Vlad’s Timely Emerging Market Trade To Buy Now

RoboStreet – January 20, 2022

Emerging Markets Are Back In Fashion

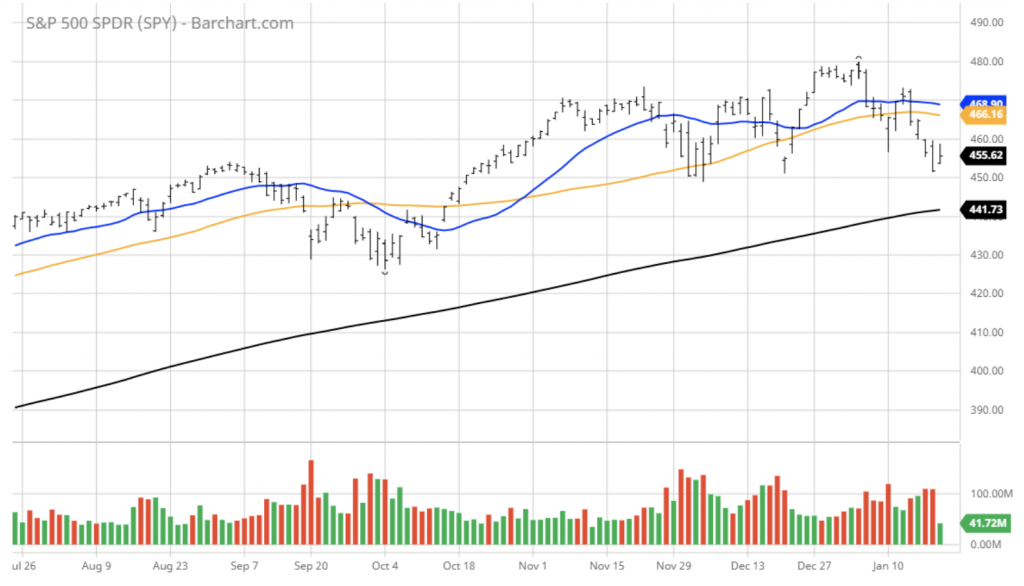

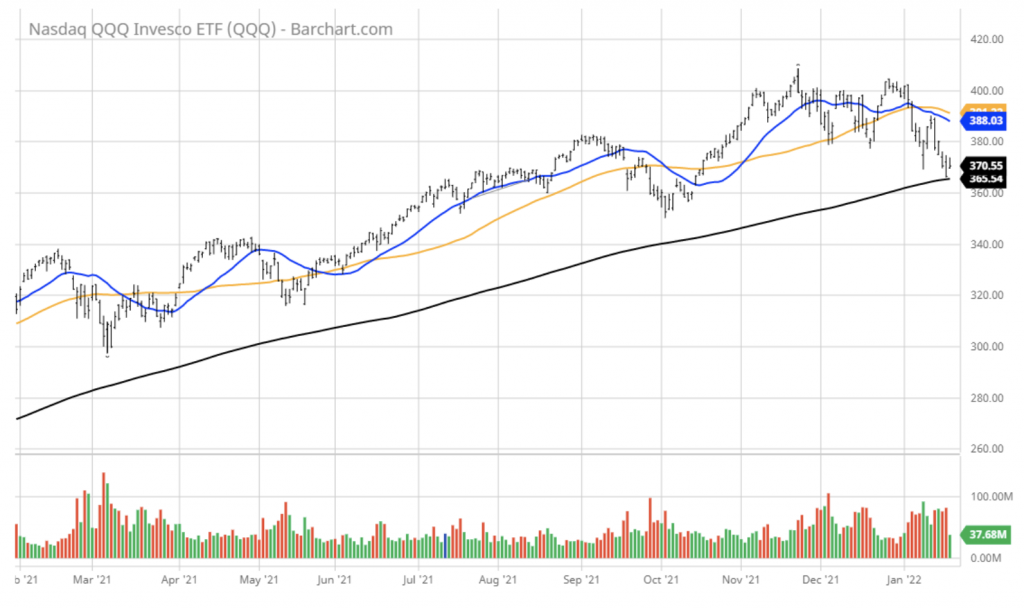

All eyes are on the moving averages for the Dow, S&P, and the Nasdaq 100, of which all three are holding above their respective 200-day moving averages. Bond yields made a sudden adjustment higher that incited a reset for growth stocks. There is a growing narrative that corporate profit growth will slow at the very same time that the Fed is embarking on tighter fiscal policy that includes the exit of QE, the raising of the Fed Funds Rate by four hikes, and the reduction on the Fed’s balance sheet.

These three measures drain liquidity from the financial system at a time when wage and commodity inflation are stubbornly high. These concerns have been getting priced into the market for the past week as all sectors of the market have retreated with the exception of energy as WTI crude has topped $87/bbl and precious metals are seeing strong buying interest.

It’s early in the earnings reporting season, but already about 70% of companies posting their fourth-quarter results are coming in above estimates as reported by Bob Pisani on CNBC Wednesday. Alcoa Corp. (AA) put up strong numbers, its shares trading higher by 7%, and is a proxy for the materials sector that is enjoying strong pricing. It speaks to the point that there are good places to invest where inflation serves as a tailwind.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

The $SPY continued to trade lower, down 1.0% at $450, and right at the December low. The value/reflationary closed lower, down 0.9% approaching the 50 DMA. The technology sector ($QQQ) is at the 200 DMA, closed down 1.1%.

The $DXY is resuming its downtrend and approaching the key long-term breakout level of $94.5. The $TLT briefly reversed its vertical move down, up 0.7%, and closed below the 200 DMA. $TLT is approaching an extremely oversold level. The $VIX traded higher, at 24 level.

The $SPY short-term support level is at $450 (key medium-term support) followed by $440. The SPY overhead resistance is at $460.

The $QQQ the second wave of the sell-off is approaching the end and has reached the 200 DMA, worst case scenario the October low, $350. I would be a seller of the high beta stocks into the rallies and continue rotating the portfolio into the value stocks ($XLE, $XLI, and $XLF). Since the DXY broke the long-term bull trend, I would accumulate $EEM, $XME, $SLV, $FCX.

The $VIX has never reached the “extreme” levels, and one should expect $SPY to reach the $440 level in the next two weeks. Short-term the $SPY is oversold and due for a rebound in the next few trading sessions.

I would consider rebalancing portfolio at this time and have an overall market BULLISH portfolio. I do expect the $SPY sell-off to come to an end in the next 1-2 weeks, followed by a rebound in the next 1-2 months.

If you are trading options consider selling premium with March and April expiration dates. Based on our models, the market (SPY) will trade in the range between $450 and $480 for the next 2-4 weeks.

The rally in the dollar that has gone back to last June has exhausted itself. After bottoming at 89.53 the Dollar Index (DXY) topped out at the end of December at 96.94 and is now beginning to fade. Currently trading at 95.65, the first level of technical support is down at 93.30 and then down at 92.00.

Coming into 2022, the market had already priced in three rate hikes, hawkish Fed rhetoric, and the latest inflation data came in only a 0.1% higher for both PPI and CPI in December, that too, was absorbed going into the release. Hence, the impetus to push the greenback higher has waned as the market sees most of the threat of headline inflation is priced in.

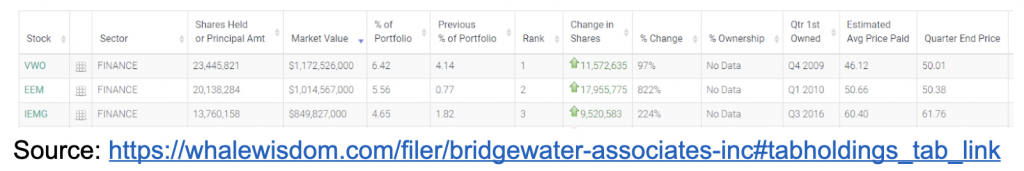

This being the base case for a lower dollar sets up a bullish trade for emerging markets that largely benefit from a weaker dollar that boosts the value of local currencies and thus overseas buying power. It’s a good setup for the leading ETFs in the emerging market space that include EEM, VWO, and IEMG, all of which sport dividend yields between 1.9%-2.9% and have pivoted higher this past week against a down tape.

I find it interesting that at the end of the third quarter, Ray Dalio’s Bridgewater Capital, the largest hedge fund in the world, had these three noted emerging market ETFs as its top three holdings. We won’t know if he has modified those positions in the fourth quarter until the 13-F filing is released in February, but it is a notable maneuver in their portfolio and one that is starting to work in their favor.

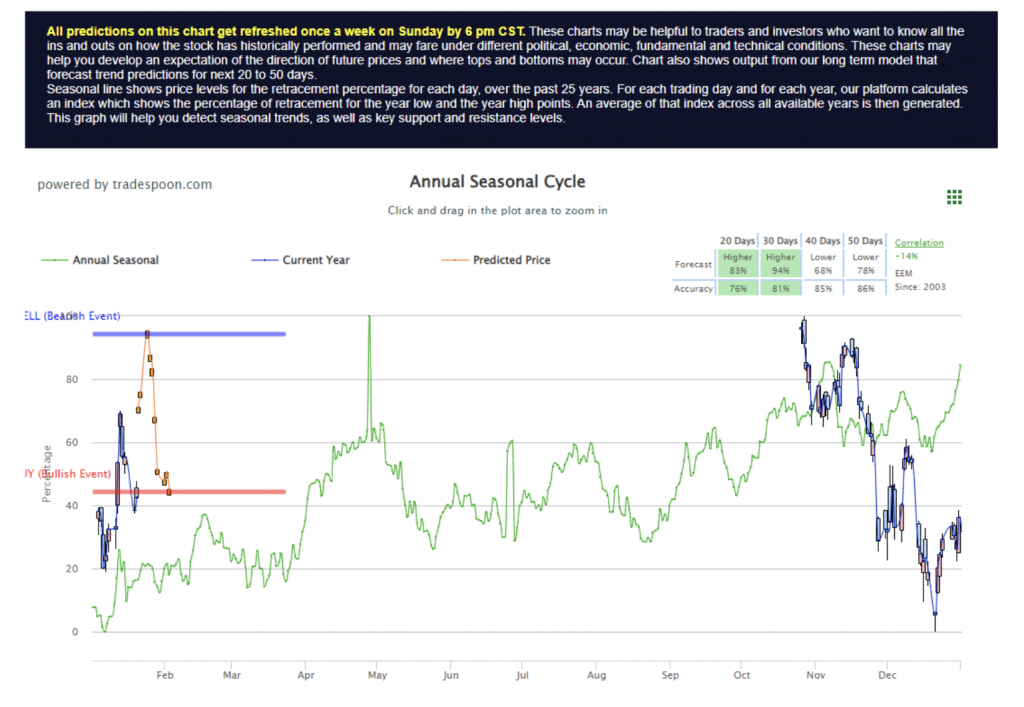

Bolstering the bullish case for the emerging market trade is confirmation from our Tradespoon proprietary AI platform where our algorithms within the Seasonal Chart are flashing a “Higher” indicator for EEM over the next 20 and 30-day periods. While it’s nice that Mr. Dalio is “all-in” on this trade, it’s even sweeter when we get a strong AI confirmation that is foundational to our conviction about whether we should add EEM or the other emerging market ETFs to our RoboInvestor model portfolio.

In a dicey market landscape, such as the present, the power of AI becomes incredibly valuable, as it removes a great deal of guesswork. Our RoboInvestor advisory service ferrets out the highest quality trades in all asset classes. Our AI tools identify high-probability trades in blue-chip stocks and ETFs that represent market indexes, the 11 major market sectors, multiple sub-sectors, commodities, precious metals, currencies, interest rates, and shorting opportunities by use of inverse ETFs.

RoboInvestor is an unrestricted system that allows us to provide our members various trades where relative strength is presently coupled with predictable momentum indicators that can identify the likely length of a directional move. These indicators and signals are updated constantly as our AI platform is always thinking, always crunching data, and always learning to refine its ability to give us that high-tech edge against the elements of uncertainty and volatility.

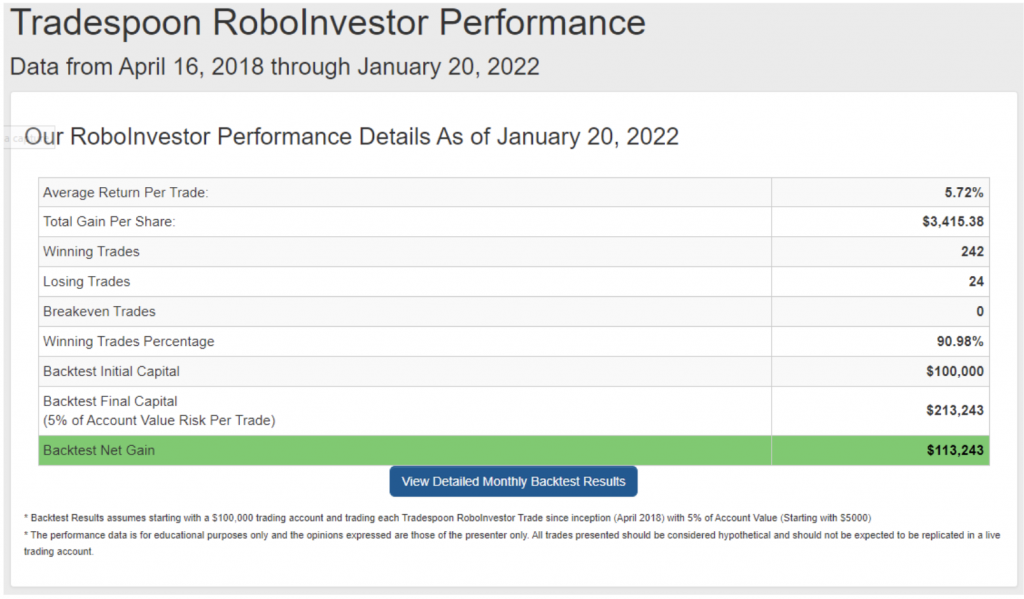

Within the RoboInvestor service, our members receive an online newsletter every two weeks, sent over the weekend, with two new recommendations they can act on come the opening bell Monday morning. Investors are thrilled to have fresh ideas with the high-probability money-making potential to put to work. There are always opportunities for profits and having the power of AI find those opportunities never leaves our members without somewhere to put capital to work. Through the use of our AI tools, RoboInvestor has demonstrated a highly-disciplined methodology with a Winning Trades Percentage of 90.98% going back to early 2018.

The model portfolio will have between 15-25 positions working, depending on market conditions. Lately, we have held fewer positions in light of the broader weakness in the Nasdaq and Russell 2000. Our current exposure to energy, banks, industrials, metals, and materials is where the market is most supportive of.

If the first three weeks of January are any indication of the road ahead for the market, then consider putting RoboInvestor to work to help guide your portfolio going forward. I personally invest alongside our members with my own capital in each and every recommendation. We’re on the same journey to growing our wealth consistently month-after-month, year-after-year that we intend to sustain well beyond 2022. Take us up on our highly affordable offer and let’s have a good year investing together.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.