U.S. Stocks and Yields Move Higher To Start Week

Dow rise impressively 7%

In the short term, the market is overbought. Although the bottoming process started, the market remains susceptible to a 10-20% selloff from the current SPY levels. Consider hedging your portfolio into the rallies until the market breaks through the $263 SPY level. Today, markets rose impressively with all three major U.S. indices trading higher; leading the pack was the Dow which saw 7% gains after closing down 2.7% for the week last week. The latest White House briefing regarding COVID-19 indicated the worst part of the pandemic could still be ahead, with the latest data showing the U.S. is nearing 400,000 confirmed cases, while also reaffirming efforts to slow the virus. Oil is seeing continued pressure while gold remains up; U.S. Treasuries reversed course today as yields moved higher, following massive selloffs in the previous month.

(Want free training resources? Check our our training section for videos and tips!)

Long-term investors can consider buying equities with dollar-cost averaging in mind as it appears the worst part of the selloff is over. Market Commentary readers are encouraged to maintain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

All three major U.S. indices closing with 7% gains

Markets surged for impressive gains today with all three major U.S. indices closing with 7% gains. Last week, markets closed lower after an up and down week which left all three indices down for the week. Still, we believe the bottoming process has started as multiple sectors saw multi0day rallies over the last two weeks. While the bottoming has started, the market remains susceptible to a 10-20% selloff from the current SPY levels.

U.S., currently reporting over 350,000 cases and 10,000 deaths from Covid

COVID remains at the forefront of the news with a growing rate of deaths and cases in the U.S., currently reporting over 350,000 cases and 10,000 deaths. White House briefings will continue to air daily as they have last week, with the latest message from D.C. indicating the worst part of the pandemic could still be ahead. Globally, both Asian and European markets traded higher, although the Shanghai Composite dipped, likely due to recent reporting of a slowdown in Spain, Italy, and China.

Several stocks booked impressive gains today, including:

- JPM +6% – JPMorgan Chase reported they have enough capital to withstand the pandemic

- W +41% – Online furniture retailer Wayfair stated online business has doubled in the last month

- BA +19% – Boeing rallied alongside other major Dow blue-chips

Also worth noting, gold and the dollar continued to trade higher while Oil saw heavy selling pressure. U.S. Treasuries reversed course, with yields up after their extended selloffs.

Key U.S. Economic Reports Out This Week:

- Job Openings (February) – Tuesday

- Consumer Credit (February) – Tuesday

- FOMC Minutes – Wednesday

- Weekly Jobless Claims (4/5) – Thursday

- Producer Price Index (March) – Thursday

- Consumer Sentiment Index (February) – Thursday

- Consumer Price Index (March) – Friday

- Core CPI (March) – Friday

(Want free training resources? Check our our training section for videos and tips!)

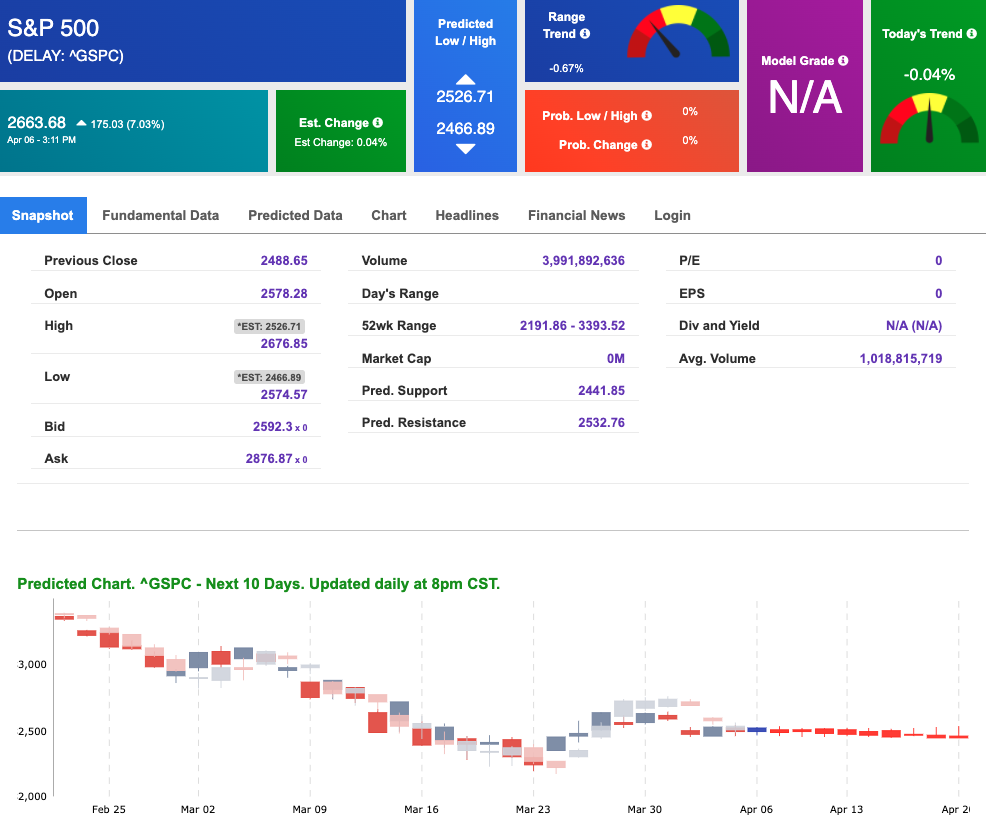

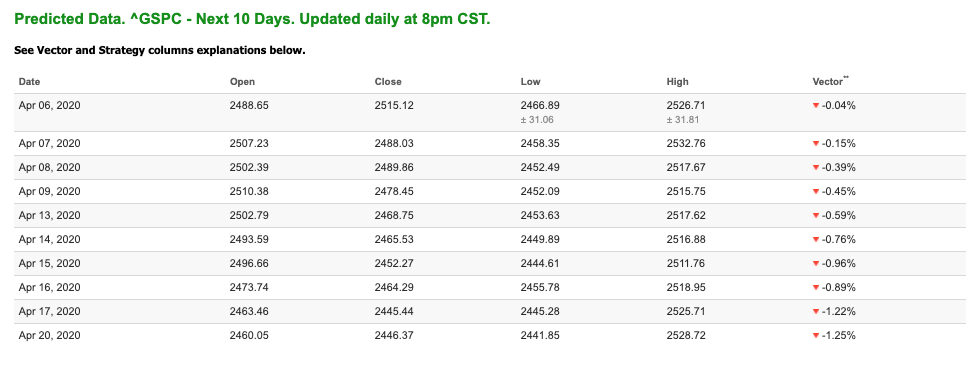

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term negative outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Highlight of a Recent Winning Trade

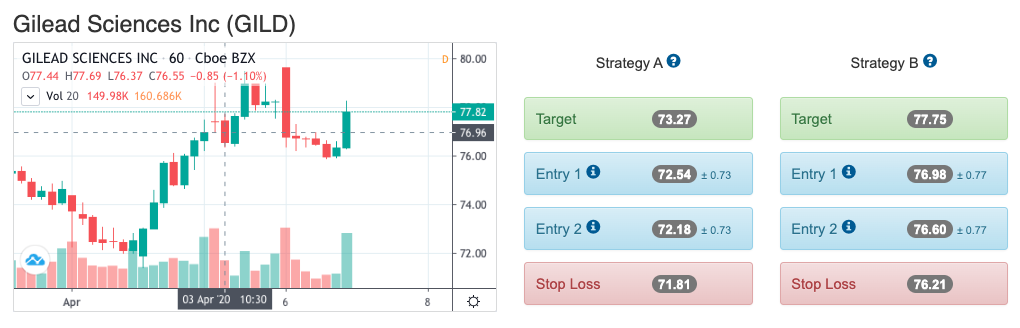

On April 3rd, our ActiveTrader service produced a bullish recommendation for Gilead Sciences Inc (GILD). ActiveTrader is included in several Tradespoon membership plans and is designed for day trading, with signals meant to last for 1-2 days.

Trade Breakdown

GILD entered its forecasted Strategy B Entry 1 price range $76.98(± 0.77) in the second hour of trading that day and passed through its Target price of $77.75 in the fourth hour of trading that day. The Stop Loss price was set at $76.21.

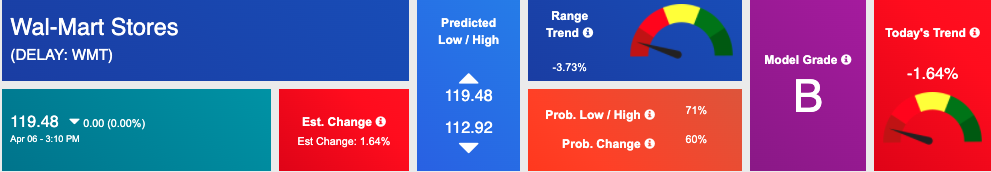

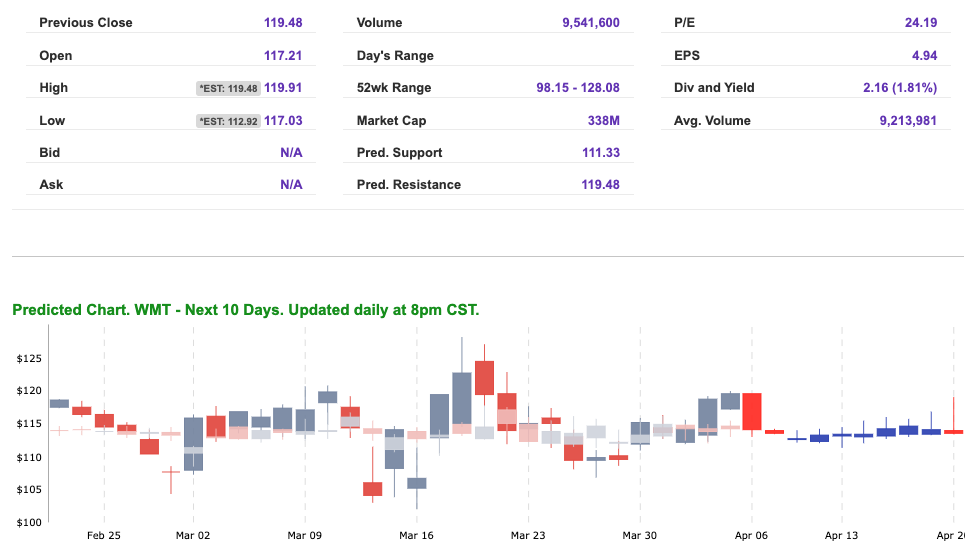

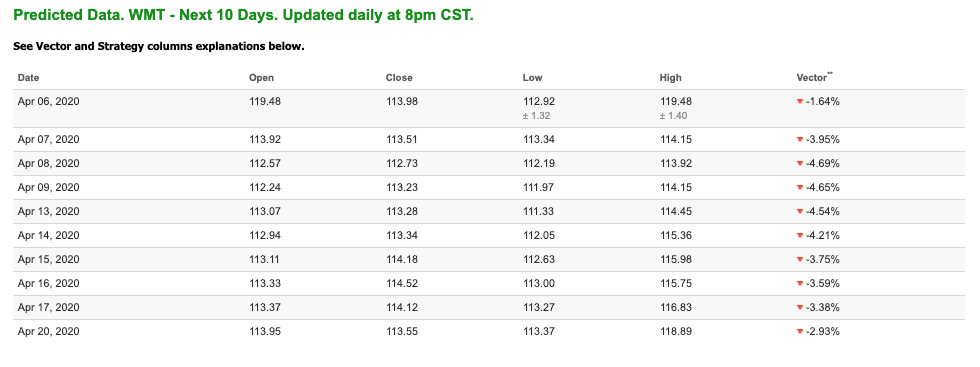

Tuesday Morning Featured Symbol

Our featured symbol for Tuesday is Wal-Mart Stores (WMT). WMT is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for current-day predicted support and resistance, relative to our entire data universe.

The stock is trading at $119.48, with a vector of 1.64% at the time of publication.

Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does not have a position in the featured symbol, WMT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

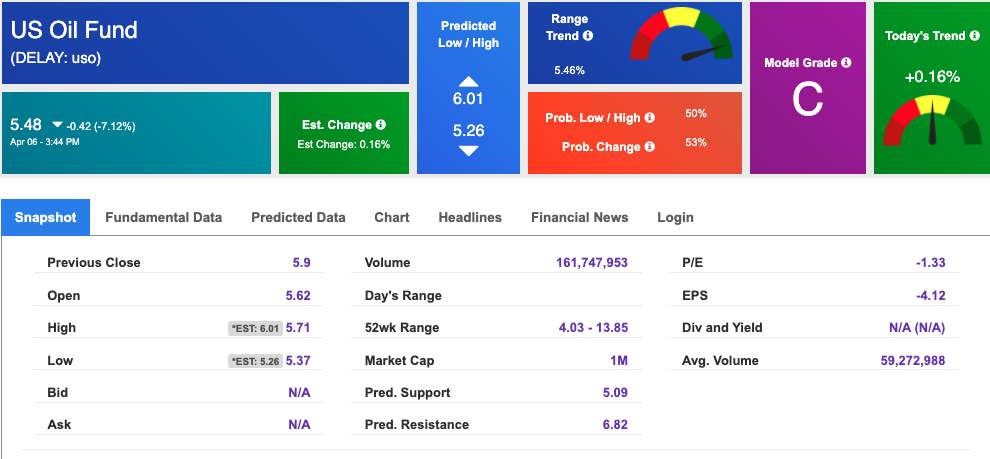

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $26.36 per barrel, down 6.99% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $5.48 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

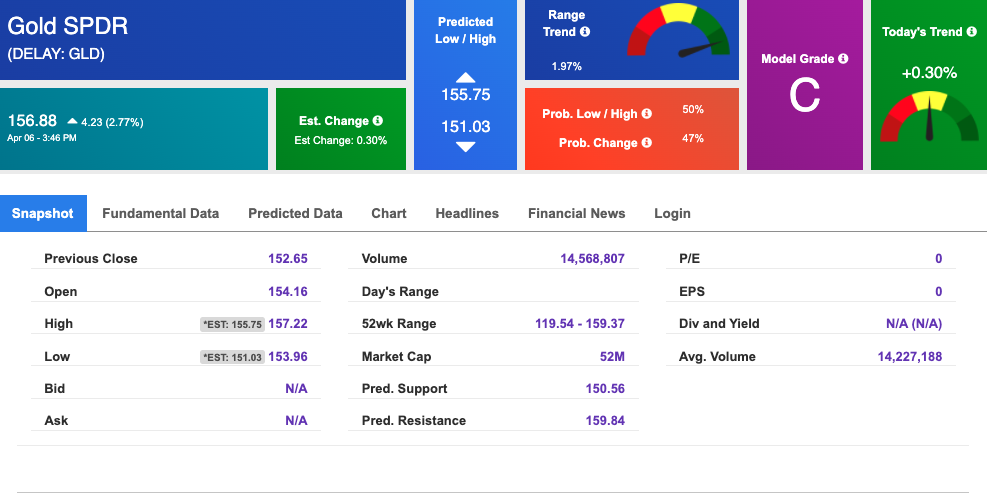

Gold

The price for the Gold Continuous Contract (GC00) is up 3.76% at $1,707.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $156.88, at the time of publication. Vector signals show +0.30% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

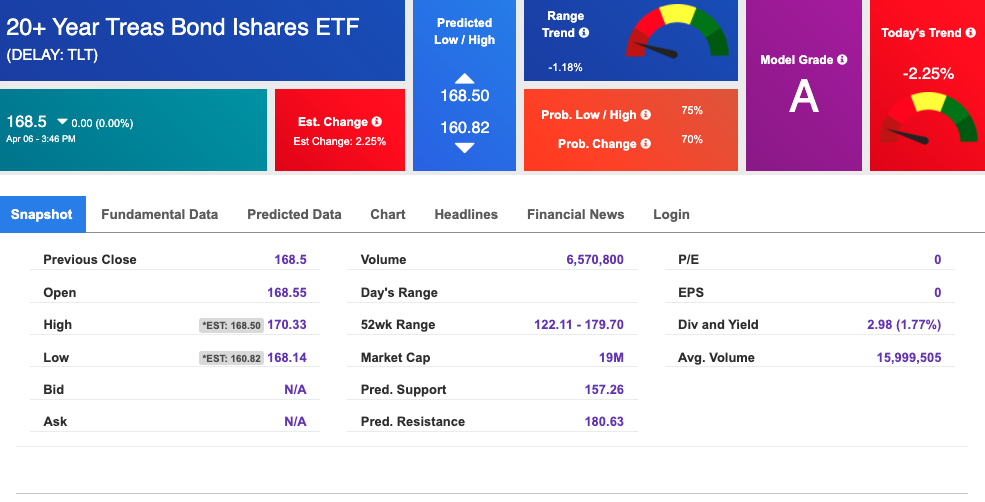

Treasuries

The yield on the 10-year Treasury note is up to 0.677% at the time of publication.

The yield on the 30-year Treasury note is up to 1.284% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

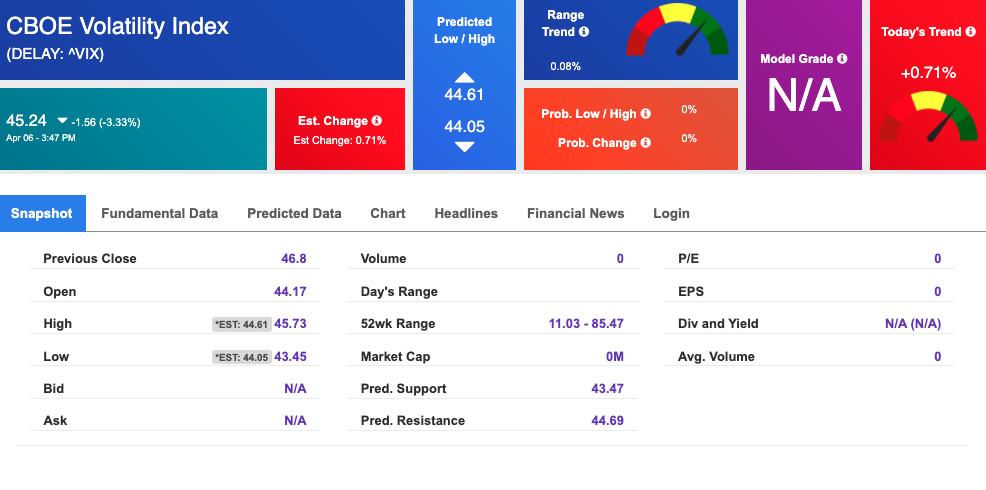

Volatility

The CBOE Volatility Index (^VIX) is $45.24 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.