Prior Resistance Levels Holding as Fresh Support

- The opening gains on Wednesday was a result of a positive Consumer Price Index report which showed inflation is slightly easing. There have been, and still remain, concerns that President Trump’s tariffs would accelerate the rate of price hikes.

- The tariff wars are set to expire on July 9th and on Wednesday, Treasury Secretary Bessent stated it would be highly unlikely that countries engaged in current trade deals would see an extension of the tariff pause. This means more deals could get done in the next week or so and likely ongoing bullish developments for the market.

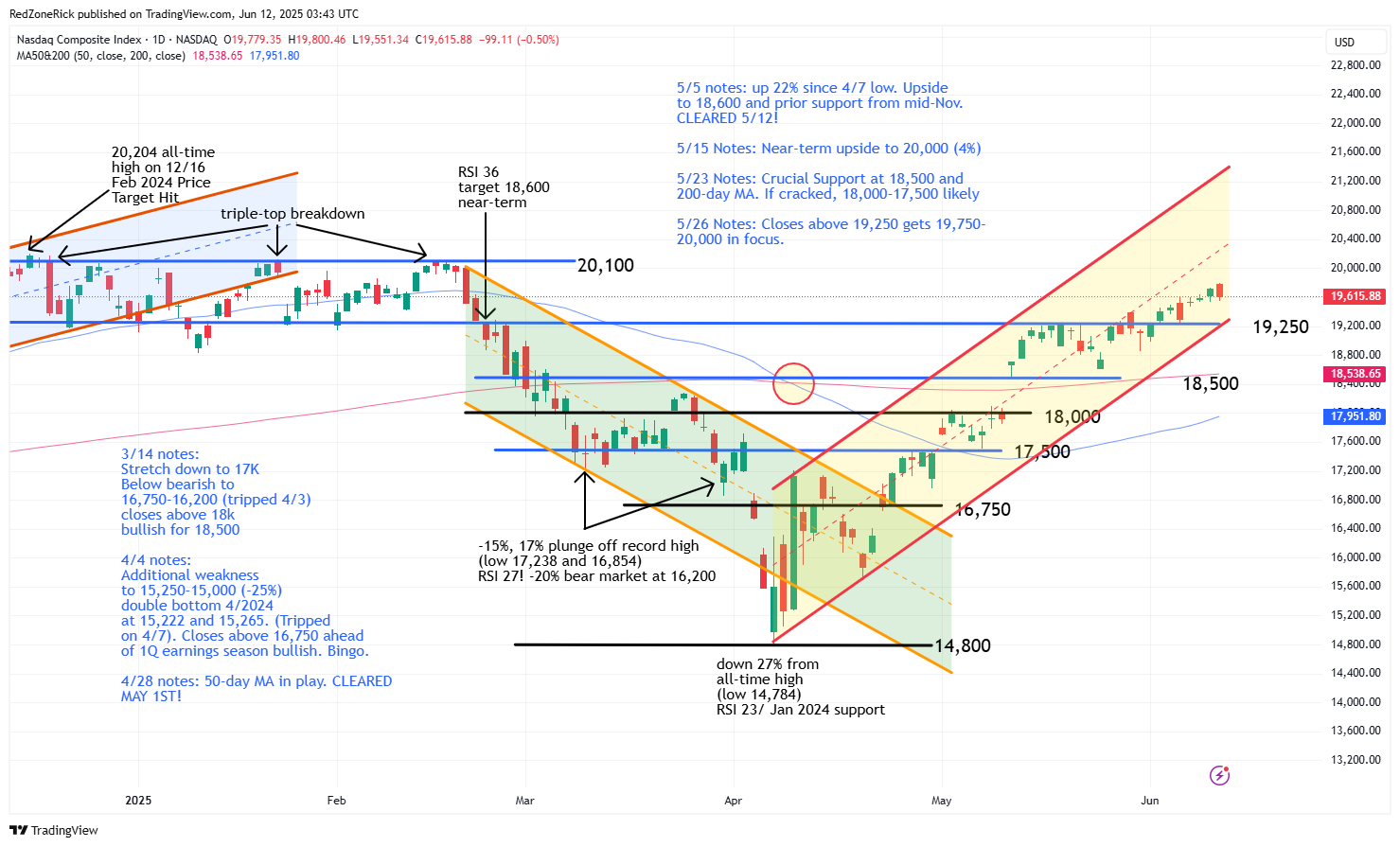

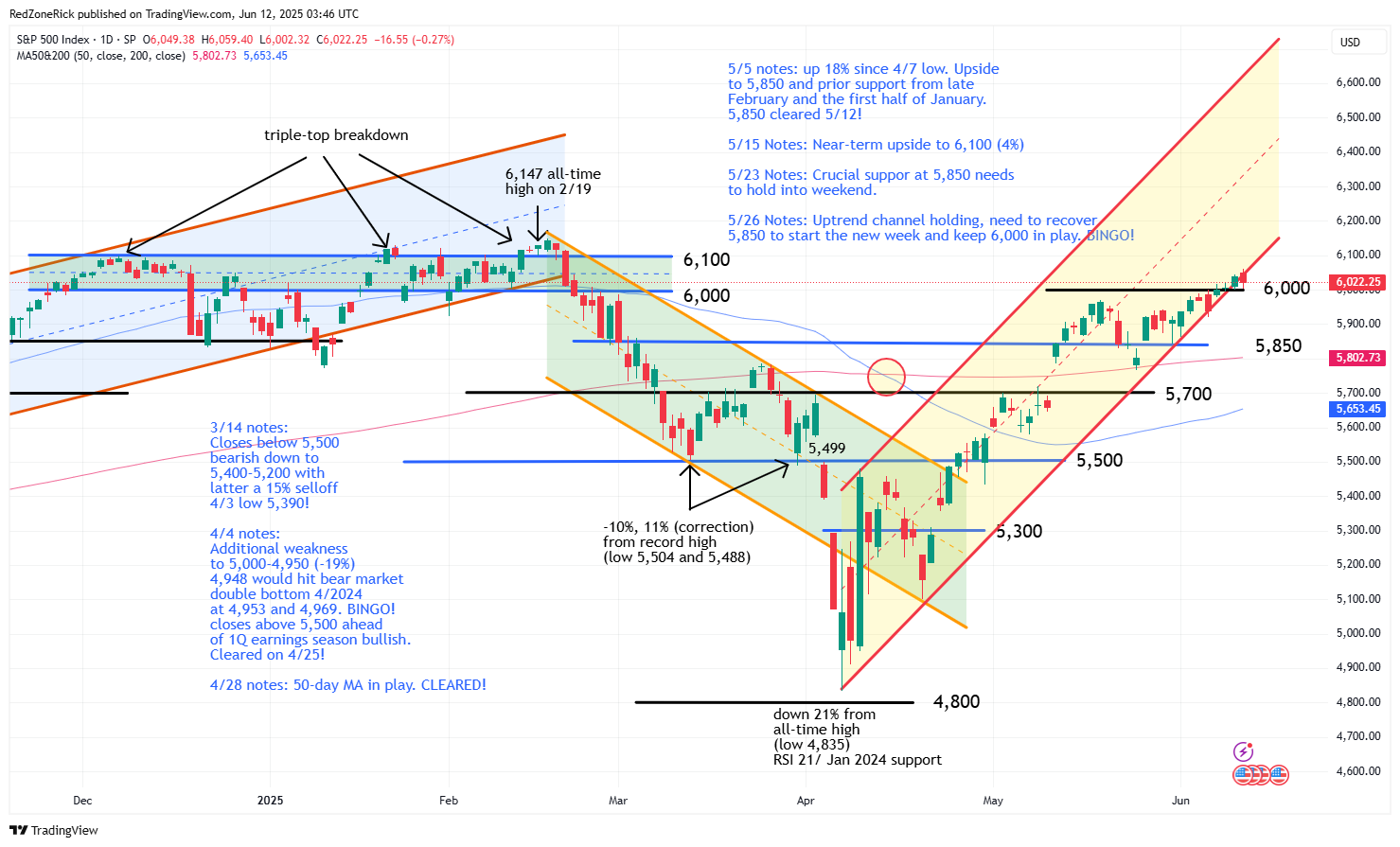

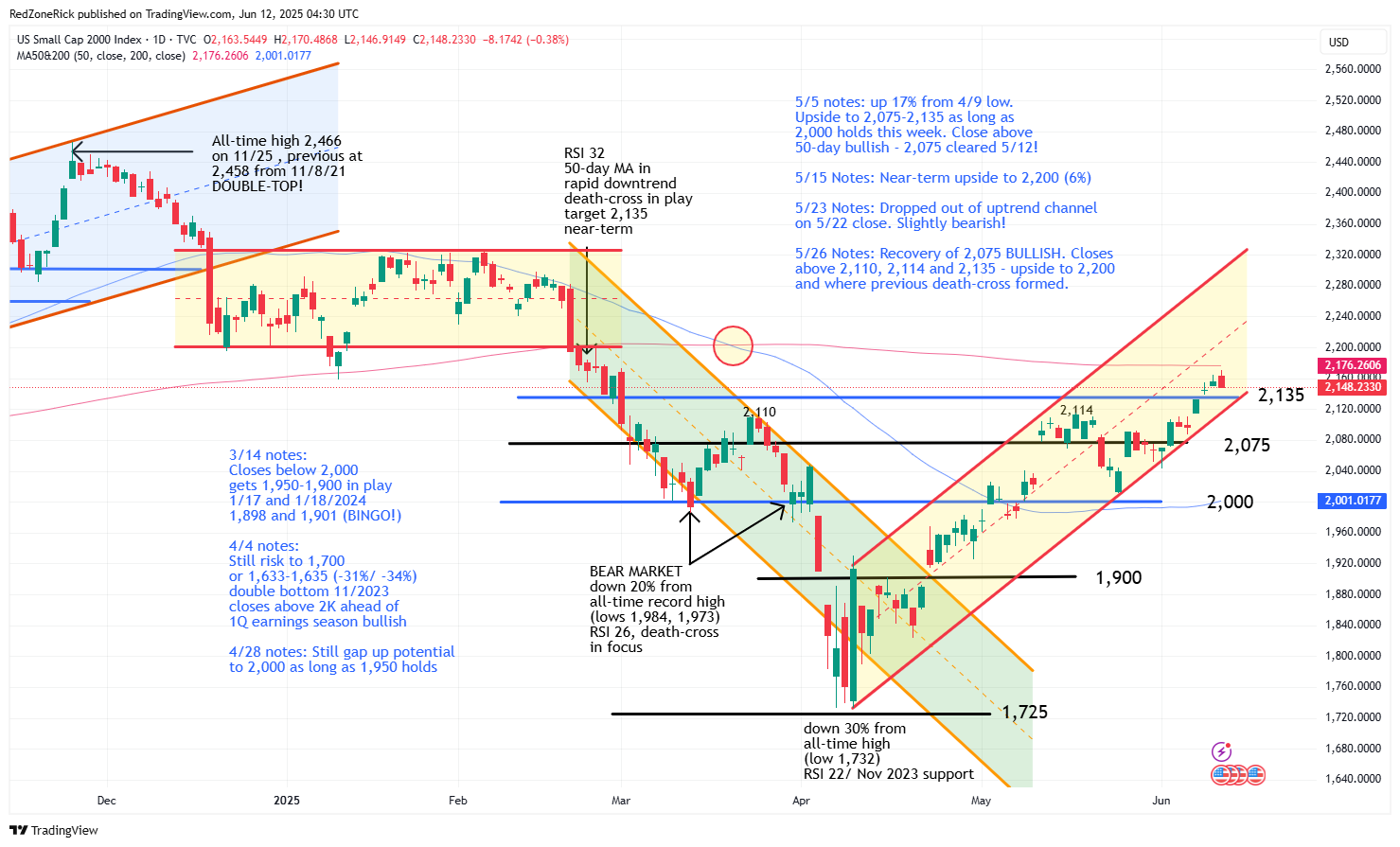

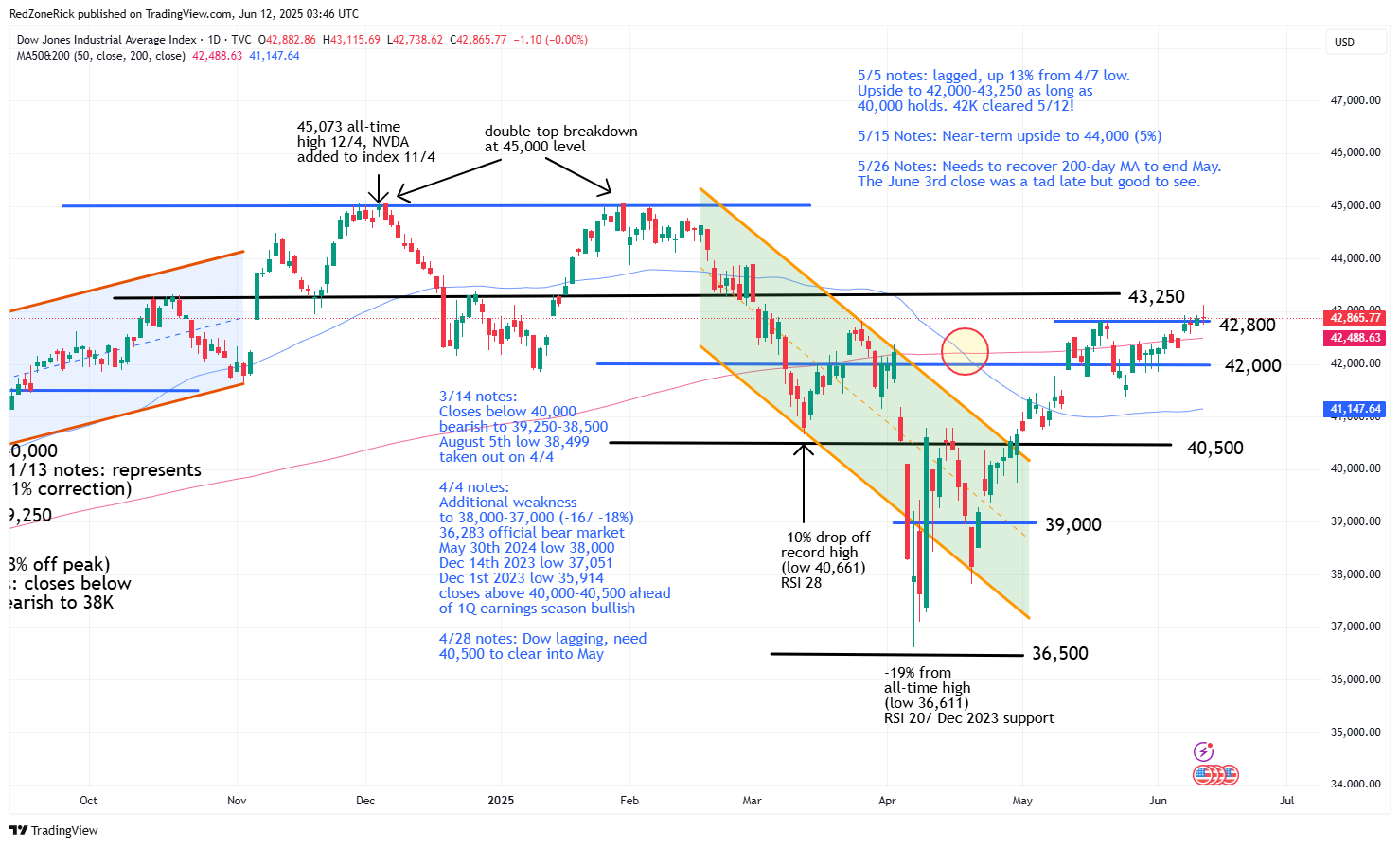

- Prior resistance levels are holding this week as key support and exactly what we wanted to see as far as the technical action. As a reminder, these price points are at Nasdaq 19,250; S&P 5,950; Russell 2,075; and Dow 42,800. A break below these levels ahead of the weekend would be a yellow flag for the market.

The stock market pulled back on Wednesday after making higher weekly highs during the first half of action. The slight sell-the-news pullback was likely a result of Tuesday’s agreement between the US and China on a proposal that would address crucial trade concerns.

The Nasdaq closed at 19,615 (-0.5%) with the low kissing 19,551. Key support at 19,500 held. Resistance is at 19,750.

The S&P 500 traded down to 6,002 while closing at 6,022 (-0.3%). Key support at 6,000 held. Resistance is at 6,100.

The Dow settled at 42,865 (-1.1%) after testing a low of 42,738. Support at 42,800 was tripped but held. Resistance is at 43,000.

Earnings and Economic News

Before the open: Lovesac (LOVE), Hooker Furniture (HOFT)

After the close: Adobe (ADBE), RH (RH), Zedge (ZDGE)

Economic news:

Initial Jobless Claims – 8:30am

Producer Price Index – 8:30am

Technical Outlook and Market Thoughts

The opening gains on Wednesday was a result of a positive Consumer Price Index report which showed inflation is slightly easing. There have been, and still remain, concerns that President Trump’s tariffs would accelerate the rate of price hikes.

The tariff wars are set to expire on July 9th and on Wednesday, Treasury Secretary Bessent stated it would be highly unlikely that countries engaged in current trade deals would see an extension of the tariff pause. This means more deals could get done in the next week or so and likely ongoing bullish developments for the market.

The Nasdaq’s has been holding 19,500 for four-straight sessions. Continued closes above this level and the February 24th intraday top at 19,644 keeps upside to 19,750-20,000 in play.

Backup support is at 19,250-19,000. A close below these levels and out of the current uptrend channel would be a slightly bearish development.

The S&P 500 has also been holding fresh support at 6,000 for four-straight sessions. A close below this level would suggest a retest to 5,950-5,900. This index is riding its current uptrend channel and is dangerously close to falling out of it.

The S&P 500 has also been holding fresh support at 6,000 for four-straight sessions. A close below this level would suggest a retest to 5,950-5,900. This index is riding its current uptrend channel and is dangerously close to falling out of it.

A move above 6,075 would likely confirm a run to 6,100-6,150 with the all-time high at 6,147 from February 19th.

The Russell 2000 closed above major resistance at 2,135 on Monday and a level that now represents the bottom of the uptrend channel. Support is at 2,100-2,075 on a drop below 2,135.

Resistance is at 2,175-2,200 and the 200-day moving average with yesterday’s top at 2,170.

The Dow has been holding 42,800 for two sessions after trading above this level over the past four. Continued closes above 42,750 keeps upside action to 43,000-43,250 in focus.

Backup support is at 42,500 and the 200-day moving average if 42,750 fails to hold into the weekend.

The Volatility Index (VIX) has closed below 17.50 for four-straight sessions with Wednesday’s bottom at 16.23. Near-term support at 16.50-15.50 was tripped but held. The last close below 15 was on February 14th.

Resistance is at 18-18.50. A pop back above 20 would be a cautious signal for the market.

Prior resistance levels are holding this week as key support and exactly what we wanted to see as far as the technical action. As a reminder, these price points are at Nasdaq 19,250; S&P 5,950; Russell 2,075; and Dow 42,800. A break below these levels ahead of the weekend would be a yellow flag for the bulls.