Small-Caps Clear 50-Day MA

The stock market showed continued strength on Wednesday following Monday’s opening selloff over tariff worries. The rebound off the lows comes after tariffs were delayed for a month on Mexico and Canada but not on China.

The Nasdaq closed at 19,692 (+0.2%) with the high hitting 19,696. Resistance at 19,750 held. Support is at 19,500.

The S&P 500 traded up to 6,062 before ending at 6,061 (+0.4%). Resistance at 6,100 easily held. Support is at 6,000.

The Dow was last seen at 44,873 (+0.7%) after reaching a peak of 44,886. Resistance at 45,000 held. Support is at 44,500.

Earnings and Economic News

Before the open: Bristol Myers (BMY), ConocoPhillips (COP), Eli Lilly (LLY), Hershey (HSY), Roblox (RBLX), Peloton (PTON), Under Armour (UAA)

After the close: Affirm Holding (AFRM), Amazon.com (AMZN), Cloudflare (NET), e.l.f. Beauty (ELF), Fortinet (FTNT), Pinterest (PINS), Take-Two Interactive Software (TTWO)

Economic news:

Initial Jobless Claims – 8:30am

Productivity and Costs – 8:30am

Technical Outlook and Market Thoughts

The main development we wanted to see from the market to start the week was continued closes above 45,000 on the Dow. We talked about a possible broader rally in the works for the overall market and this would help confirm that theory. Although Monday was a down day, the blue-chips only fell 122 points after being down 665 points.

Monday’s opening selloff pushed the index to a low of 43,879 with the 50-day moving average easily holding. If 43,750 fails, there is wiggle room down to 43,500-43,250.

Key resistance at 45,000 held throughout last week but is once again in play heading into the weekend. Continued closes above this level and the December 4th all-time high at 45,073 would imply ongoing upside to 45,500-46,000.

The Russell led Wednesday’s gains after recovering key resistance at 2,300 while tagging a high of 2,316. We have been talking all year long about closes above 2,325 and the 50-day moving average being a better setup for the bulls and yesterday’s close above the latter was a start.

Support is once again at 2,275-2,260 with backup help at 2,225. Monday’s low kissed 2,229.

The Nasdaq held its uptrend channel and key support at 19,250 on Monday but both were stretched. Monday’s low touched 19,141 with a move below this level getting 19,000-18,750 in play.

The index struggled clearing key resistance at 19,750 all of last week with the bigger hurdle at 20,000. A move above last Friday’s high at 19,969, and then 20,000, would indicate a run towards 20,250 with the December 16th record high at 20,204.

The S&P also had its uptrend channel stretched on Monday after bottoming at 5,923. Key support at 6,000 and the 50-day moving average were stretched but levels that held into the close. There is risk down to 5,900-5,850 if 5,925 fails ahead of the weekend.

The current trading range between 6,000-6,100 has now reached 11 sessions with the January 24th all-time high at 6,128. The prior range in this zone lasted 16 sessions. Multiple closes above 6,100 keeps breakout potential towards 6,200-6,250 in focus.

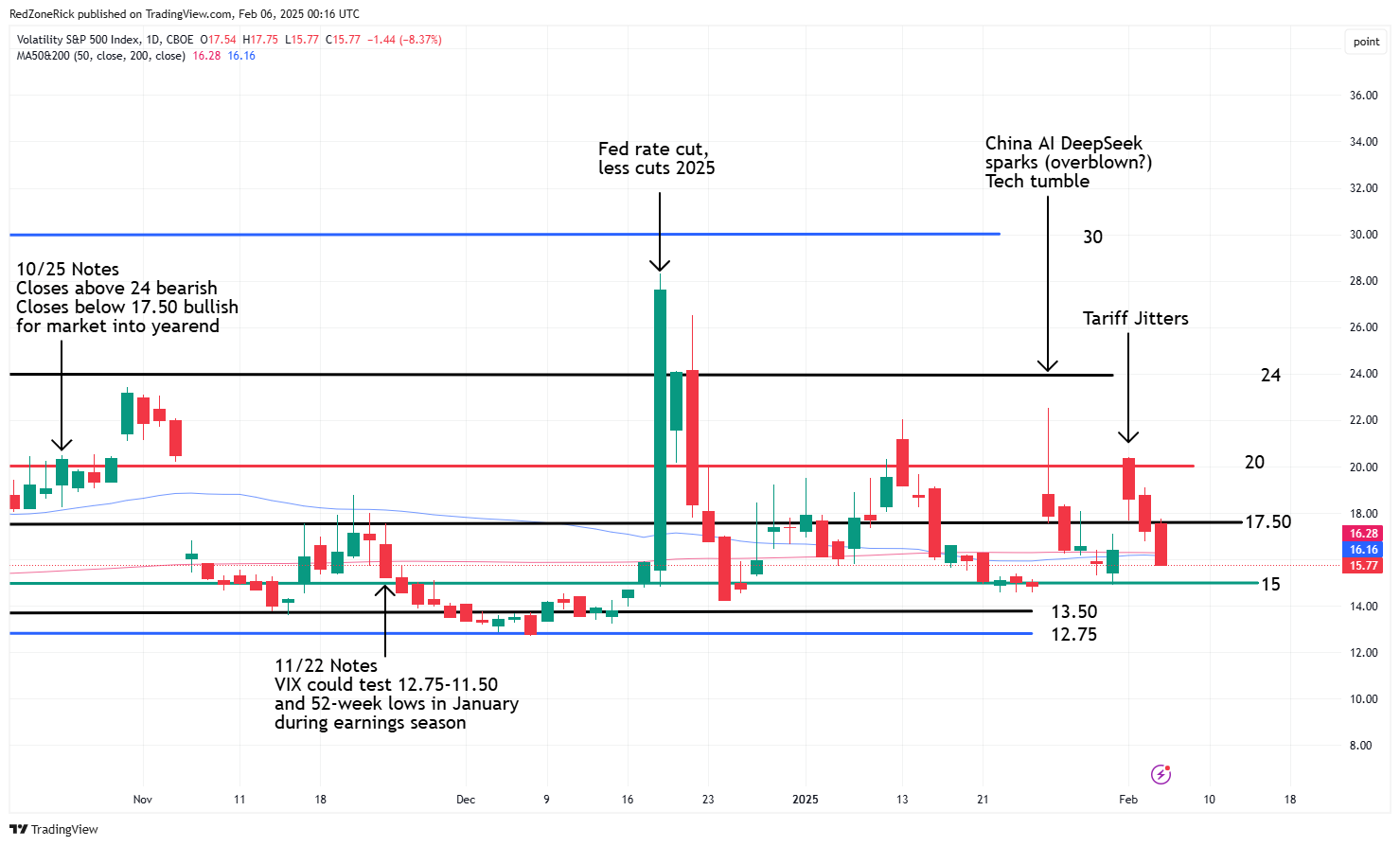

The Volatility Index (VIX) fell below its 50-day and 200-day moving averages with the close on the session low at 15.77. Key support is at 15 held. Closes below this level reopens talks of weakness towards 13.50-12.75.

Monday’s high on the VIX kissed 20.42 with key resistance at 20 holding into the closing bell. We have warned multiple closes above 20 on the VIX would be a bearish development for the market. Despite the volatility, the bulls have kept the closes on the VIX to start 2025 below 20.

The bears have kept the VIX above 15 into the close throughout the year, except once, on January 24th. Multiple closes below 15 should lead to another round of fresh all-time highs for the major indexes.

The Russell has actually outperformed the Nasdaq to start the year, as of yesterday’s close, and settled above the 50-day moving average for the first time since December 17th. If the small-caps can join the blue-chips in a breakout rally, February could turn into a very bullish month for the overall market.

___________________________________________________________________________________

NEW: ‘Pyramid’ System Now Ready For 2025

A 91% win rate is harder and harder to come by these days…

Heck most traders would die for a 70%+ win rate on ANY trade strategy…

Yet here we are. And traders can now use 3 simple trades with an easy to follow ‘pyramid’ system designed to scale risk and reward while doing a better job of allocating your precious trading capital.

Why did traders fall in love with this system in 2024? Because they can mix and match each of these 3 simple trades – using many of the same tickers over and over.

That means it’s repeatable.

And done properly – can make your results more and more consistent over time.

So you have a system that you can use for a lifetime.

Go here… watch this video see if you like the strategies.

(guess what? you can access them for just $5 bucks if you like what you see)