5 Reasons to Beware of the Coming Bear

Source: Shutterstock.com/g/Rawpixel

October is living up to its reputation for a month when trading gets volatile and bad things happen to stock prices.

The reputation is not just based on the fact that a few of largest one-day sell-offs, or “crashes,” have occurred during the month. It rests on statistical evidence, which shows October as the most volatile month of the year.

This has been especially true since the financial crisis first flared up in October of 2007.

Source: macroriskadvisors.com

Now with the S&P 500 having tumbled 8% from its high, many money managers and market observers have turned decidedly more negative.

Even long time bull JC Parets, has gone as far to say that, “In my opinion, we are in a stock market environment where a crash is entirely possible.”

So what are some of the issues that could bring about a bear market?

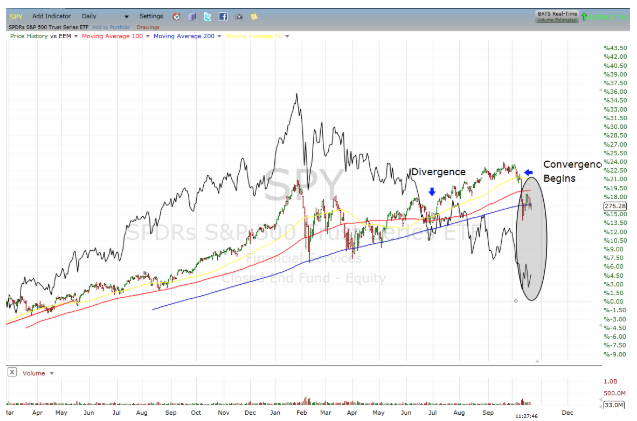

Last week I wrote about the U.S. market decoupling from the rest of global markets and how it was vastly outperforming since the summer.

Initially my premise was they would converge by the rest of the world playing catch up. Instead, it appears that U.S. stocks are heading lower.

Source: freestockcharts.com

As the saying goes, the generals can lead the charge, but if none of soldiers follow, they will soon beat a hasty retreat.

This seems not only to be true of the overall U.S. market vis-a-vis the rest of world. But also within the U.S. market itself.

It had been large cap technology leading the indices higher. But, they had been going higher on narrow leadership. In fact, the bulk of stocks had already moved into down trends, and the number of issues hitting new 52 lows was the highest in nearly two years.

Source: jlfmi.tumblr.com/

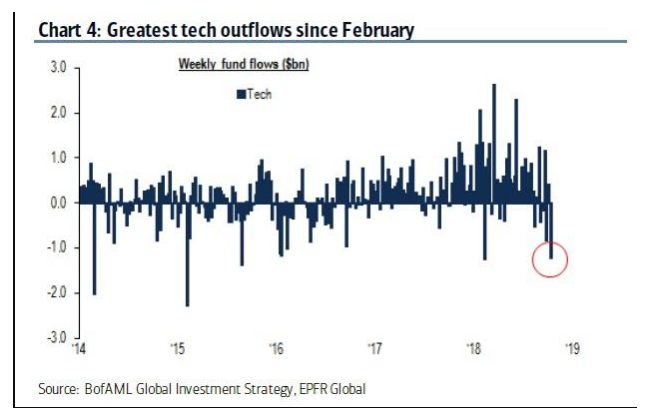

This loss of leadership has led to investor outflows with tech funds seeing their largest withdrawals of the year last week.

Source: BofAML Global Investment Strategy, EPFR Global

How Higher Rates Hurt

The near zero rate environment of the past 6 years had created the TINA (There Is No Alternate) helping fuel the bull market as investors were forced in stocks to seek yield.

But with 2-Year notes now yielding 2.5%, many wealth managers can now move client money into fixed income without feeling foolish — meaning they are selling stocks to make this reallocation happen.

A more detrimental aspect of rising rates is that companies with weaker balance sheets that were able to borrow (and basically stay in business) are starting to default on loans.

Last week, Bank OZK (formerly Bank of the Ozarks), blew up after reporting earnings that contained two shockingly large write-offs that were tied to commercial loans for construction projects – the kind of projects you see underway in cities and states all over America, such as skylines filled with cranes revitalizing downtowns, business districts, and millennial-friendly urban spaces everywhere.

George Gleason, the Chairman & CEO of Bank OZK, predicted that there will be more to come, and the stock immediately lost 25% of its market cap. This brings us to housing. You can see the U.S. Home Construction Index (ITB) — which had been underperforming for most of the year — went into an absolute free-fall late September. This happens to be when 10-year interest rates crossed above the psychological 3% level, and quickly rose to 3.25%.

Source: stockcharts.com

The housing market had already been hurting because of a lack of supply, especially at the lower to middle market. This made it difficult for first time buyers. With 30 year mortgages now moving above 5% affordability, it is even harder.

Housing has an outsized impact on the economy, some say as “it punches above it’s weight,” because of the number and variety of other industries it touches — from a broad range of jobs (plumbers, electricians, brokers, architects, lawyers) to all the material and equipment purchased, rent and what was consumed (lumber, pick-up trucks, tile, etc.

Any further slowdown in housing will ripple through the broader economy, possibly leading to a recession.

Lastly, low rates have spurred a record number of stock buybacks over the past few years. companies were able to borrow money. This was essentially done for free to use for stock repurchase plans. This shrank share count, which boosted earnings per share and helped put a floor under prices.

Without the free money, buybacks are likely to dwindle. This will leave the market vulnerable air pockets, and free falls.

The post Options: 5 Reasons to Beware of Bear appeared first on Option Sensei.