U.S. Stocks Rebound Behind Strong Real Estate Data Following Formal Impeachment Bid

Nike corporate earnings and August home sales report bring optimism among investors

Major U.S. indices are recouping early morning loses and are on track to close in the green behind strong Nike corporate earnings and August home sales report.

Lack of U.S.-China trade progress will continue to weigh on markets

Yesterday, impeachment concerns shook markets as Speaker of the House Nancy Pelosi announced the formal inquiry. While long-term market fears regarding impeachment have seemed to ease today, lack of U.S.-China trade progress will continue to weigh on markets.

(Want free training resources? Check our our training section for videos and tips!)

Short-term support is near 50-days MA on SPY, $295

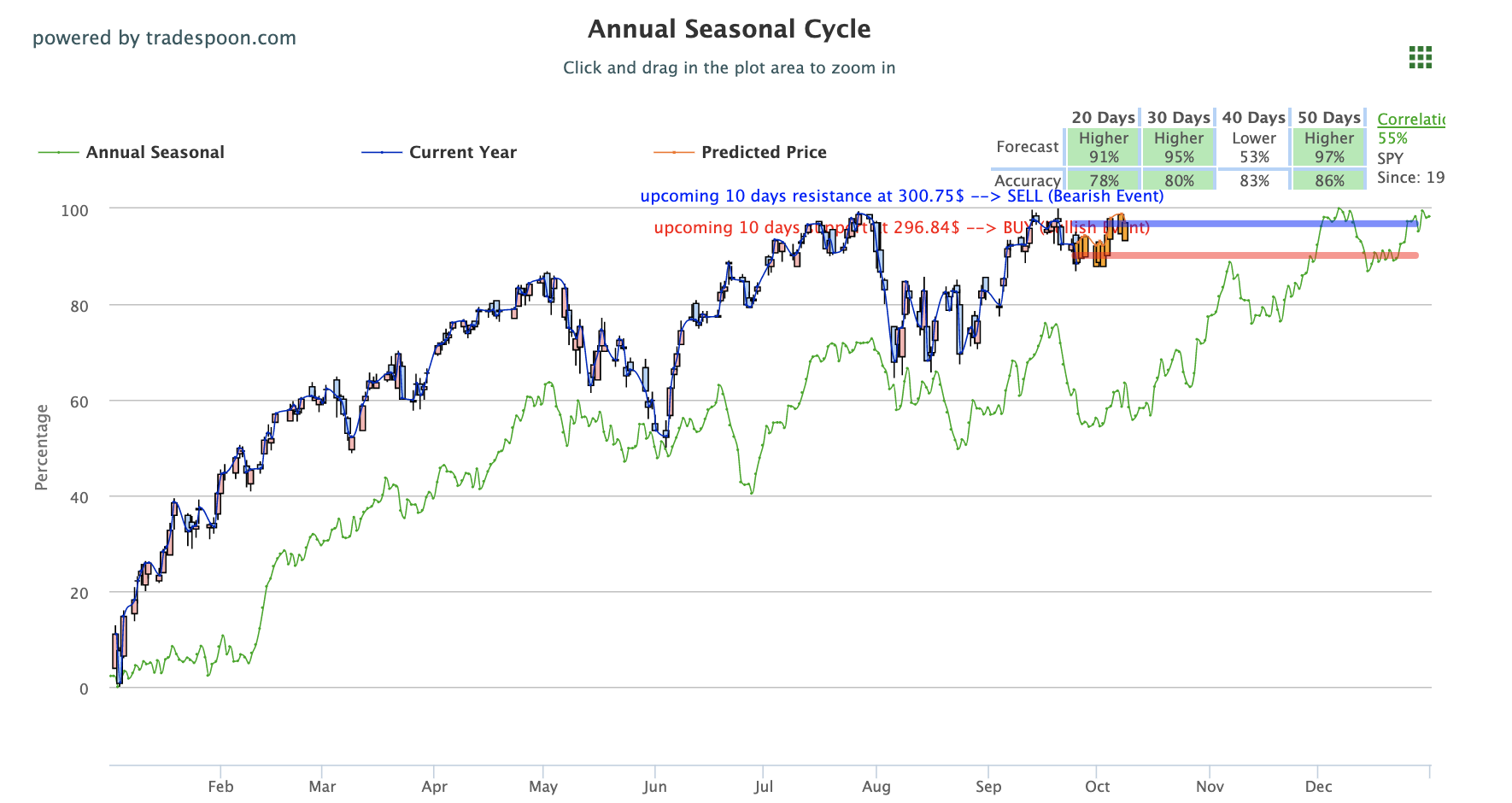

The SPY is trading between $294-$302 and we believe the market is range-bound. We do not see the potential for the market to overshoot an all-time high of $302. Short-term support is near 50-days MA on SPY, $295, and we will look to buy when SPY is near $282 and sell near $300. With further volatility expected, we encourage maintaining clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Fourth time in U.S. history impeachment had been formally presented in Congress

Markets have rebound following three straight days of trading lower amid impeachment and global trade concerns. On Tuesday, House Speaker Pelosi submitted an impeachment inquiry regarding President Trump’s comments in a White House call with Ukranian President in July. This marked the fourth time in U.S. history impeachment had been formally presented in Congress. Following the news, the White House released transcripts of the call. While long-term fears have seemingly eased today, further developments could surely affect markets. This coupled with the lack of progress in U.S.-China negotiations has affected markets poorly this week while positive economic reports continue to support it.

While earnings have been light lately, today’s Nike report provided a nice boost to the Dow after the major retailer reported earnings above expectations, sending shares up 5%. Also supporting markets today is the latest real estate data which shows a 7% rise in U.S. house sales in the last month. Phillip Morris is seeing shares up over 6% following news their merger talks with Altria Group have ended. Tomorrow, look for GDP revision, weekly jobless claims, and August pending home sales index to release and dictate markets.

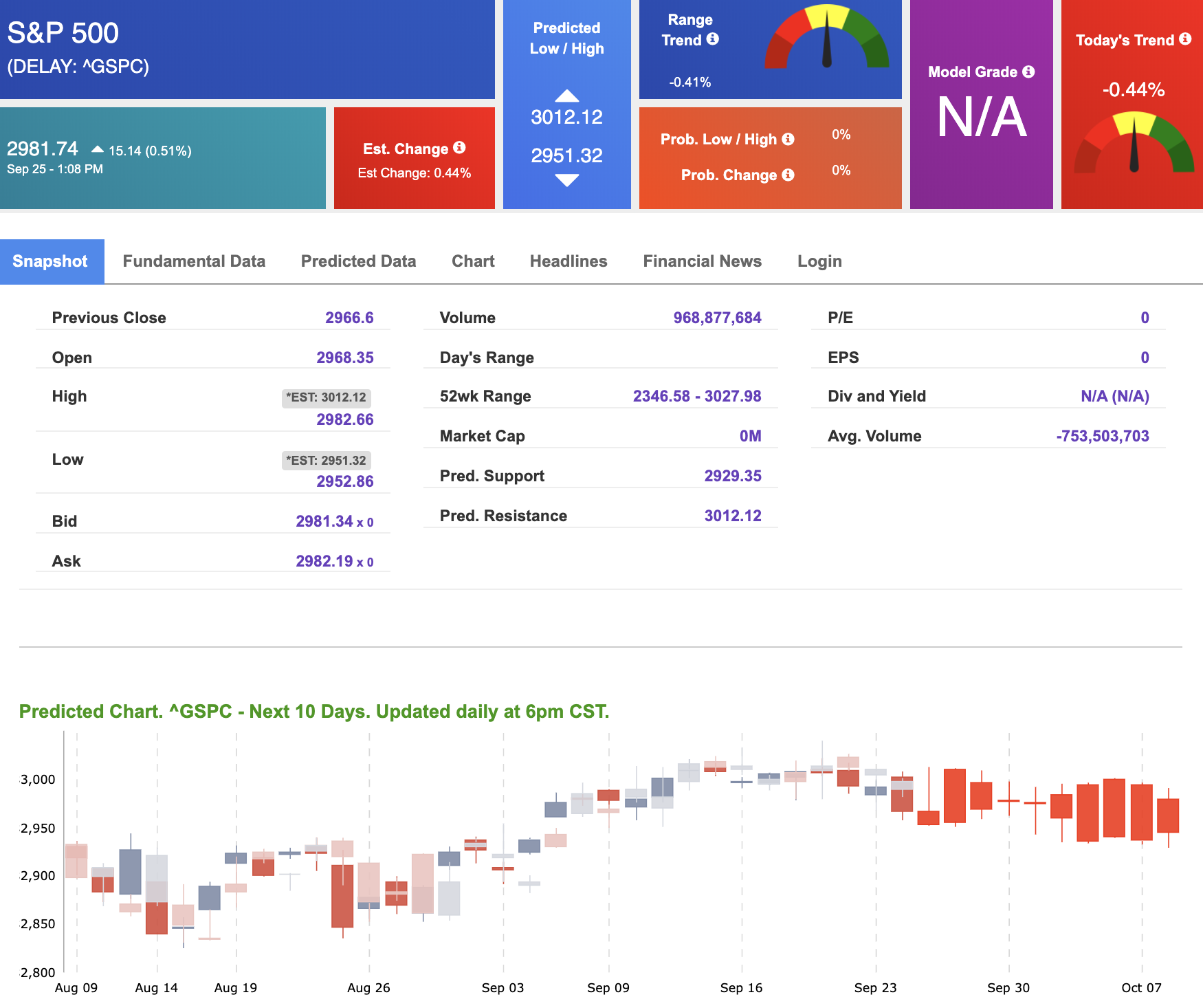

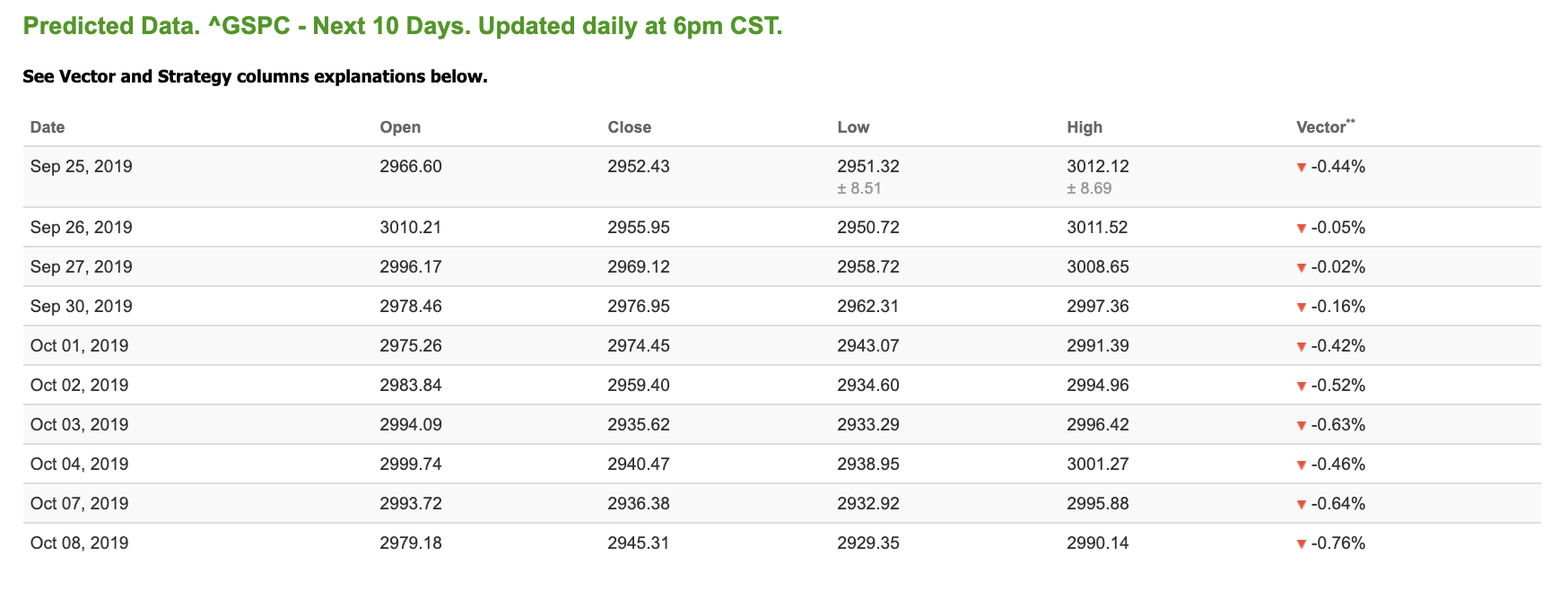

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows negative signals. Today’s vector figure of -0.44% moves to -0.52% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock-in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,314%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,414,472

-

Tradespoon Premium is the only trading service you’ll ever need.

CLICK HERE TO SIGN UP

Highlight of a Recent Winning Trade

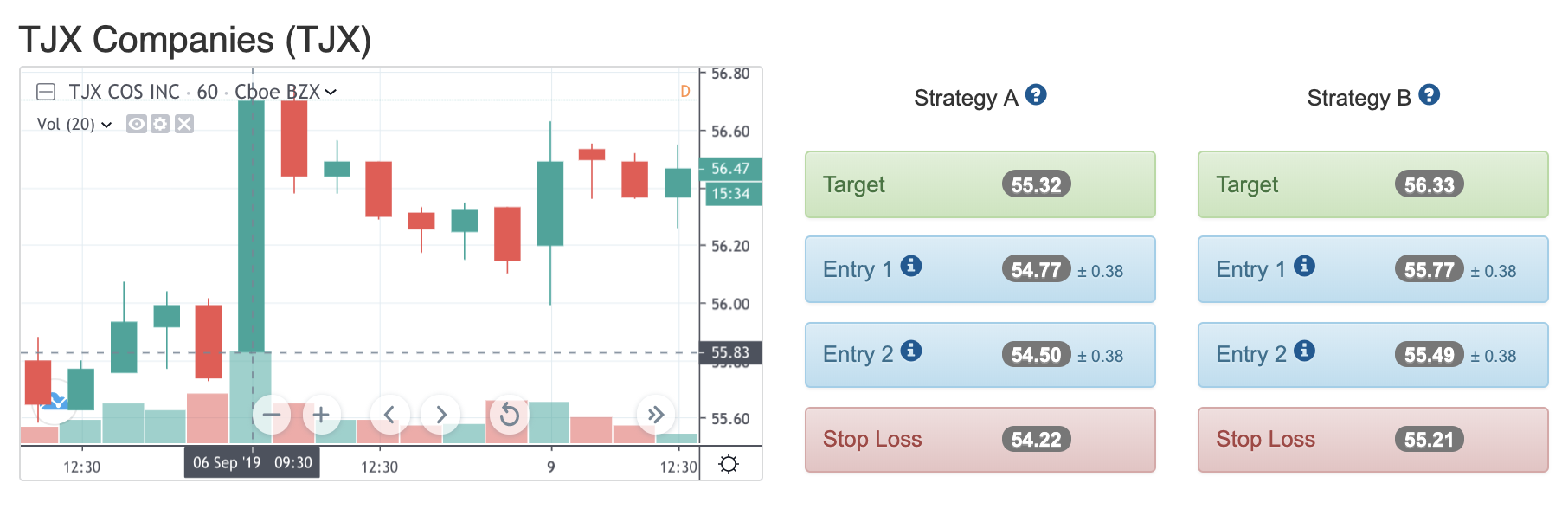

On September 6th, our ActiveTrader service produced a bullish recommendation for TJX Companies (TJX). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

TJX entered its forecasted Strategy B Entry 1 price range $55.77 (± 0.38) in its first hour of trading and passed through its Target price $56.33 in the first hour of trading that day. The Stop Loss price was set at $55.21

Thursday Morning Featured Symbol

*Please note: At the time of publication we do own the featured symbol, VXX. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

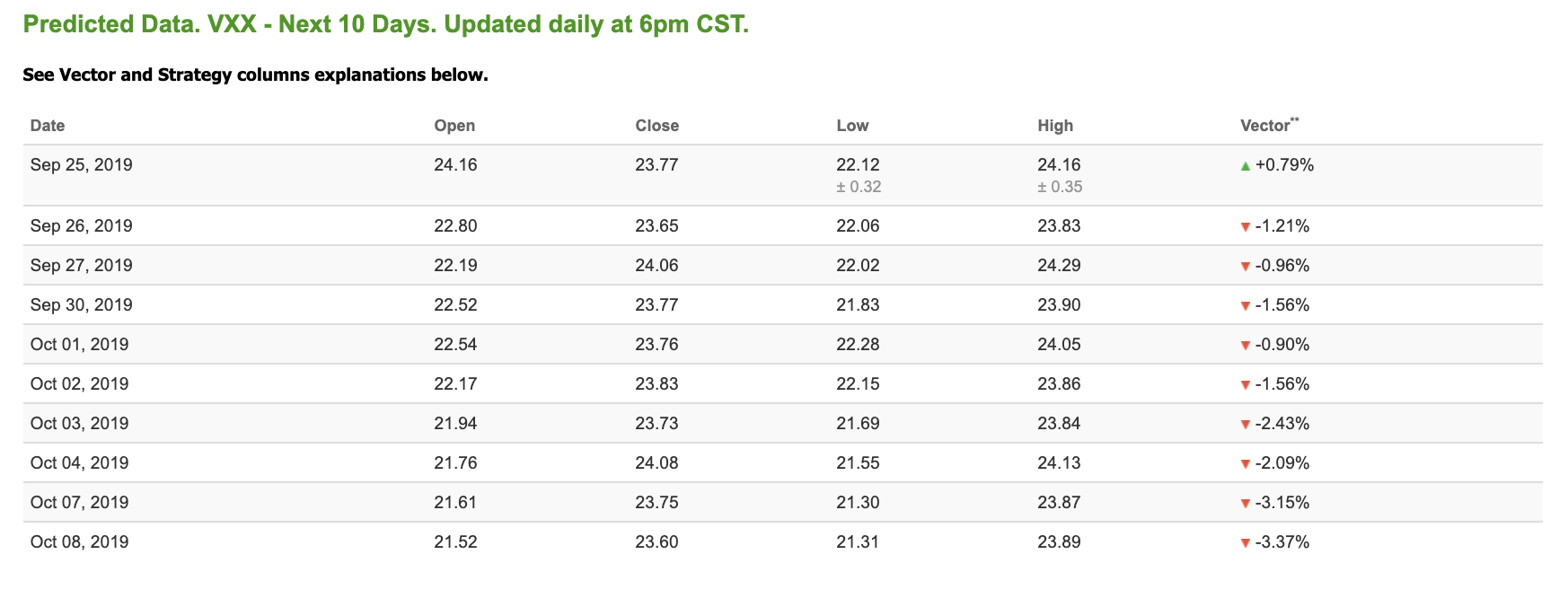

Our featured symbol for Thursday is iPath S&P 500 VIX Short-Term(VXX). VXX is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (C) indicating it ranks in the top 50th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $23.66 at the time of publication, down 2.07% from the open with a +0.79% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $56.17 per barrel, down 1.95% from the open, at the time of publication.

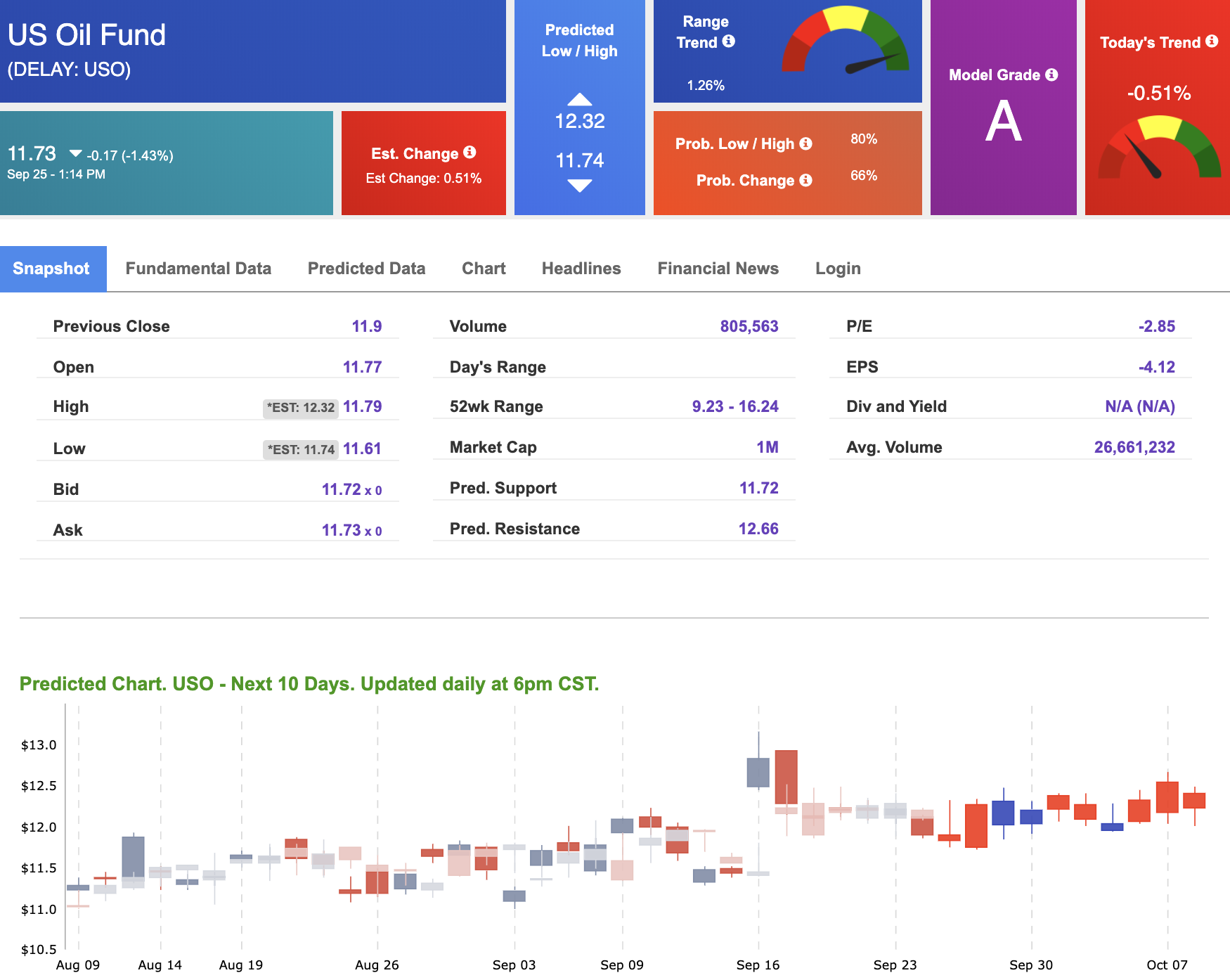

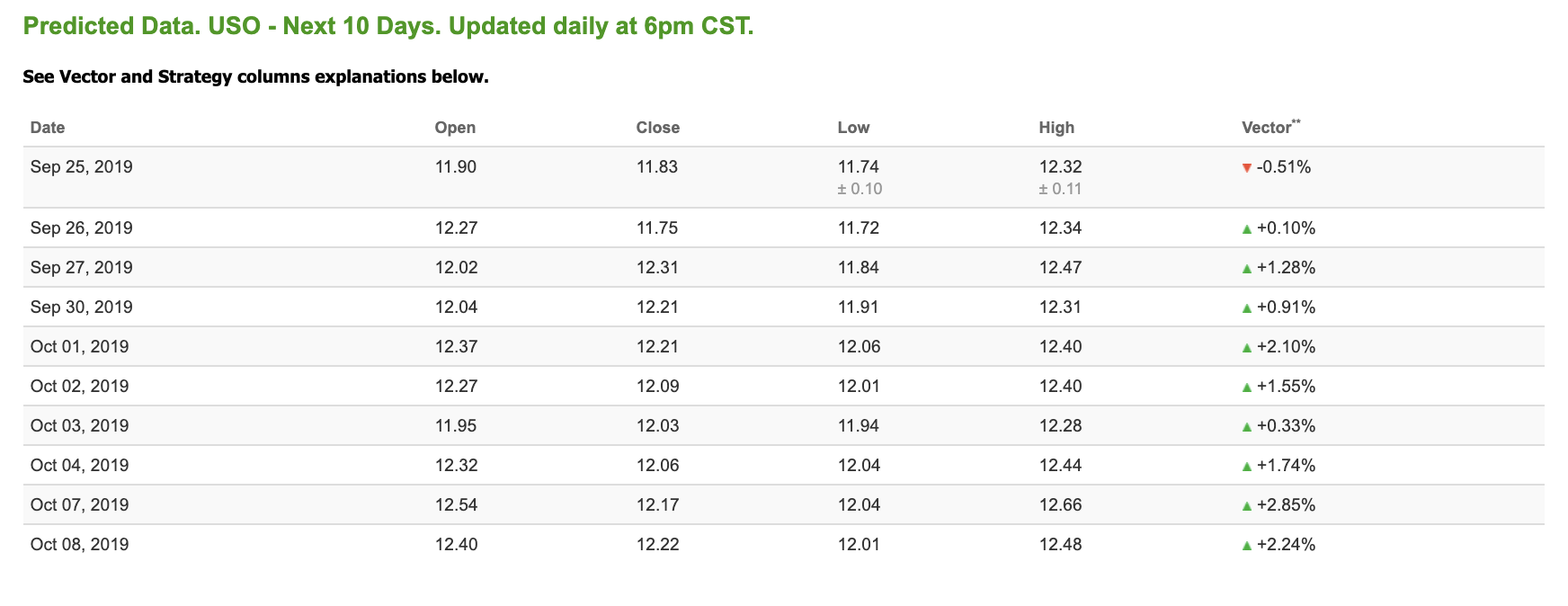

Looking at USO, a crude oil tracker, our 10-day prediction model shows mostly positive signals. The fund is trading at $11.73 at the time of publication, down 1.43% from the open. Vector figures show -0.51% today, which turns +1.55% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

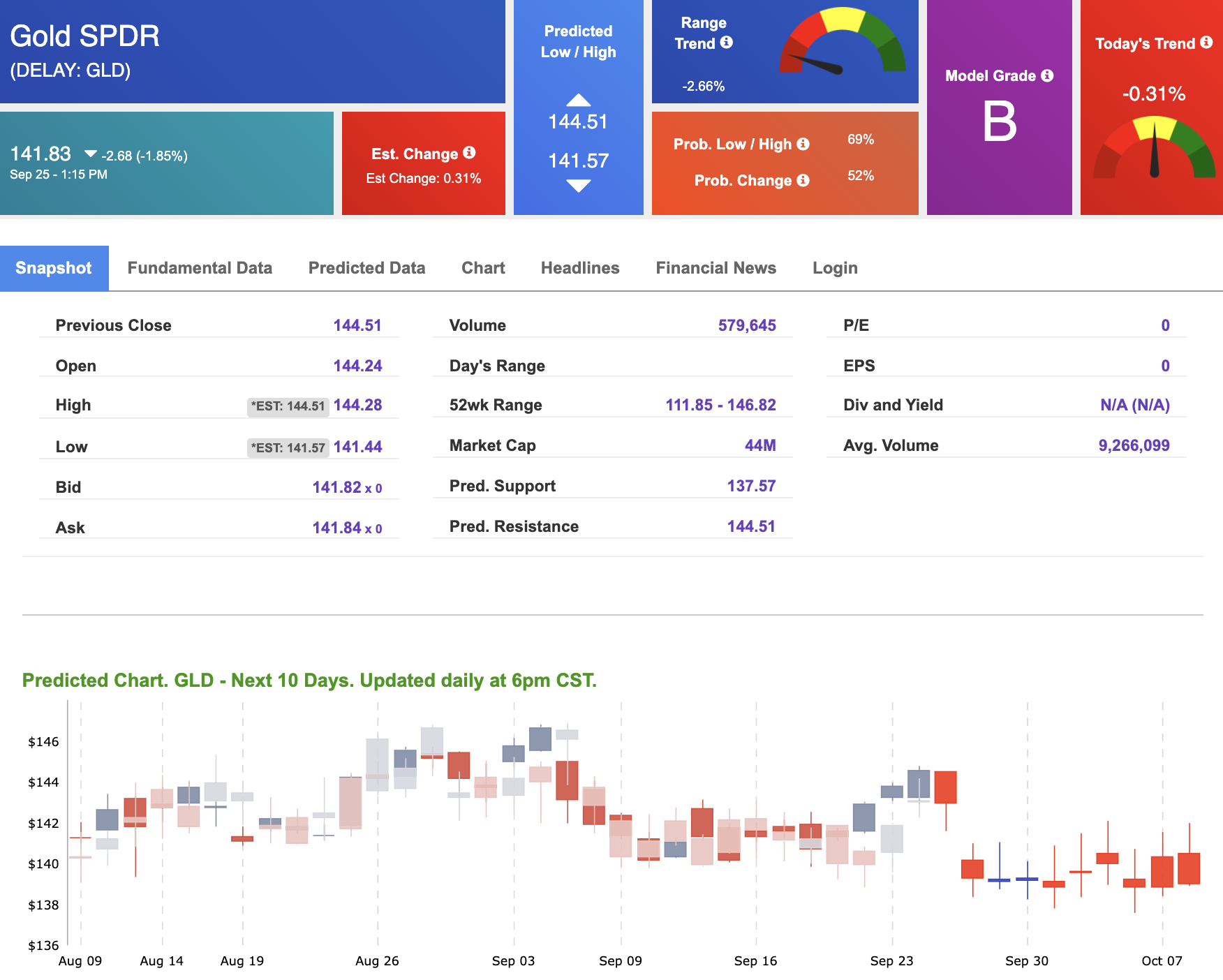

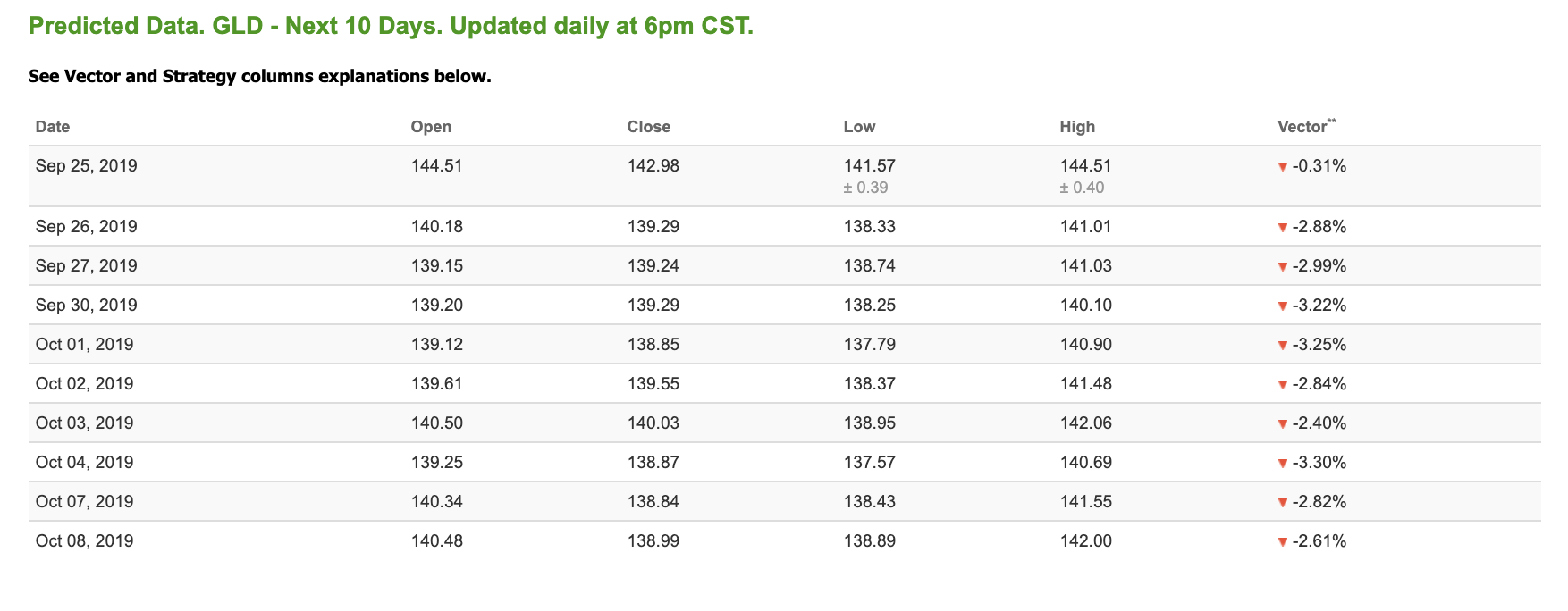

Gold

The price for the Gold Continuous Contract (GC00) is down 1.84% at $1,511.80 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows negative signals. The gold proxy is trading at $141.83, down 1.85% at the time of publication. Vector signals show -0.31% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

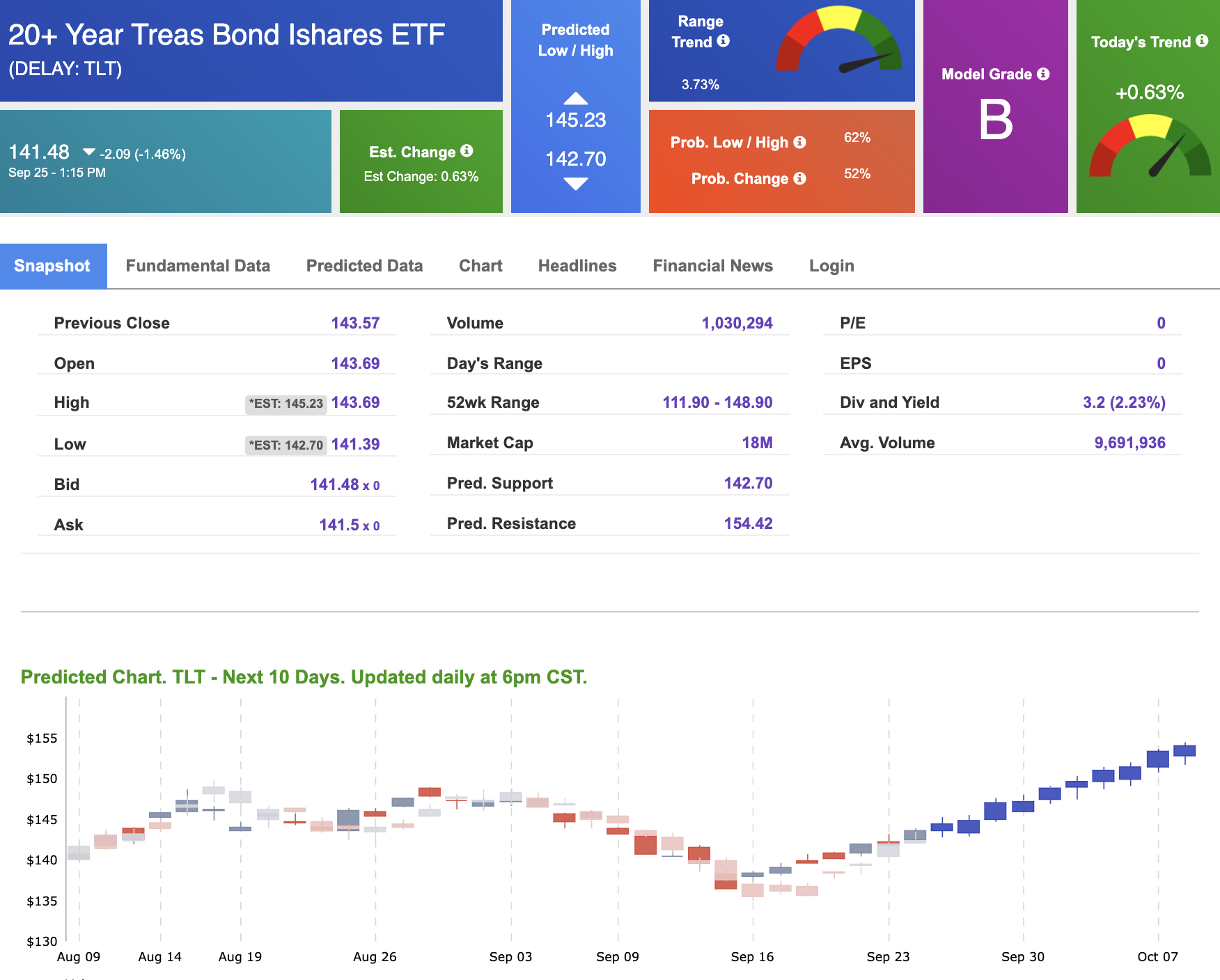

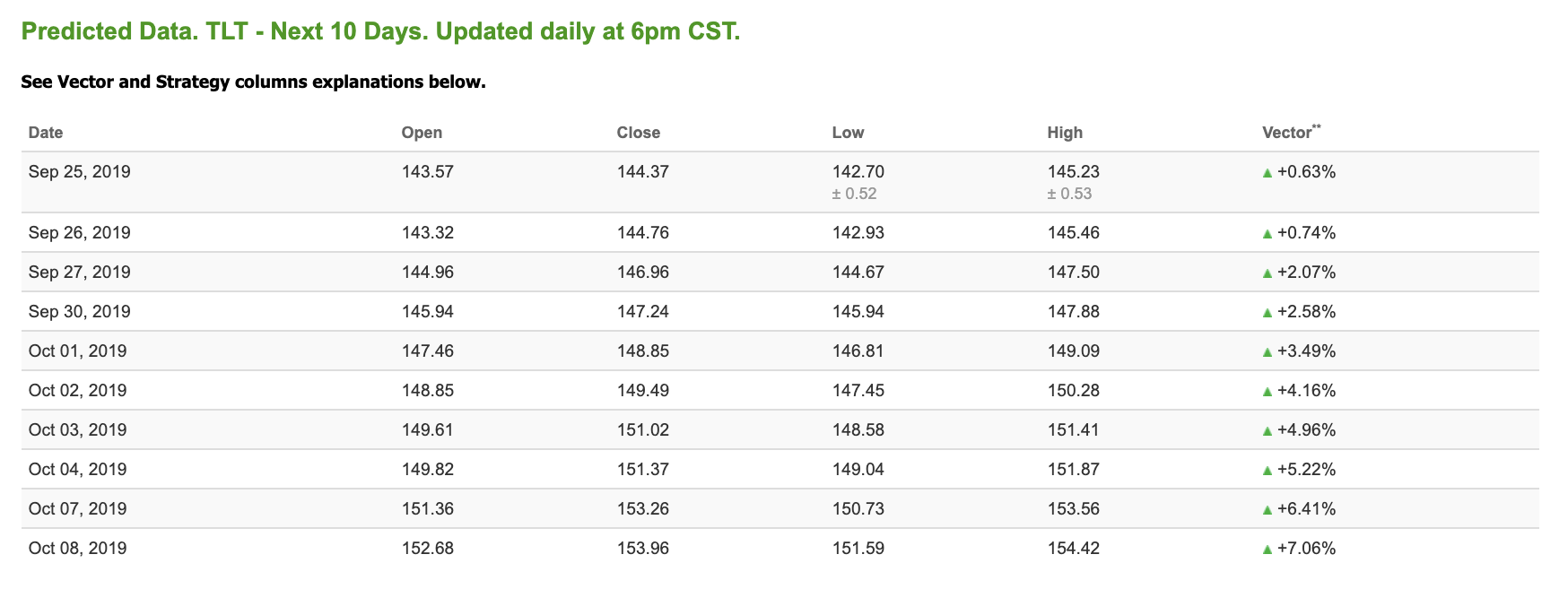

Treasuries

The yield on the 10-year Treasury note is up 4.34% at 1.72% at the time of publication. The yield on the 30-year Treasury note is up 3.24% at 2.17% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.63% moves to +2.58% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

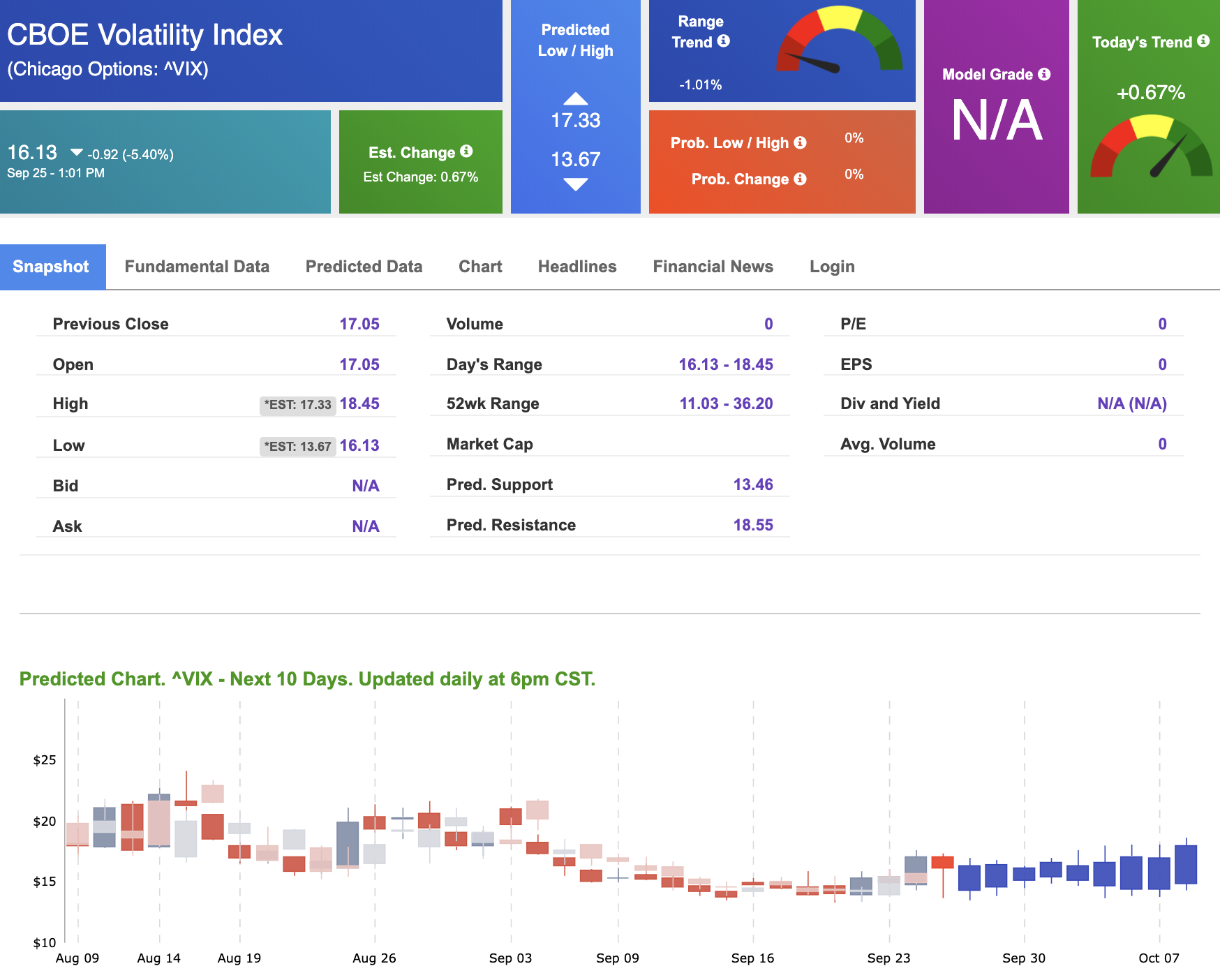

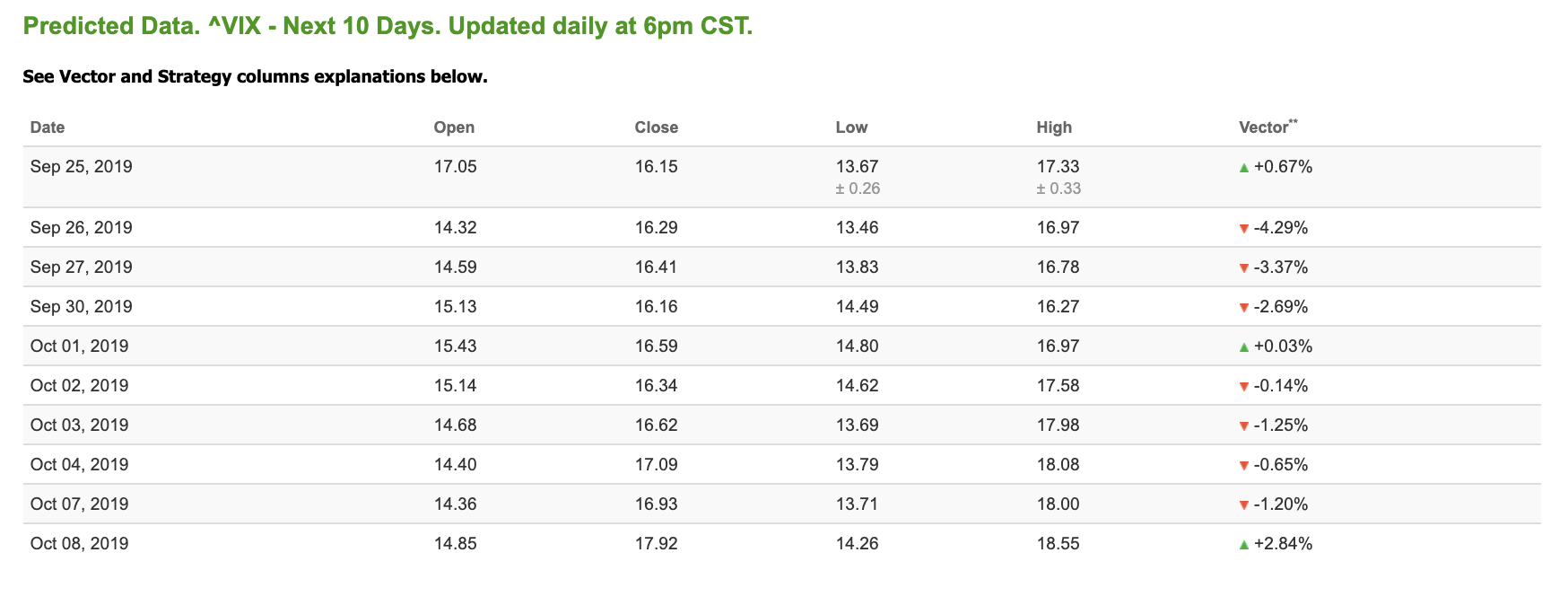

Volatility

The CBOE Volatility Index (^VIX) is down .61% at $22.36 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $16.29 with a vector of -4.29%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock-in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,314%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,414,472

-

Tradespoon Premium is the only trading service you’ll ever need.