Mid-terms Loom in Investor Headspace as Q3 Earnings Mount Up

Major indices are attempting a slight pullback today after selling off late Wednesday due to another round of investor concerns- including rate hikes, the pace of the broader global economy and a more tepid round of earnings than expected. Wednesday marked five straight weeks of losing for the Dow, the longest streak since July 2008.

The European Central Bank had updated its policy statement with no changes- as expected- signalling its commitment to tapering off its asset-buying program by this December.

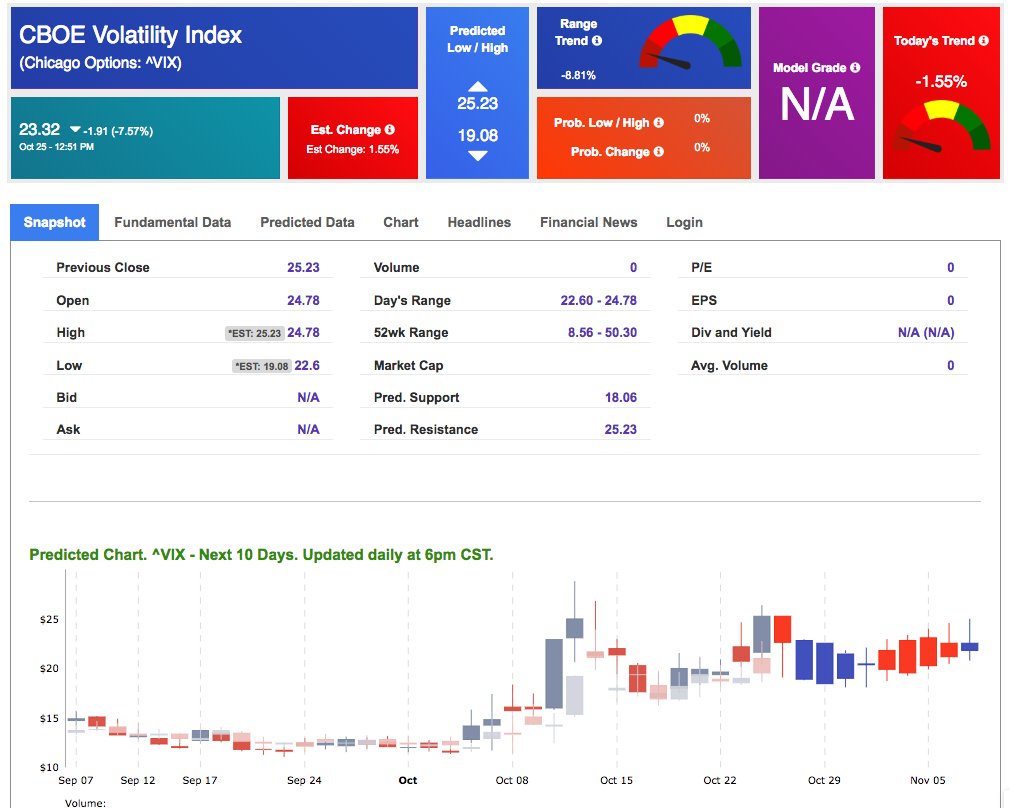

On the political front, midterm elections will soon be an item moving on investors’ radar and the uncertainty surrounding the outcomes impacting the House will dampen the rallying effect of other events, including positive earnings. The VIX is looking to top out at 25, capping off a streak of volatility- likely easing back in the bull market by the end of November.

Tesla, Comcast and Twitter are all seeing positive action today after reasurring earnings reports. Tesla in particular saw a 10% spike in share value in premarket activity today after the carmaker posted the biggest quarterly profit in its history. Next on the docket for earnings will be Amazon, Alphabet Inc, and Chipotle- all reporting Q3 earnings after the close today.

A new round of economic data is also now available as well- ranging for labor, durable goods and trade. Unemployment benefits applications jumped by 5,00 to 215,000 for the week ending 10/20, although this figure hovers around 50-year lows. A suprising report on durable goods orders showed a reversal of what was forecasted- figures show an increase of 0.8% in Septmember against analyst expecations of a 1.9% decrease. In international trade, however, the drop of $75.8 billion was heavier than an expected decrease of $74.7 billion.

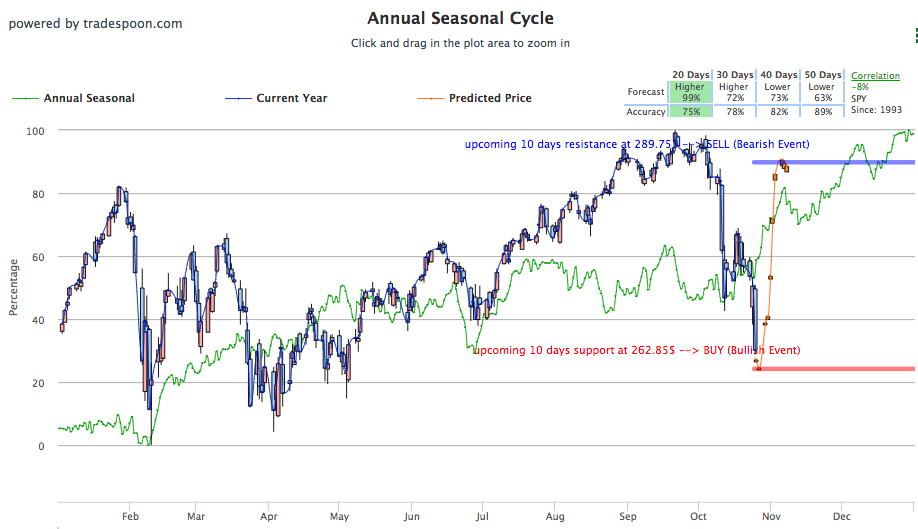

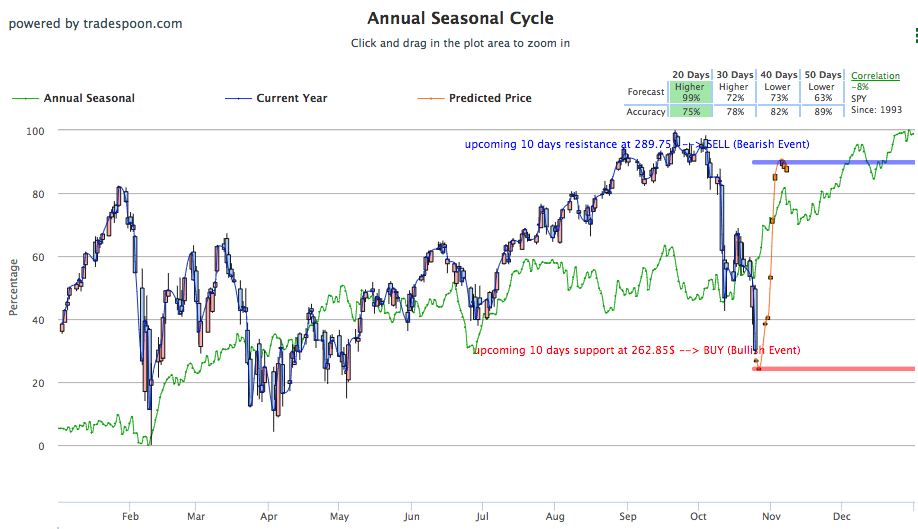

Tradespoon’s Seasonal Chart forecast for SPY shown below:

There is some consensus among anaylsts that the selling is a bit overdone at this point, and we may be seeing residual effects from algorithmic trading and institutional activity which is exacerbating the declines, and investors should look outward to Fed monetary policy for direction.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -1.14% moves to +0.86% in three trading sessions. The predicted close for tomorrow is 2,673.53. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility Performance

Even with increased volatility, Tradespoon technology has been able to provide strong results and accuracy in our post-selloff trading. Similar selloff, to the one we’re seeing this week, in mid August resulted in 77% winning trades, or 7 out of 9!

Trade Breakdown

On October 18th, in the midst of last week’s volatility, we opened a short option on American Express (AXP)and closed it on October 19thwith a gain of $0.16 (57.14% Net Gain!), and that’s just one of many winning trades we had during volatility!

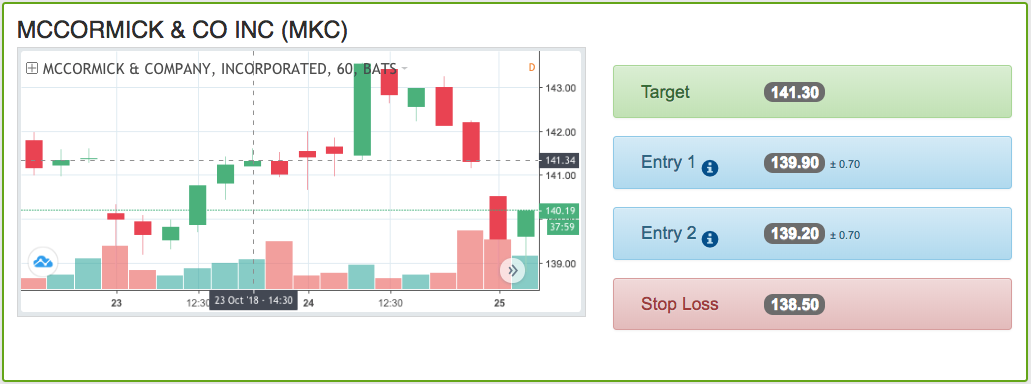

Highlight of a Recent Winning Trade

On October 23rd, our ActiveTrader service produced a bullish recommendation for McCormick & Co Inc (MKC). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

MKCentered the forecasted Entry 1 price range of $139.90 (± 0.70) in its first hour of trading and hit its Target price of$141.30 in the second to last hour of the trading day. The Stop Loss was set at $138.50.

Finance 3.0 is here! Get Ready for “The Fintech Effect!”

It’s about to disrupt the old financial order…turn IBM and Oracle on their heads… topple some of the World’s Top Traders…and help you generate consistent profits of 46 to 142 percent with 78% accuracy.

Click Here To Learn More

Friday Morning Featured Stock

Our featured stock for Friday isMorgan Stanley. (MS).MS is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B)indicating it ranks in the top 25th percentile for accuracyfor predicted near-term support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $44.62 at the time of publication, up 2.60% from the open with a +2.08% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

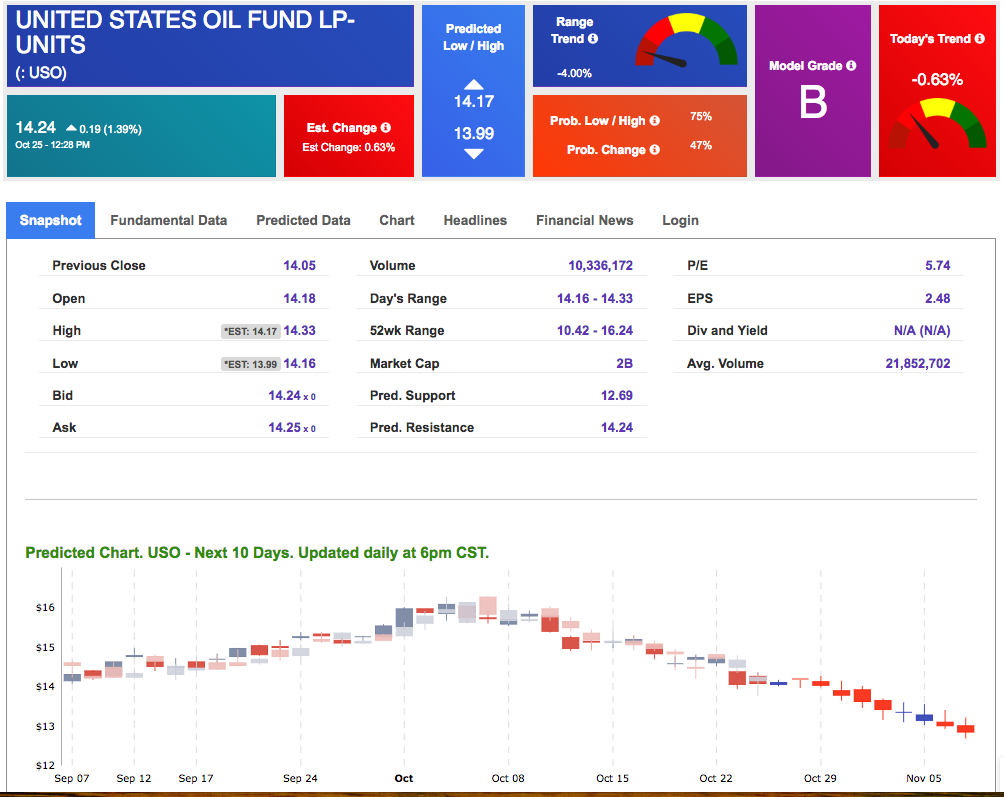

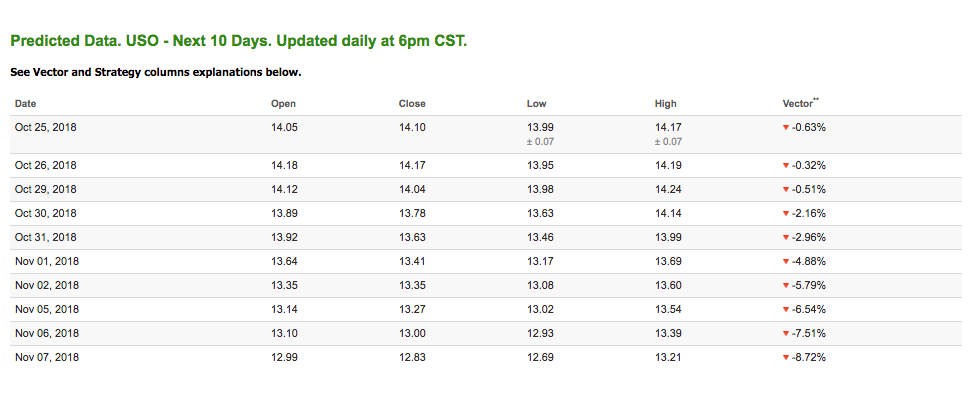

Oil

Oil prices are seeing a boost today as the equities market attempts to return to form, re-introducing a bit of risk-on sentiment. West Texas Intermediate for December delivery (CLZ8) is priced at $67.15 per barrel, up 0.46% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows bearish signals based on yesterday’s trading activity. The fund is trading at $14.24 at the time of publication, up 1.39% from the open and breaking predicted resistance. Vector figures show -0.63% today, which turns -2.16% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

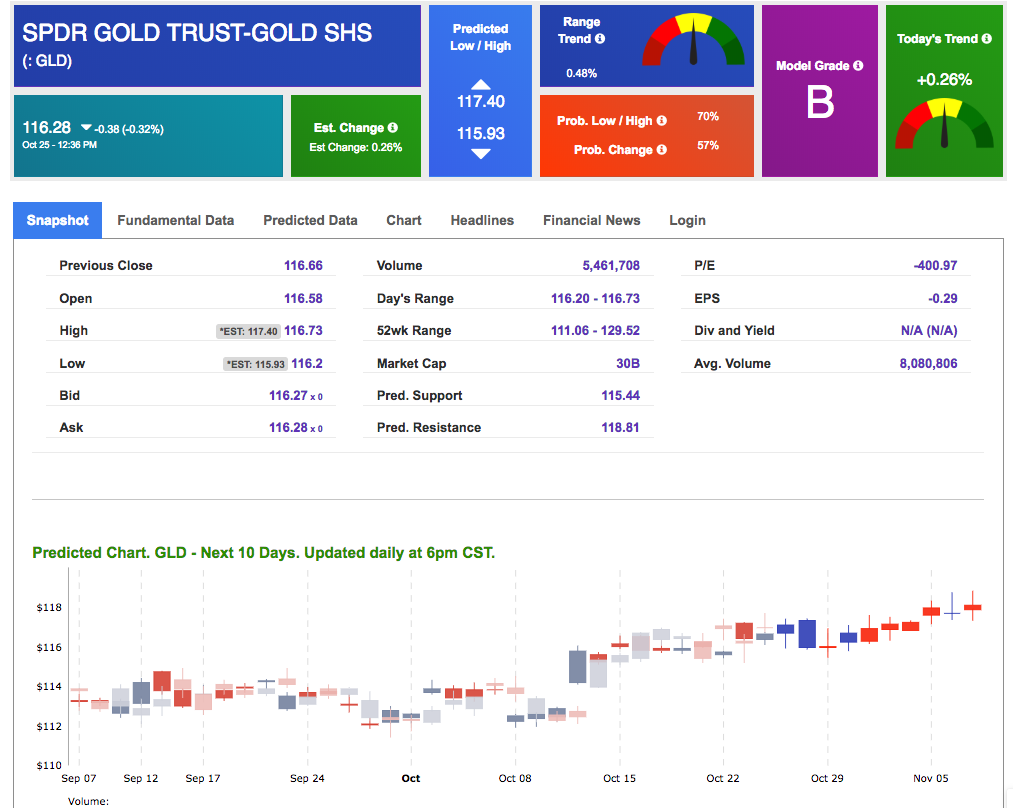

Gold

Gold prices are finding new support levels, adjusting to econmic data released yesterday and today. The price for December gold (GCZ8) is up 0.05% at $1,232.30 at the time of publication. New data showing a rise in U.S. pending home sales is tempering the rise in prices. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $116.38, down 0.32% at the time of publication. Vector signals show +0.26% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

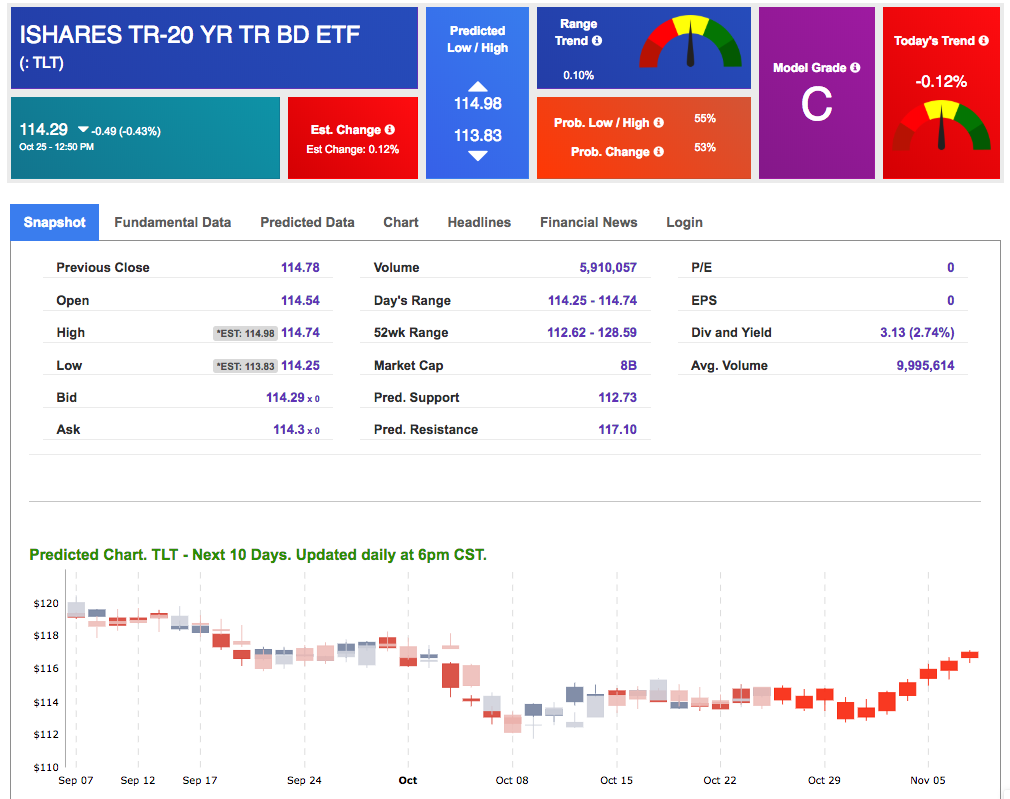

The yield on the 10-year Treasury note is up 1.28% at 3.14% at the time of publication.The yield on the 30-year Treasury note is up 0.56% at 3.35% at the time of publication. Yields are finding stability amidst a stock rebound, but will typically follow suit according to how equities behave ongoing into the near-term future.

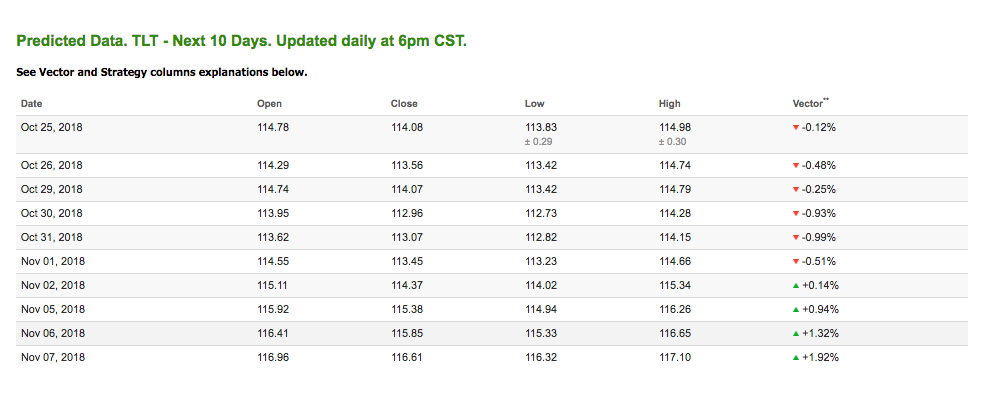

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly signals in our 10-day prediction window with a late uptrend. Today’s vector of -0.12% fluctuates just under -1.00% for the majority of the outlook. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 7.57% at $23.32 at the time of publication, and our 10-day prediction window shows all negative signals. The predicted close for tomorrow is $17.15 with a vector of -17.87%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Finance 3.0 is here! Get Ready for “The Fintech Effect!”

It’s about to disrupt the old financial order…turn IBM and Oracle on their heads… topple some of the World’s Top Traders…and help you generate consistent profits of 46 to 142 percent with 78% accuracy.