testing_stock

by

Options Sensei

I love the 4th of July. For my money, America is the greatest nation in the history of the world. I know that seems kind of trite to say on the birthday of our great nation, but I am worried that a lot of the chaos in the US today is because it...

Read More

by

Vlad Karpel

All three major U.S. indices on track to finish in the green

Today, impressive manufacturing and employment data supported markets as all three major U.S. indices are on track to finish in the green.

Latest earnings and economic reports topped...

Read More

by

Vlad Karpel

RoboStreet – July 2, 2020

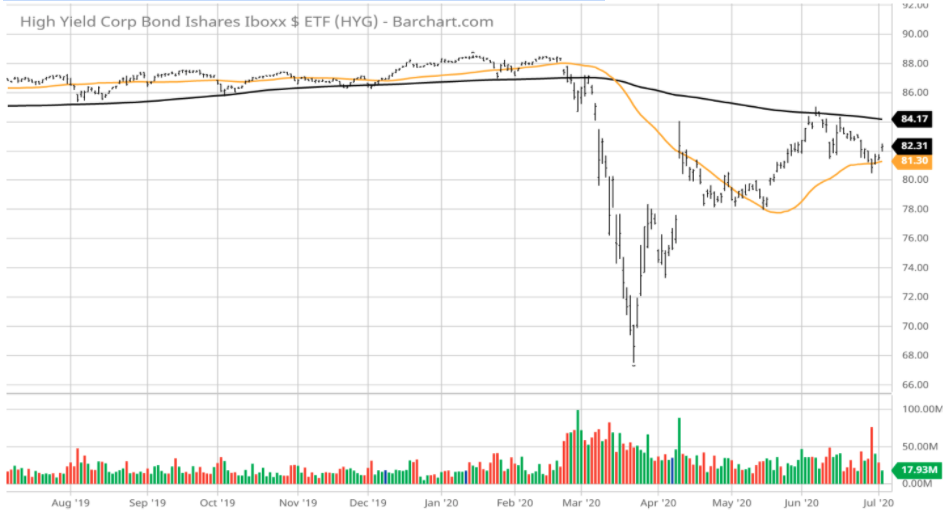

Watch Out For Falling Junk In the Bond Market

Back on March 20, right before the market bottomed, S&P Global Ratings put out a dire forecast that high-yield default rates would likely rise to 10% over the next 12...

Read More

by

Options Sensei

There’s no denying the first half of 2020 was a wild one from but a societal and financial standpoint.

Historically speaking, “v” bottoms bode well for future returns over the next 6-12 months. The typical six-month return for the...

Read More

by

Options Sensei

The economy seems to be in a massive recession, with millions of people unemployed, companies not reopening after the shutdown, a spike in foreclosures, and a laundry list of generally bad economic news…

And the markets seem to be in a massive...

Read More

by

Options Sensei

Stocks took a scary dip last week, but no technical indicators were broken and the bullish bounce still seems in effect. With this in mind, I’m looking to add a bullish position in a couple of individual names while overwriting them with a bear...

Read More

by

Options Sensei

The stock market tends to overshoot on both the downside and upside. The way the indices came roaring back, the “Nasdaq 100 (QQQ – Get Rating)” hitting a new all-time high and the “S&P 500 (SPY – Get Rating)” on hopes of a...

Read More