Trump Deliver State of The Union, Earnings Season Winds Down

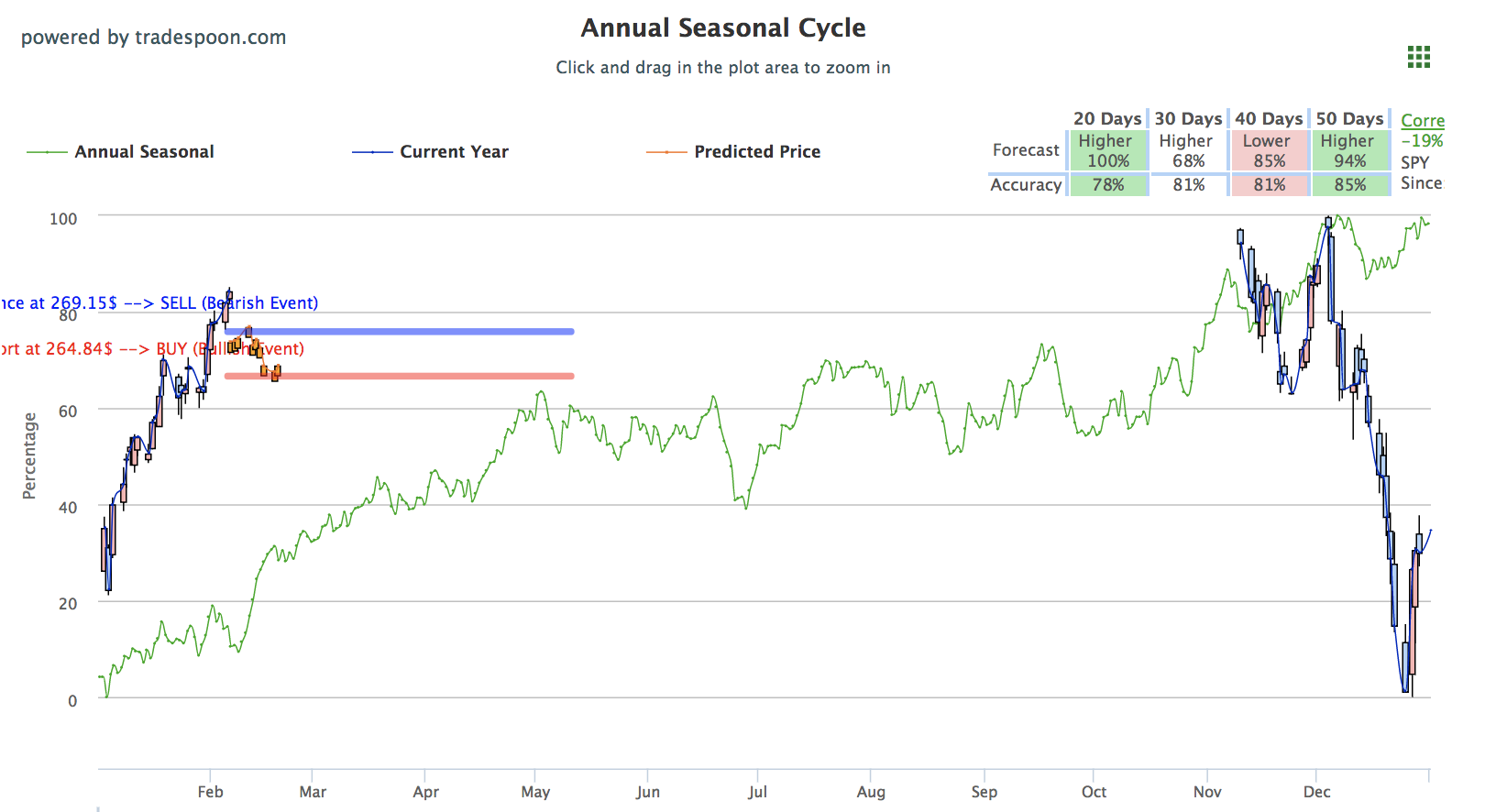

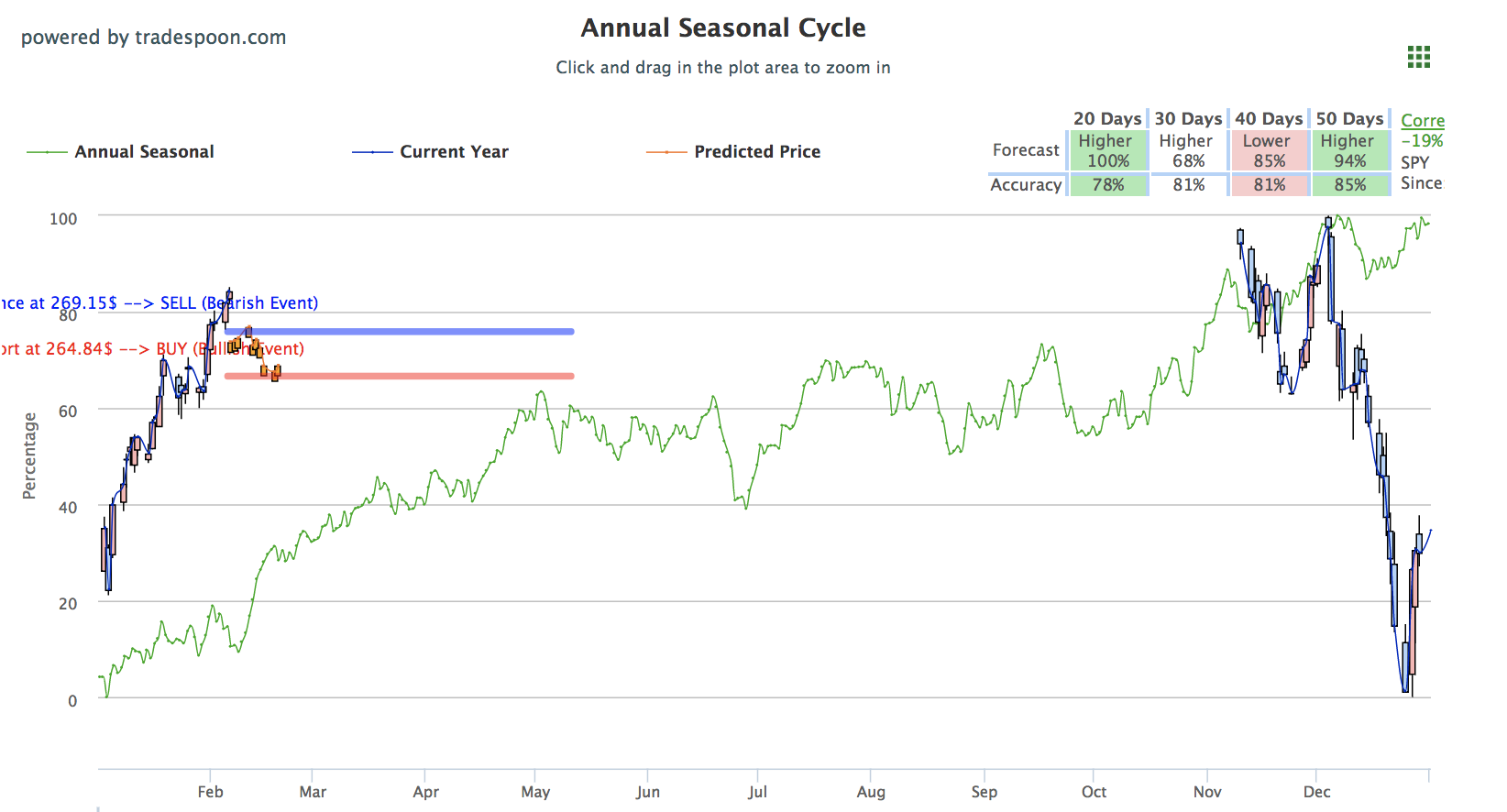

Major U.S. Indices are on track to close modestly lower today, snapping a multi-day streak for the S&P and Nasdaq. With most household names already reporting and a scaled-back number of reports scheduled in the days to come, corporate earnings season is winding down. Yesterday’s State of the Union address by President Trump touched on many key-market factors including China-trade, the state of the economy, and the government funding dispute; based off pre-market index movement, the comments did not seem to move markets significantly. The state of the market appears to remain overbought according to most technical indicators. We encourage our members to avoid chasing the rallies and look to buy the selloffs. We do not see the market retesting December lows until the second or third quarter of 2019. Still, the market could regress to $260-$264 level for SPY support in the weeks to come. For reference, the SPY Seasonal Chart is shown below:

Disney earnings returned yesterday to top expectations, sending shares up on Tuesday but slightly down today. Yesterday’s biggest earnings drop came from Electronic Arts which missed holiday sales expectations and had to cut earnings forecast, causing shares to lower over 15% yesterday, and currently down 13% today. This follows a string bad earnings forecasts for video-game makers with Activision Blizzard, Ubisoft, and Take-Two all currently down over 8%. General Motors reported before market open today to beat expectations and send shares up 1%, look for Chipotle earnings after the close today and Twitter, Marathon Petroleum, and Philip Morris tomorrow. Also scheduled for tomorrow are speeches from Fed Chair and Vice Chair Jerome Powell and Randal Quarles.

Yesterday’s delayed State of The Union took place in D.C. with President Trump speaking on many topics ranging from North Korea to the price of prescription drugs and included a plea for a southern border wall. With less than 10 days to go until the government funding deadline, Congress and the President will look to resolve the border funding dispute in hopes of a long-term deal that keeps the government open. Trump boasted about the state of the economy, calling it a “miracle” and referring to the growing employment rate and shrinking unemployment and benefit applications. Referring to the growth and success of the economy, Trump stated “the only thing that can stop it are foolish wars, politics, or ridiculous partisan investigation.”

Other things to note include during the Union address were the announcements of a planned meeting with North Korean leader Kim Jung Un and further efforts to meet with Chinese officials and resolve the trade and tariff disputes. Trump will meet Jung Un in Vietnam on February 27th and 28th while Treasury Secretary Mnuchin will head out to Beijing next week. The U.S. delegation led by Mnuchin will discuss plans for a meeting between Trump and Chinese President Xi, and will ideally take place later this month and before the March 1st deadline when tariffs by both sides resume and increase. A 90-day timetable was set by both sides to resolve trade deficit concerns and the rapidly increasing tariffs which began this summer. Trump also more directly addressed China, stating “real, structural change” is needed within the agreement and relationship between China and the U.S. in order to “end unfair trade practices, reduce our chronic trade deficit, and protect American jobs.”

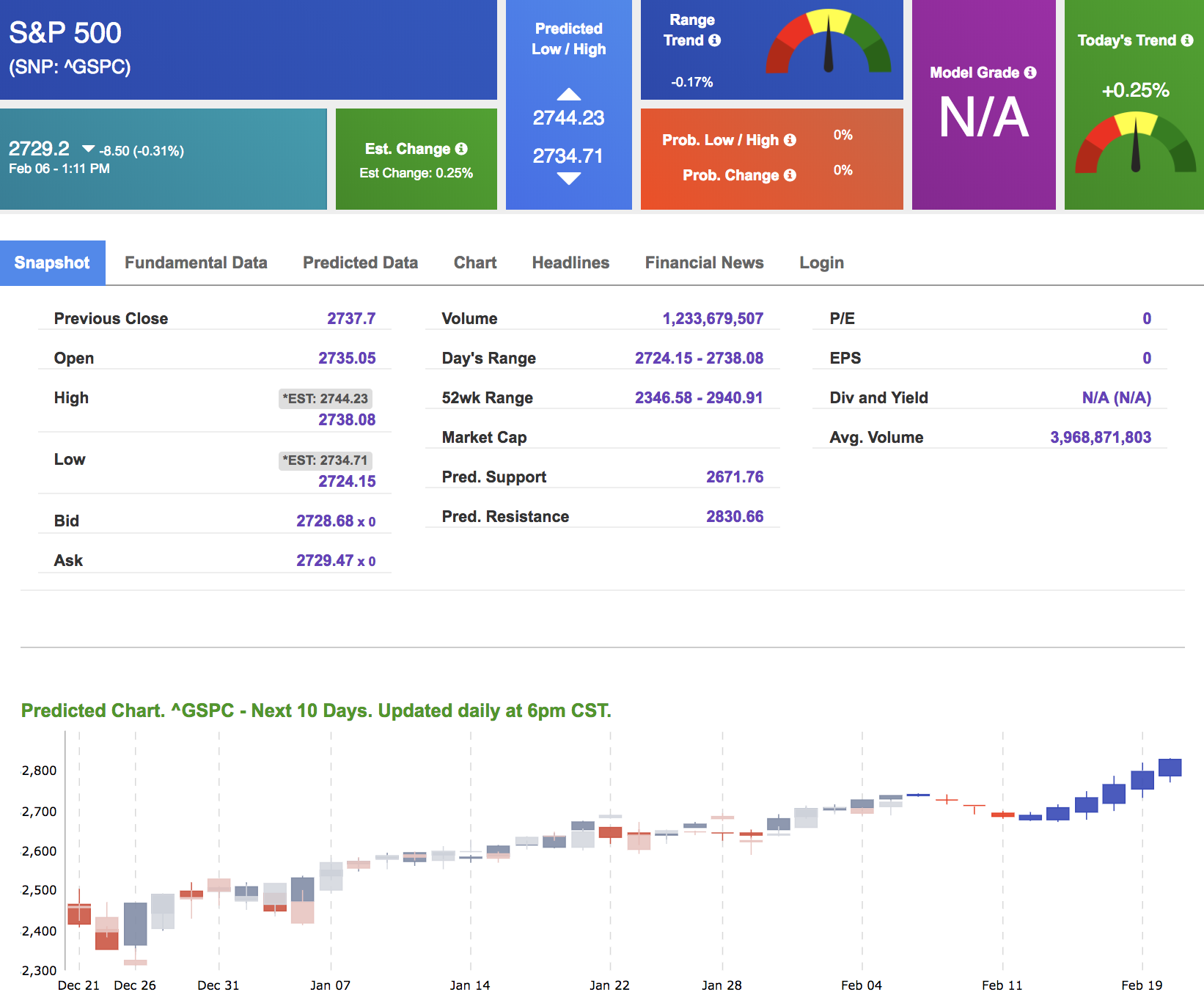

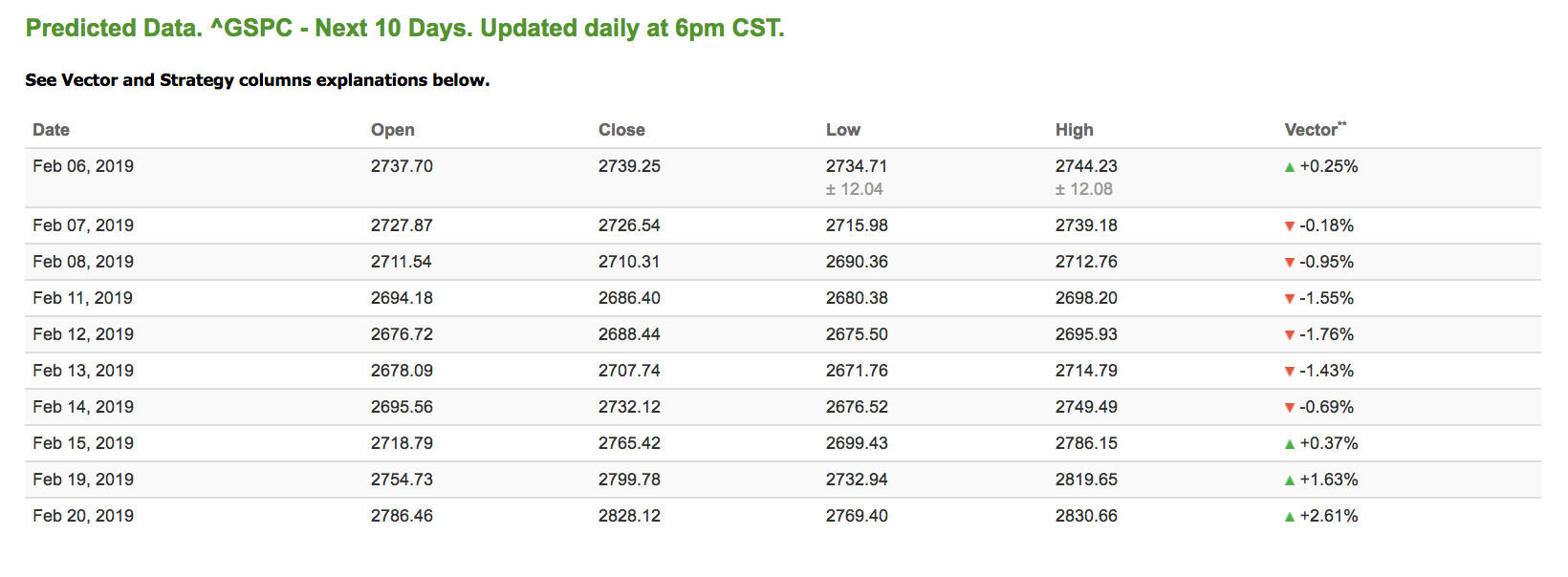

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.25% moves to -1.43% in five trading sessions. The predicted close for tomorrow is 2,726.54. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility Performance

See yesterday’s action below, how we trade this volatile market, and what you can expect in our next Live Trading Room. During yesterday’s session, we recorded 6 of 8 winning trades, ranging from 0% to 325% ROI!

| HD (Option) | -7.14% |

| DE (Option) | 16.67% |

| OXY (Option) | 57.89% |

| DE (Option) | 325.00% |

| ROST (Option) | 0.00% |

| TXT (Option) | 54.55% |

| OXY (Option) | 16.22% |

| HD (Option) | -15.00% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch Recording

LAST CHANCE: This Limited-Time Offer Expires at Midnight

TODAY ONLY – If you sign up for the Tools Membership, we will automatically upgrade your account to our Premium Membership which includes access to our entire suite of trading tools as well as our Premium Member Picks, SMS Alerts, and Live Trading Room!

CLICK HERE TO LEARN MORE!

Highlight of a Recent Winning Trade

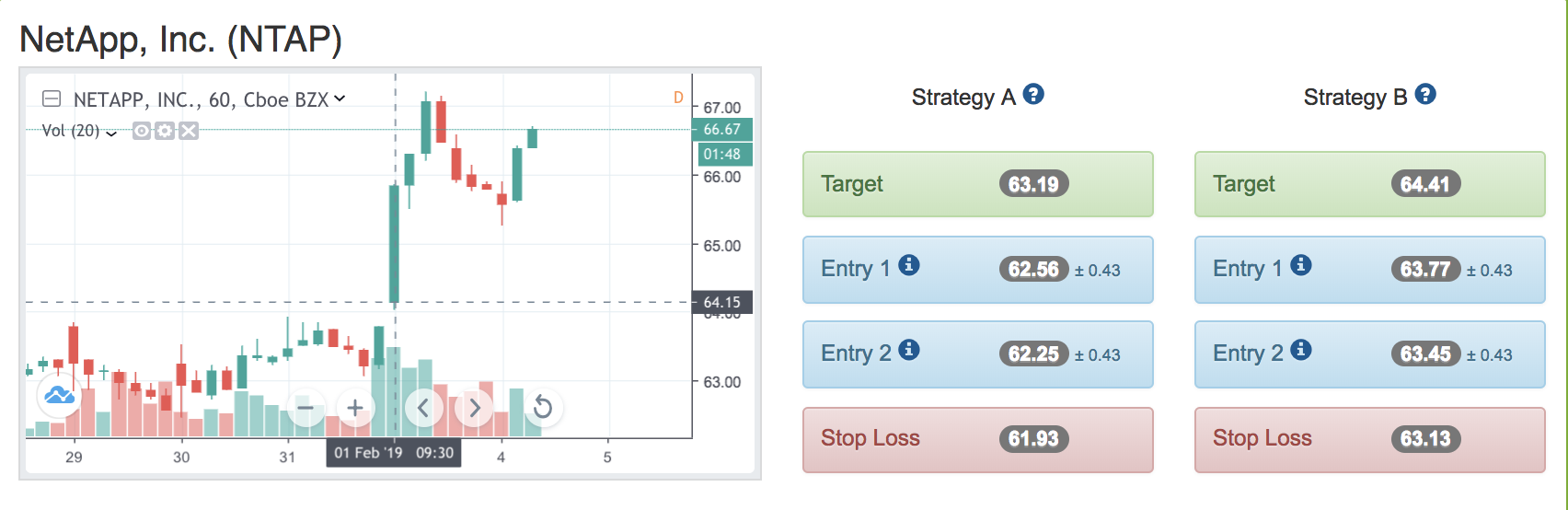

On February 1st, our ActiveTrader service produced a bullish recommendation for NetApp, Inc. (NTAP). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

NTAP opened in its forecasted Strategy B Entry 1 price range $63.77 (± 0.43) and passed through its Target price $64.41 in the first hour of trading, reaching a high of $67.06. The Stop Loss price was set at $63.13.

Thursday Morning Featured Stock

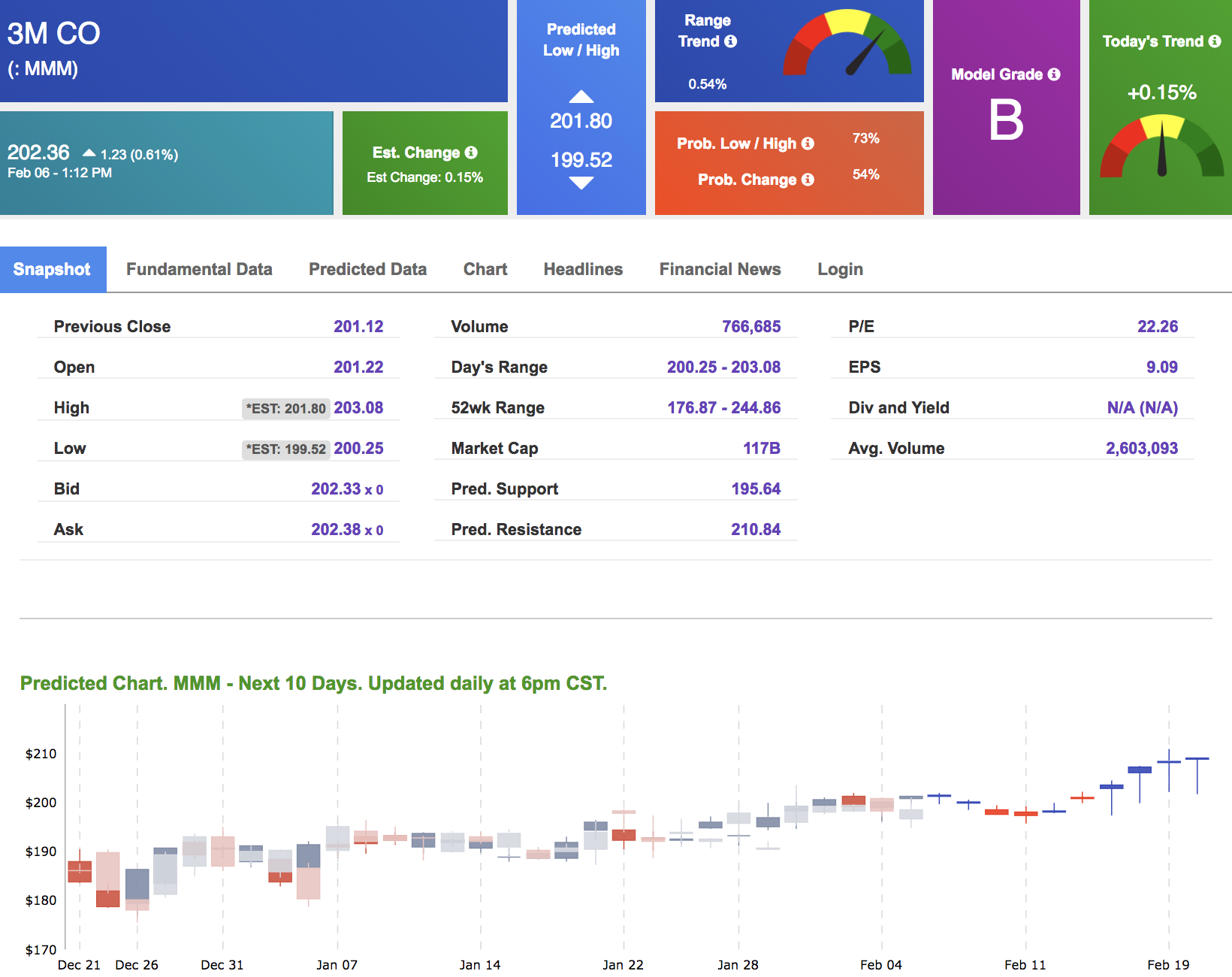

Our featured stock for Thursday is 3M Co. (MMM). MMM is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $202.36 at the time of publication, up 0.61% from the open with a +0.15% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

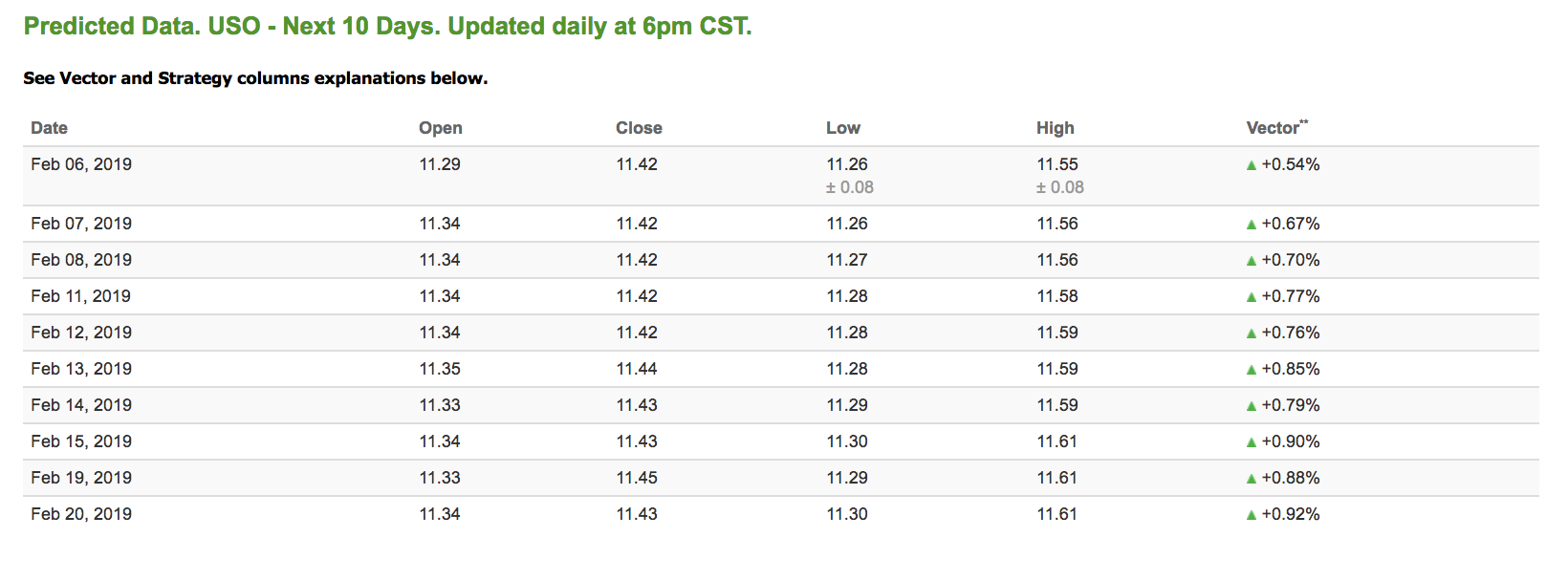

Oil

West Texas Intermediate for March delivery (CLH9) is priced at $53.89 per barrel, up 0.43% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.34 at the time of publication, down 0.44% from the open. Vector figures show +0.54% today, which turns +0.85% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

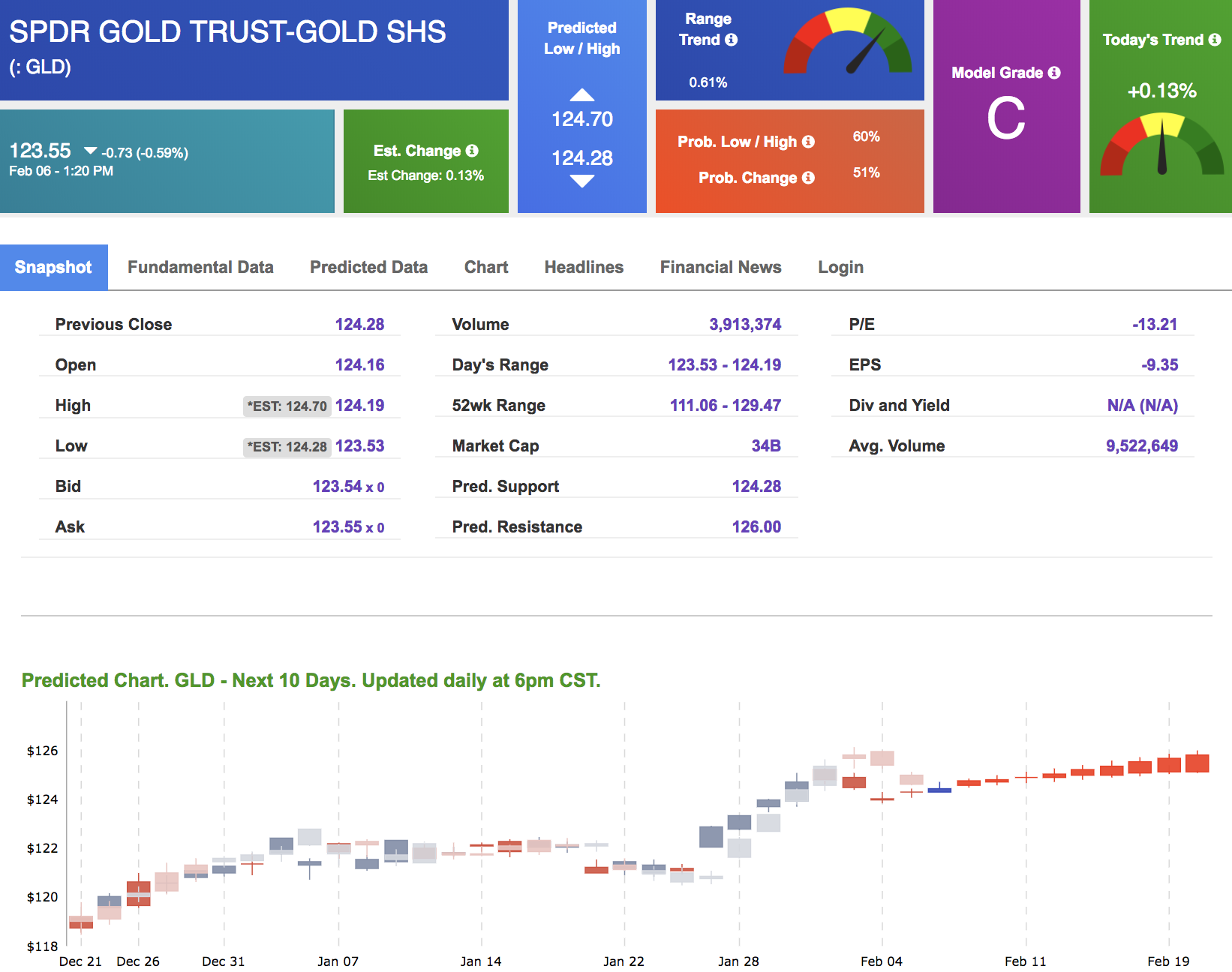

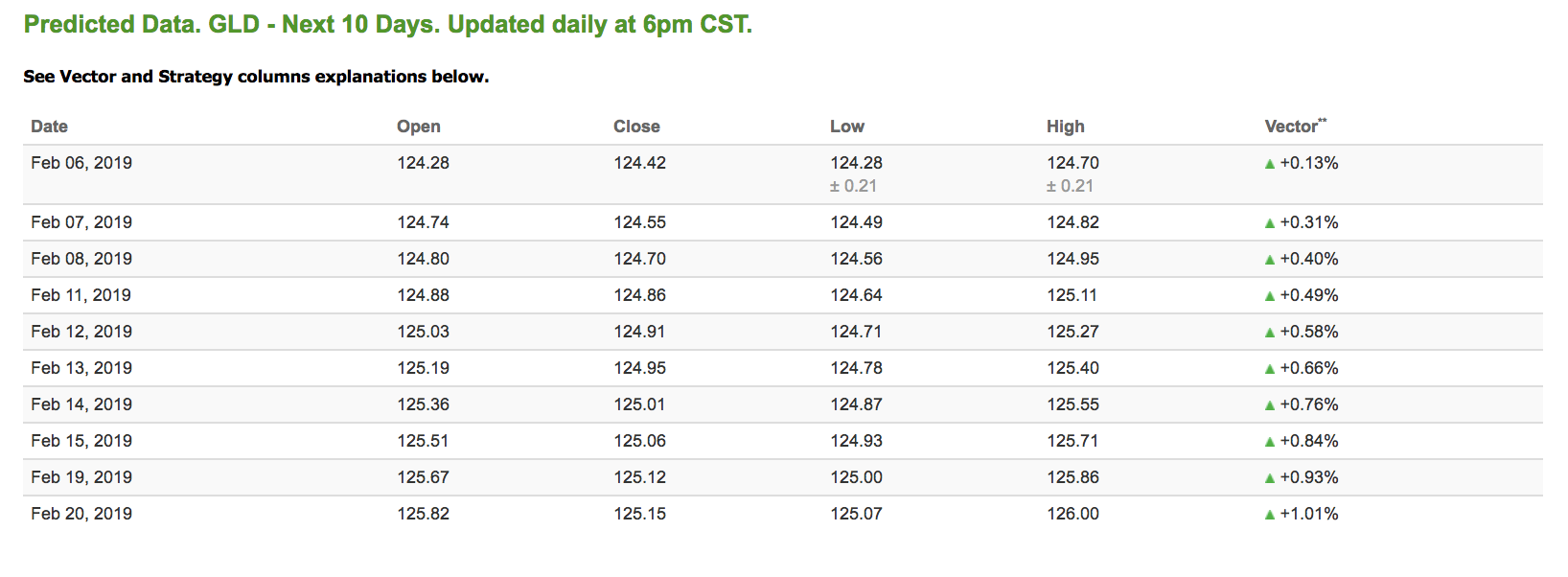

The price for April gold (GCJ9) is down 0.58% at $1,311.60 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows all positive signals. The gold proxy is trading at $123.55, down 0.73% at the time of publication. Vector signals show +0.13% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

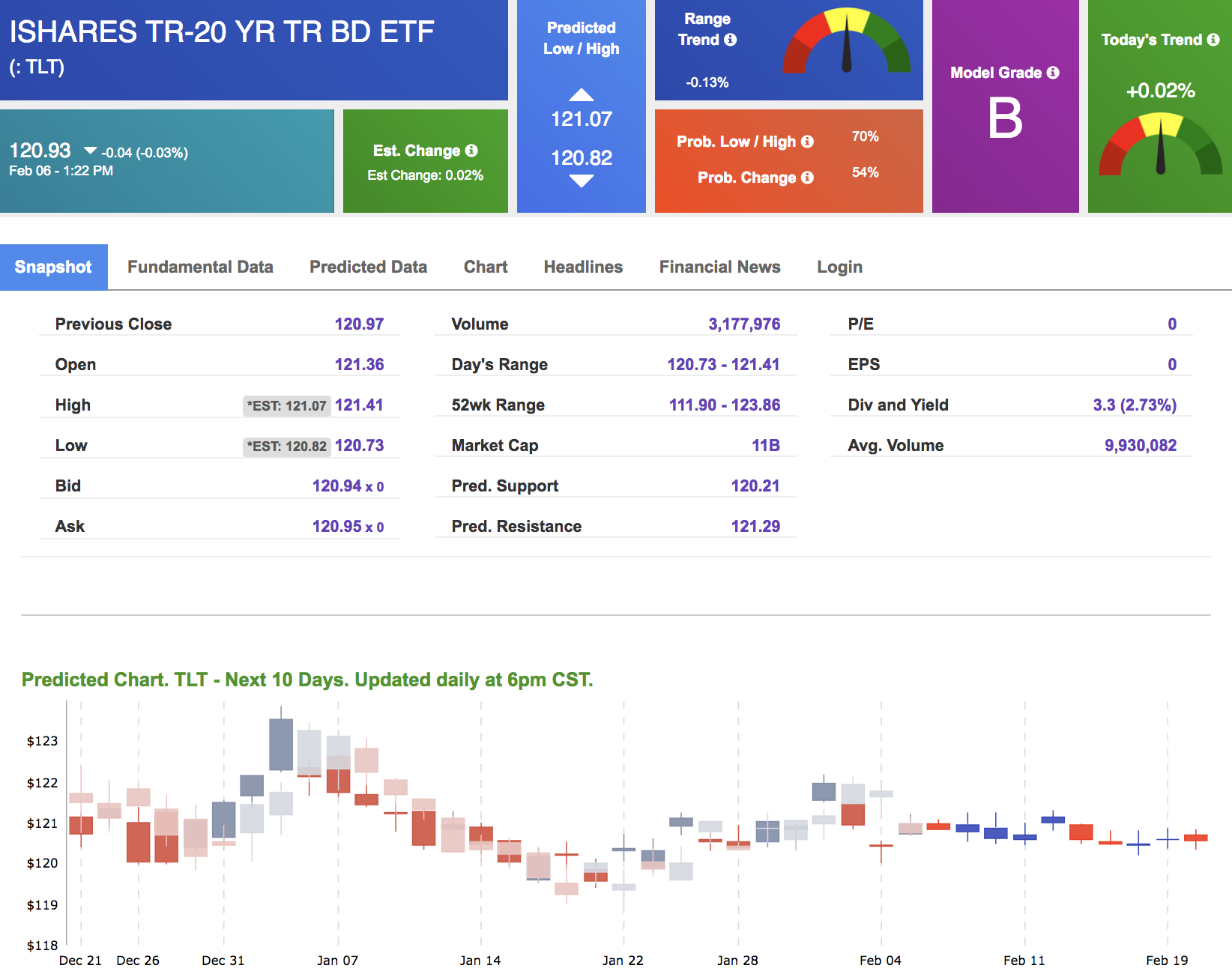

The yield on the 10-year Treasury note is down 0.10% at 2.70% at the time of publication. The yield on the 30-year Treasury note is up 0.08% at 3.03% at the time of publication.

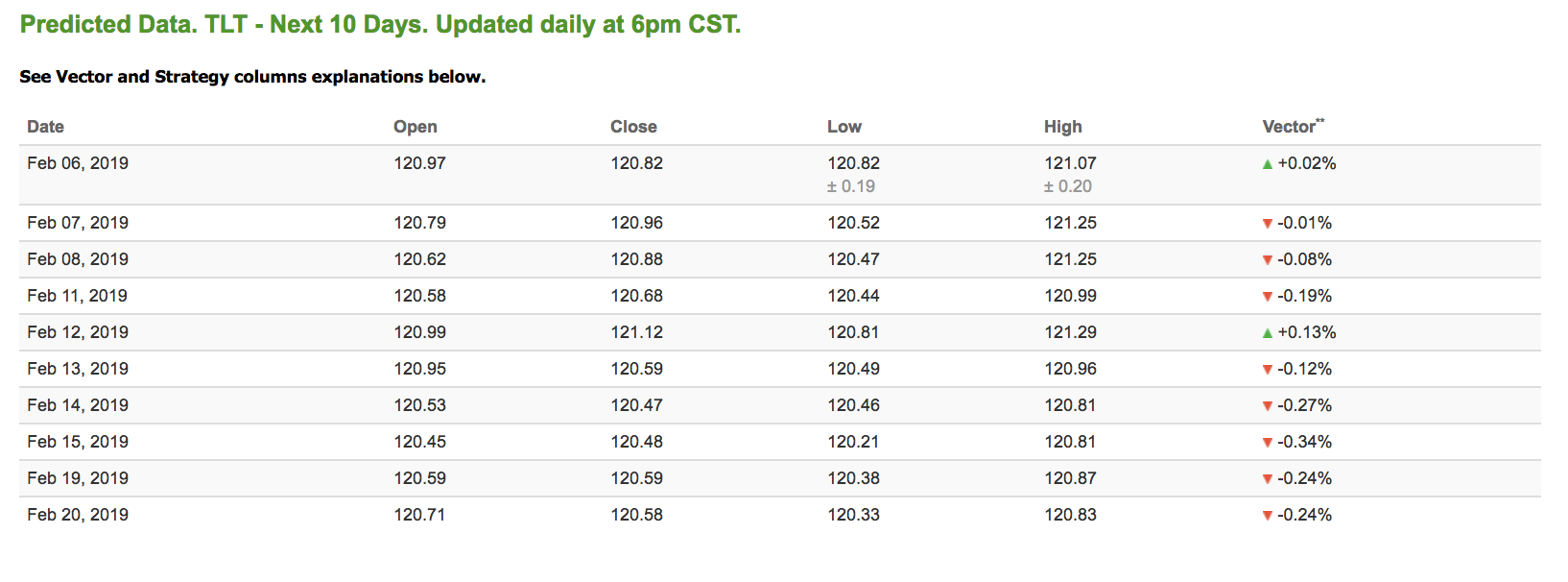

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly negative signals in our 10-day prediction window. Today’s vector of +0.02% moves to -0.19% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

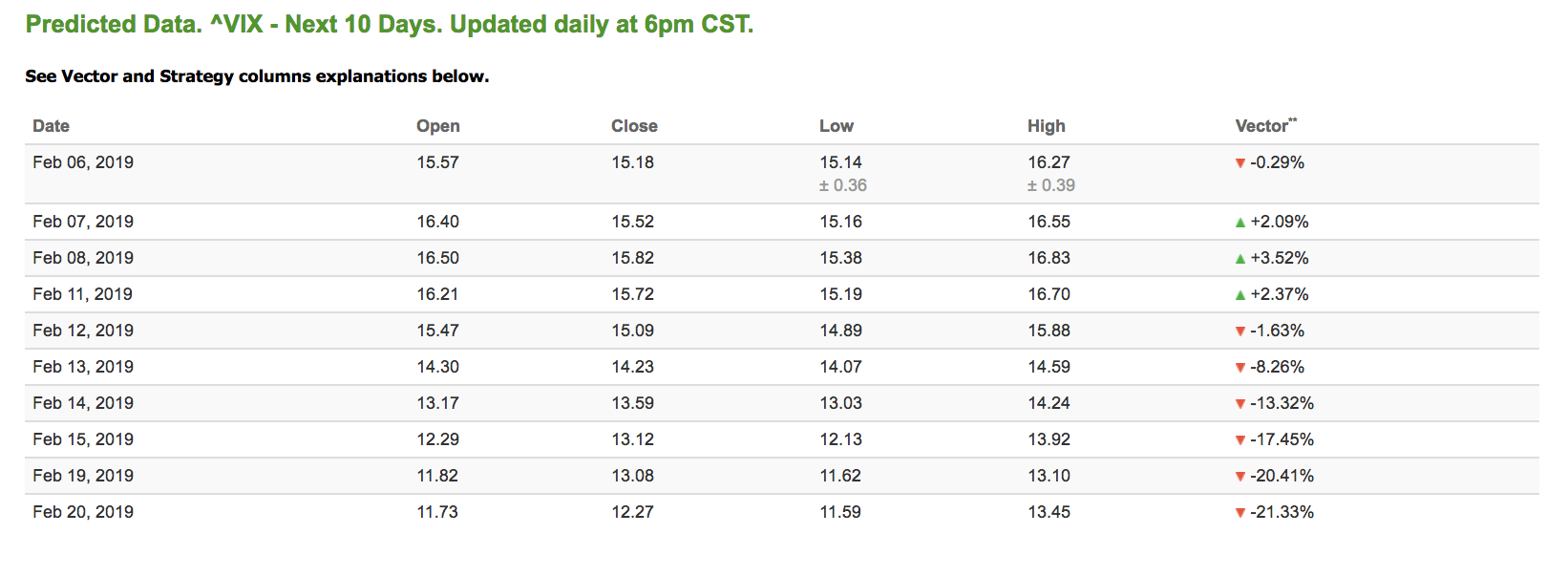

Volatility

The CBOE Volatility Index (^VIX) is down 1.03% at $15.41 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $15.52 with a vector of +2.09%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.