What’s Next for Netflix?

RoboStreet – October 17, 2018

Earnings Season a Counter Lever to Global Jitters

With the market on the verge of a meaningful shift in investor sentiment, earnings season arrived right on time with early indications that key support levels will hold and the bull trend will continue on. Since the market is dominated by program trading that is triggered at various technical levels, the fact that the S&P 500 held its ground as per the 50-week moving average (blue line) worked to have the shorts cover and the longs to get longer. It was quite the reversal day.

Tuesday’s rally was a quintessential oversold rebound on the back of some much-needed upbeat earnings and forward guidance. The primary catalysts in my view were Adobe Systems guiding to 20% revenue growth for 2019 in conjunction with stellar earnings from Johnson & Johnson, UnitedHealth Group, and Goldman Sachs. After the close Netflix, CSX Corp. and Lam Research all posted strong Q3 results that fortified and lent credence to the strong session, which argues that the recovery rally has legs.

The one thing that was missing from the rally was volume. A strong rally needs to be associated with heavy volume, so we need to monitor this closely in the days ahead and look for all the money that ran into short durationtreasuries and money-markets to come back into equities as evidence the bull market is alive and well. Thursday’s down session is tied to the further sell off in China and pullout of key U.S. companies and officials, like Treasury Secretary Mnuchin,from the Saudi Arabian investment conference due to the events surrounding the disappearance of Washington Post contributor Jamal Khashoggi, last seen in the Saudi consulate in Turkey.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Looking at how our RoboInvestor Portfolio is positioned, we’ve been taking full and partial profits all the way up with the rally that ran selling pressure two weeks ago and aside from Tuesday’s rally, has yet to find fresh sponsorship. Most all of our positions are profitable, but the recent action has had a notable impact on short-term performance with stocks struggling to trade higher on good news.

Of the 18 positions we are long, Square Inc. (SQ) trades well below our mental 10% stop loss level. The announcement on October 10 of the pending departure of the company’s CFO Sarah Friar caused a sharp decline in the shares to $65 where the stock caught a bid and now trades at $75. Nothing has changed with the fundamentals of the company in my view and thus we should see the stock trade back up to new highs when the market stabilizes and Square’s earnings are released on November 11.

In most cases, I’ll adhere to a 10% stop loss threshold, but when algorithms force stocks lower, I’m of the view that great stocks should be given the benefit of the doubt as long as the long-term market bias is bullish, and I believe it is. There is a good chance we retest the lows seen on October 11, but I do look for the market to challenge the 52-week highs by year-end.

I’ve also let our market hedge, the Barclays Bank PLC iPath S&P 500 VIX Short-Term Futures ETN (VXX) trade in a wider range given the heightened level of volatility evidenced. We bought the position at $32.52 and sold half at $36.20 for a nice 11.3% gain. The strategy of owningstock or ETF where we trade half the position while staying long the position as a core holding is working beautifully for us.

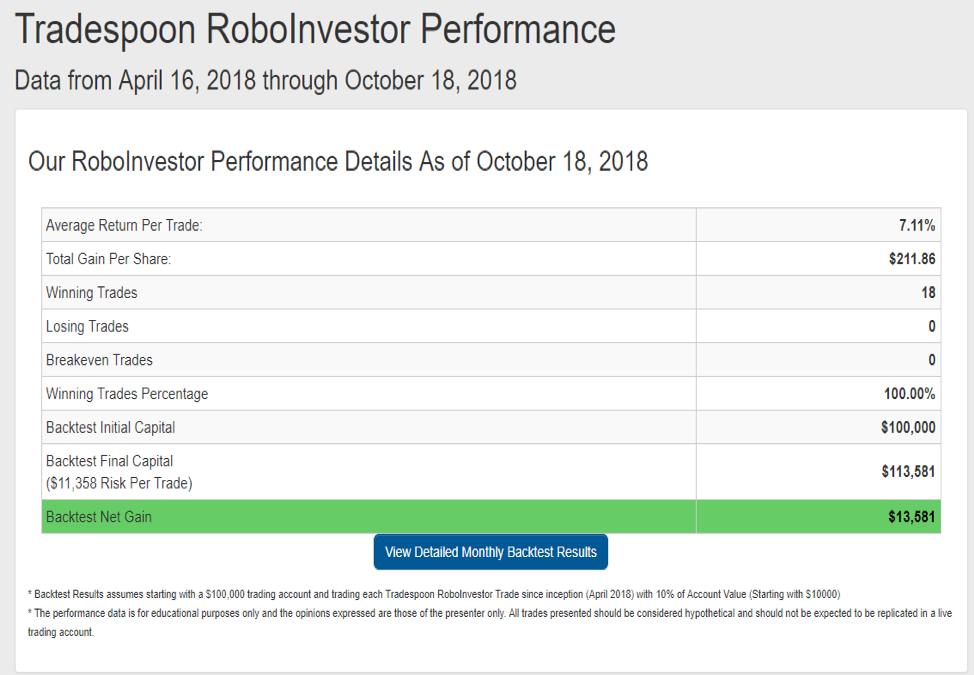

We’ve added a new feature for RoboInvestors recently – a Performance table that tracks our capital growthas measured by closed trades only. An unrealized profit isn’t a gain unless you book it and the same is true for unrealized losses. If you don’t close the position, it’s not a loss. Since establishing our first trades on April 2, 2018 we’ve closed out 18 trades for an average return of 7.1%. An account that started with $100K that has acted on every trade recommendation has recorded roughly $13,581 in profits. For six and a half months, 13.5% in this market is nothing short of outstanding.

The power of my proprietary artificial intelligence (AI) platform is the most essential set of tools I utilize every day to sift out those stocks and ETFs that can not only make us great profits, but also endure market corrections andrecover quickly from oversold conditions. Of the 18 stocks and ETFs recommended only three that fit the high-beta profile, Square Inc. (SQ), GrubHub Inc. (GRUB) and Netflix (NFLX) – and I’m totally fine owning all three stocks.

The heart of third quarter earnings season is next week when the greater majority of market leading companies report their results. For Q3 2018 (with 6% of the companies in the S&P 500 reporting actual results for the quarter), 86% of S&P 500 companies have reported a positive EPS surprise and 68% have reported a positive sales surprise, and we’re just getting started. At some point in the not-too-distant future, this kind of sales and earnings momentum will be too hard to ignore and stocks should elevate.

Yesterday, David Kostin, chief U.S. equity strategist at Goldman Sachs, put it very succinctly in a CNBC interview. He laid out the three drivers for the bull market to continue as dependent on earnings, valuations, and money flow. As far as earnings are concerned, Q3 2018 is forecast to post 19.1% EPS growth. From a valuation standpoint, the market is not cheap, but it’s not expensive either. As to money flow, there is a capital flight from China, Europe and around the world into U.S. dollar-based assets and that situation isn’t about to change any time soon.

It’s a good time to assess one’s portfolio and look to pick up hot stocks like Netflix that initially gaped by 53 points in extended hours after posting a lights-out quarter and hitting $380 during Wednesday’s session. Now with the stock pulling back and trading around $350, my AI platform is signaling RoboInvestors when we should initiate and add to positions. The question for readers of this column is whether you’ll be a RoboInvestor subscriber and get that information first hand.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.