On Final Trading Day of 2018 Markets Move Higher

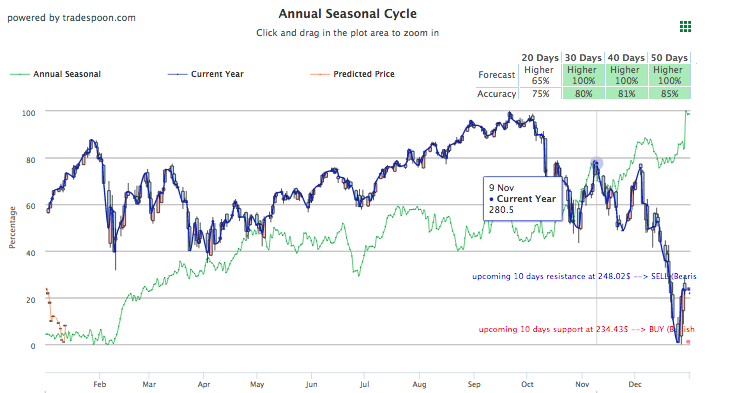

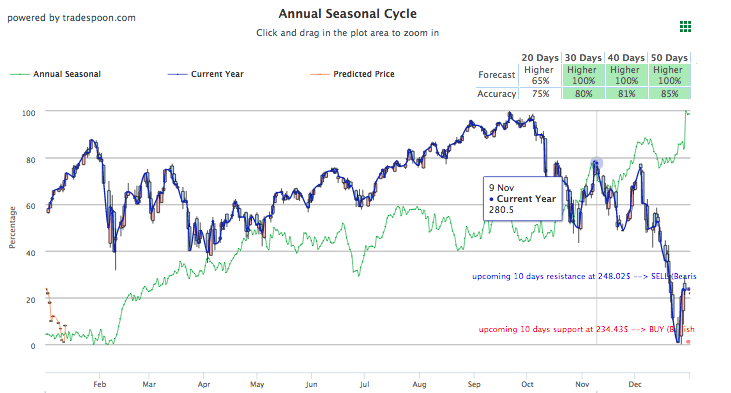

Markets are trading slightly higher today ahead of the New Year holiday when markets will be closed for the day. After a seesaw week that had the market hit historic lows and rallies, careful optimism in China-U.S. trade relations behind sustained progress has U.S. indices marginally trading up today. The partial government shutdown has slowed some economic data from being released but we will still see labor reports later this week. Look for fourth-quarter earnings in mid-January as the next major set of economic data to drive the market, as well as the minutes from this month’s Federal Open Market Committee meeting which will release this week. Taking into consideration last week’s historic rally, the market has set new lows at $230-233 for SPY. As the market trades in the range between $233 and $253, $240 is key support of the short term to monitor. For reference, the SPY Seasonal Chart is shown below:

In the last trading session of 2018, stocks are trading higher but major U.S. indices are still significantly down for December. Nasdaq has taken the biggest hit of December and is currently down 10%. The next major financial event to drive markets will be the upcoming release of fourth-quarter earnings in the month of January. After an up and down end to the month earnings should provide clarity on market direction and corporate outlook. Also worth noting are minutes from this month’s Federal Reserve meeting, releasing January 3rd, and will give further insight to the “softening” or more dovish stance chairman Powell promised. Closing out January will be the first FOMC meeting, scheduled for January 29-30.

Continued signs of improved relations and progress towards tariff resolution between the U.S. and China looks to be a major component in supporting stocks today. President Trump revealed over the weekend that he and Chinese President Xi had a “long and very good call.” This precedes the upcoming trade talks scheduled for the week of January 7th. The efforts to make progress by both nations has helped ease global trade tensions and slowed the notion of a spiraling trade war. A 90-day window to negotiate tariffs and discuss trade will begin tomorrow and ostensibly halt tariffs on both ends. Recent Chinese manufacturing data came in at a multi-year low signaling some cause for concern. Globally, Asian markets closed to mixed results while European markets closed higher.

The U.S. government shutdown is going on its 8th day and with tomorrow’s federal holiday, congressional talks will not resume until later in the week. Over 800,000 government employees will be affected by the shutdown while Defense, Energy, Health, Human Services, Veterans, and Education departments will remain open. Historically, government shutdowns since 1976 have had little effect on markets as half of the time markets reported gains, according to LPL Financial.

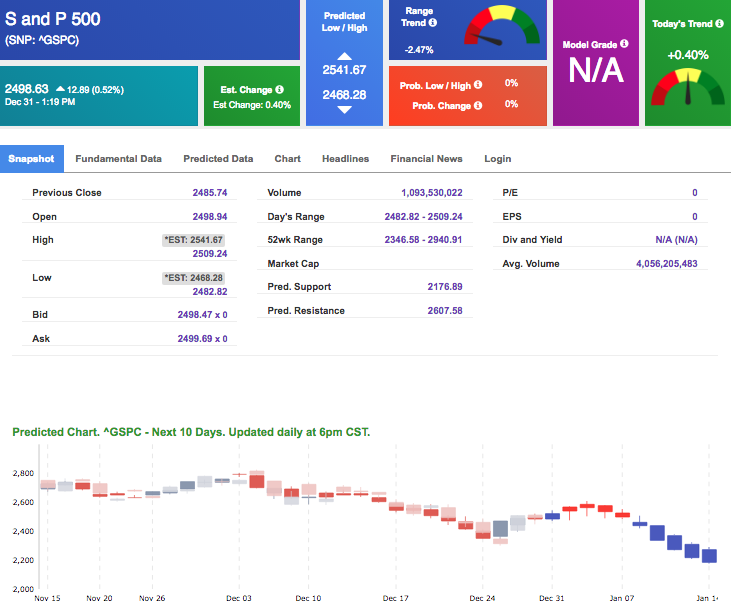

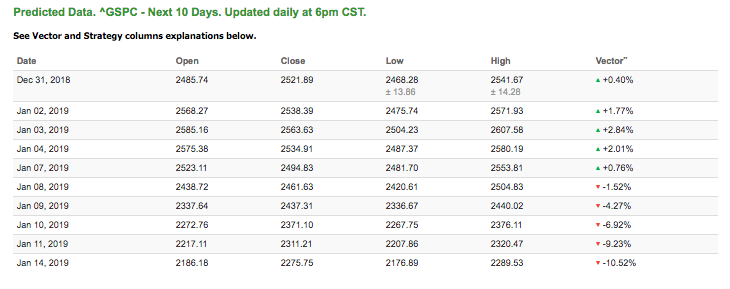

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.40% moves to -1.52% in five trading sessions. The predicted close for tomorrow is 2,538.39. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

New Year’s Eve Flash Sale!

Get Unlimited LIFETIME ACCESS to our Premium Membership for less than the price for 1-year of service!

Click Here to Sign Up

Highlight of a Recent Winning Trade

On December 21st, our ActiveTrader service produced a bearish recommendation for Mastercard Inc. (MA). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

MA entered the forecasted Entry 1 price range of $182.71 (± 1.83) in its first hour of trading and hit its Target price of $180.88 in the third hour of trading that day. The Stop Loss was set at $184.54.

Wednesday Morning Featured Stock

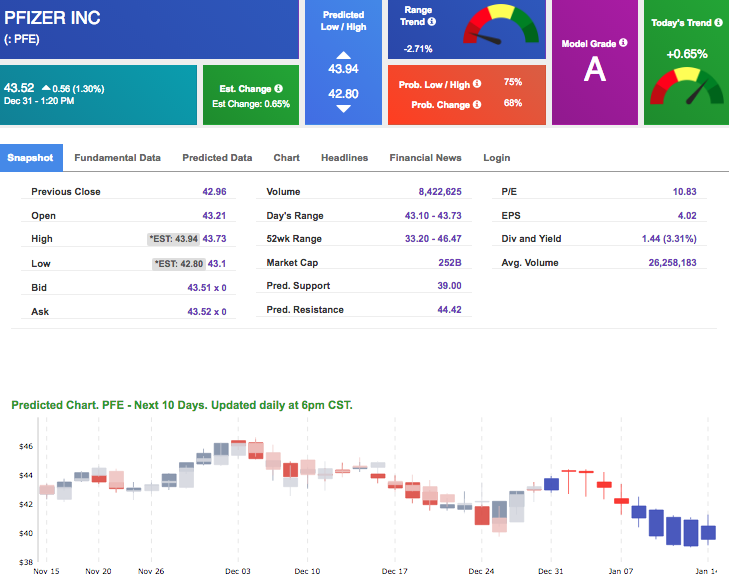

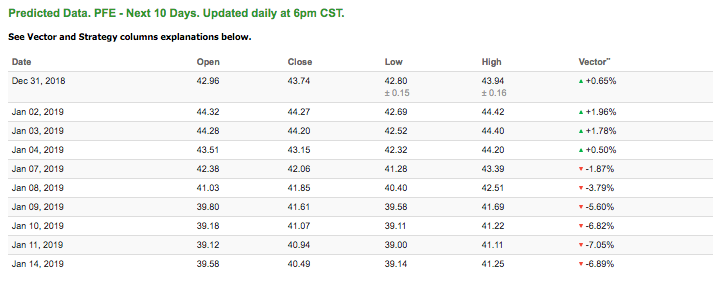

Our featured stock for Wednesday is Pfizer Inc. (PFE). PFE is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $43.52 at the time of publication, up 1.30% from the open with a +0.65% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

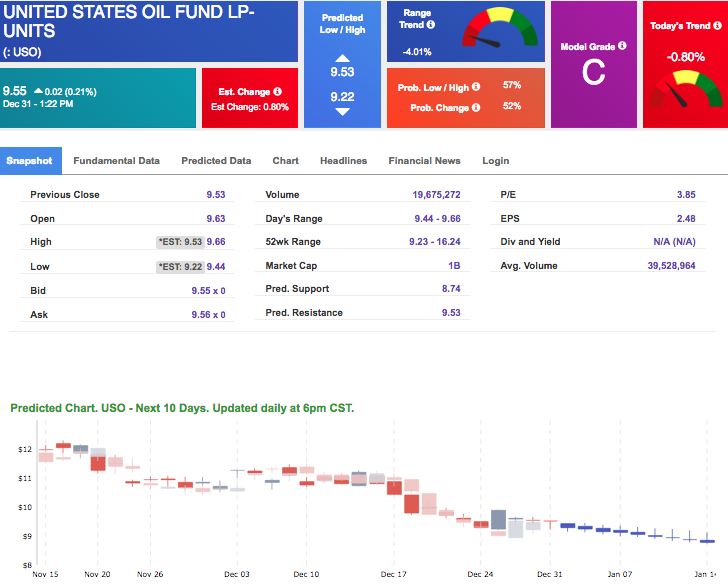

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $75.49 per barrel, up 0.35% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $9.55 at the time of publication, up 0.21% from the open. Vector figures show -0.80% today, which turns -4.37% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

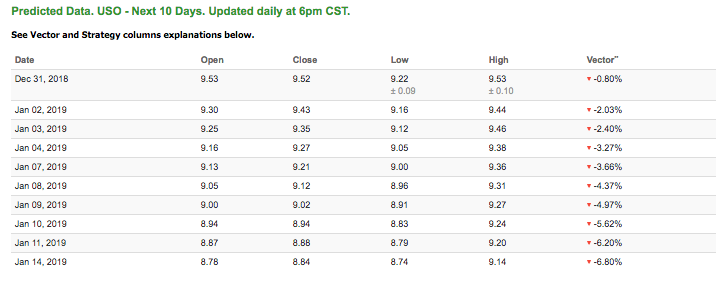

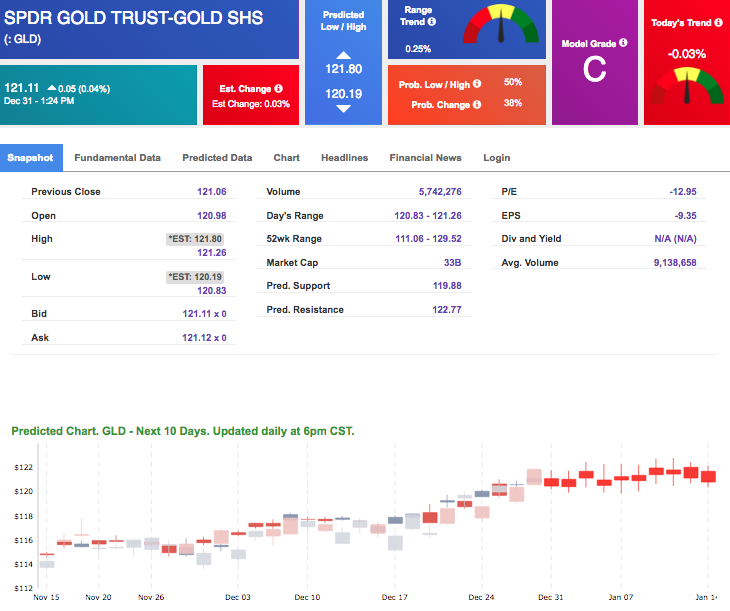

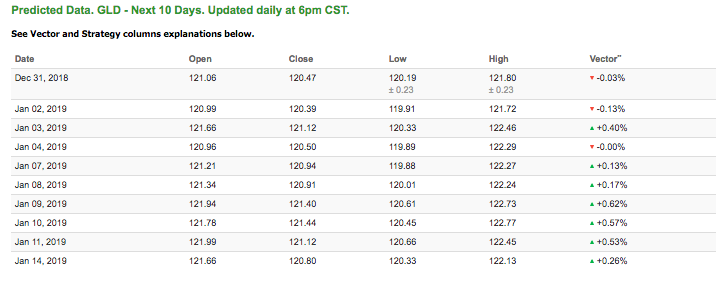

Gold

The price for February gold (GCG9) is down 0.33% at $1,203.10 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $121.11, up 0.04% at the time of publication. Vector signals show -0.03% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

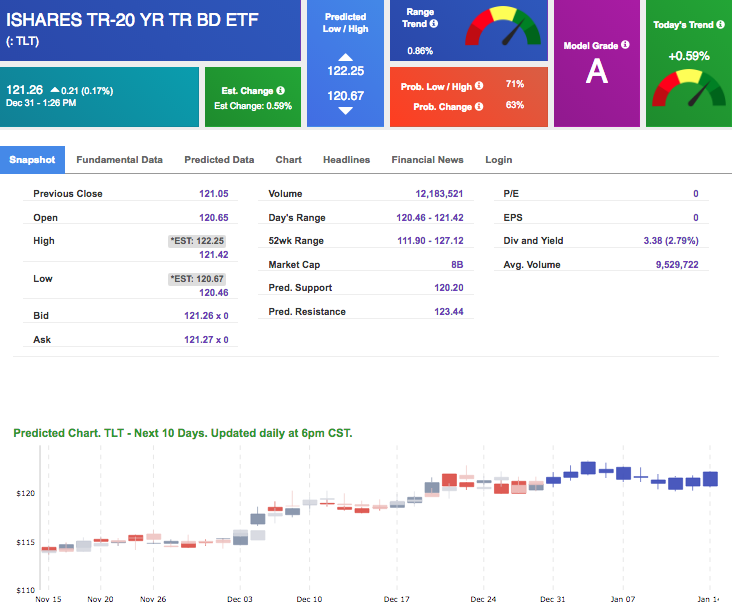

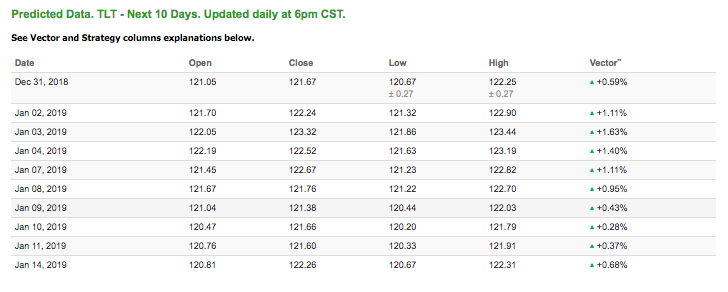

The yield on the 10-year Treasury note is up 2.29% at 3.14% at the time of publication. The yield on the 30-year Treasury note is up 2.32% at 3.39% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.59% moves to +1.40% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

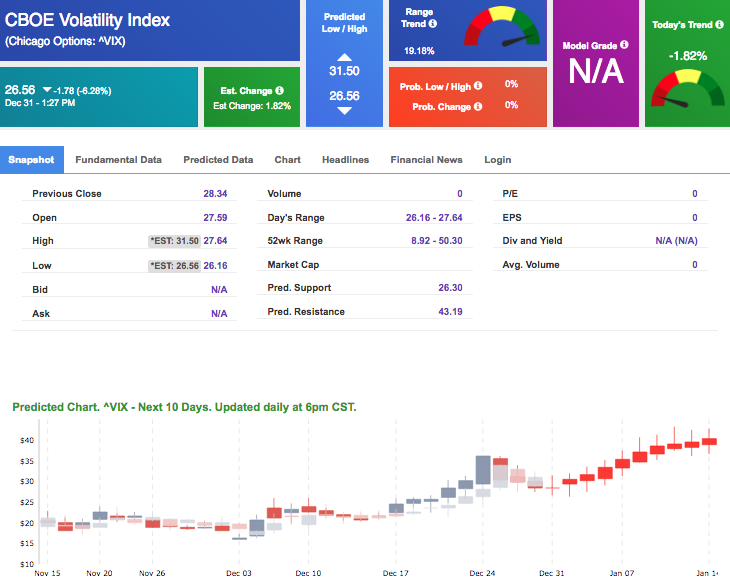

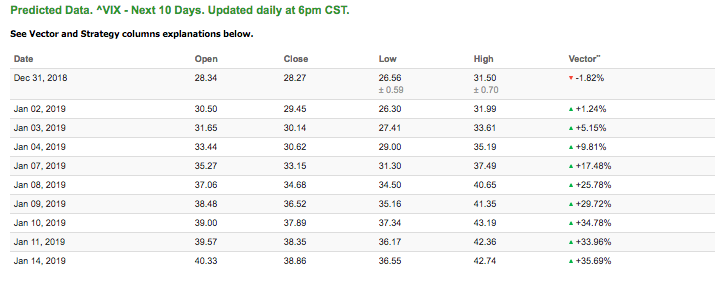

The CBOE Volatility Index (^VIX) is down 6.28% at $26.56 at the time of publication, and our 10-day prediction window shows mostly positive signals. The predicted close for tomorrow is $29.45 with a vector of +1.24%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

New Year’s Eve Flash Sale!

Get Unlimited LIFETIME ACCESS to our Premium Membership for less than the price for 1-year of service!

Click Here to Sign Up