Small-Caps Recover First Wave of Resistance

- The small-caps were the first index to clear and hold the first layer of resistance following the beginning of the month selloff. This could be an early signal the rest of the market could be bottoming.

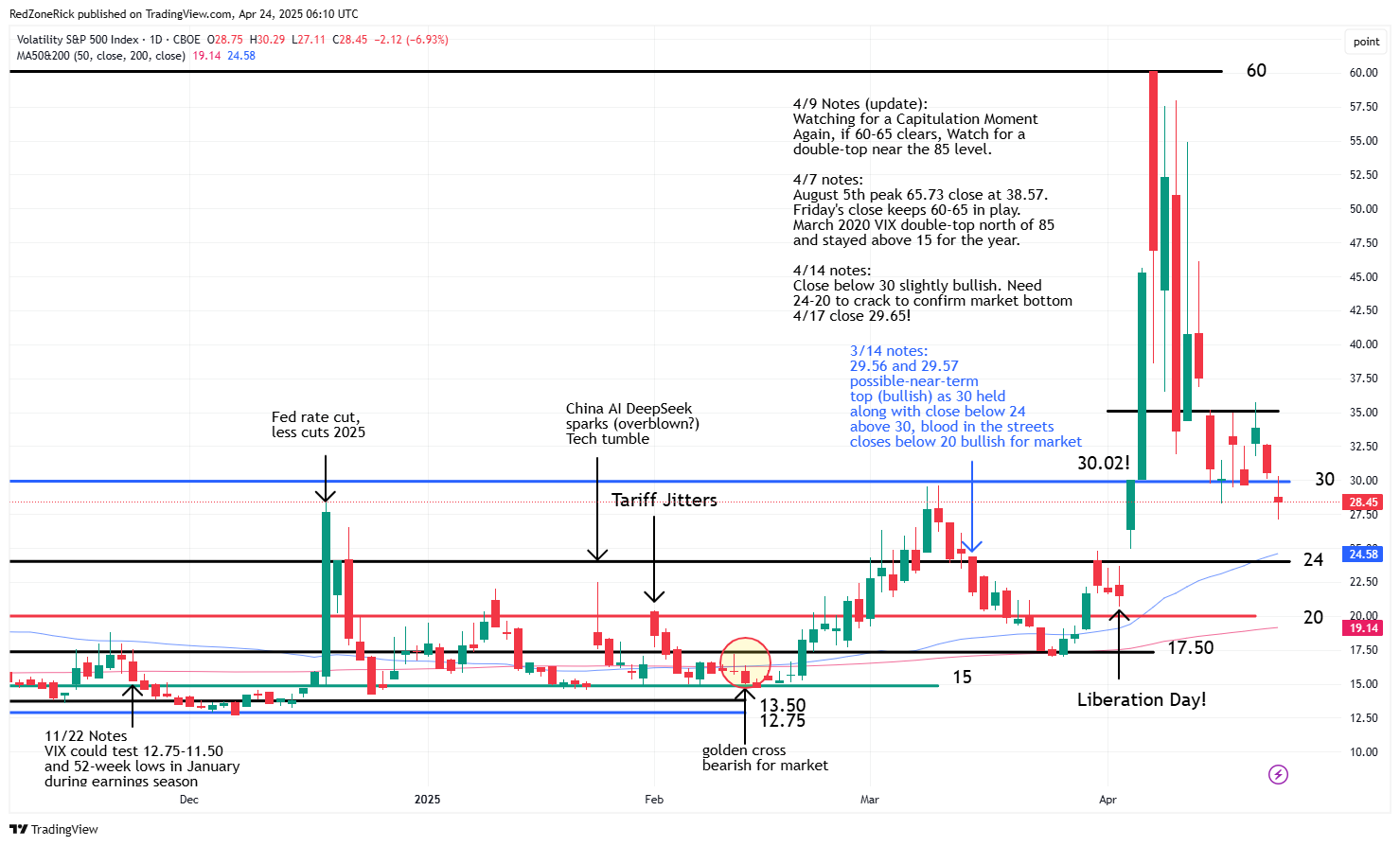

- Key resistance at 35 held on the VIX following Monday’s pop to 35.75. This was also a good clue this week could possibly be bullish or at least hold the ongoing trading ranges of 10%-12% for the major indexes.

- The first-quarter earnings season is in full swing and could impact the action for the rest of the week, and month. Better-than-expected numbers from the heavyweights along with major trade deals could cause a ripe-your-face-off rally so stay nimble.

Wall Street turned positive for the week following Wednesday’s gains and comments from the President he had no plans to fire current Fed Chairman Powell. He did reiterate that interest rates needed to be lower and now was the perfect opportunity to start cutting.

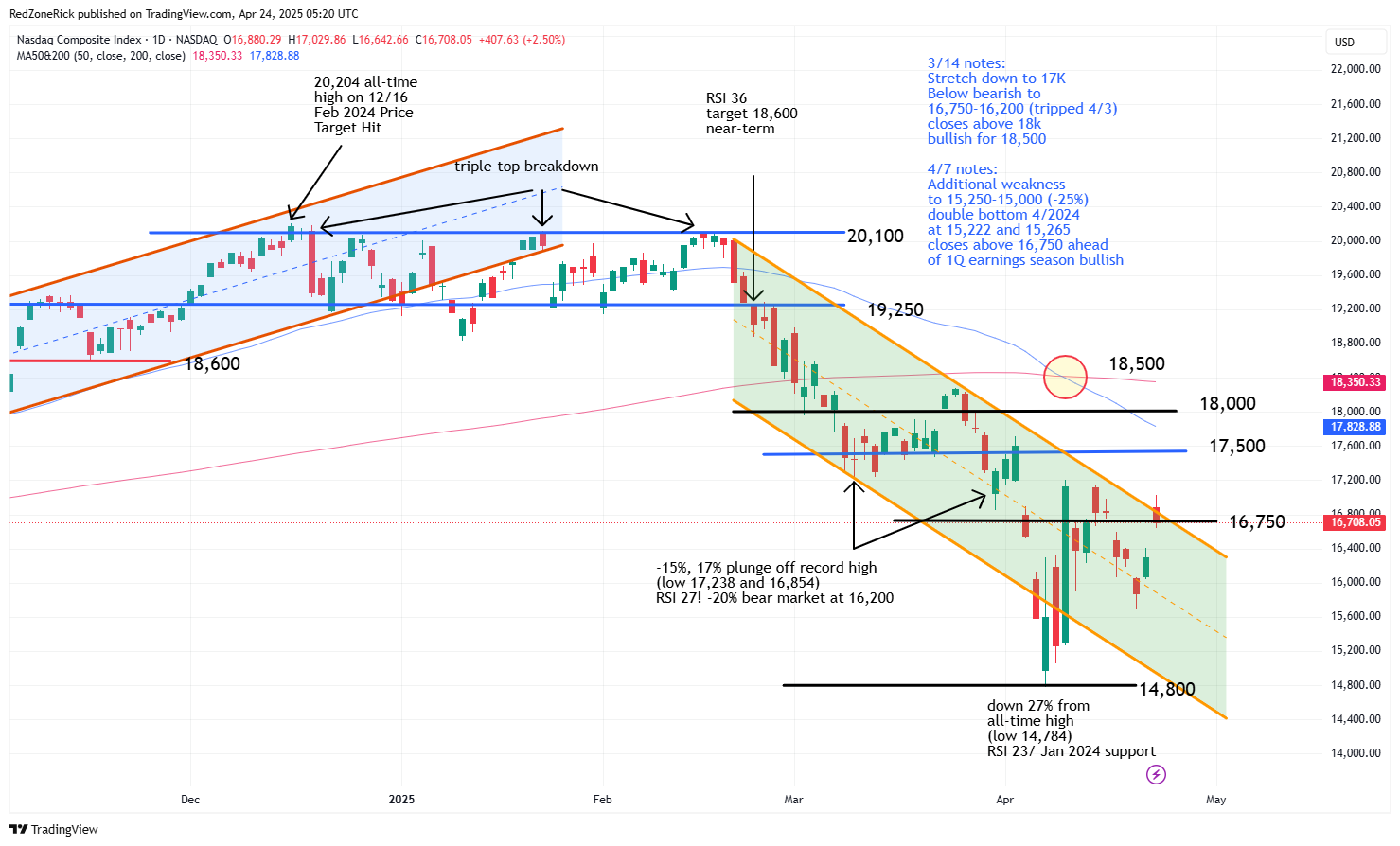

The Nasdaq traded up to 17,029 while ending at 16,708 (+2.5%). Key resistance at 16,750 was cleared but held. Support is at 16,500.

The S&P 500 closed at 5,375 (+1.7%) after making a push to 5,469. Key resistance at 5,500 held. Support is at 5,350.

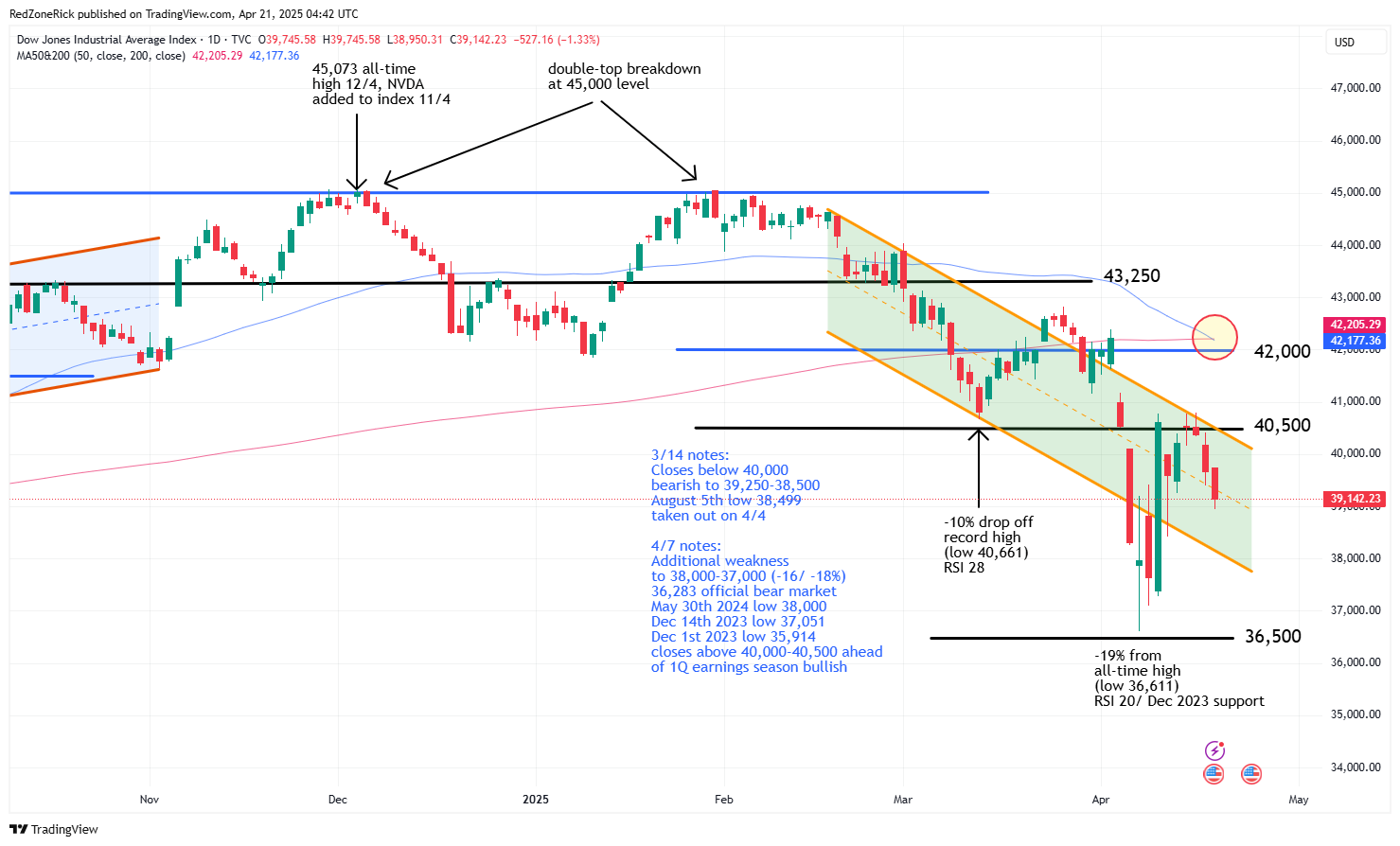

The Dow peaked at 40,376 before settling at 39,606 (+1.1%). Resistance at 40,500 held. Support is at 39,500.

Earnings and Economic News

Before the open: American Airlines (AAL), PepsiCo (PEP), Union Pacific (UNP)

After the close: Alphabet (GOOGL), Celestica (CLS), Intel (INTC), T-Mobile (TMUS)

Economic news:

Initial Jobless Claims – 8:30am

Durable Goods Orders – 8:30am

Existing Home Sales – 10:00am

Technical Outlook and Market Thoughts

The small-caps were the first index to clear and hold the first layer of resistance following the beginning of the month selloff. This could be an early signal the rest of the market could be bottoming.

The Russell 2000 closed at 1,919 (+1.5%) with the high at 1,967. Key resistance at 1,900 was cleared and held. We have been mentioning there is 5% gap up potential to 2,000 on closes above this level.

Support will try to hold at 1,900 with backup help at 1,875-1,850. The breakout of the downtrend channel looks bullish as long as it holds into the weekend.

The Nasdaq just missed holding 16,750 into Wednesday’s close. The more important development is the possibility of the index breaking out of its downtrend channel, as well. However, there are still several layers of hurdles on closes above 17,000 at 17,500-17,750 and the 50-day moving average.

Support is at 16,500-16,250. A move back below 16,000 would be a renewed bearish signal.

The S&P traded to the top of its downtrend channel and key resistance at 5,500 on Wednesday. Closes above these levels gets 5,650-5,700 and the 50-day moving average in focus.

Shaky support is at 5,350 with additional layers at 5,300-5,250.

The Dow made a brief intraday run above its downtrend channel with key resistance at 40,500 holding. An adjusted downtrend channel shows the top at 40,750. A pop above 41,200 would be a bullish sign for a trip towards 42,000 and the 50-day moving average.

Support is at 39,500 with a close below 39,000 signaling another false breakout.

The Volatility Index (VIX) made a strong drop below key support at 30 with the low at 27.11. On Monday, we said with “a big push lower towards 27.50 and then 24” was needed on a close below 30. So far, so good for the bulls.

Key resistance at 35 held on the VIX following Monday’s pop to 35.75. This was also a good clue this week could possibly be bullish, or at least hold the ongoing trading ranges of 10%-12% for the major indexes.

The first-quarter earnings season is in full swing and could impact the action for the rest of the week, and month. Better-than-expected numbers from the heavyweights along with major trade deals could cause a ripe-your-face-off rally so stay nimble.