S&P Triggers Fresh High

8:00am (EST)

The stock market showed a little strength on Wednesday to keep fresh all-time highs in play while holding key support levels. Volatility continues to give a neutral reading but there are some warning signs trouble could be brewing.

The Nasdaq finished at 20,056 (+0.1%) with the afternoon peak reaching 20,099. Key resistance at 20,250 easily held. Support remains at 19,750.

The S&P 500 traded to a record high of 6,147 while ending at 6,144 (+0.2%). Resistance at 6,150 was challenged and held. Support is at 6,100.

The Dow closed higher at 44,627 (+0.2%) despite the morning fade to 44,312. Support at 44,500 was tripped but held. Resistance remains at 45,000.

Earnings and Economic News

Before the open: Alibaba (BABA), Baxter International (BAX), Shake Shack (SHAK), TripAdvisor (TRIP), Unity (U), Walmart (WMT), Wayfair (W)

After the close: Booking Holdings (BKNG), Block (XYZ), Celsius Holdings (CELH), Dropbox (DBX), Rivian Automotive (RIVN)

Economic news:

Initial Jobless Claims – 8:30am

Leading Indicators – 10:00am

Technical Outlook and Market Thoughts

The overall market has traded in a tight range during the shortened week with sentiment leaning to the bearish side in the morning and bullish in the afternoon. This has produced slight gains for the bulls but there are still some trouble spots that need to be cleared before there is a possible broader breakout.

The S&P has now spent the past four sessions above new support and prior resistance at 6,100. Continued closes above this level keeps strength up to 6,200-6,250 and the middle of the current uptrend channel in focus.

Backup support if 6,100 fails is at 6,050-6,000 and the 50-day moving average. A move below the latter two and breakdown out of the uptrend channel would be a bearish signal for weakness towards 5,950-5,900.

The Nasdaq has been holding 20,000 the past three sessions and will once again try to build a base above this level. If so, it keeps another run to 20,250-20,500 possible with the December 16th all-time high at 20,204.

Key support is at 19,750 and the 50-day moving average. A drop below these levels and the bottom of the uptrend channel would be a cautious development. Backup support levels are at 19,500-19,250.

The Dow’s continues to muddle in a 1,000-point range between 44,000-45,000 that has now pushed 20 sessions. Current resistance is at 44,750-45,000. There is breakout potential towards 45,500-46,000 and the middle of the current uptrend channel on multiple closes above 45,000 and the December 4th all-time high at 45,073.

Support at 44,250-44,000 has been holding this week. There is additional help at 43,750 and the 50-day moving average which is showing signs of rolling over. A close below 43,500 and below the current uptrend channel could signal a further slide to 43,250.

The Russell 2000 tested a high of 2,288 with key resistance at 2,300 and the 50-day moving average holding for the past three sessions. Continued closes above 2,325 would be a more bullish development.

Near-term support is at 2,260 with backup at 2,225-2,200 and the 200-day moving average.

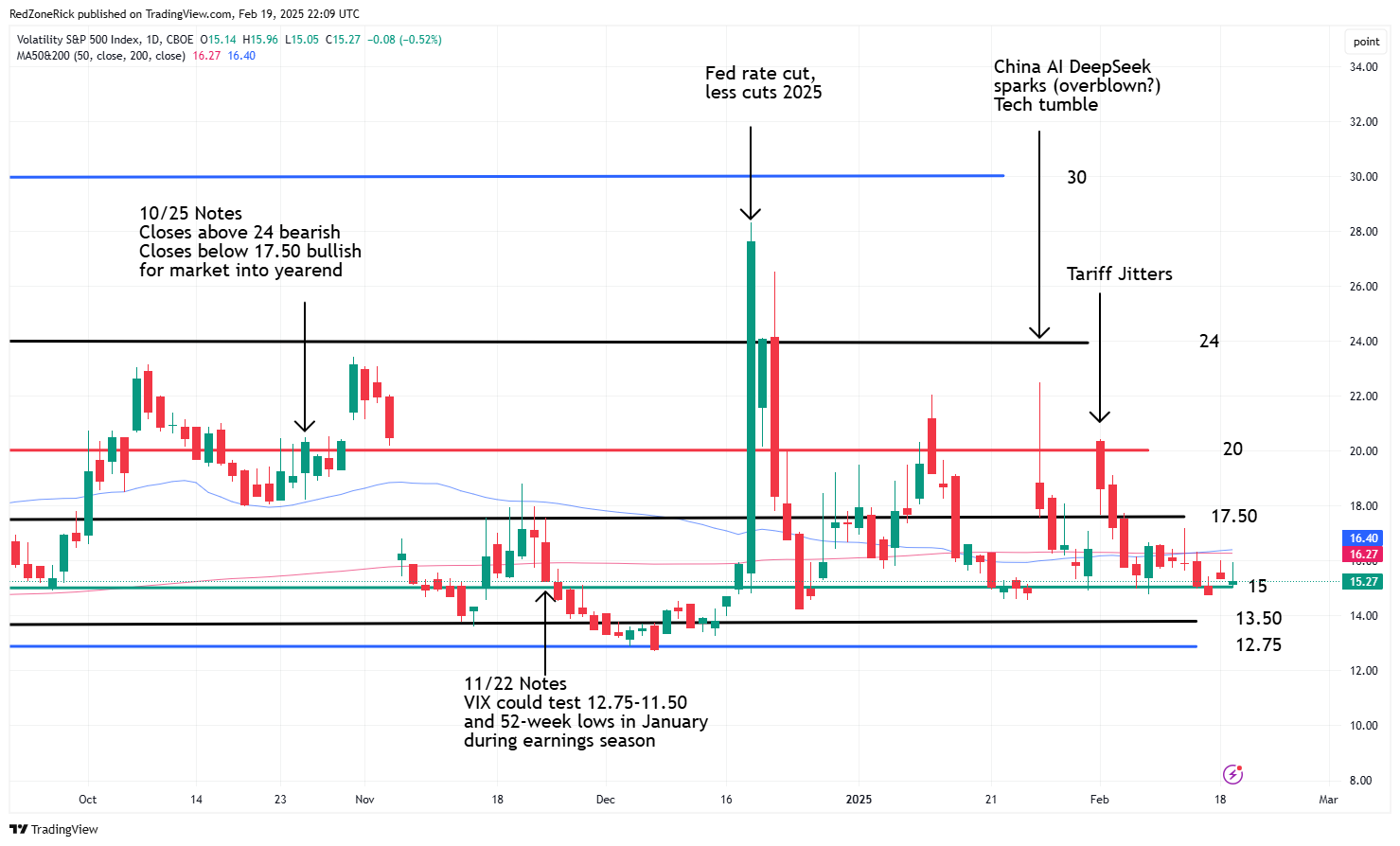

The Volatility Index (VIX) closed back above 15 on Tuesday and held this level on Wednesday. Continued closes below 15-14.50 would be bullish for the market with additional weakness towards 13.50-12.75 and December lows.

Resistance is at 16.50 and the 200-day and 50-day moving averages. Closes above these levels would likely lead to a retest up to 17.50-20.