U.S., Canada, and Mexico Reach New Trade Agreement

U.S. Stocks rally behind the recently announced U.S.- Canada trade agreement, ostensibly replacing NAFTA with a new North American trade deal between U.S., Mexico, and Canada. The new deal, USMCA for short, is intended for sixteen years and will be reviewed every six, with thirty-four chapters that covers over $1 trillion in trade, covering dairy, auto, and much more. This helped North American markets rally, with all three currencies recording sizeable gains, as well as most U.S. futures also noticeably up. Monday also marks the first day of the fourth quarter, capping a nice third quarter for U.S. assets and indexes. Third quarter gains for S&P and Nasdaq came in around 7%, while the Dow rose 9%. SPY Annual Seasonal Chart forecast is shown below:

President Trump spoke on the new North American trade agreement encouraging optimism in the trade deal and overall U.S. manufacturing while stating “trading with the U.S. is a privilege.” He deferred China-trade questions, stating those trade-talks are too early for the time being. Seemingly, China trade talks will be up next for the U.S. as most of the previous trade concerns look to be resolved with the new USMCA deal. Other important speeches to note include Boston Fed President and Minneapolis Fed President, both speaking at separate events.

Big market-movers today include Boeing which jumped over 2%, most likely due to the new USMCA deal, supporting the Dow into sizeable gains. GE shares soared over 9% after it announced they will replace their recently-appointed CEO as shares for the company have dropped over 25% for the year. Tesla saw a nice boost, over 14%, as CEO Musk settled SEC probe by stepping down as chairman, paying $40 million in fines. Secondly, the Musk also recently emailed employes indicating the electric-car company is on the verge of making a profit. Finally, shares of Facebook dropped slightly as news of a leak and compromised accounts made rounds late Friday. The European Union is looking to find the company over $1 billion for the data breach and the company saw a 1% drop. Globally, Asian and European markets were modestly up.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.00% moves to +0.40% in five trading sessions. The predicted close for tomorrow is 2,913.38. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On September 25th, our ActiveTrader service produced a bullish recommendation for Abbott Labs (ABT). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

ABT entered the forecasted Entry 1 price range of $71.31 (± 0.28) in its first hour of trading and moved through its Target price of $72.02 in its second to last hour of trading that day. The Stop Loss was set at $70.60.

We are going to do something that we RARELY do!

Today only, anyone who signs up for our Tools Membership will be automatically upgraded to our Premium Membership at NO ADDITIONAL COST!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click here to read more…

Tuesday Morning Featured Stock

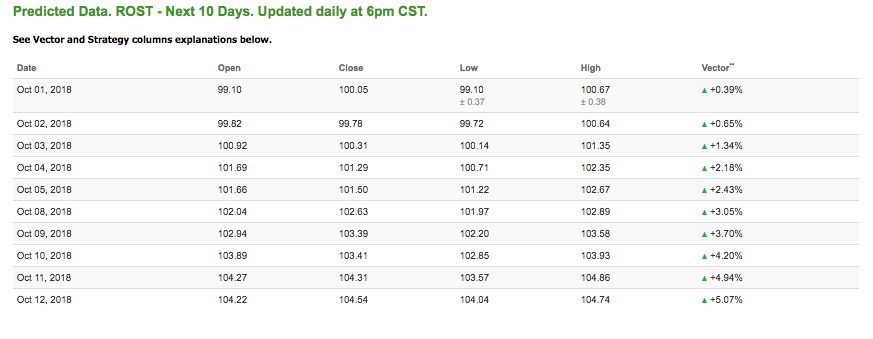

Our featured stock for Tuesday is Ross Stores Inc (ROST). ROST is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $99.09 at the time of publication, down 0.01% from the open with a +0.39% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLX8) is priced at $74.96 per barrel, up 2.33% from the open, at the time of publication. Trading sharply higher today, oil is nearing a four year high behind a fear of production loss due to Iranian sanctions set to take effect next month.

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $15.84 at the time of publication, up 2.06% from the open. Vector figures show 0.76% today, which turns +2.05% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is down 0.34% at $1,191.70 at the time of publication. With the recently announced North American trade agreement, the dollar rallied causing gold to lower modestly.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $112.49, down 0.24% at the time of publication. Vector signals show +0.04% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 0.11% at 3.07% at the time of publication. The yield on the 30-year Treasury note is down 0.31% at 3.22% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of 0.04% moves to 0.59% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 2.39% at $11.83 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $12.45 with a vector of +0.30%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

We are going to do something that we RARELY do!

Today only, anyone who signs up for our Tools Membership will be automatically upgraded to our Premium Membership at NO ADDITIONAL COST!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!