Why December Is Shaping Up to Be a Very Volatile Month

It looked like we might coast into the end of 2021 on a calm and seasonally bullish note with the major indices up some 25% for the YTD. But, a new Covid variant and stubbornly-high inflation have thrown a wrench into that outlook. I think December will be unusually volatile, which equates to unpredictable, which will offer good trading opportunities.

Indeed, stocks were trying to stabilize on Monday and early Tuesday until Fed Chairman Powell started speaking in front of Congress, giving a clear indication of a policy shift with a need to fight inflation, which is no longer being described as “ transitory,” as its primary objective. Powell expressed plans to wind down QE at an accelerated pace and possibly raise rates sooner than expected. Following these remarks, stock indices quickly moved back to session lows with the SPDR S&P 500 (SPY) testing Friday’s lows.

However, you guys could’ve gotten a market price action recap anywhere. What insights can I provide? Basically, to beat the same drum this has been a market told by a tale of two tapes with mega caps propping up the indices and masking the massacre underneath the surface of the high valuation names.

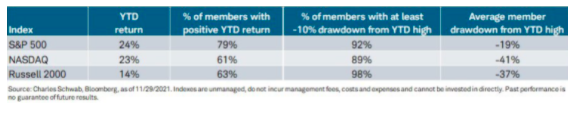

The articles above had a few images displaying the market’s deterioration; here’s a new view on the bifurcation. You have the SPY and Powershares Nasdaq 100 (QQQ) up some 24% on the YTD. But, the average stock has incurred a 19% and 41% drawdown, respectively. The Russell 2000 has similar dispersion with the small-cap index up 14% YTD while the average stock’s down 37% on the year.

Basically, if you rip through 100-200 charts a night, as I do, you’d think we were in a pronounced bear market. However, then you look up and see the SPY and QQQ are still up 60% from March 2020 lows and are only 4% from all-time highs.

It’s small solace when I speak to many seasoned traders and see my Twitter stream dry up that I’m not alone in finding this bear market tucked under a bull market. This has created an especially-challenging trading environment. But, it does confirm my shifting Options360 focus towards risk management, adjusting current positions, and protecting our 52% YTD gains.

What’s ironic about the Fed’s policy shift today — which I welcome and is long overdue — is that it comes too late and for the wrong reasons. Inflation has been due to supply chain constraints. Recently, we’ve heard from major retailers such as Walmart (WMT), automakers like Volkswagen, and chip makers such as Applied Materials (AMAT) have all said supply chain issues have improved dramatically over the past four weeks. Once again, the Fed’s fighting the last war. If today’s drinking game was based on the phrase ‘policy mistake’ I’d already be flat on the floor.

[$19 SALE ] Access the top-secret trading techniques you need to profit in Options Trading!

The Fed should have begun the taper years ago when it became clear housing, wage, food, and energy prices were all rising due to supply constraints. Instead, it spent all its political capital and credibility being ‘transparent’ by prepping the market with a slow, dovish timetable. The market knew the Fed was behind the curve, but also knew that you don’t fight the Fed with them promising lower for longer. They’ve now thrown the market a curveball, seemingly making December exceptionally volatile.

What I have to ask myself is whether I’m also making a ‘policy mistake’ by reducing the Options360 risk profile. Or, should I take this current sell-off and increase in volatility as an opportunity? On Monday, Options360 dipped our toe into a new CVS (CVS) bullish position, and still hold longs in Morgan Stanley (MS), Nextera (NEE), and Snap (SNAP). However, I’m not seeing a lot of compelling setups, and I find no compulsion to force trades or play hero ball.

Ray Dalio is still saying ‘cash is trash’ as inflation is a tax on your money. But, I don’t have billions of dollars under management for which I’m trying to squeeze out two extra basis points. I need and have the luxury of, keeping dry powder and patiently awaiting high probability setups. I think December will be unusually volatile and offer plenty of opportunities. But, the key is to remain patient and flexible.

[LAST CHANCE] Try out the Options360 Concierge Trading Service for the low introductory rate of $19!

The post Why December Is Shaping Up to Be a Very Volatile Month appeared first on Option Sensei.