U.S.-China Tension and Brexit Uncertainty Remain While Markets Rise

Positive market sentiment paint U.S. markets in green

U.S. Indices are on track to close in the green today with the energy sector leading in gains behind continued positive corporate earnings and economic reports supporting positive market sentiment.

U.S.-China trade relations and Brexit make anxiety

Still, anxiety over U.S.-China trade relations and Brexit remain with several key deadlines approaching. Also weighing on markets today is the growing yield spread between two and ten-year Treasury notes.

Globall markets mixed

Globally, markets are mixed with the pound lowering in the U.K. while Chinese markets lowered behind tariff uncertainty. Earnings and economic reports remain light this week with GDP revisions tomorrow, personal income and consumer spending on Friday.

(Want free training resources? Check our our training section for videos and tips!)

Buy and sell points for SPY

With SPY support at $277-$282, we will look to sell when the market is near $290 and buy near $278. Potential for the market to overshoot 50-days MA on SPY, which would be around $293-$294 level, remains and further volatility is expected. We strongly encourage our readers to have clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Major U.S. indices rise today

All three major U.S. indices rose today as several key economic reports continue to support positive market sentiment following several days of lowering.

Hewlett Packard report better than expected results

U.S. Energy Information Administration reported crude inventories fell last week which supported oil and energy sectors while Hewlett Packard reported better than expected results, helping shares grow 3%.

Two and ten year notes fall further into negative territory

Still, concerns regarding the widening yield spread remain with two and ten year notes falling further into negative territory. Behind growing fears of global economic slowdown, notes could continue to lower especially with U.S.-China uncertainty remaining.

(Want free training resources? Check our our training section for videos and tips!)

U.S.-China negotiations to resume in Washington

Additional U.S. tariffs on Chinese goods could be levied next month while negotiations are set to resume in Washington. Other concerns weighing on stocks include Brexit and political unrest in Italy.

Prime Minister Boris Johnson looked to suspend Parliament ahead of the upcoming Brexit deadline

Globally, both Asian and European markets closed to mixed results. In the U.K., the pound lowered significantly after Prime Minister Boris Johnson looked to suspend Parliament ahead of the upcoming Brexit deadline. A rate cut is expected for the U.K. and the current date set for them to leave the European Union is October 31st.

U.S Q2 GDP revision data to release tomorrow

Look for U.S Q2 GDP revision data to release tomorrow along with weekly labor reports and July pending home sales index. On Friday, notable economic reports to follow include personal income, consumer spending, and core inflation for July.

(Want free training resources? Check our our training section for videos and tips!)

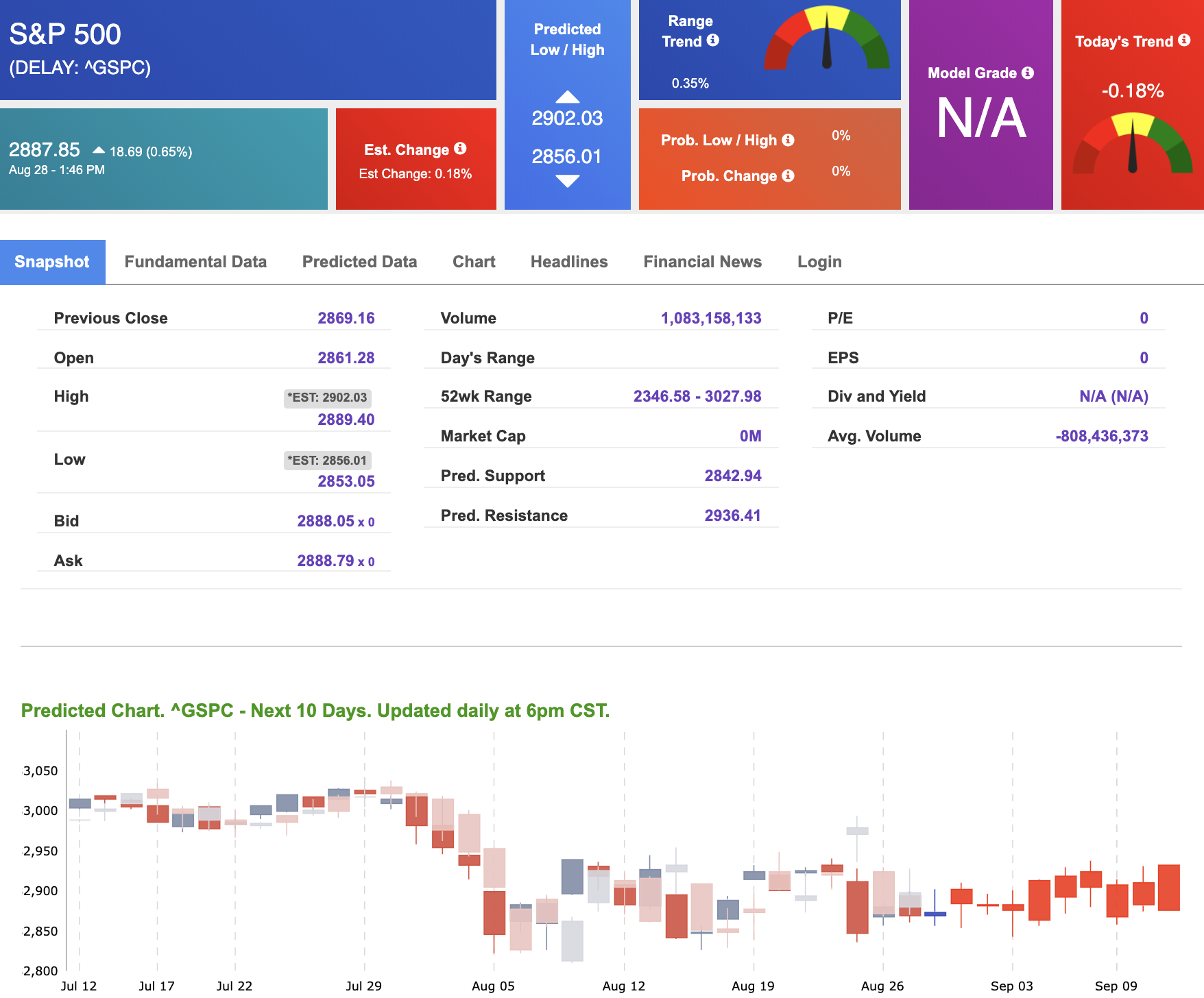

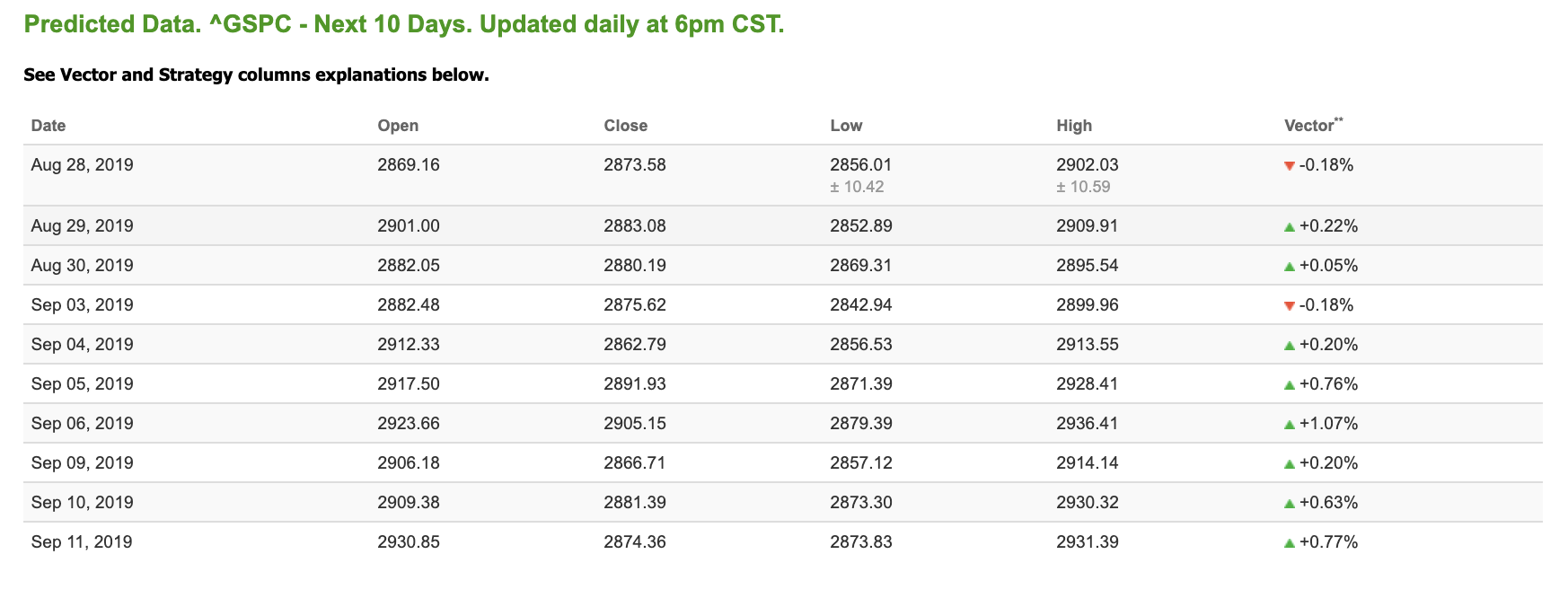

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows mostly positive signals. Today’s vector figure of -0.18% moves to +0.76% in five trading sessions. Prediction data is uploaded after the market close at 6 pm, CST. Today’s data is based on market signals from the previous trading session.

Introducing – Vlad’s Portfolio Trading Service

“Join me as I continue my run of 1,335% gains!” Vlad Karpel, CEO

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS AND DO IT RISK-FREE THROUGHOUT THE DAY!

We make money in every market. Don’t miss our next big trade!

Click Here to Learn More

(Want free training resources? Check our our training section for videos and tips!)

Highlight of a Recent Winning Trade

On August 16th, our ActiveTrader service produced a bullish recommendation for Crown Castle International (CCI). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

CCI entered its forecasted Strategy B Entry 1 price range $142.41 (± 0.73) in its first hour of trading and passed through its Target price $143.83 in the first hour of trading the following trading day. The Stop Loss price was set at $137.15

(Want free training resources? Check our our training section for videos and tips!)

Thursday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, TGT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

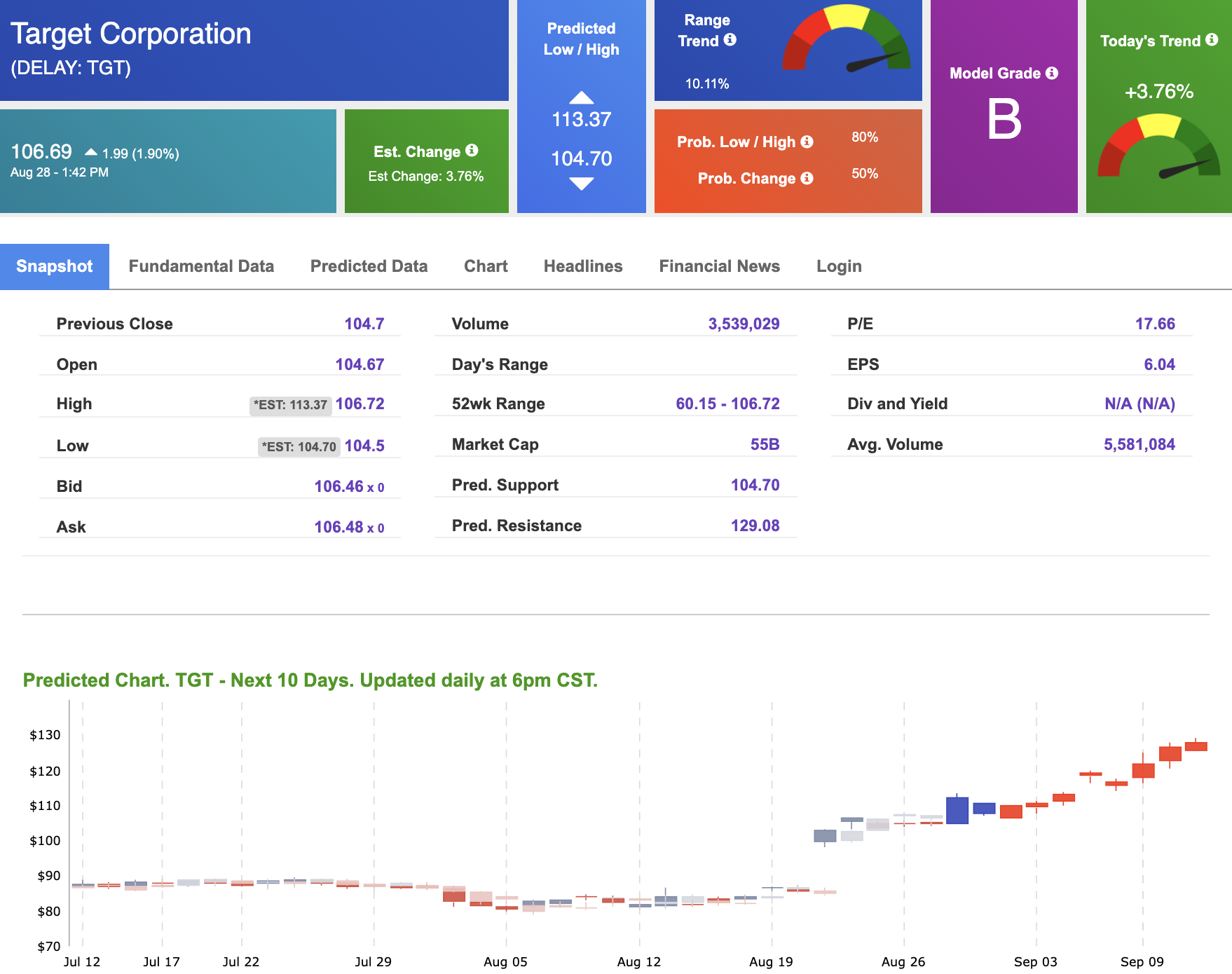

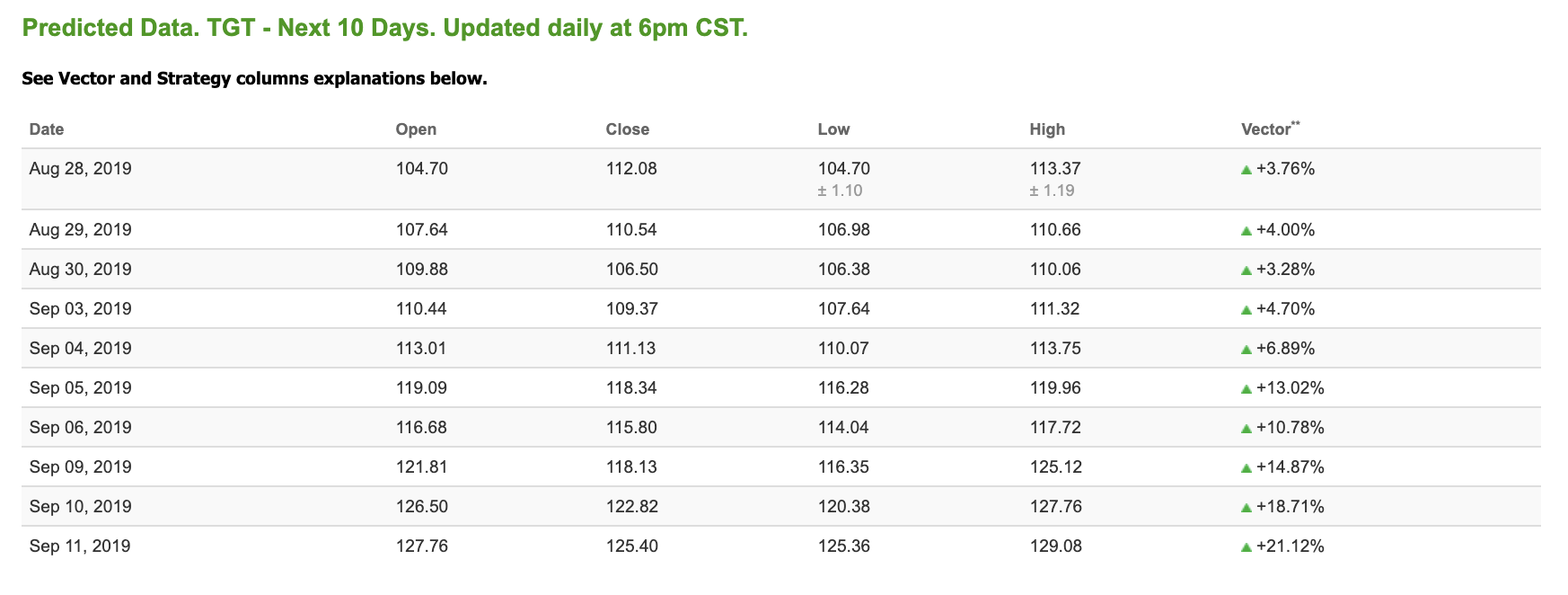

Our featured symbol for Thursday is Target Corporation (TGT). TGT is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

(Want free training resources? Check our our training section for videos and tips!)

The stock is trading at $106.69 at the time of publication, up 1.90% from the open with a +3.76% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent.

Oil

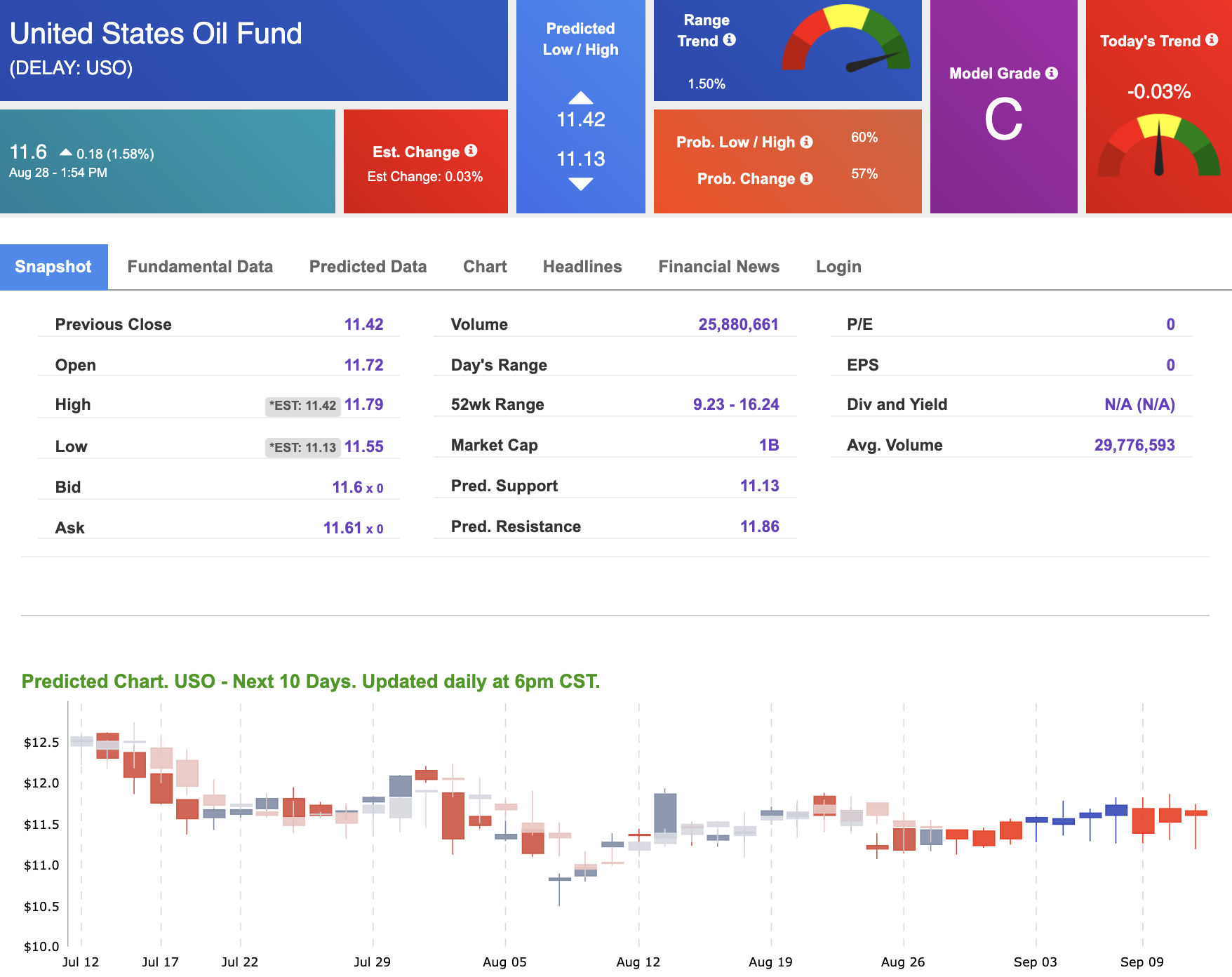

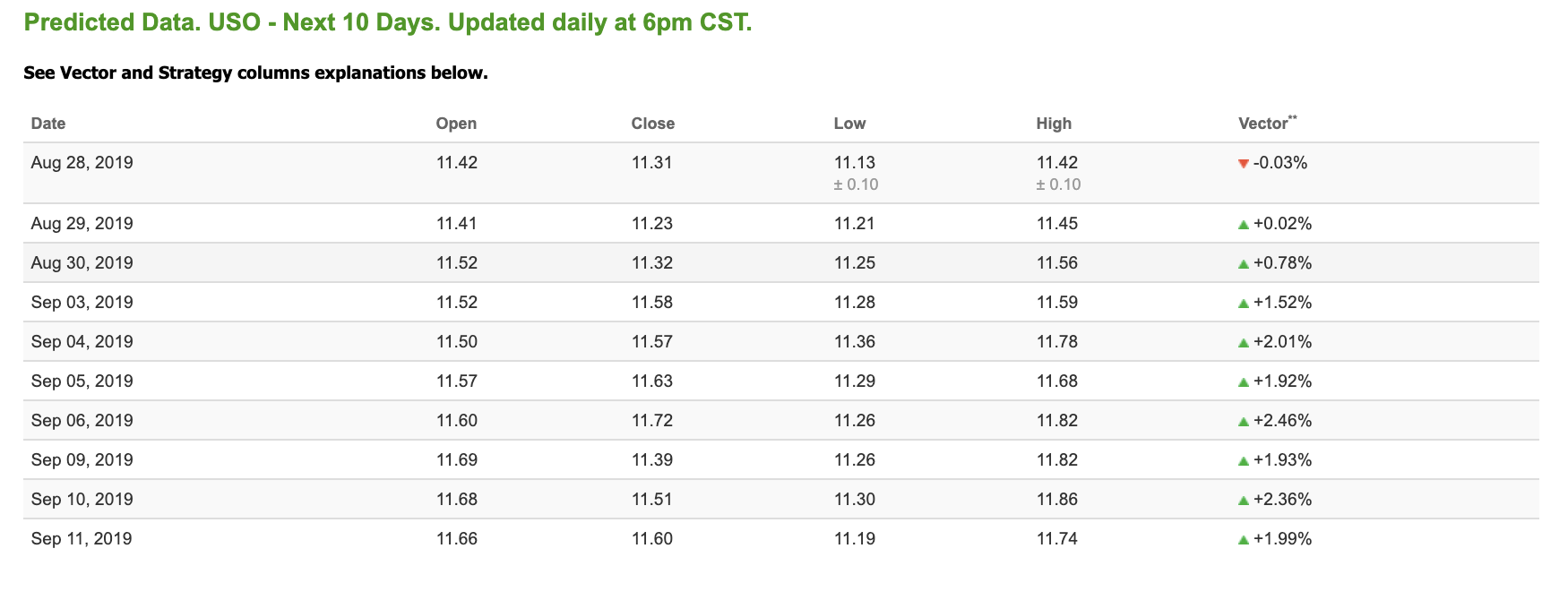

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $55.78 per barrel, up 1.55% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.6 at the time of publication, up 1.58% from the open. Vector figures show -0.03% today, which turns +1.92% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)

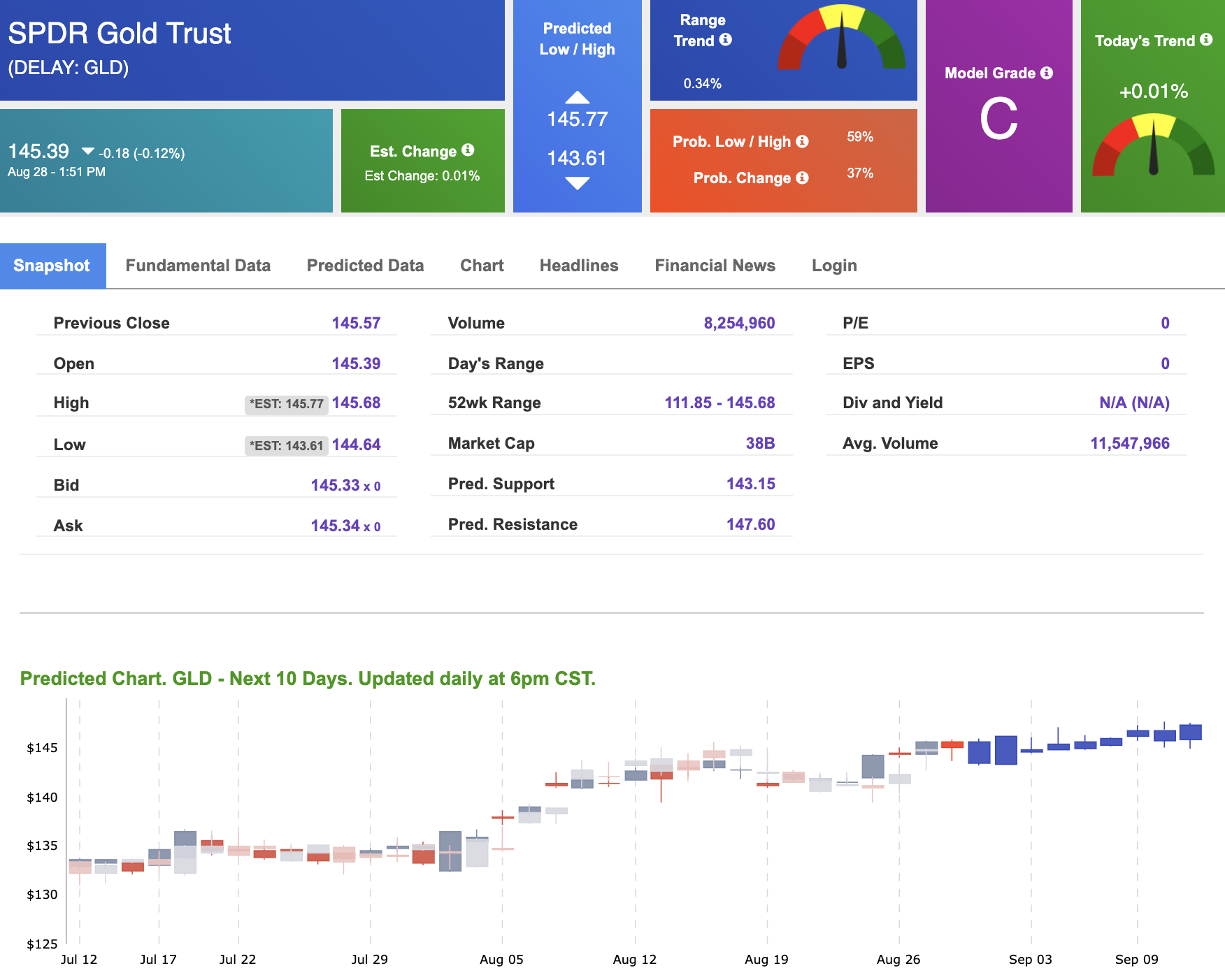

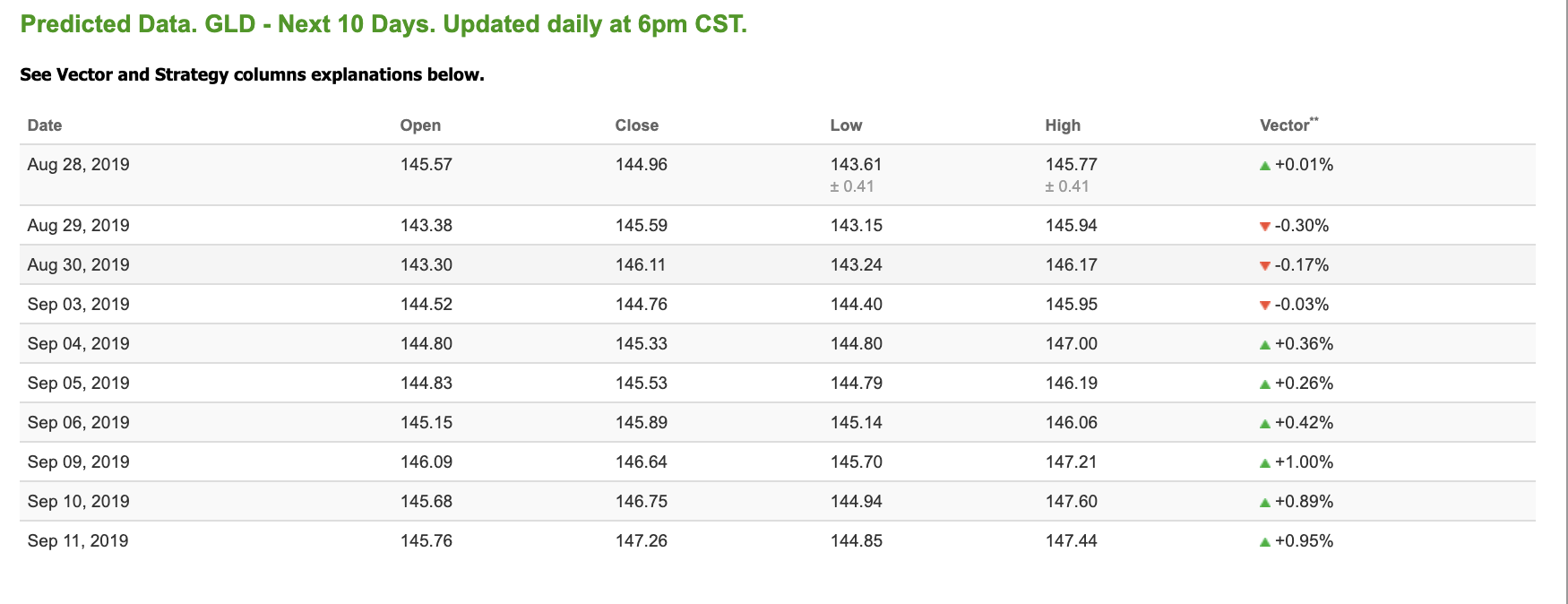

Gold

The price for the Gold Continuous Contract (GC00) is down 0.04% at $1,551.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $145.39, down 0.12% at the time of publication. Vector signals show +0.01% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)

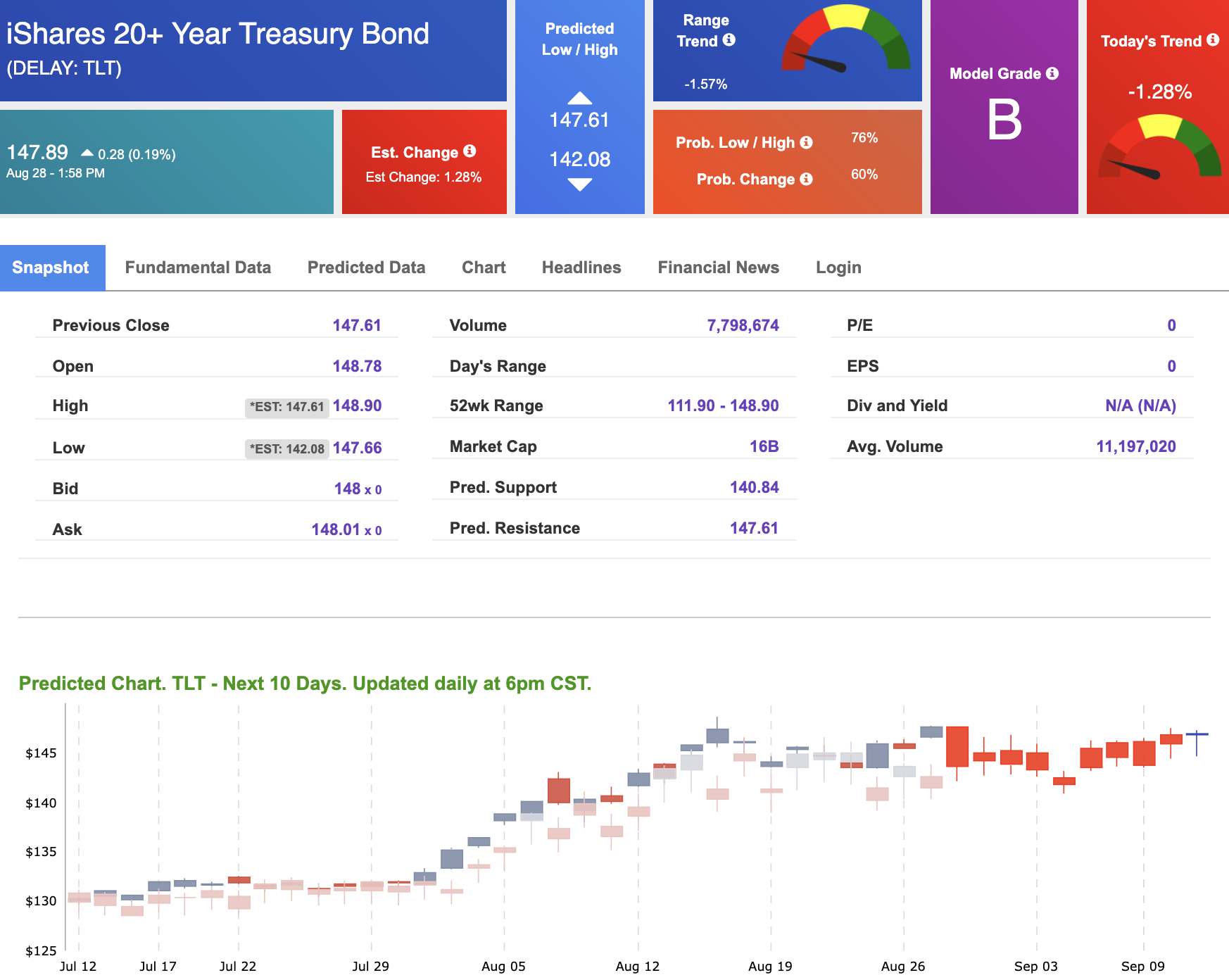

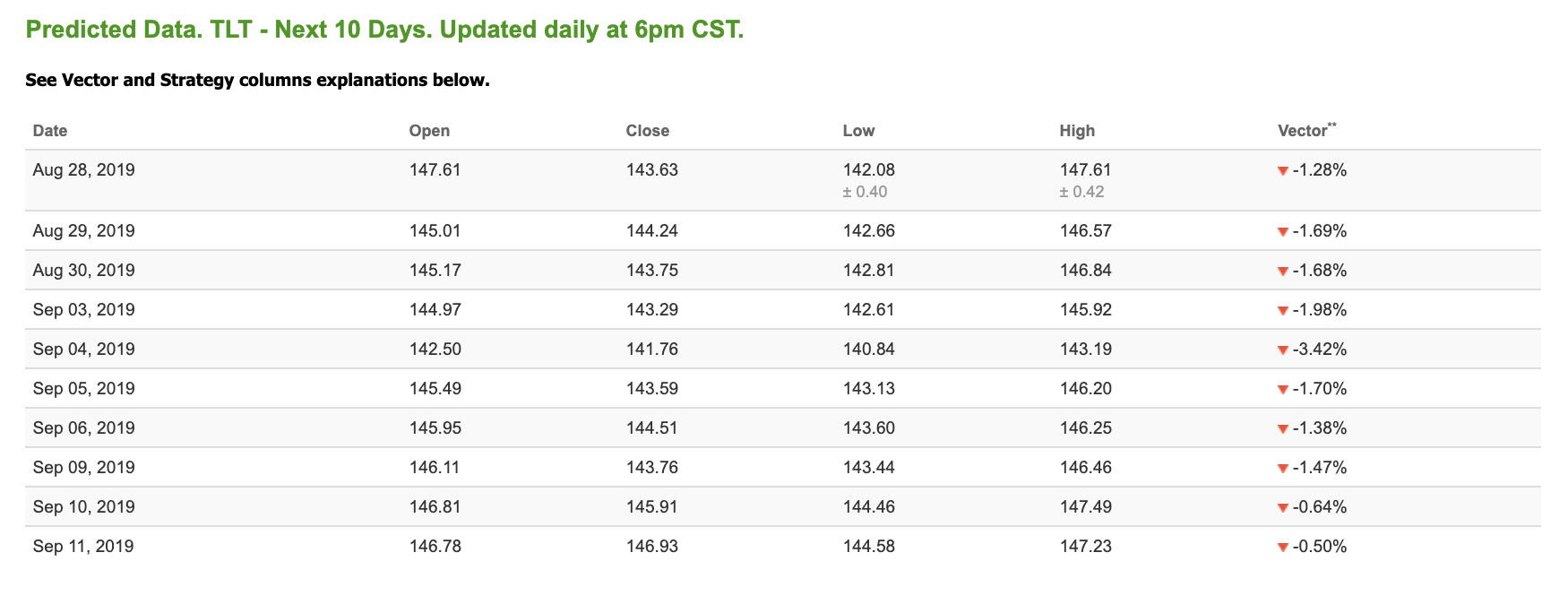

Treasuries

The yield on the 10-year Treasury note is down 0.40% at 1.47% at the time of publication. The yield on the 30-year Treasury note is down 0.59% at 1.94% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -1.28% moves to -1.98% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)

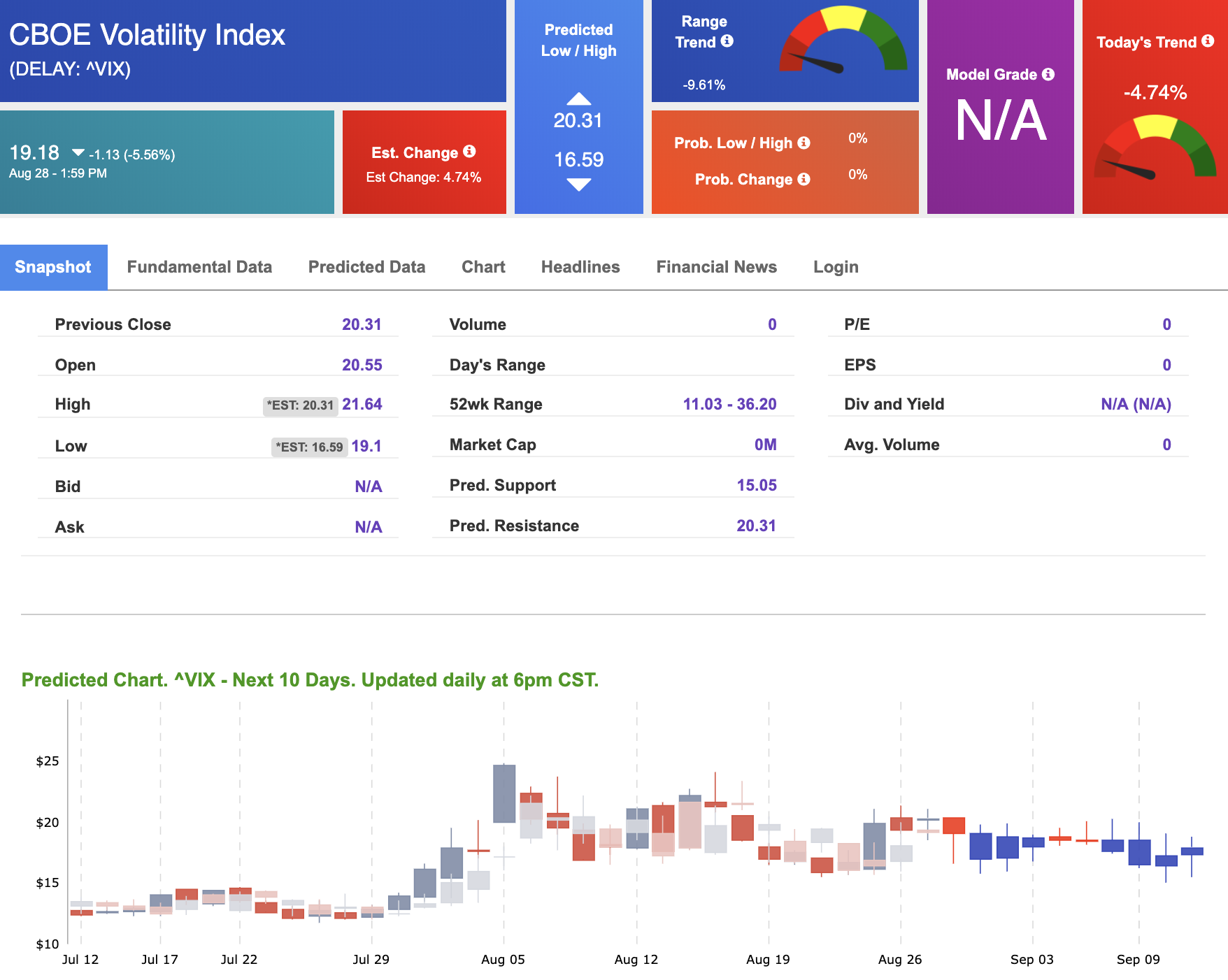

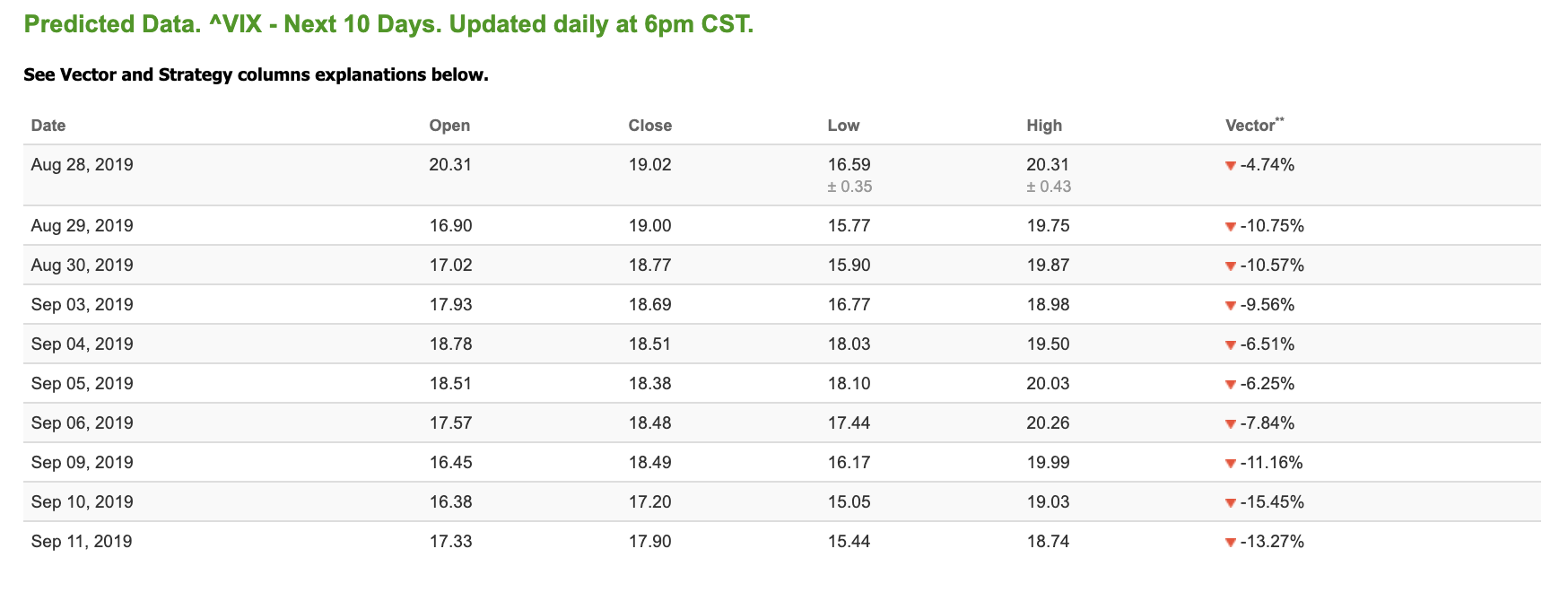

Volatility

The CBOE Volatility Index (^VIX) is down 5.56% at $19.18 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $19.00 with a vector of -10.75%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)