Options Trading: A Golden Opportunity

When I first started publishing options trading articles online in 2002, I quickly learned that if you wanted to get feedback, write something negative about gold. People will really bug out.

At the time gold was trading around below $400 an ounce and I thought that was too high. It of course proceeded to have one of the great bull runs over the next decade.

I never shorted it, but I’ve also never been convinced the metal has real worth.

With that caveat, I’ve come to accept that gold does have a 5,000 year history as a store of value. Since people are willing to exchange both real goods and paper money for it, I’m here to recommend a bullish trade in a gold mining company.

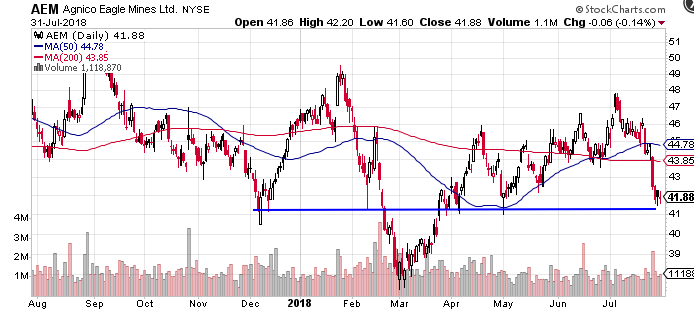

Agnico Eagle Mines (AEM) is a Toronto-based gold miner that engages in the exploration, development, and production of mineral properties in Canada, Mexico, and Finland.

It also happened to be the largest holding in the Vanguard Precious Metals & Mining ETF (VGPMX), an Exchange Trade Fund with over $2 billion in assets under management.

This is important because last week ago Vanguard renamed and restructured this fund as the Vanguard Global Capital Cycles Fund.

Agnico had been a full 12% weighting of the fund. The restructuring pared to about 4%, meaning $200 million worth of some shares were sold by Vanguard. Not an insubstantial amount of the Agnico’s total $8 billion market capitalization.

This selling pressure came just when the company reported earnings on July 25th. The earnings were not too bad, revenue beat expectations while EPS missed due to some one-time charges.

I think the combination of Vangaurd’s liquidation and uninspiring earnings has created a price dislocation and a buying opportunity.

Gold is near important support around the $1200-$1220 level.

AEM is near important support near $41. This makes a good risk/reward entry point.

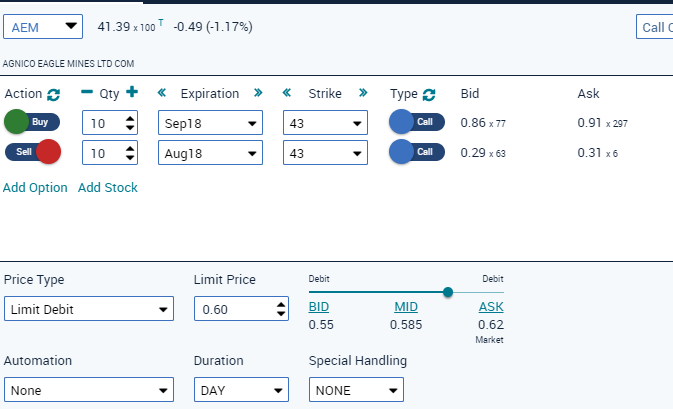

I’m going to use an options trading strategy called a calendar spread to establish a bullish position.

-Buy to open 10 contracts September 43 Calls

-Sell to open 10 contracts August 43 Calls, for a Net Debit $0.60

I’m still not convinced gold, or the gold mining companies make good long-term investments but this a great low cost and limited risk way to play for a bounce in the shares over the next two months.

Related: Do Buybacks Really Help the Market? Here’s What We Know.

Related: Do Buybacks Really Help the Market? Here’s What We Know.

The post Options Trading: A Golden Opportunity appeared first on Option Sensei.