testing_stock

by

Vlad Karpel

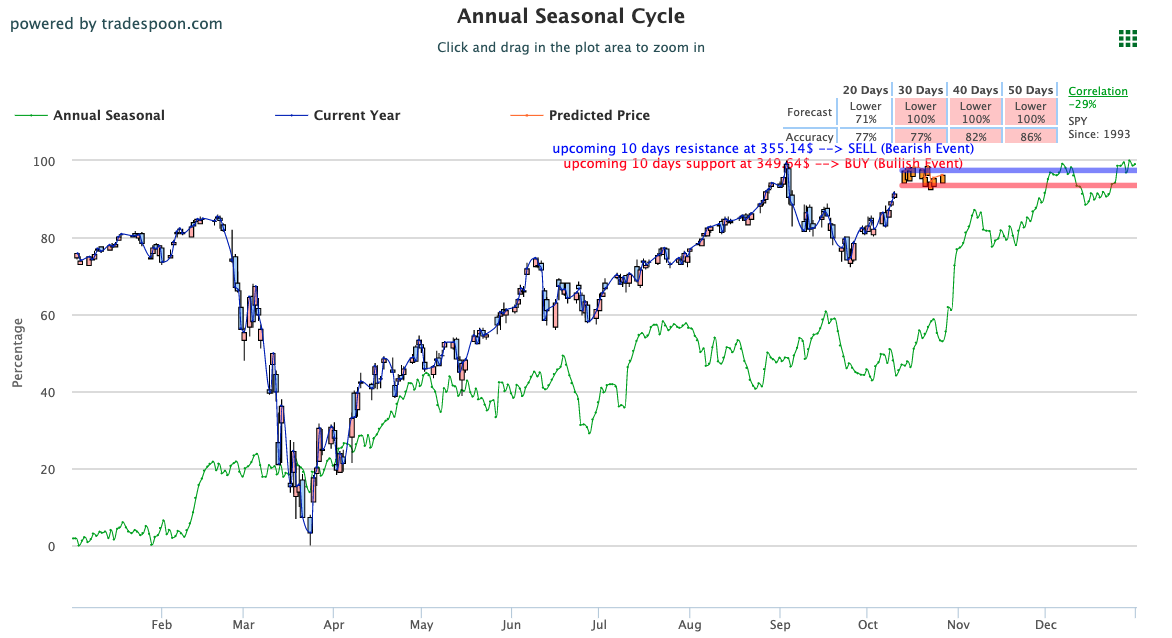

Our latest models are projecting the SPY to trade in the range of $318-$360 and we will look to be buyers into any short-term corrections. Markets dipped today as fiscal stimulus talks continue to stall. All three major U.S. indices closed in the...

Read More

by

Options Sensei

These last couple of weeks have been a roller coaster ride in the market. We’ve seen huge swings based solely on news, announcements, or tweets…

And as the election gets closer you can expect more of the same.

Election years are always...

Read More

by

Options Sensei

Buying opportunity or a value trap

The major banks kicked off earnings season with most reporting significantly better-than-expected results yet their stocks remain stuck in doldrums, begging the question: Is this a buying opportunity, or a value...

Read More

by

Options Sensei

Elections, a potentially large price movement catalyst

The options market continues to brace for the upcoming U.S. election. As the date rapidly approaches, the bold trade is to sell the pumped up premium by assuming that not everything will be...

Read More

by

Vlad Karpel

With bond markets closed today, U.S. stocks extended their streak as all three major U.S. indices, which finished 3% higher last week, closed with impressive gains. Supported by a strong tech rally, the Dow traded 1% higher for most of the day while...

Read More

by

Options Sensei

I sent this email on Saturday and it got a great response, so I wanted to make sure you saw it before the deadline passes.

The deadline is tonight at midnight, so make sure to read now and take...

Read More

by

Options Sensei

There’s a lot to admire about Columbus.

Sure he was apparently a brutal man – which we don’t want to glorify, but in fairness that was the world back then.

What is admirable is that he set out to prove that there was a better way to...

Read More