Optimism Omicron Will Not Disrupt Economic Rebound Rallies U.S. Markets

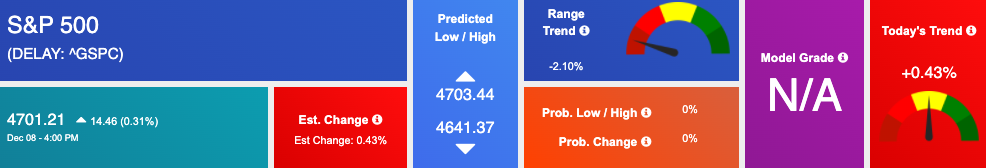

All three major U.S. indices closed in the green as the $VIX pulled back from its recent extreme levels, back to $20. The market’s future direction will likely be determined by a variety of factors, including the Omicron virus, inflation CPI numbers, the Fed’s statement next week, and other news. This week’s key earnings announcements include ORCL, LULU, and AVGO, all of which might have an impact on the market’s course. U.S. Markets appear to be positively reacting to the Pfizer and BioNTech report that the third dose of the vaccine will be effective against the latest COVID variants. This, alongside positive economic data reported in the last few weeks, supported markets after a shaky start to the week.

Please watch the critical support levels on the SPY at $450 and then at $440 (low probability event). We do expect the market to pull back the next week and then continue the rebound toward the end of December. Last week, Fed Chair Powell’s more hawkish remarks put added strain on the market. The effects of the newest variation will continue to have an impact on the market throughout the year.

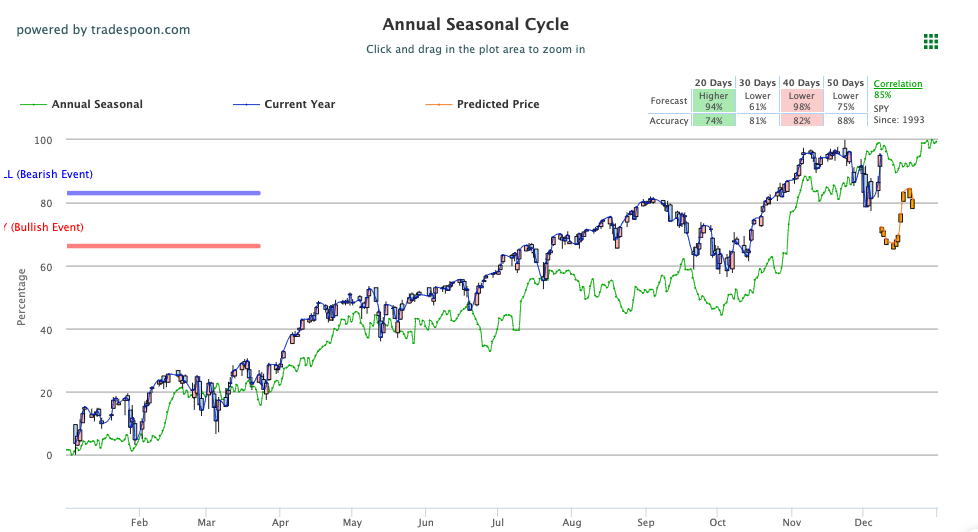

As the year comes to a close, tensions over travel restrictions and further omicron developments will have an impact on markets. Asian markets rose while European markets closed in the red globally. We recommend that all market commentary readers establish distinct stop levels for all open positions. For reference, the SPY Seasonal Chart is shown below:

Key U.S. Economic Reports/Events This Week:

- Job Openings (October) – Wednesday

- Weekly Jobless Claims (12/4) – Thursday

- Consumer Price Index (November) – Friday

- Core Inflation (November) – Friday

- CPI (year-over-year November) – Friday

- Federal Budget (December) – Friday

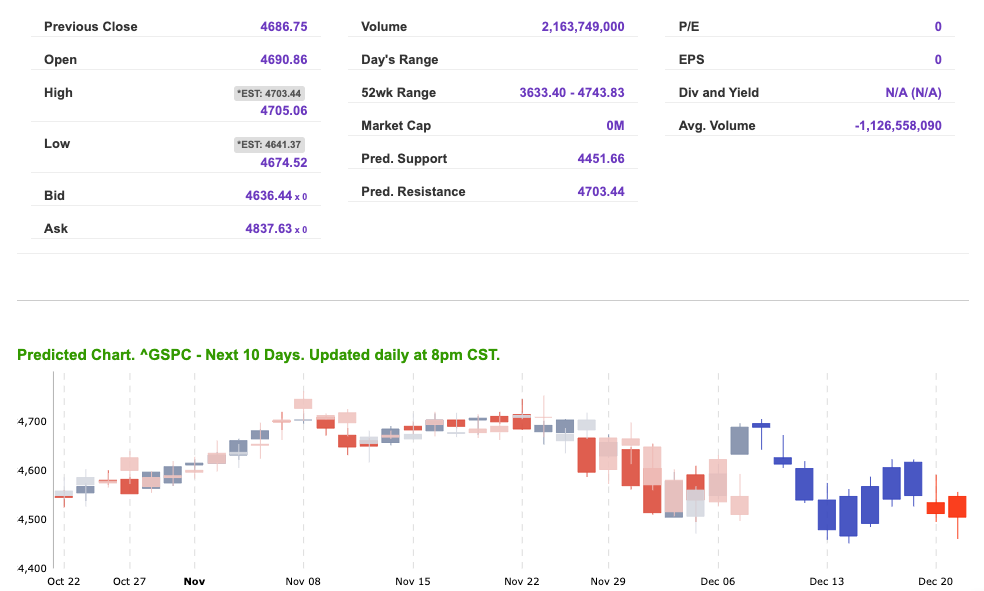

For reference, the S&P 10-Day Forecast is shown below:

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Thursday Morning Featured Symbol

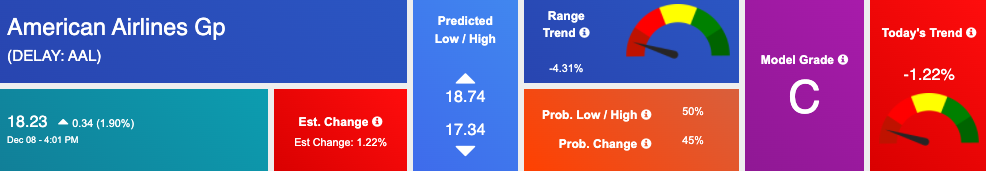

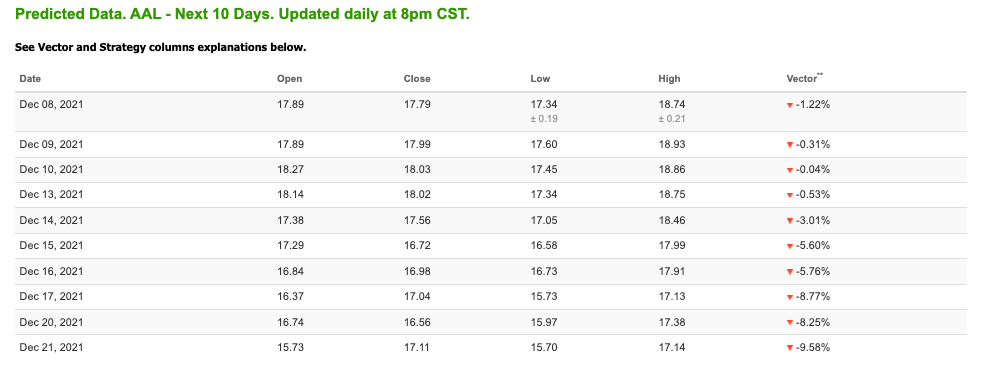

Our featured symbol for Thursday is American Airlines Group (AAL). AAL is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $18.23 with a vector of -1.22% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, AAL. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

Oil

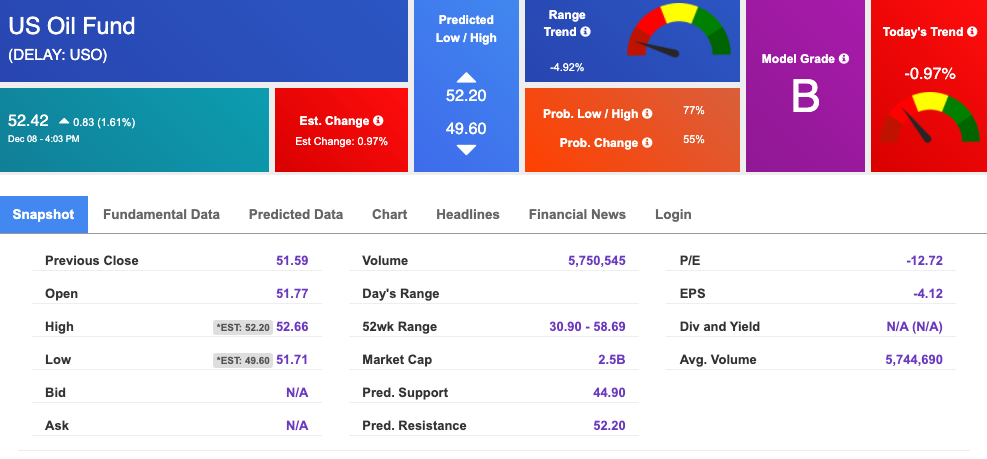

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $72.65 per barrel, up 0.83% at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $52.42 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

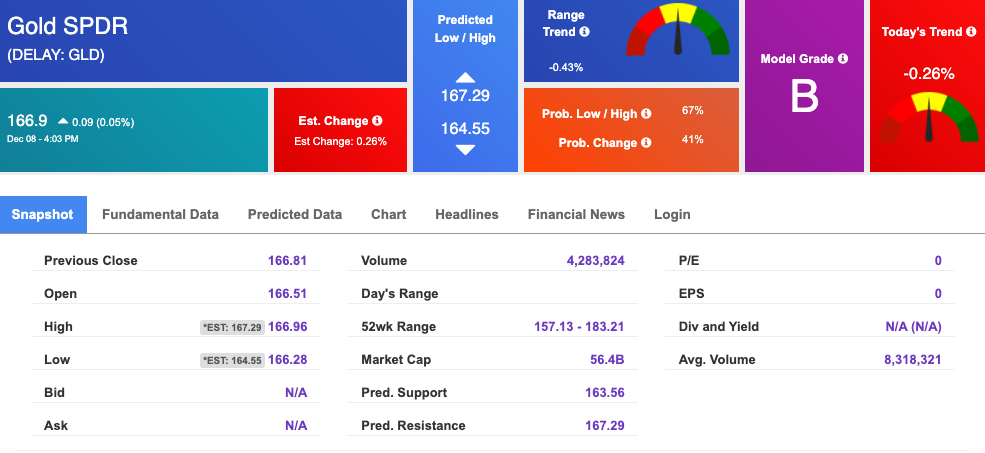

The price for the Gold Continuous Contract (GC00) is down 0.03% at $1784.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $166.9 at the time of publication. Vector signals show -0.26% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

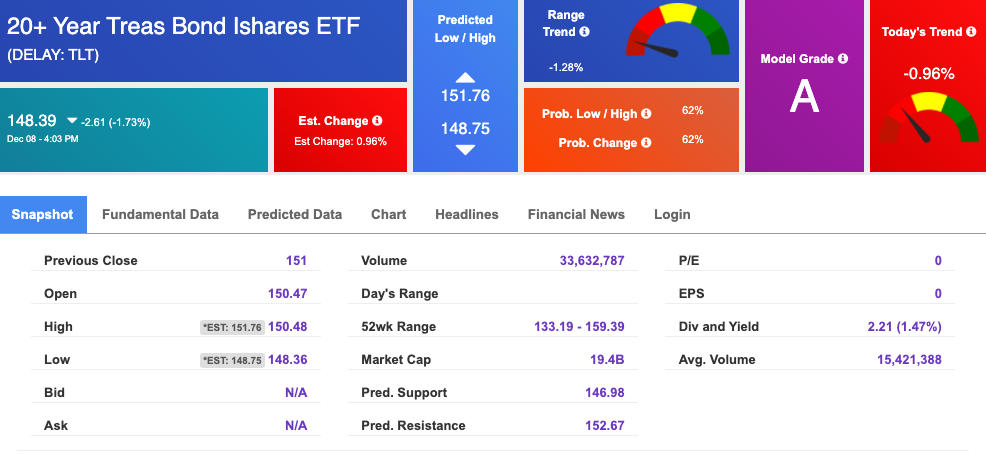

The yield on the 10-year Treasury note is up, at 1.526% at the time of publication.

The yield on the 30-year Treasury note is up, at 1.896% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

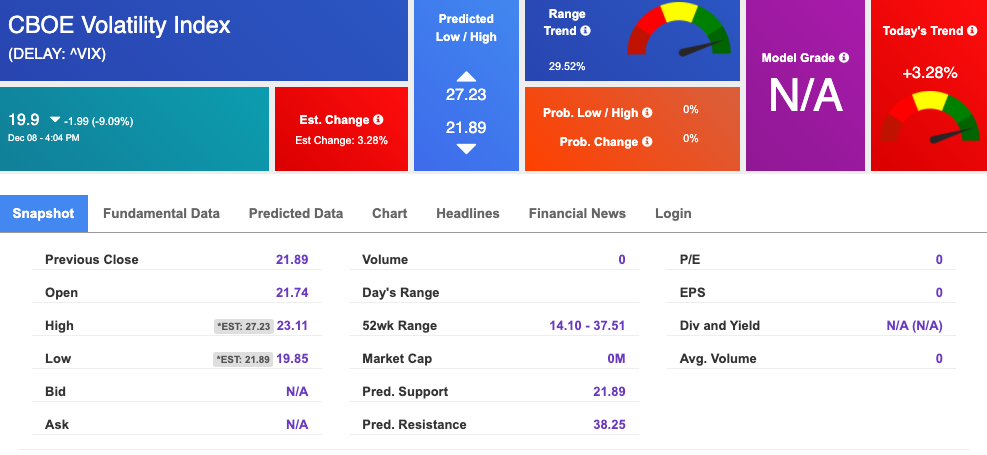

Volatility

The CBOE Volatility Index (^VIX) is $19.9 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.