U.S.-Iran Tension and Strong Labor Data Inform Markets

Both sides are looking to de-escalate the current situation

After rising tensions in the Middle East caused markets to lower earlier this week, all three major U.S. indices rebounded nicely today. The latest from President Trump indicated both Iran and the U.S were refraining from any additional military activity in the area which eased market-fears. Although both sides are looking to de-escalate the current situation, additional sanctions could be in play. Also impacting markets today are the latest ADP employment data for December as well as the Boeing plane crash in Iran.

(Want free training resources? Check our our training section for videos and tips!)

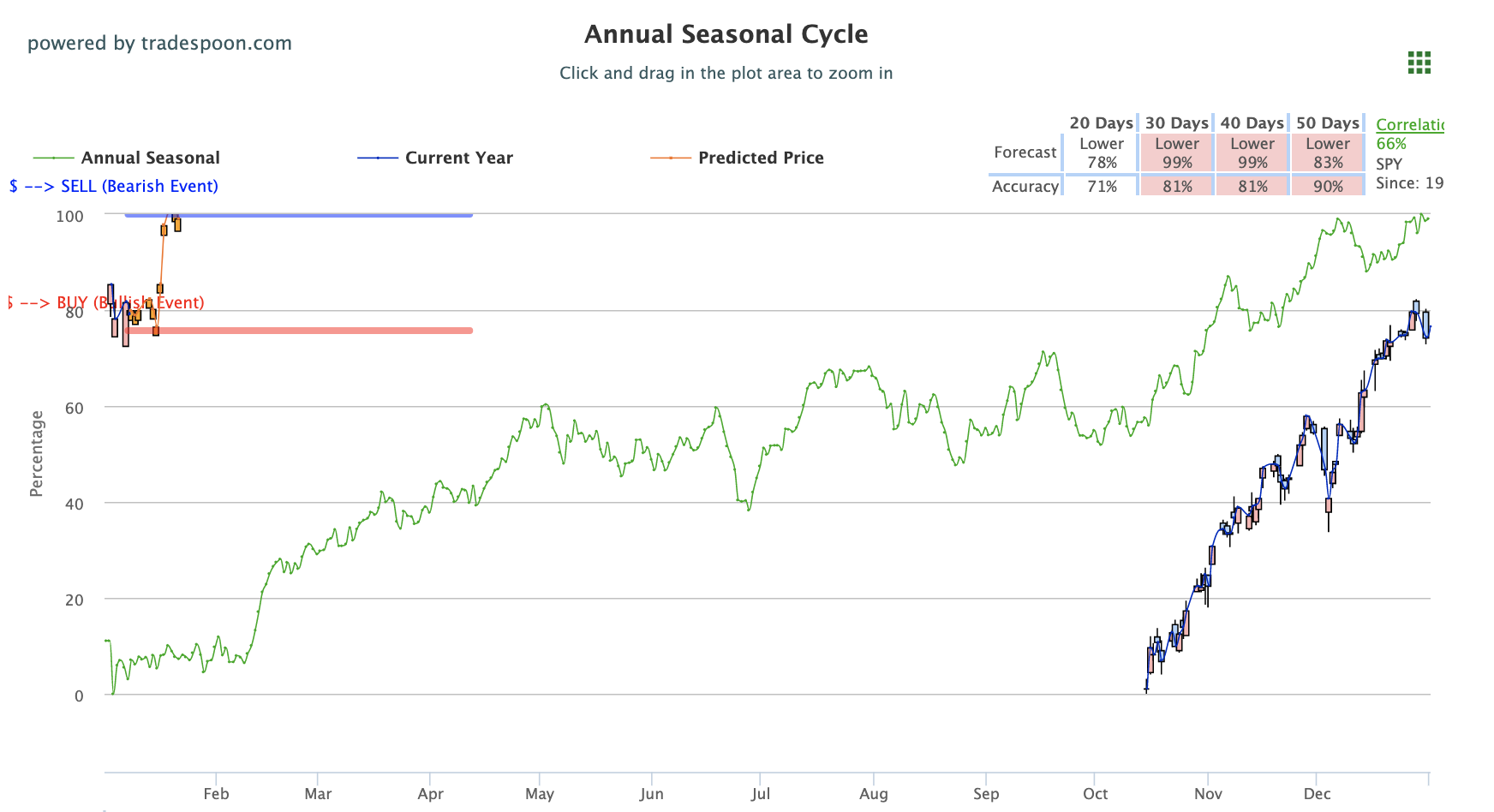

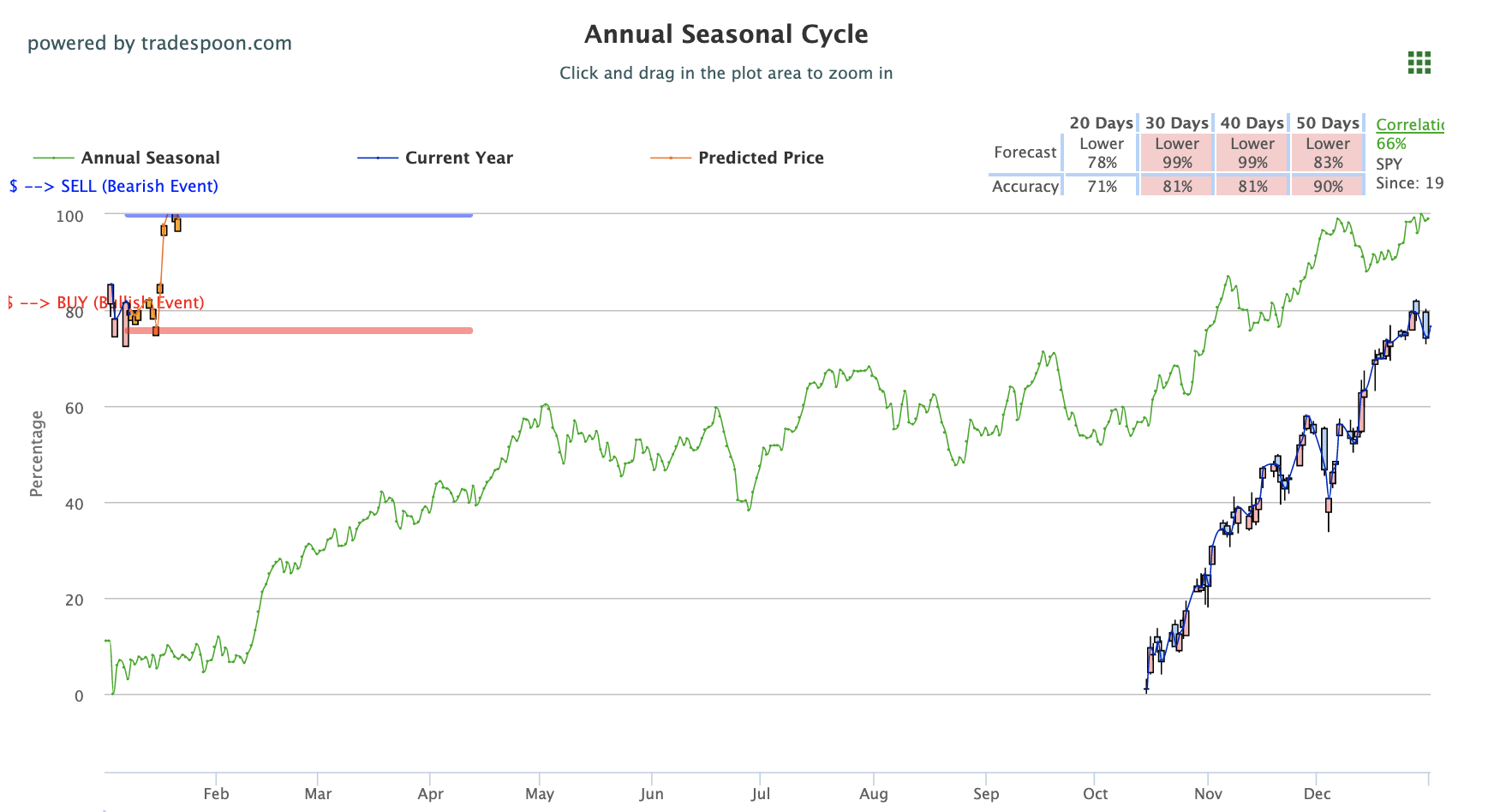

With the current support and resistance levels, $315-$325, we will look to buy when SPY is near $315. In the short-term, we remain bullish on the market but also expect shallow pullbacks going into the next earnings season. Further volatility could be expected and we encourage readers to retain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Supporting comments about Middle East from President Trump moves markets higher

Markets were able to record gains today after trading lower the last few sessions, triggered by the rising tensions in the Middle East. As the U.S.-Iran situation escalated since last week, markets continued to trade significantly lower but were able to rebound today behind supporting comments from President Trump as well as strong economic data. President Trump stated both Iran and the U.S. were working on resolving the issue without further military activity. Iran has since also stated their desire to move forward without further escalation. Look for both sides to continue communication as the issue is addressed, while additional sanctions could also occur. Beyond the military conflict, Iran was also hosting the latest Boeing plane crash. A plane traveling to Ukraine from Iran crashed upon takeoff which resulted in fatalities of all those that were on board as well as Boeing shares to lower drastically. Still, U.S. markets were able to record impressive gains today. ADP Employment data returned positively and above expectations with over 200,000 private-sector jobs added in December. Globally, Asian markets lowered while European markets traded slightly higher.

(Want free training resources? Check our our training section for videos and tips!)

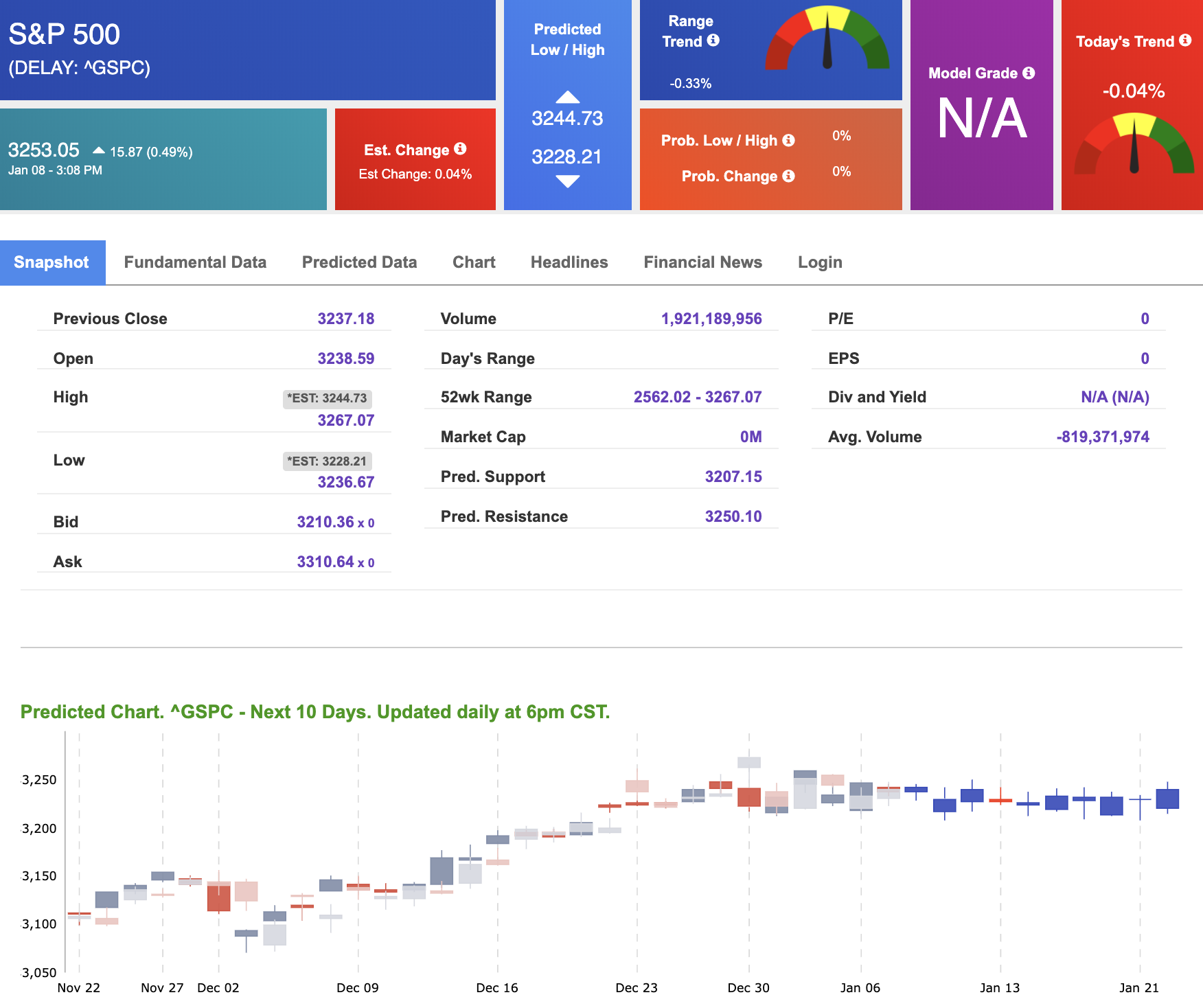

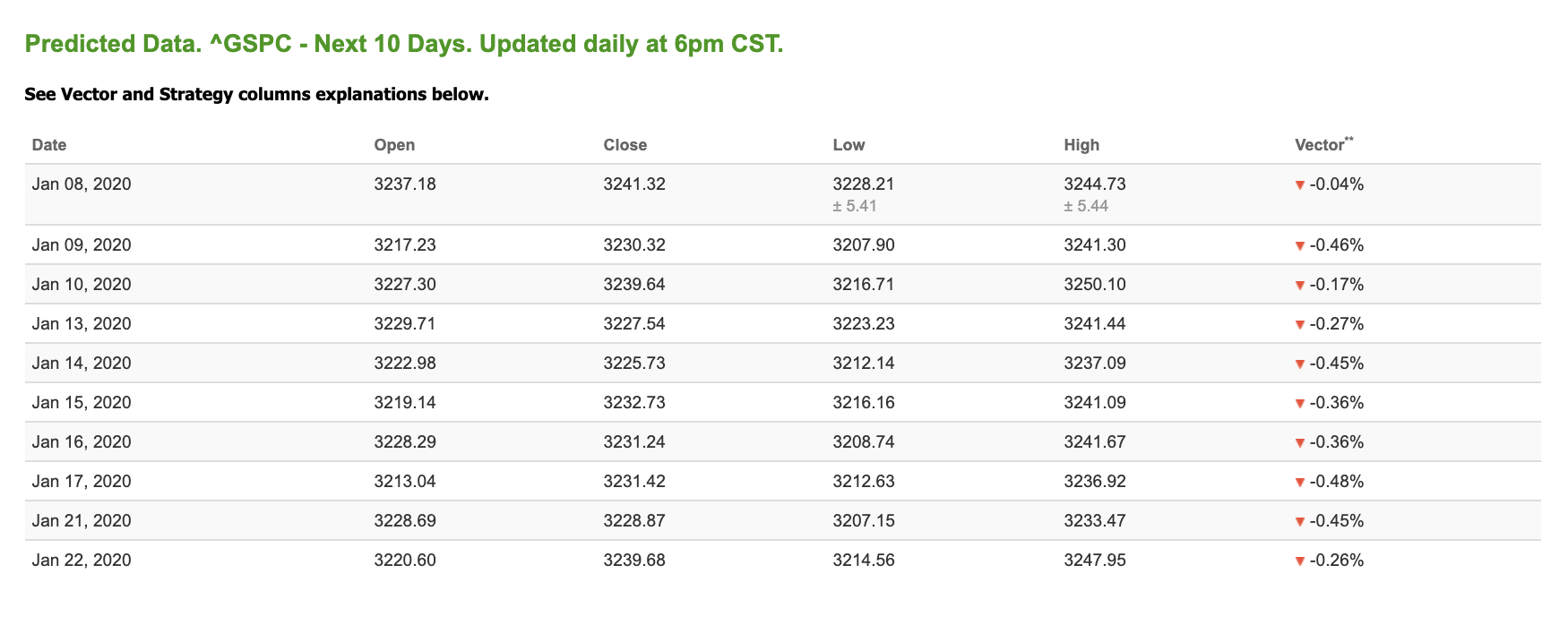

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term negative outlook. Today’s vector figure of -0.04% moves to -0.45% in four trading sessions. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Want a more manageable portfolio with fewer trades and more profits

How often do you sign up for an investment advisory and find dozens, or hundreds, of open trades in their portfolio?

It’s almost as though the guru is trying to cover all his bases by recommending every potential stock that could go up.

As an investor, it’s overwhelming: what do you focus on?

With Vlad’s system, you never have to worry about more than a handful of stocks at one time. It’s a focused approach to trading, and that means you can spend more of your brain energy on other activities without sacrificing profitability.

And there’s a unique advantage Vlad’s system has that is a must-have in this day and age…

That winning percentage doesn’t budge…

even during volatile times

CLICK HERE TO LEARN MORE

Highlight of a Recent Winning Trade

On December 20th, our ActiveTrader service produced a bullish recommendation for Eli Lily and Company (LLY). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading, with signals meant to last for 1-2 days.

Trade Breakdown

LLY entered its forecasted Strategy A Entry 1 price range $129.39(± 1.03) in its first hour of trading and passed through its Target price of $132.16 in the last hour of trading the following trading day in the final hour of trading. The Stop Loss price was set at $132.16.

Thursday Morning Featured Symbol

*Please note: At the time of publication Vlad Karpel does not have a position in the featured symbol, JBHT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

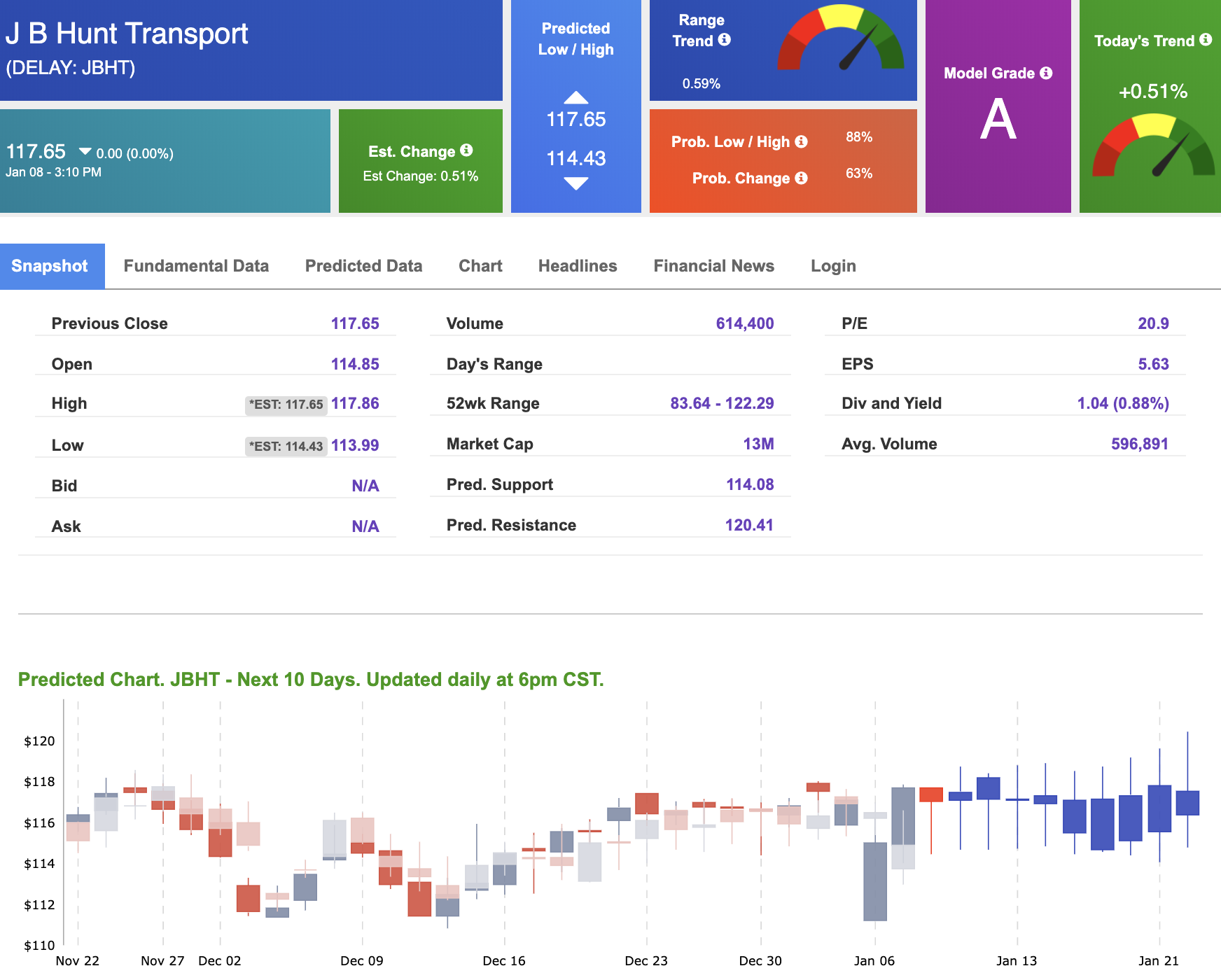

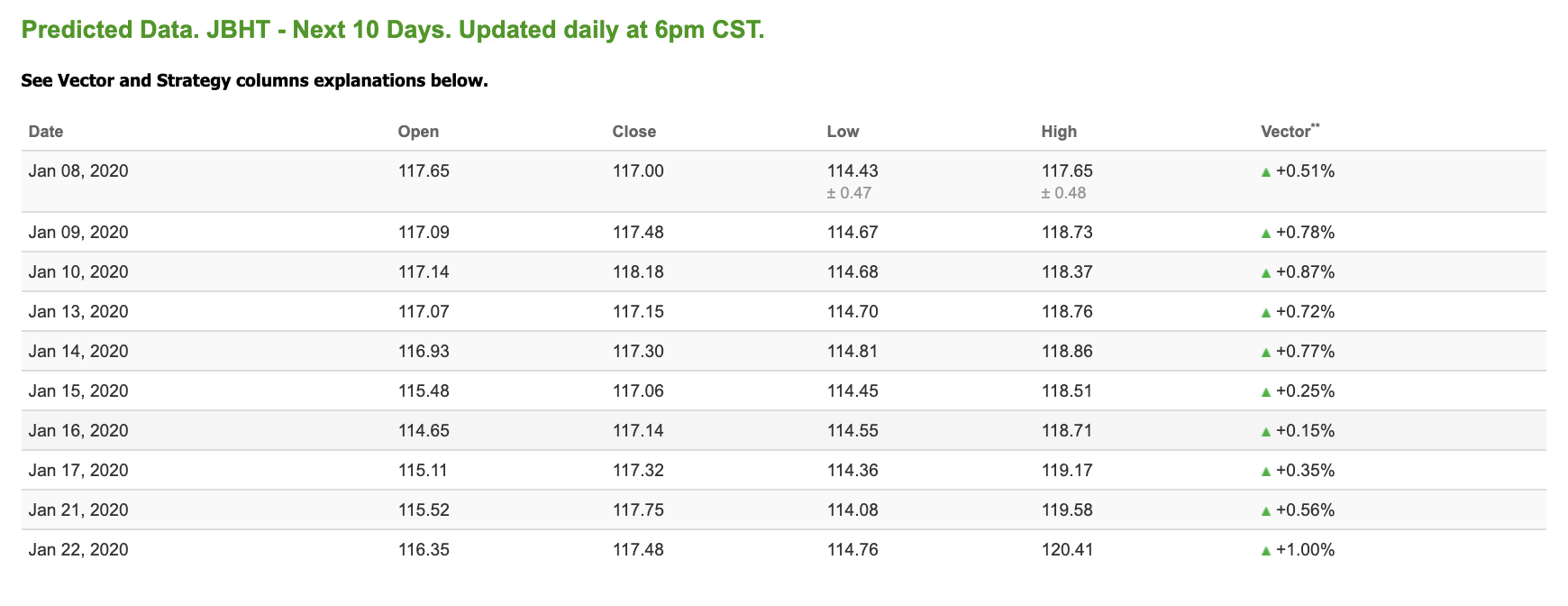

Our featured symbol for Thursday is J.B. Hunt Transport (JBHT). JBHT is showing a mixed vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for current-day predicted support and resistance, relative to our entire data universe.

The stock is trading at $158.62 at the time of publication, with a -0.16% vector figure.

Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

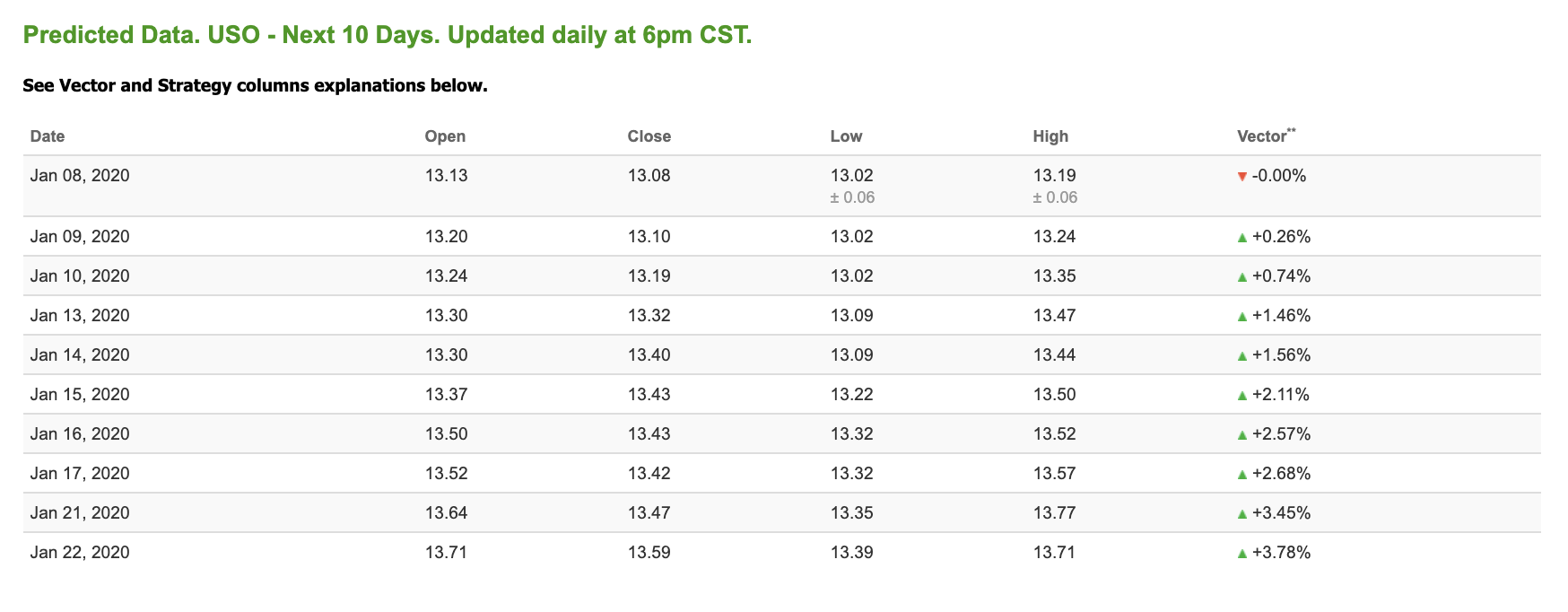

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $62.83 per barrel, down 0.35% from the open, at the time of publication.

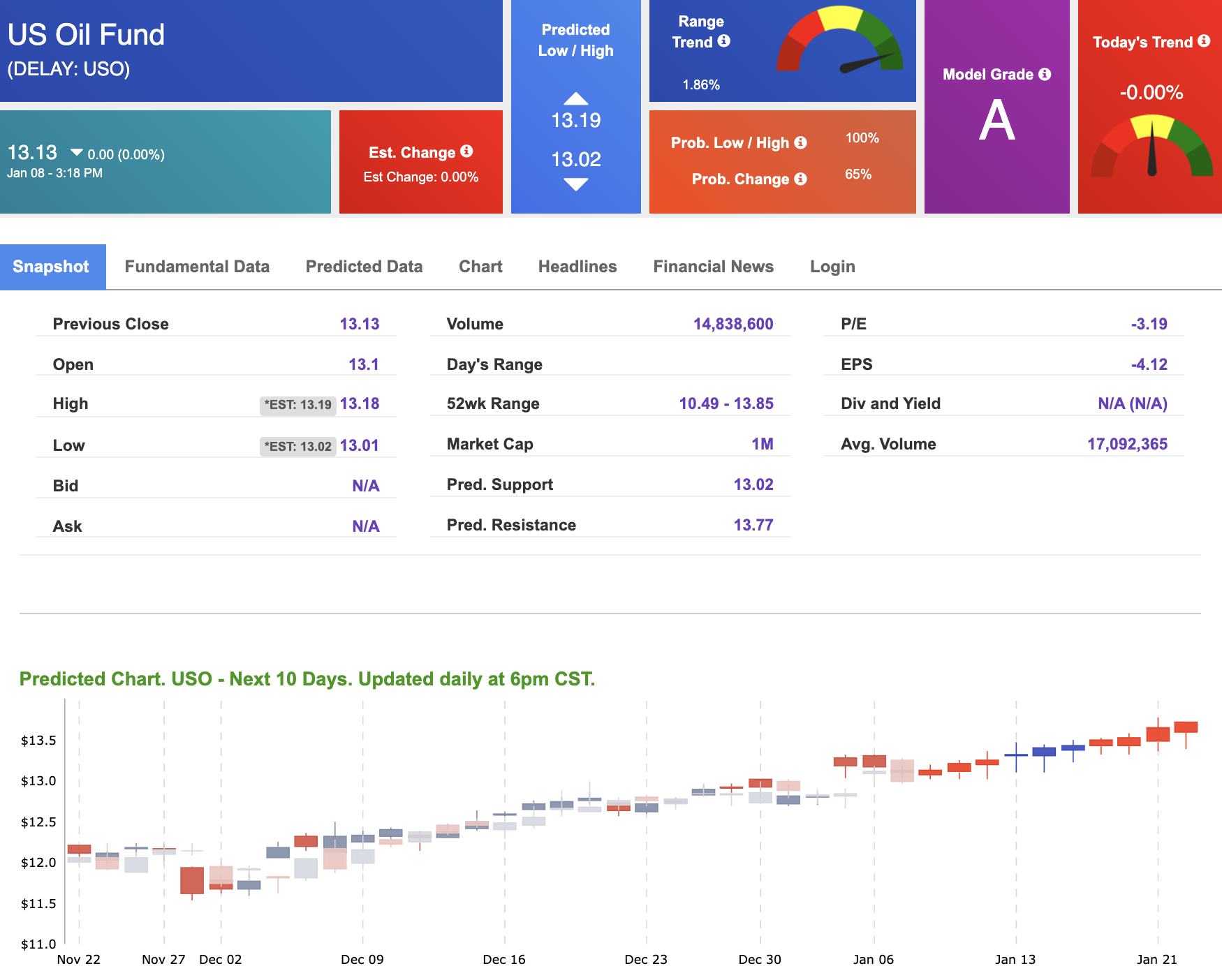

Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $13.16 at the time of publication. Vector figures show -0.77% today, which turns to -1.43% in three trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

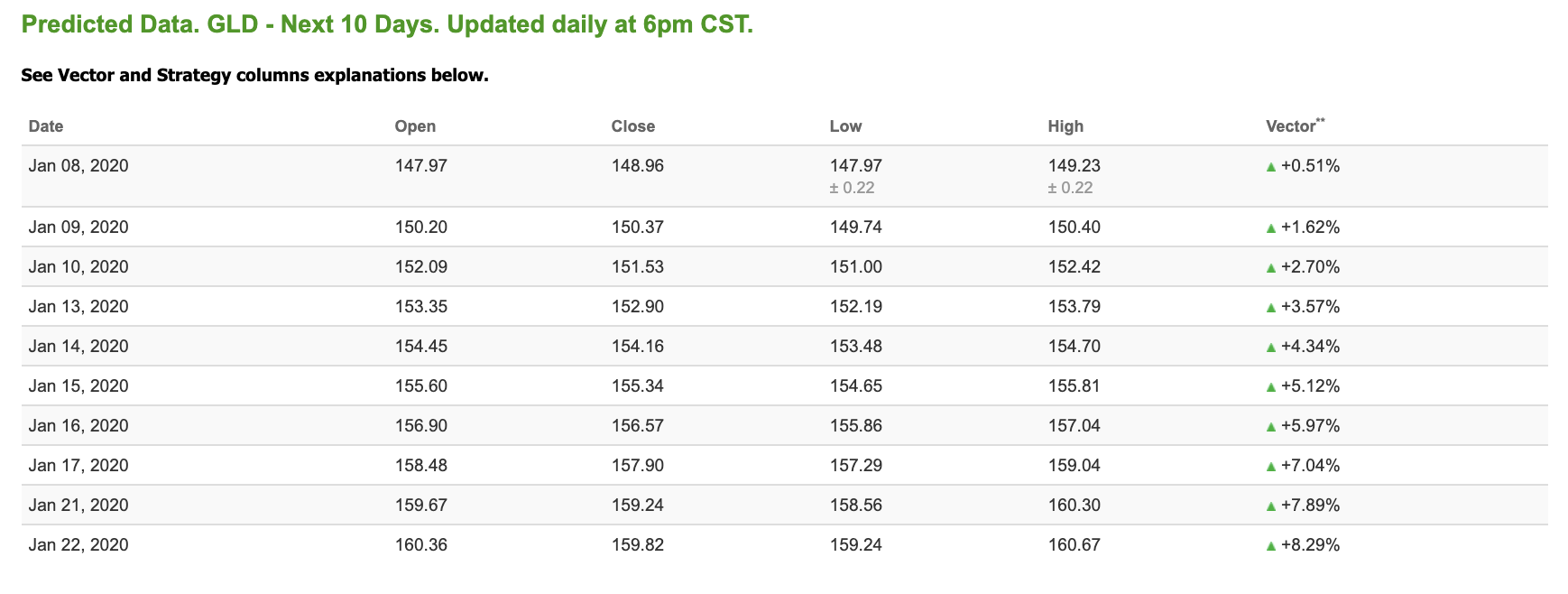

Gold

The price for the Gold Continuous Contract (GC00) is up 0.99% at $1,567.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $147.39, at the time of publication. Vector signals show +0.19% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

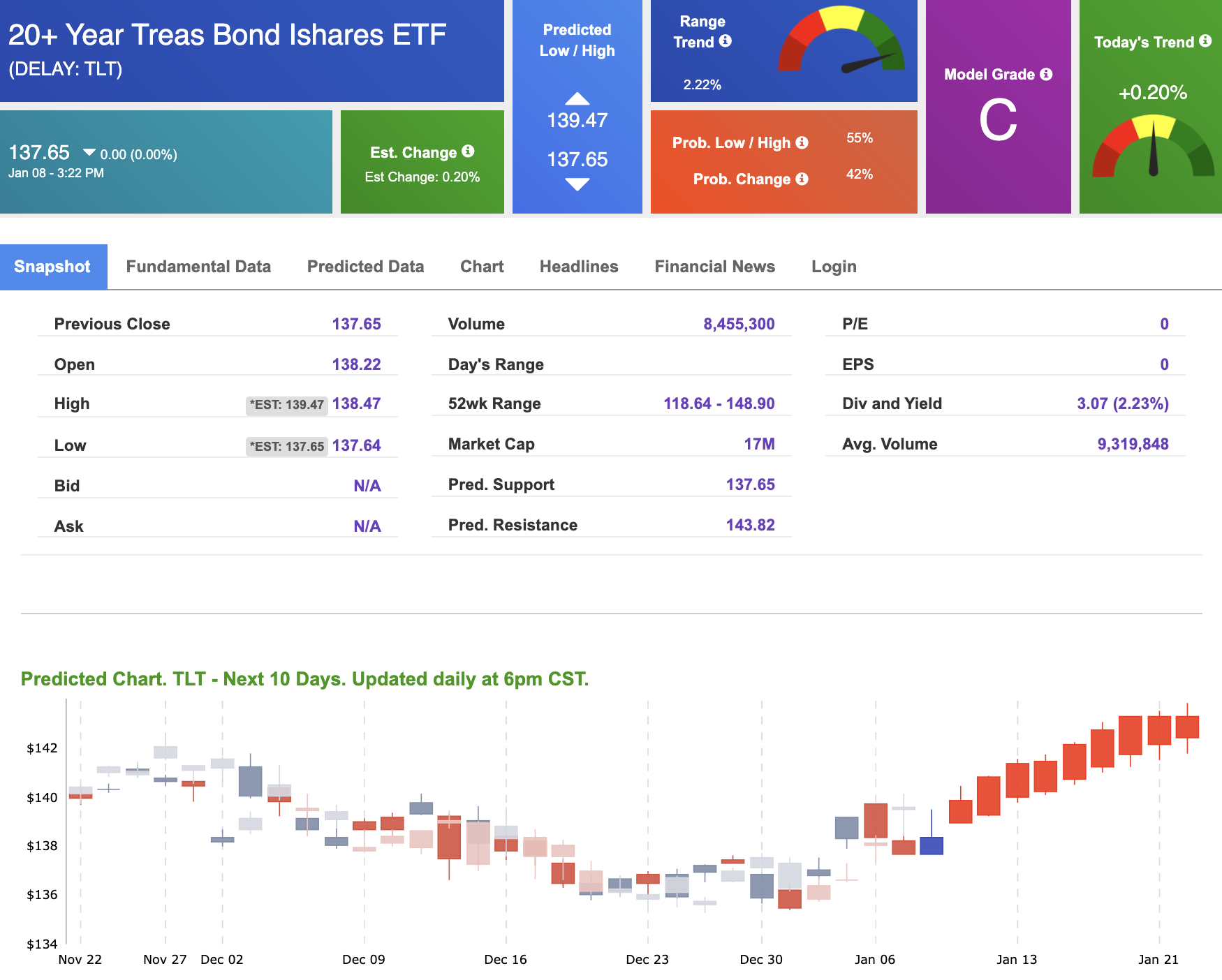

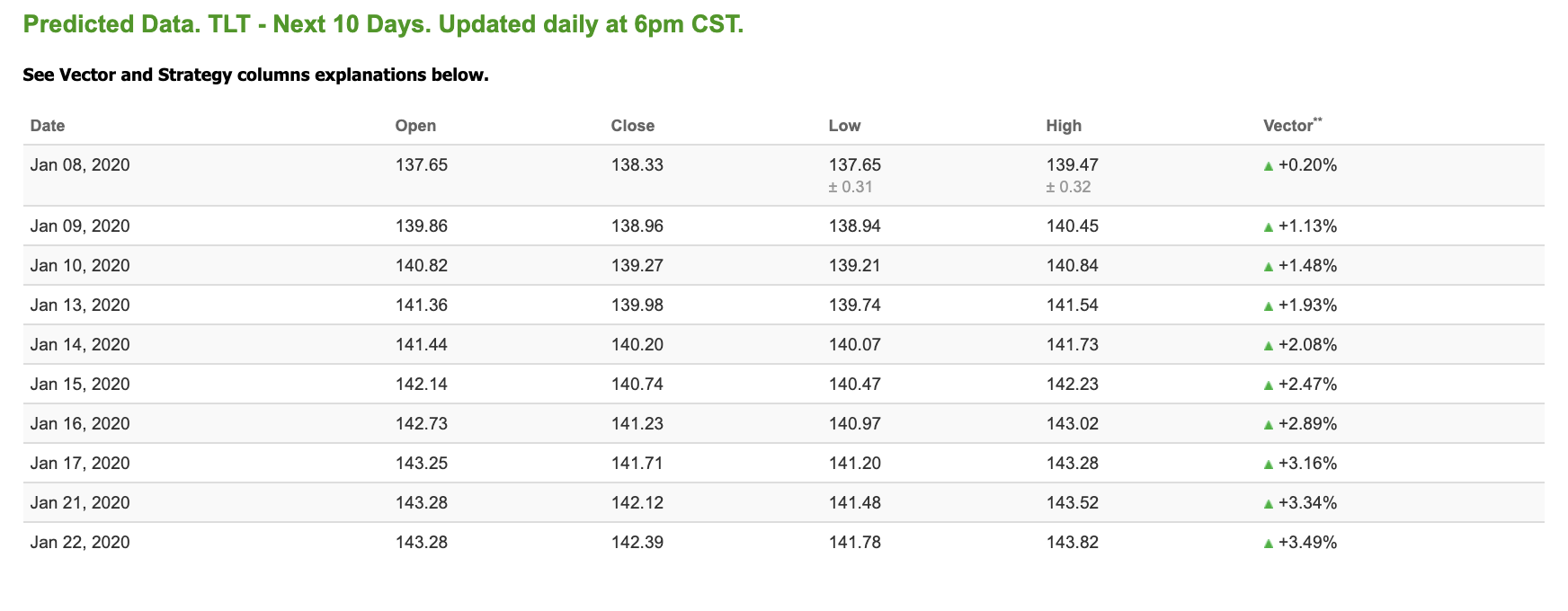

Treasuries

The yield on the 10-year Treasury note is up 1.17% at 1.81% at the time of publication.

The yield on the 30-year Treasury note is up 1.83% at 2.29% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.14% moves to 0.82% in four sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

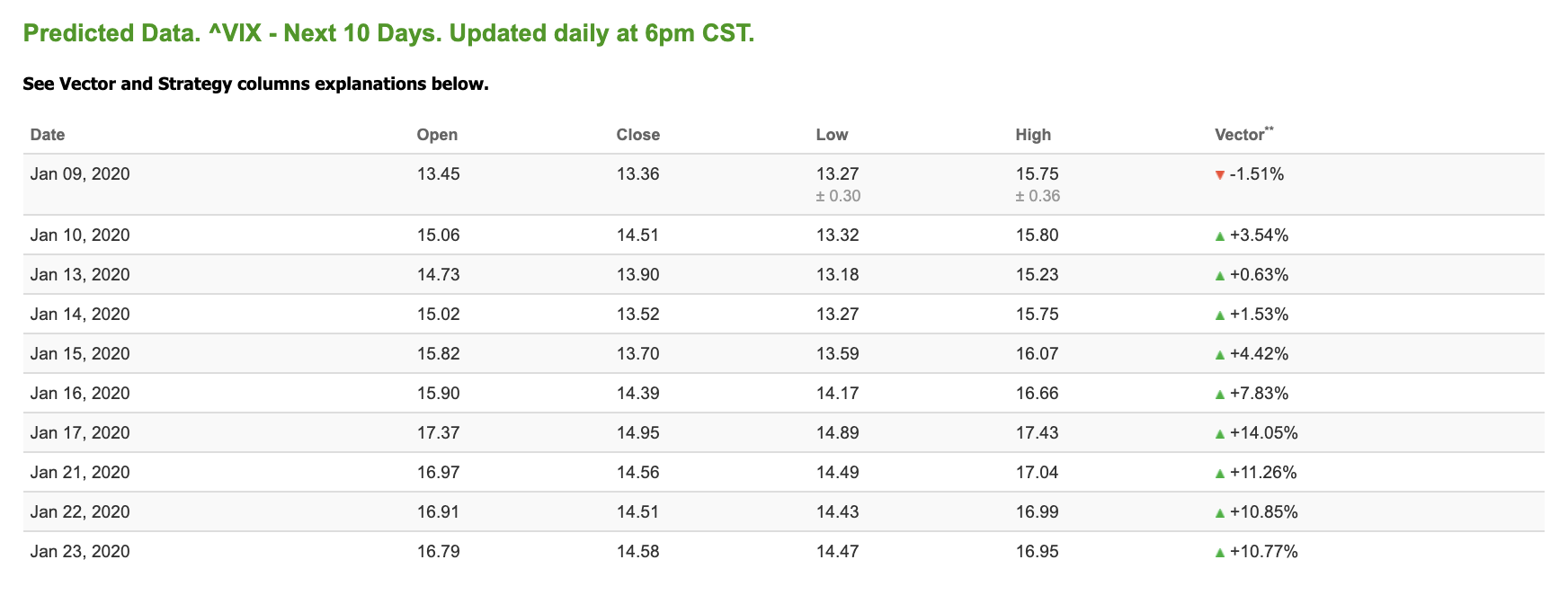

Volatility

The CBOE Volatility Index (^VIX) is $13.85 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.