Strong Financial Earnings Lead Markets, Beige Book Released Today

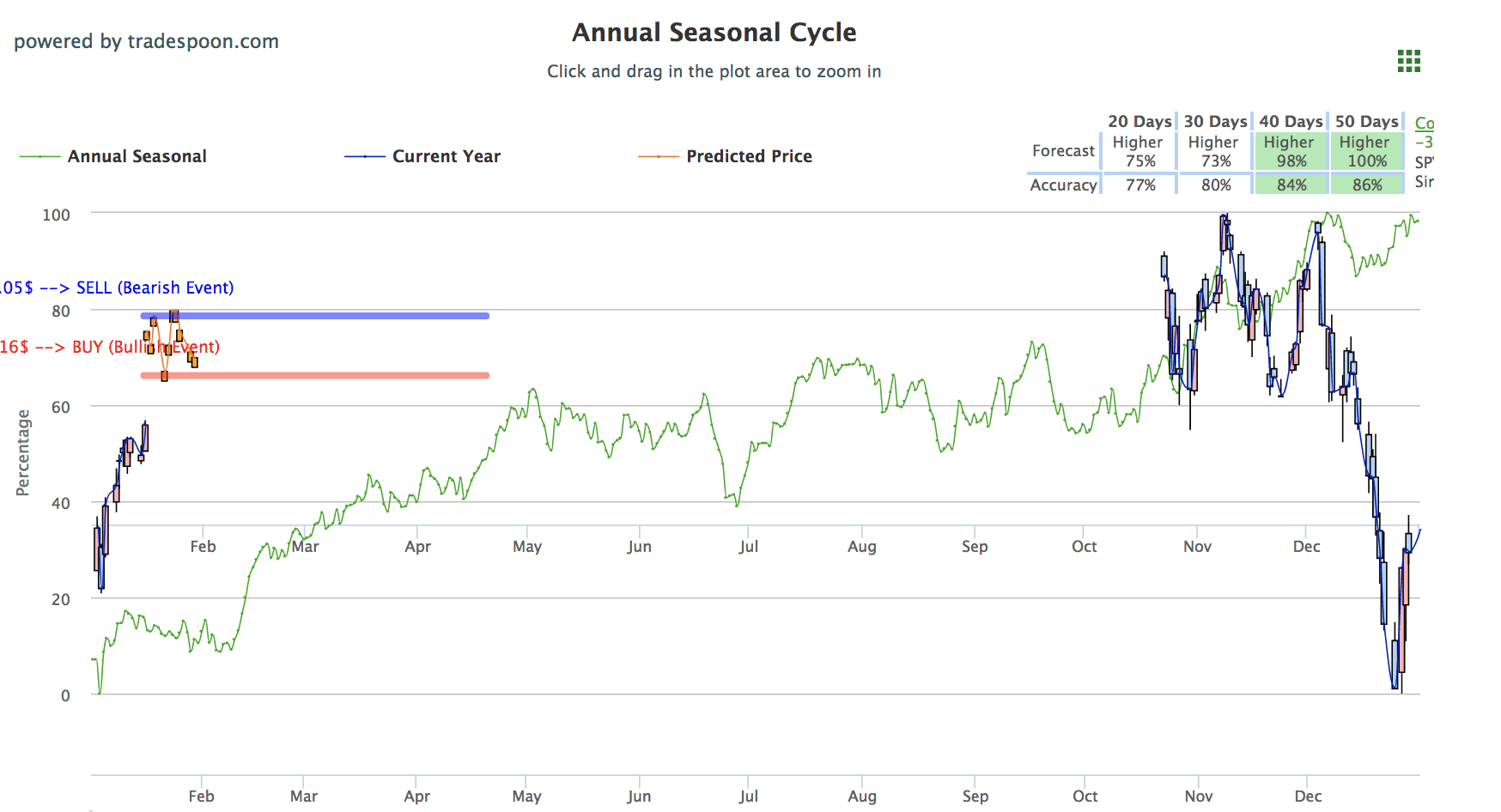

Major U.S. indices are on track to record their second straight day of gains after two losing sessions amid growing global trade concern and the partial U.S. government shutdown, going on its 26th day. Strong earnings for Goldman Sachs and Bank of America are helping support the market today after a tepid start to reporting that included Chase and Citi reporting below expectations. The new support for SPY is at $254 and the next level of resistance is at $264, aligning with the 50-day moving average. Volatility could return if market trades below 50-days moving average. Poor earnings or geopolitical unrest could cause a market retrace back to $254 level, $245 at worst. Still, the market will have opportunities to reach $280 level this quarter as more earnings and the late-January Fed policy update are still ahead. For reference, the SPY Seasonal Chart is shown below:

All three major U.S. indices are up today as Bank of America and Goldman Sachs fourth quarter reports are pushing the shares of each company over 7% after beating estimates. BlackRock shares also rose today after earnings were released, though reporting for the investment management corporation were below expectations. Major banks got off on a slow start as both JPMorgan Chase and Citigroup reports fell below revenue and profit expectations. Tomorrow American Express, Morgan Stanley, and Netflix will report, with the latter company seeing a seesaw week that included stocks rising 6% yesterday only to modestly lower today.

The partial U.S. government shutdown is going on its 26th day as the Trump administration has asked thousands of furloughed federal employees to return to work. Food safety, tax refund, and offshore oil drilling are just a few of the departments ordered back to work without pay. December Retail Sales, both auto and non-auto, as well as November Business Inventories continue to be delayed due to the shutdown though several other reports are set to release as scheduled. The Fed Beige Book, which offers insight on the current state of the U.S. economy, was released today at 2 PM Eastern, while jobless claims and housing starts should report tomorrow. Look for more data from the Beige Book to be dissected and disclosed closer to market close and in tomorrow’s Market Commentary.

Globally, Asian markets traded to mix results while European markets traded higher with the exception of U.K. that lowered amid Brexit uncertainty. Having already gone through confidence vote on her position as Prime Minister in December, Theresa May went through another such vote today as her most recent Brexit draft was voted down in parliament Yesterday. The dead deal arrives with less than three months until the deadline the U.K. set to exit the European Union, which more and more seems likely to be pushed back. Opposition leader Jeremy Corbyn called for the confidence vote, which finished in favor 325 to 306.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows positive signals. Today’s vector figure of +0.85% moves to +0.97% in five trading sessions. The predicted close for tomorrow is 2,637.10. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

“I cannot guarantee your acceptance”

Are you aware that you are one of a very select few (for real) to whom I recently extended a limited-time invitation to “test-drive” a game-changing very personal newElite Trading service from Tradespoon?

If you are quick enough, you can join me live, in my trading room (real time) and duplicate my trades seconds after I make them.

- This breakthrough service is limited to only 50 traders.

- Acceptance is on a first come first served basis and when the 50 Elite seats are taken, that’s it

- Your personal access PIN is 0014

- There is no risk for your trial

Click on the link below and hope that one of those 50 Elite seats is still available. If they’re gone, I’m sorry. There’s nothing I can do.

Click Here to Learn More and Check on Availability

Highlight of a Recent Winning Trade

On January 11th, our ActiveTrader service produced a bullish recommendation for Fluor Corporation (FLR). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

FLR opened in its forecasted Strategy A Entry 1 price range $35.80 (± 0.36) and passed through its Target price $36.18 within the second of trading. The Stop Loss price was set at $35.44.

Thursday Morning Featured Stock

Our featured stock for Thursday is Hospital Corporation of America Inc. (HCA). HCA Healthcare Inc. is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (C) indicating it ranks in the top 50th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $132.97 at the time of publication, up 1.13% from the open with a +1.02% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for February delivery (CLG9) is priced at $52.37 per barrel, up 0.50% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.06 at the time of publication, up 0.55% from the open. Vector figures show +0.84% today, which turns +4.70% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is up 0.37% at $1,293.20 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $122.28, up 0.33% at the time of publication. Vector signals show -0.02% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.16% at 2.72% at the time of publication. The yield on the 30-year Treasury note is up 0.01% at 3.08% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of +0.01% moves to -0.11% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 0.86% at $18.44 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $18.11 with a vector of -6.39%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

“I cannot guarantee your acceptance”

Are you aware that you are one of a very select few (for real) to whom I recently extended a limited-time invitation to “test-drive” a game-changing very personal newElite Trading service from Tradespoon?

If you are quick enough, you can join me live, in my trading room (real time) and duplicate my trades seconds after I make them.

- This breakthrough service is limited to only 50 traders.

- Acceptance is on a first come first served basis and when the 50 Elite seats are taken, that’s it

- Your personal access PIN is 0014

- There is no risk for your trial

Click on the link below and hope that one of those 50 Elite seats is still available. If they’re gone, I’m sorry. There’s nothing I can do.