Second-Quarter Earnings Season Gets Underway

- For the week, the Nasdaq slipped 0.1% and the S&P dipped 0.3%. The Dow fell 1% while the Russell lost 0.7%. Year-to-date, the Nasdaq has gained 6.6% followed by the S&P at 6.4%. The Dow has added 4.3% and the Russell is up four points, or 0.2%.

- In crypto news, Bitcoin surged above $118,000 last Thursday after breaking out of a six-week trading range. The move comes ahead of a review of several digital asset regulations this week by Congress. Coinbase Global (COIN) set a fresh 52-week high of $389.16 on Friday and typically trades in tandem with Bitcoin.

- This week will also include the start of the 2Q earnings season with the Financial sector mainly in the spotlight. However, Netflix (NFLX) will announce numbers on Thursday and will be the highlight of the week. Shares recently hit an all-time peak of $1,341 and could move 5%-10% based on results.

The stock market took a breather on Friday as the losses gave the bears the weekly win despite the run to fresh record highs during the previous session. The consolidation period throughout the week was good to see and comes ahead of the start of the 2Q earnings season.

The Nasdaq traded down to 20,509 while settling at 20,585 (-0.2%). Fresh support 20,500 held. Undefined resistance is at 20,750.

The S&P 500 went out at 6,259 (-0.3%) with the bottom at 6,237. Support at 6,250 was tripped but held. Resistance is at 6,300.

The Dow kissed a low of 44,275 before closing at 44,371 (-0.6%). Support at 44,250 held. Resistance is at 44,500.

Earnings and Economic News

Before the open: Fastenal (FAST)

After the close: Simulations Plus (SLP), FB Financial (FBK)

Economic News

None

Technical Outlook and Market Thoughts

For the week, the Nasdaq slipped 0.1% and the S&P dipped 0.3%. The Dow fell 1% while the Russell lost 0.7%. Year-to-date, the Nasdaq has gained 6.6% followed by the S&P at 6.4%. The Dow has added 4.3% and the Russell is up four points, or 0.2%.

The Nasdaq and S&P 500 set another round of record highs on Thursday again while closing just below overbought territory with both RSI levels at 68. We mentioned last week, readings above 70 are typically a top for a stock or index but can reach the 80’s and 90’s. RSI readings can also stay elevated above 70 for weeks and even months.

The Russell 2000 maintained positive for the year and the Dow is still within striking distance of a fresh all-time high. The RSI readings for the two indexes has dropped to 62 and 63, respectively. The 50 level (neutral) has been holding for both since late April following the lows earlier that month. The 30 level indicates oversold levels on a stock or index.

The Nasdaq traded between 20,323 and 20,655 while holding its uptrend channel off the April 7th and June 23rd intraday lows. Fresh resistance is at 20,750-21,000. Our near-term target is at 21,500 and represents another 4% gain from current levels. Our January 22nd target prediction for the Nasdaq is at 22,000 by yearend.

The bottom of the uptrend channel has moved up to 20,500 with stretch down to 20,350. A close back below 20,100-20,000 would suggest a near-term top with further back test potential to 19,750.

The S&P 500 traded in an 89-point range last week while also holding its uptrend channel. Our Price Targets for the index from February 23rd were at 6,350-6,500 with the former coming within 60 points from Thursday’s all-time peak. The latter is also 4% away with the technical setup still matching the Nasdaq’s.

A close back below 6,200 and out of the uptrend channel would be a slightly bearish development with wiggle room down to 6,100. A drop below this level would most likely lead to further weakness down to 6,000 and the 50-day moving average.

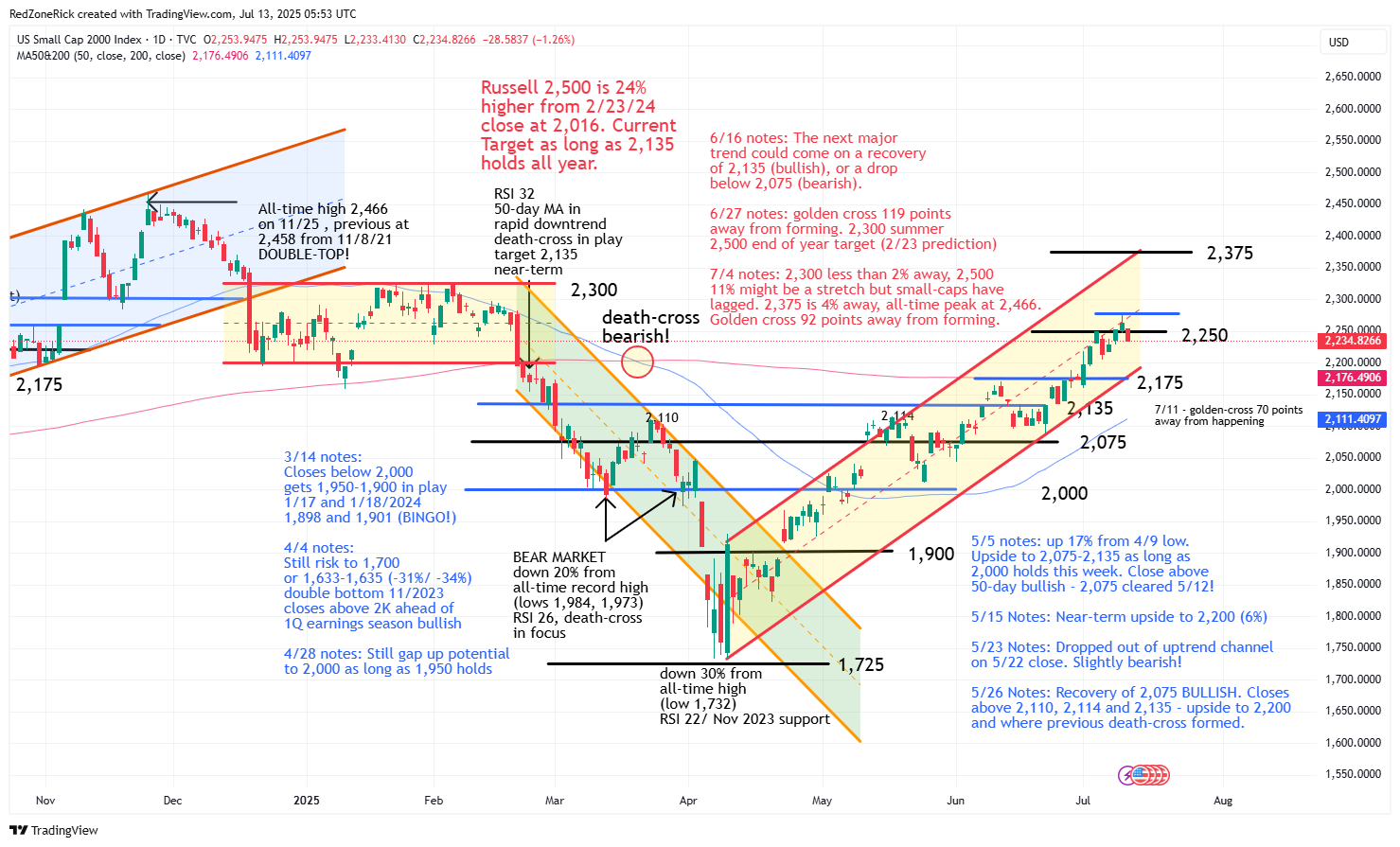

The Russell 2000 stayed with a 71-point range and is holding near the middle off its current uptrend channel. Continued closes above 2,275 keeps our near-term target Price Target for the index at 2,375 in play and represents another 6% upside for the index.

The bottom of the uptrend channel remains at 2,175 and the 200-day moving average at 2,176. A move below these levels gets 2,135 back in the picture followed by 2,100 and the 50-day moving average. A golden cross is now just 70 points away from forming.

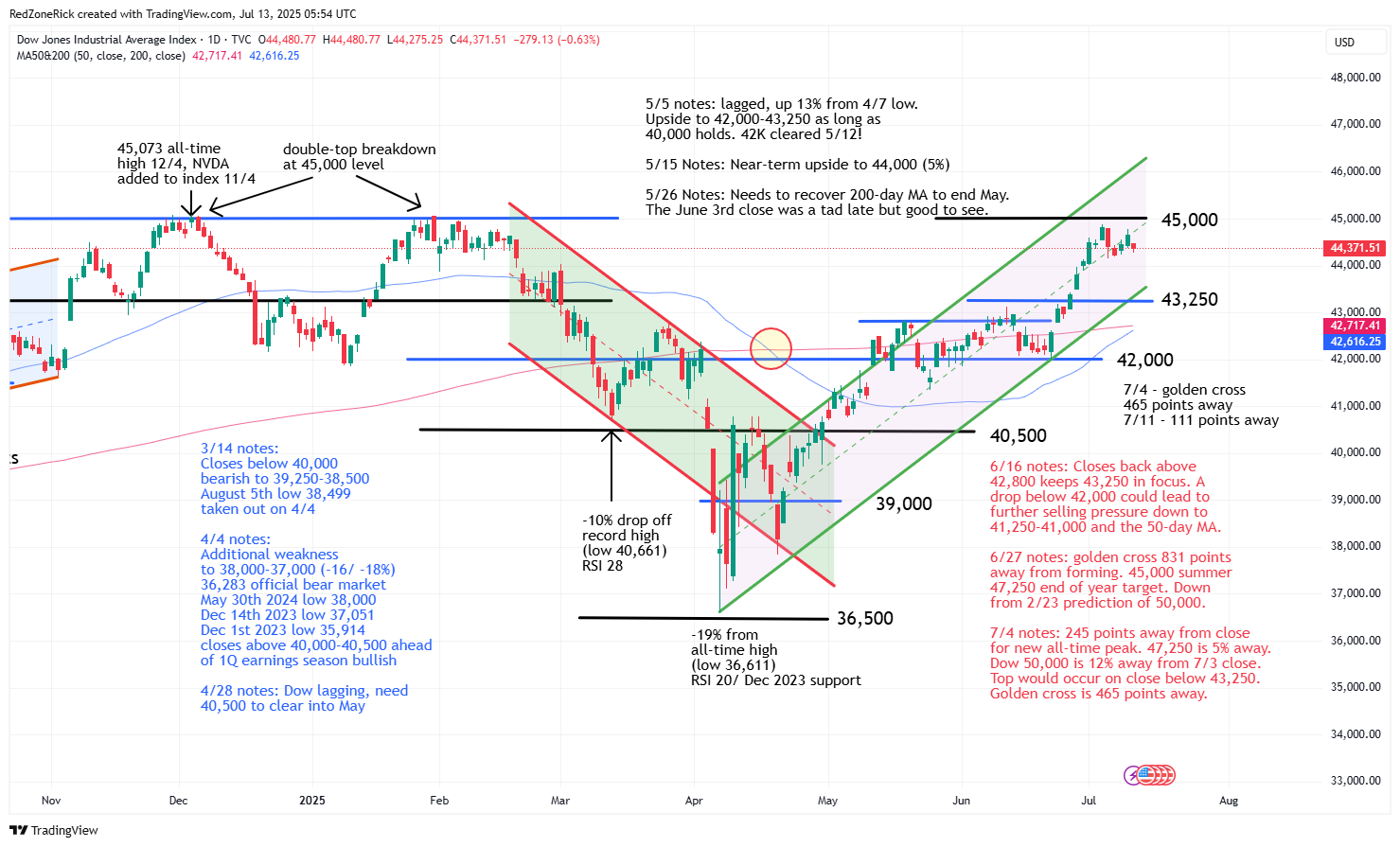

The Dow traded in a 643-point range last week which represented last Monday’s low at 44,160 and high at 44,803, respectively. Our near-term Price Target for the index is at 47,250 on a breakout above 45,000. A golden cross is now just 111 points away from happening.

The first wave of support remains at 44,000 with a drop below this level likely leading to further weakness down to 43,500 and the bottom of the uptrend channel back. If 43,250 fails, it would imply a near-term top for the blue-chips.

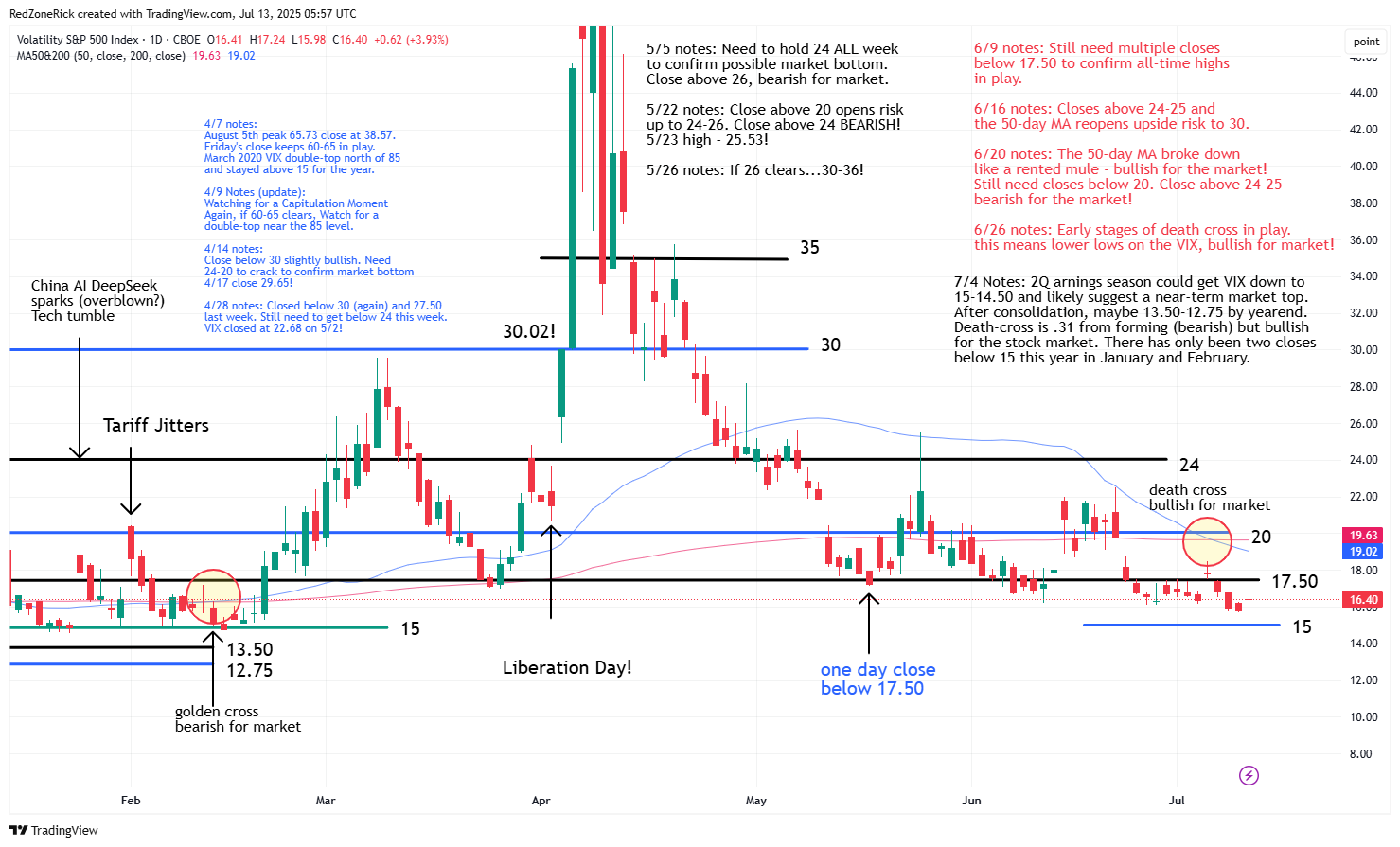

The Volatility Index (VIX) has closed below 17.50 in 12 of the past 13 for sessions with the 50-day moving average showing signs of leveling out after being in a sharp downtrend since mid-June. The 17.50 level remains key resistance followed by 20 and the 200-day moving average. A close above 20 would imply a near-teem market peak.

Last Thursday’s low tagged 15.70 and we are looking for drop down to 15-14.50 during earnings season. A death cross officially formed last week when the 50-day moving average falls below the 200-day moving average. This technical indicator typically suggests lower lows for a stock or index and would be an ongoing bullish signal for the market.

In crypto news, Bitcoin surged above $118,000 last Thursday after breaking out of a six-week trading range. The move comes ahead of a review of several digital asset regulations this week by Congress. Coinbase Global (COIN) set a fresh 52-week high of $389.16 on Friday and typically trades in tandem with Bitcoin.

We like playing Bitcoin by using the ProShares Bitcoin ETF (BITO, $22.72, up $0.90). The exchange-traded fund also pays a MONTHLY dividend and we think there is more upside over the near-term.

This week will also include the start of the 2Q earnings season with the Financial sector mainly in the spotlight. However, Netflix (NFLX) will announce numbers on Thursday and will be the highlight of the week. Shares recently hit an all-time peak of $1,341 and could move 5%-10% based on results.