmas Eve selloff that preceded the rally was also historically significant but in the wrong direction. The volatility that has plagued most of December looks to remain this week and through the final days of 2018. Several things to note as the week concludes and we head into the new year include recent developments in China-trade negotiations and the elongated effect of the partial government shutdown on the market. The SPY Seasonal Chart is shown below:

Yesterday’s gains continue to be erased today although there are several factors for optimism as we head into the new year. First, an earlier than expected meeting between China and the U.S. will take place on January 7th in Beijing. The meeting will continue to work on trade and tariff negotiations two nations agreed to work on over the next 90 days during the G20 summit. A U.S. delegation will meet with Chinese officials in what will hopefully continue to ease trade tensions and investor worries. Next, President Trump recent reassurance of Powell’s job security, although coming under strong criticism lately, no major changes look to be coming to the Fed in early 2019. After last week’s interest rate hike, Powell took a more dovish tone and signaled for fewer hikes in the new year. Finally, strong retail, energy, and tech sectors continue to support the market amidst a historically bad December.

The recent partial-government shutdown will delay several economic reports while employment and consumer confidence data will be released today on schedule. The continued dispute in D.C. over the border wall has prevented both sides of the aisle from funding several federal departments for 2019. Look for more on this after the new year as a resolution to this matter in the 11th hour of 2018 seems less and less likely. No major corporate earnings are scheduled for today; next earnings season begins in mid-January. Globally, Asian markets traded to mixed results while European markets lowered.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +2.53% moves to +4.31% in five trading sessions. The predicted close for tomorrow is 2,579.13. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

MIDNIGHT SPECIAL:

Monday, we sent out a ridiculous offer with LIFETIME ACCESS to our Market Commentary subscribers before we raise our prices on January 2nd!

It was a huge success and many people jumped at the opportunity but we also had our fair share of complaints because some people didn’t open the email until this morning and missed out.

So, we decided to open up this offer for one more day, but act fast, because at midnight, the offer is GONE!

CLICK HERE to Sign-up

Highlight of a Recent Winning Trade

On December 21st, our ActiveTrader service produced a bearish recommendation for Mastercard Inc. (MA). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

MA entered the forecasted Entry 1 price range of $182.71 (± 1.83) in its first hour of trading and hit its Target price of $180.88 in the third hour of trading that day. The Stop Loss was set at $184.54.

Friday Morning Featured Stock

Our featured stock for Friday is Barclays iPath S&P 500 VIX (VXX). VXX is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $51.29 at the time of publication, up 9.36% from the open with a -2.87% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for February delivery (CLG9) is priced at $44.84 per barrel, down 2.77% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $9.48 at the time of publication, down 4.24% from the open. Vector figures show +0.06% today, which turns -12.91% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is up 0.42% at $1,279.10 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $120.58, up 0.77% at the time of publication. Vector signals show -0.27% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 2.01% at 2.75% at the time of publication. The yield on the 30-year Treasury note is down 0.58% at 3.05% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.09% moves to +2.43% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 2.61% at $22.36 at the time of publication, and our 10-day prediction window shows mostly positive signals. The predicted close for tomorrow is $30.96 with a vector of -5.50%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

MIDNIGHT SPECIAL:

Monday, we sent out a ridiculous offer with LIFETIME ACCESS to our Market Commentary subscribers before we raise our prices on January 2nd!

It was a huge success and many people jumped at the opportunity but we also had our fair share of complaints because some people didn’t open the email until this morning and missed out.

So, we decided to open up this offer for one more day, but act fast, because at midnight, the offer is GONE!