Record Highs for S&P and Dow, Markets Closed Thursday

S&P at fifth straight day in the green

Markets remain on the move up this week with the S&P recorded its third straight day at an all-time high level and its fifth straight day in the green.

Today’s trading session closed early

All the three major indices are on track and closed in positive territory while the Dow set its first record day since last year. Today’s trading session closed early ahead of the 4th of July holiday.

Christopher Waller, Trump’s new Fed-member pick

Reports from D.C. have named Trump’s new Fed-member picks as St. Louis Fed member Christopher Waller and former campaign adviser Judy Shelton.

ADP June employment report in focus today

Major economic reports to track today include ADP June employment report, trade deficit data for the month of May, June’s Markit services PMI.

(Want free training resources? Check our our training section for videos and tips!)

Next week notable earnings reports

While this week featured no corporate earnings of significance, next week look for Pepsico, Bed Bath & Beyond, and Delta Airlines data.

SPY buying opportunity near $290

With the SPY trading at an all-time high level, we encourage our readers to buy near $290 level and avoid chasing near $298. Still, volatility is expected as U.S.-China trade developments continue to be reported following G20. With that in mind, we do not see this week’s market momentum pushing SPY above $300, potentially overshooting to 305. For reference, the SPY Seasonal Chart is shown below:

ADP helps markets continue multi-day streak

Impressive labor data upheld markets today, continuing multi-day streaks for all three major U.S. indices. ADP reported an increase of 102,000 private-sector jobs in June, slightly below expectations but significantly more than in May.

(Want free training resources? Check our our training section for videos and tips!)

June’s factory orders data slightly down for the month

Unemployment benefits for the week also dropped, providing another positive sign for the current state of the economy. Still, not all data returned positive this week with June’s factory orders data slightly down for the month.

Major market focus continues to hold over possible U.S-China negations and progress as a trade deal continues to be the goal of both nations. Following the G20 summit in Japan this weekend, both U.S. and China agreed to hold off any additional tariffs for now. Look for more information on this in the weeks to come, possibly inducing some volatility. Globally, European markets closed in the green while Asian markets closed unanimously in the red.

The latest news from D.C. prompted some optimism with investors as both of the new candidates Trump is looking to appoint for the FOMC are faring better in the public largely due to their experience compared to the last two attempted appointments. Christopher Waller is the current research director at the St. Louis Federal Reserve, while Judy Shelton, a former campaign adviser, currently operates as the U.S. executive director for the European Bank of Reconstruction and Development. Prior to her nomination, Shelton openly discussed her opinion that the Fed should lower rates immediately, another signal interest rates could come soon. With markets closed on Thursday for the Independence Day holiday, look for June employment data on Friday, while next week we will see consumer credit for the month of May as well as last month’s FOMC minutes.

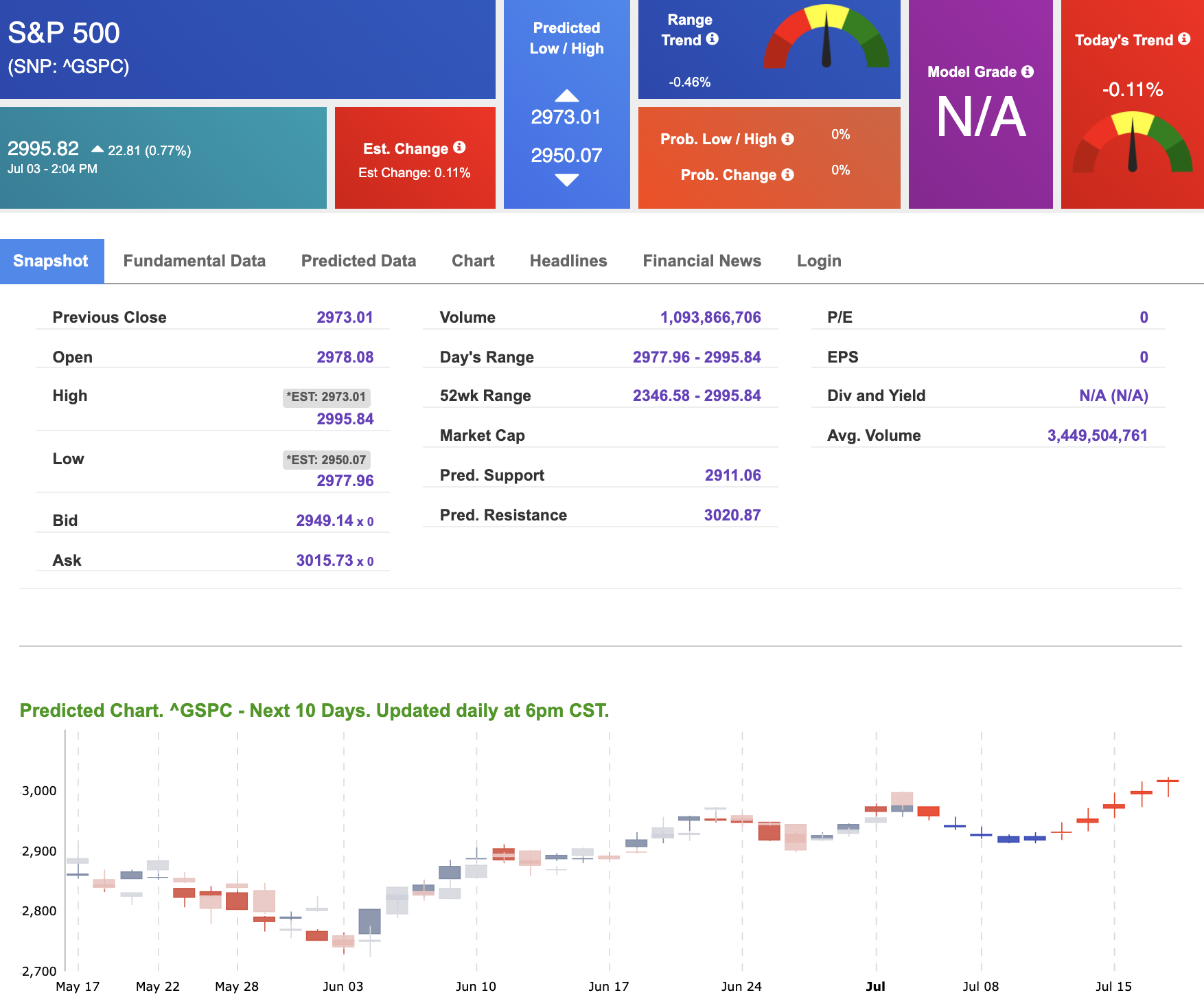

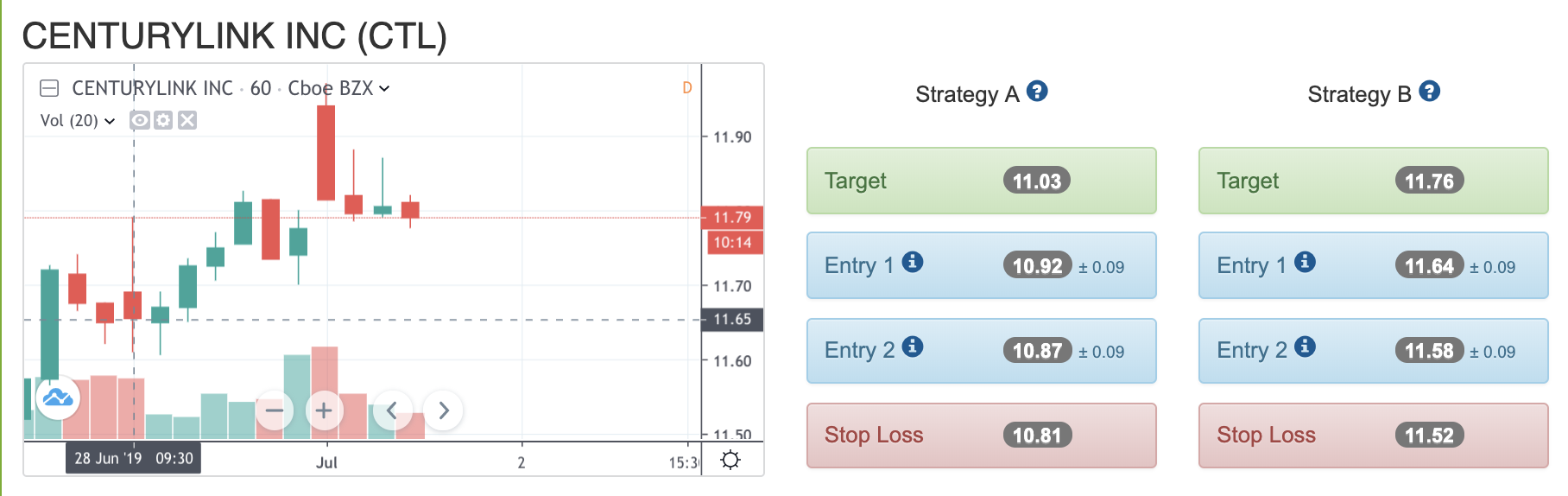

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows negative signals. Today’s vector figure of -0.11% moves to -1.21% in five trading sessions. Prediction data is uploaded after the market close at 6 pm, CST. Today’s data is based on market signals from the previous trading session.

CLICK HERE FOR THE $97 SUPER

JULY 4 TH SALE!

I put my money where my mouth is!

Listen, I’ve been around long enough to have been exposed to every “earth-changing” investment strategy Wall Street has ever dreamed up.

I’m telling you Artificial Intelligence is not just another gimmick for Wall Street to market itself.

I don’t like the way Wall Street’s Robo advisors cut you out of the decision process, but I am personally relying upon the very latest, cutting-edge AI to identify money-making opportunities.

YES! I’m investing my own money in each and every stock as my AI platform identifies.

I racked up huge gains on my own money by relying on my mind-boggling high-tech AI platform to accurately forecast everything I needed to know about the stocks in my portfolio.

And remember we’re not talking about day-trading here. I already have a 94% success rate and almost 5% return per trade. With 59 winners out of 63 trades in the last 13 months, I have a cumulative return of 295 %!

Twice a month, you’ll get a complete rundown on what I’ve done with my money that week, what you should do now as well as how our past picks are doing and when to sell them.

CLICK HERE FOR THE $97 SUPER

JULY 4 TH SALE!

Highlight of a Recent Winning Trade

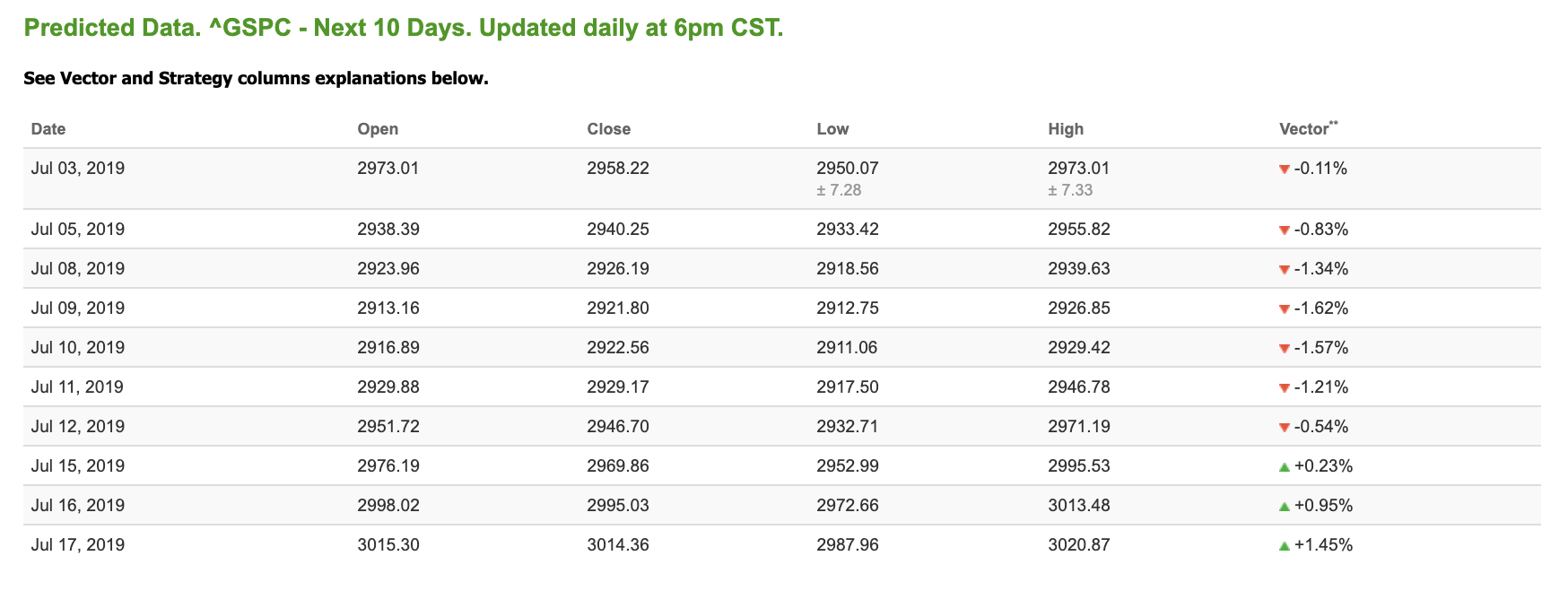

On June 28th, our ActiveTrader service produced a bullish recommendation for CenturyLink Inc (CTL). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

CTL entered its forecasted Strategy B Entry 1 price range $11.64 (± 0.09) in its first hour of trading and passed through its Target price $11.76 in the fifth hour of trading that day. The Stop Loss price was set at $11.52.

Friday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, AFL. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

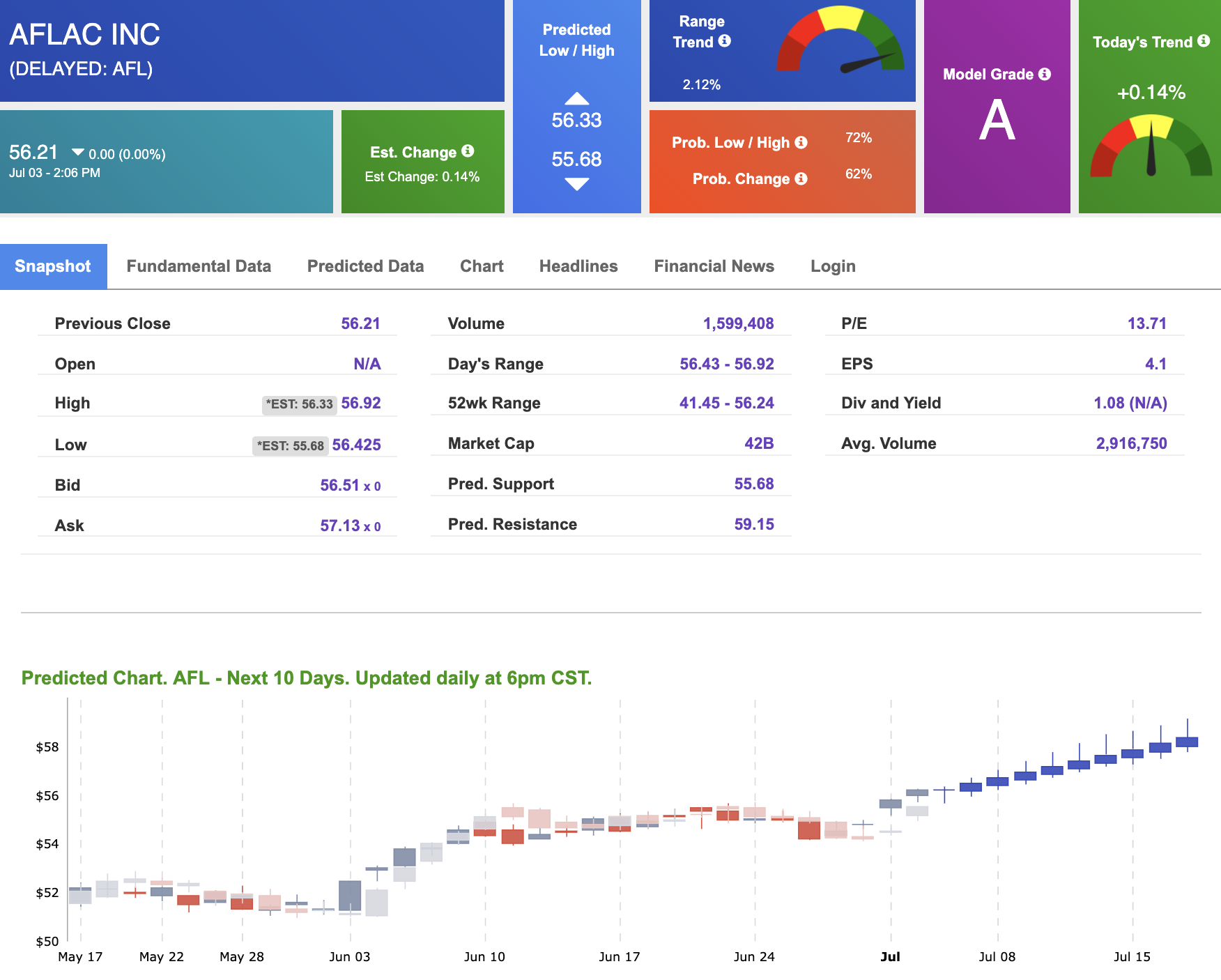

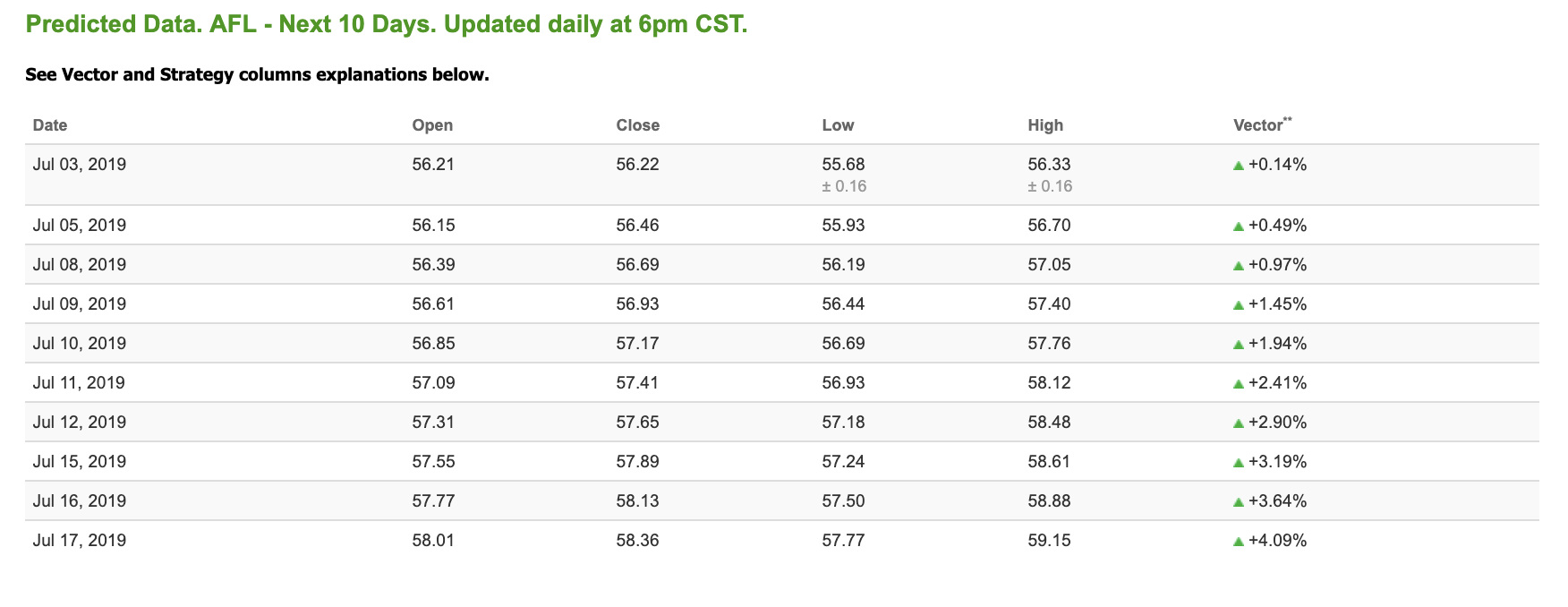

Our featured symbol for Friday is Aflac Inc (AFL). AFL is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $56.21 at the time of publication, with a +0.14% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

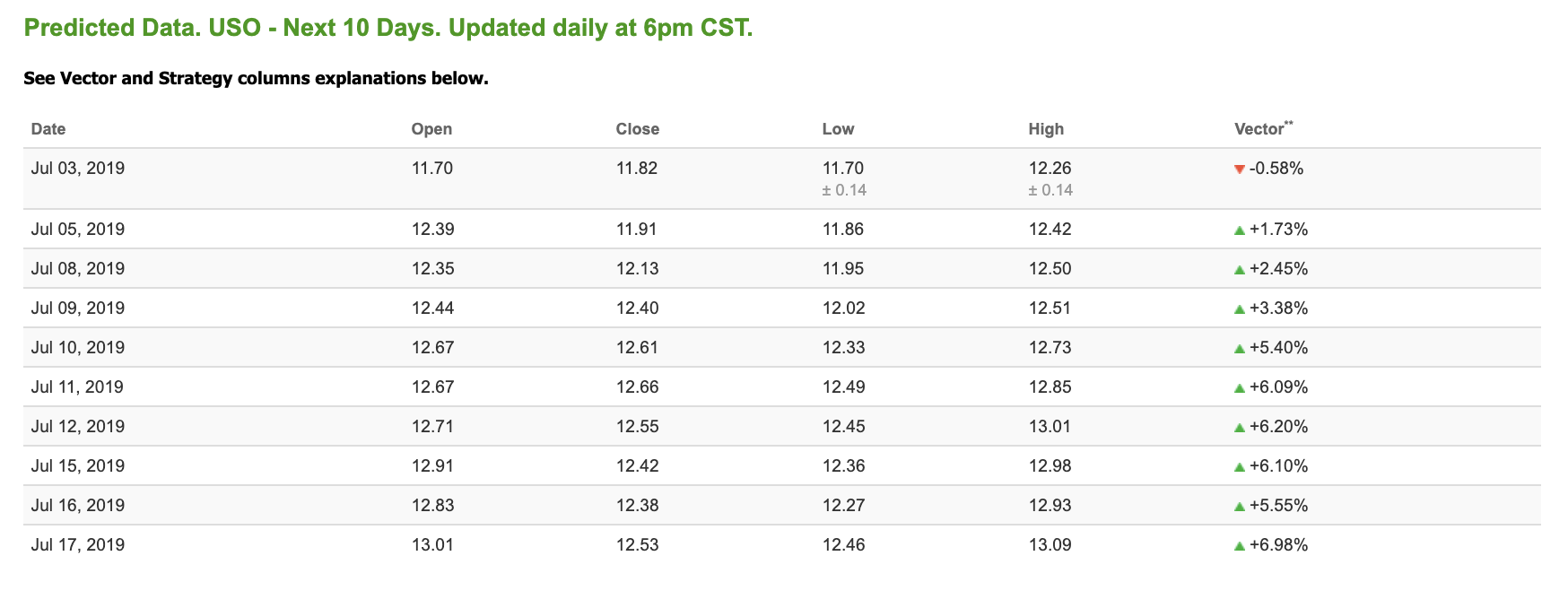

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $57.31 per barrel, up 1.88% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.89 at the time of publication, up 2.00% from the open. Vector figures show -0.58% today, which turns +6.09% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

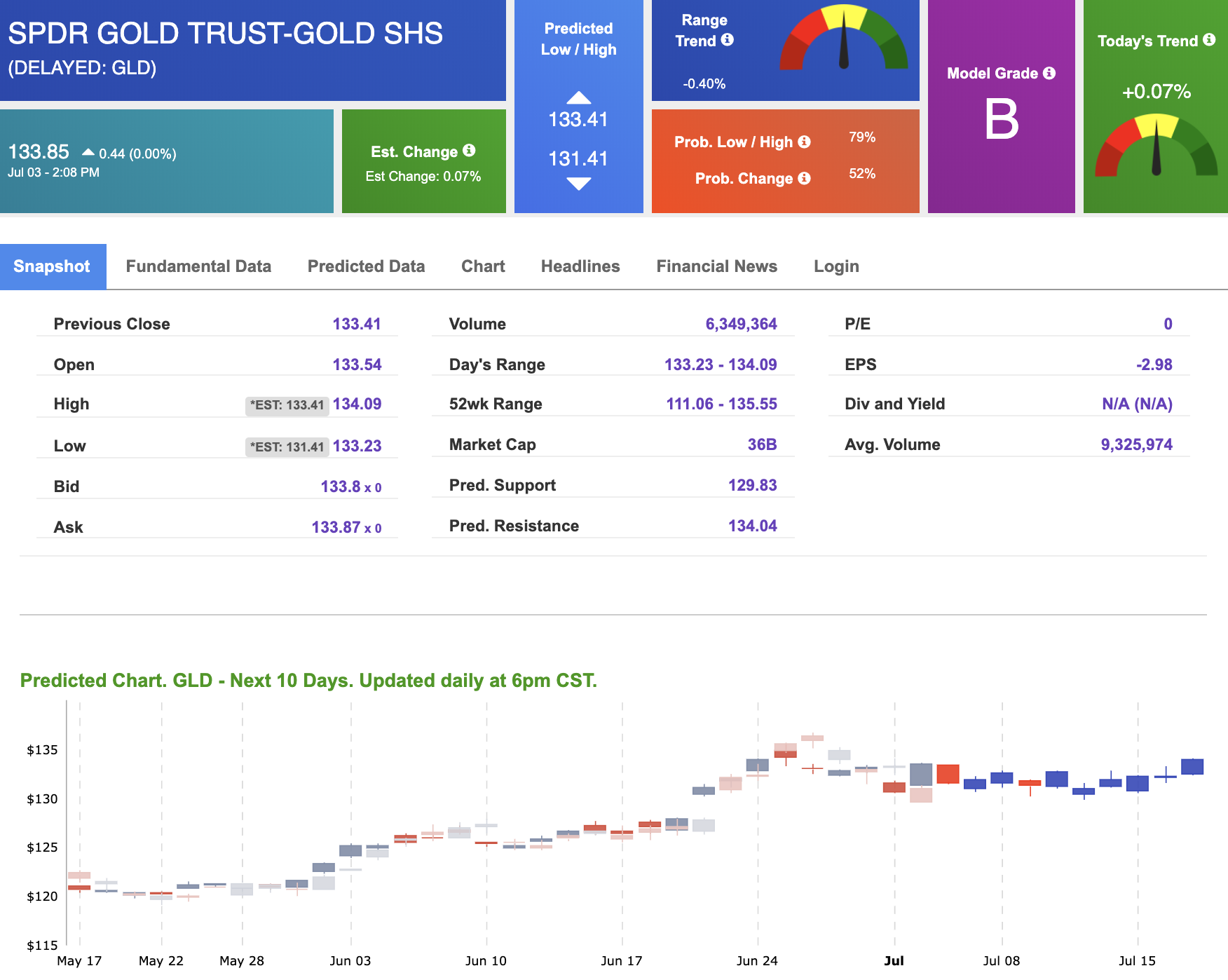

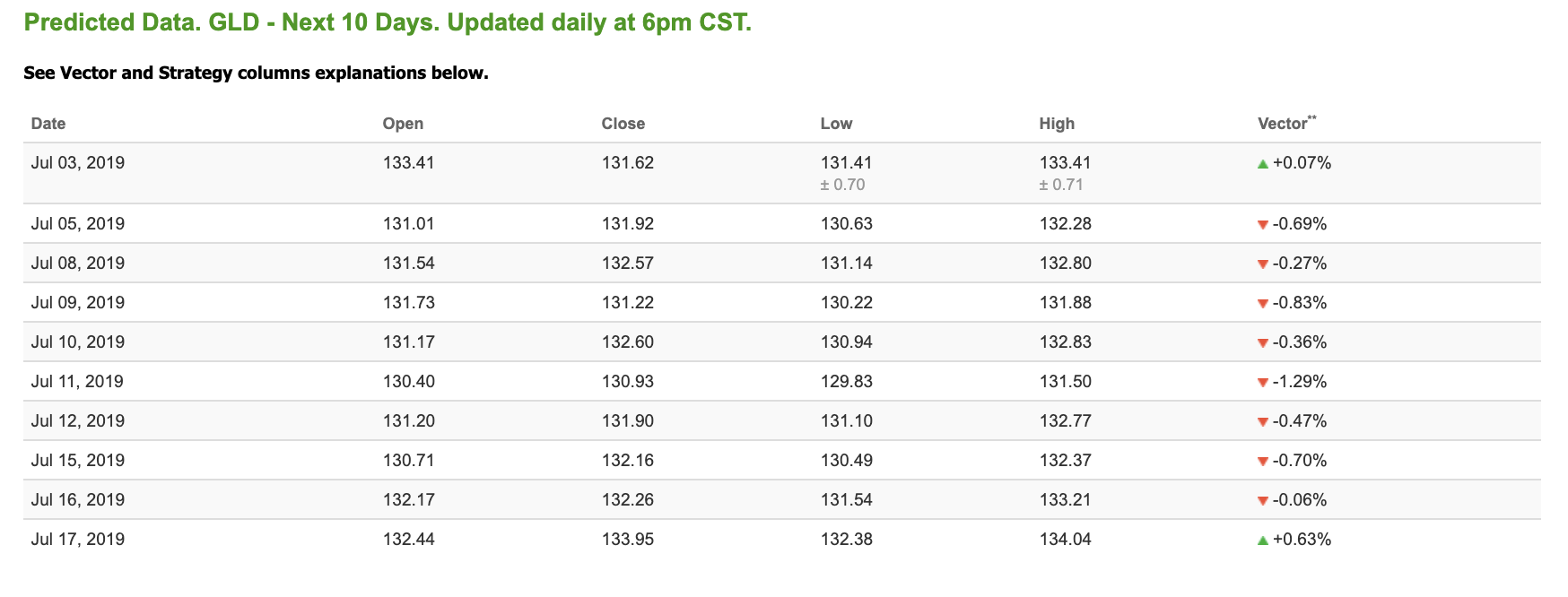

Gold

The price for the Gold Continuous Contract (GC00) is up 0.94% at $1,421.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $133.85 at the time of publication. Vector signals show +0.07% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

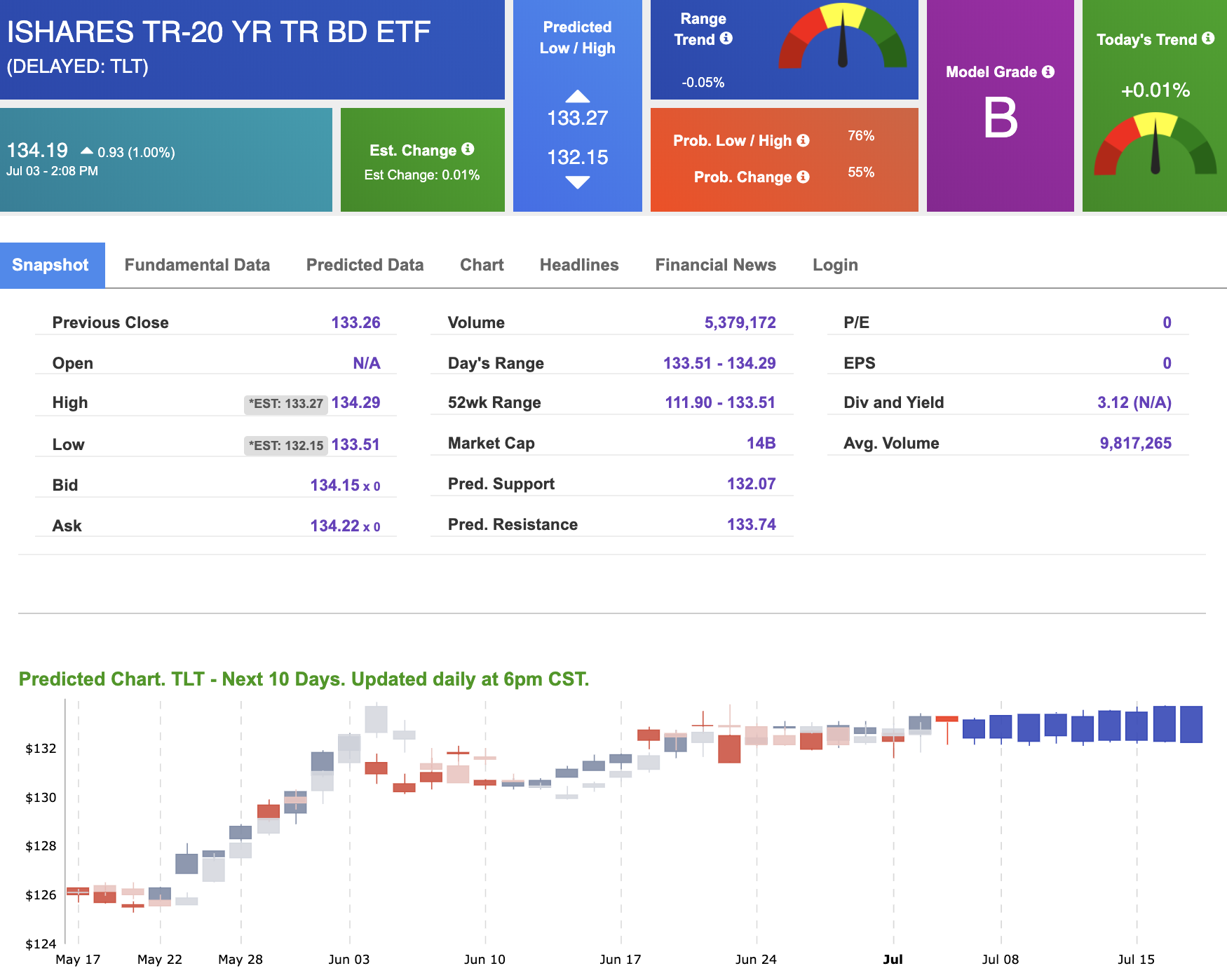

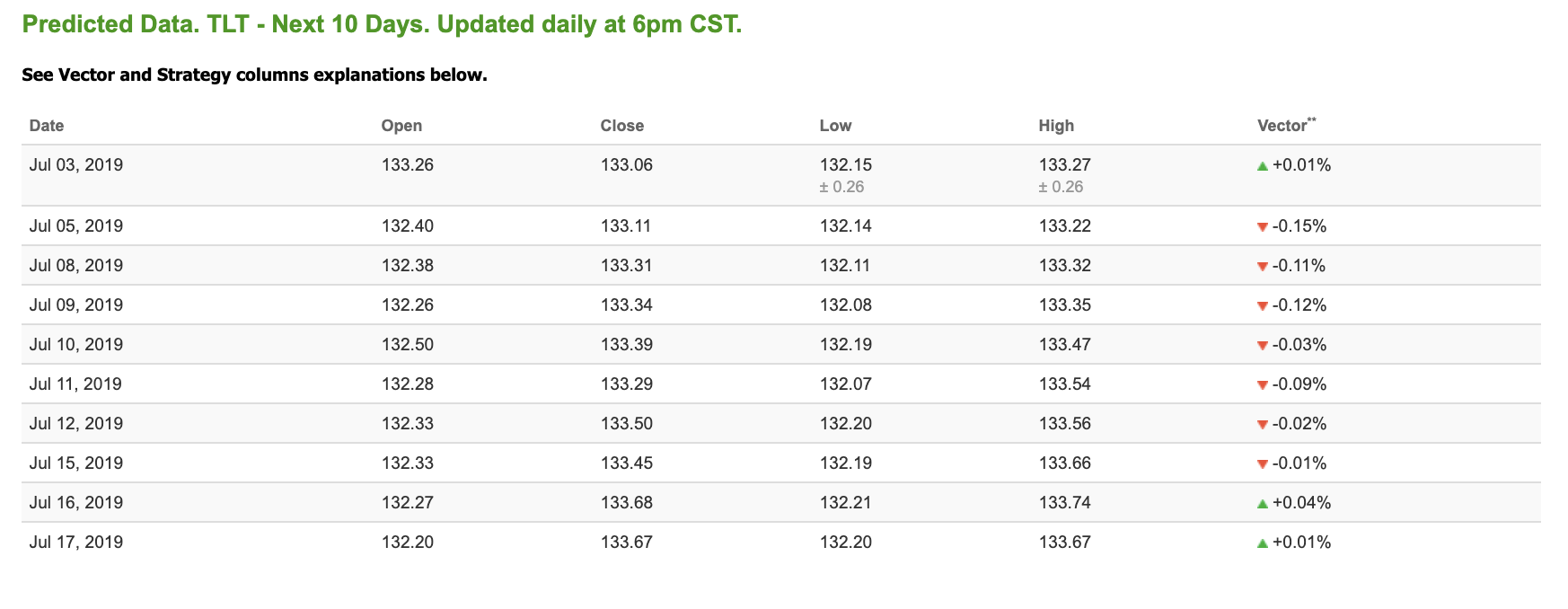

Treasuries

The yield on the 10-year Treasury note is down 1.26% at 1.95% at the time of publication. The yield on the 30-year Treasury note is down 1.43% at 2.47% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of +0.01% moves to -0.12% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

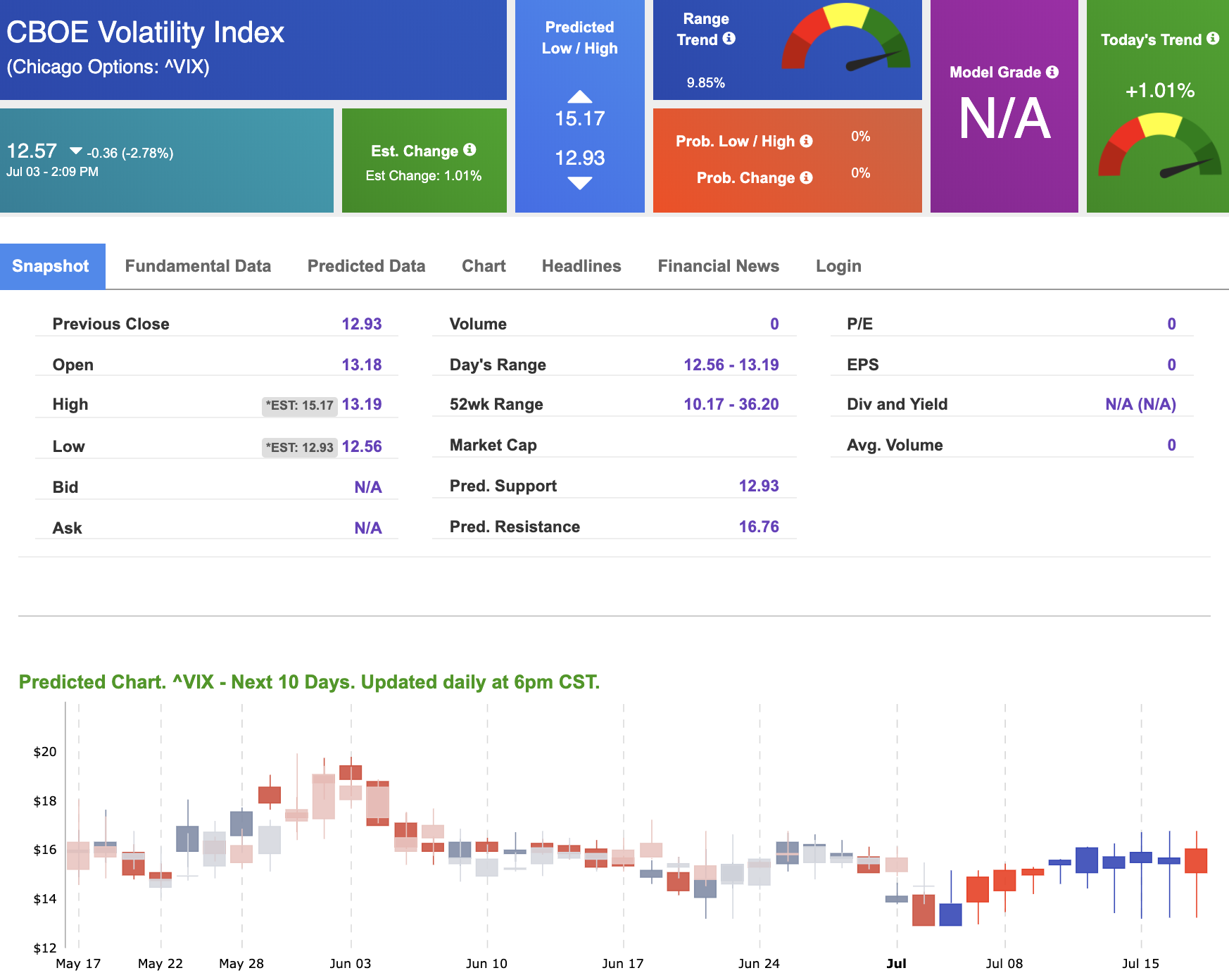

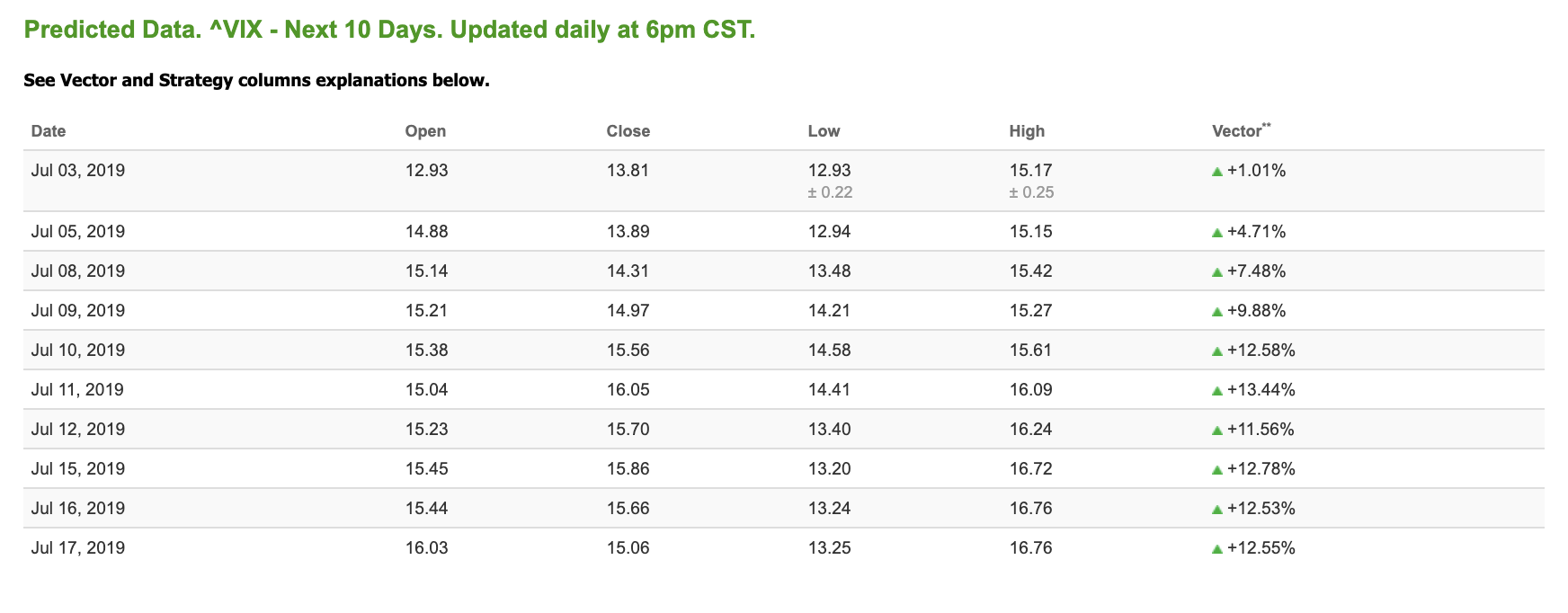

Volatility

The CBOE Volatility Index (^VIX) is down 2.78% at $12.57 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $13.89 with a vector of +4.71%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)

CLICK HERE FOR THE $97 SUPER

JULY 4 TH SALE!